Dear #LUNAtics

In just 4 short months:

Stader has experienced supersonic growth.

How do we know that?

These numbers told us so: ⏬

In just 4 short months:

Stader has experienced supersonic growth.

How do we know that?

These numbers told us so: ⏬

Our community is already over 50K strong.

And during this time our TVL has shot up more than 2x.

Over 8.6M $LUNA is staked in Stader and 30K+ wallets are using the

protocol.

So, what's spurred users to adopt Stader this rapidly?

And during this time our TVL has shot up more than 2x.

Over 8.6M $LUNA is staked in Stader and 30K+ wallets are using the

protocol.

So, what's spurred users to adopt Stader this rapidly?

Our north star was always to evolve, striving to be more accessible, profitable for everyone.

To that end, we launched 3 staking products since Nov'21:

- Stake Pools

- Liquid Staking

- Stake+

And a fourth - Degen Vaults - which will launch very soon.

There's more.

To that end, we launched 3 staking products since Nov'21:

- Stake Pools

- Liquid Staking

- Stake+

And a fourth - Degen Vaults - which will launch very soon.

There's more.

We have a kickass vision for 2022.

And so far, it's going exactly as we have envisioned.

Here's what's next for us in 2022:

And so far, it's going exactly as we have envisioned.

Here's what's next for us in 2022:

1. We are set to bring more exciting strategies to our Stake Pools.

Currently, You can decide how much of your rewards you want to auto-compound and how much you want to withdraw.

And we are adding way more yield-farming possibilities with rewards.

Next on our list:

Currently, You can decide how much of your rewards you want to auto-compound and how much you want to withdraw.

And we are adding way more yield-farming possibilities with rewards.

Next on our list:

2. We already launched Stake+ with 6 validators.

And recently, we had the great fortune of on-boarding the rockstar @danku_r.

The list is only going to go up from here on.

In 2022, you'll see many of your favourite validators joining the party.

Next up:

And recently, we had the great fortune of on-boarding the rockstar @danku_r.

The list is only going to go up from here on.

In 2022, you'll see many of your favourite validators joining the party.

Next up:

@danku_r 3. The powerful $LunaX is about to go places.

We'll make it available for leveraging in more current and upcoming DeFi protocols.

That means:

More leveraging possibilities and strategies for you to exploit.

If this sound's thrilling...

Then you're in for a big treat. 👇

We'll make it available for leveraging in more current and upcoming DeFi protocols.

That means:

More leveraging possibilities and strategies for you to exploit.

If this sound's thrilling...

Then you're in for a big treat. 👇

@danku_r 4. In the next few weeks, we'll launch Degen Vaults.

It's designed to make your life a hell of a lot easier.

You can activate elaborate and profitable leveraging strategies with just one click.

And enabling $LunaX in more protocols means bigger and better vaults for you.

It's designed to make your life a hell of a lot easier.

You can activate elaborate and profitable leveraging strategies with just one click.

And enabling $LunaX in more protocols means bigger and better vaults for you.

@danku_r 5. By the end of 2022, we see Stader firmly grounded in other major blockchains.

At least in 10+ PoS networks.

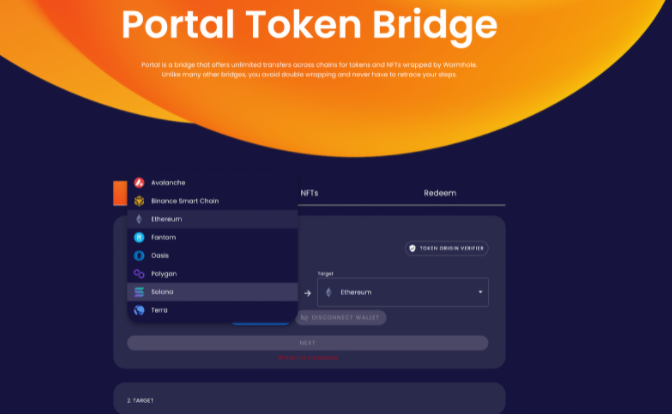

Our contracts across Fantom, Solana, Hedera, Polygon will be launched over the next few weeks.

Next:

At least in 10+ PoS networks.

Our contracts across Fantom, Solana, Hedera, Polygon will be launched over the next few weeks.

Next:

@danku_r 6. We have always wanted Stader to be more than just a staking platform.

We wanted it to be an ecosystem where anyone could build innovative DeFi products.

How?

But leveraging our smart contracts and infrastructure.

In fact:

We wanted it to be an ecosystem where anyone could build innovative DeFi products.

How?

But leveraging our smart contracts and infrastructure.

In fact:

@danku_r Several institutional customers (including most of our investors) are already leveraging Stader smart contracts to stake their Luna across Stake Pools, Stake+ and LunaX.

And we are doing all this with security at the top of our priority.

That means:

And we are doing all this with security at the top of our priority.

That means:

@danku_r More pro-active audits and extensive testings.

To wrap up:

2022 is about to become a critical year for the whole Stader Fam.

And our community empowers us with their drive and passion to continue building innovative solutions.

And for that, we thank you.

To wrap up:

2022 is about to become a critical year for the whole Stader Fam.

And our community empowers us with their drive and passion to continue building innovative solutions.

And for that, we thank you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh