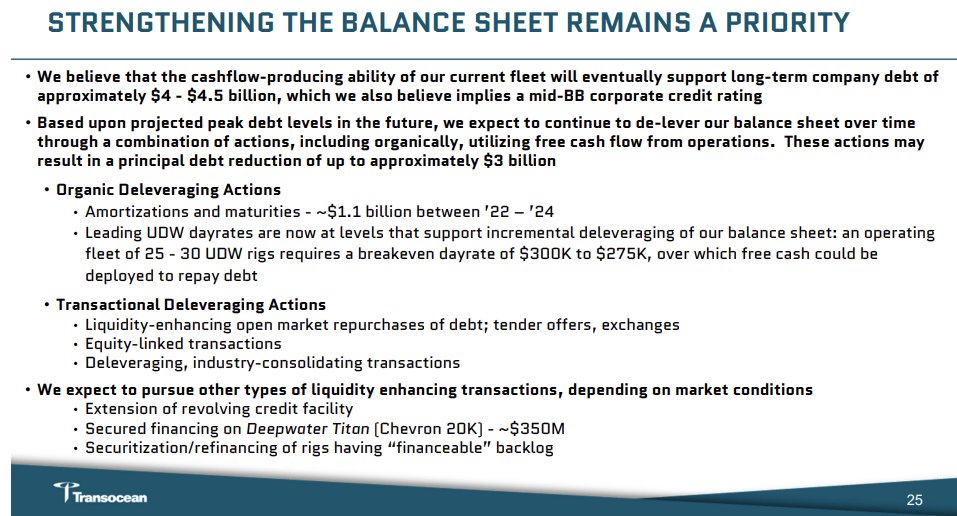

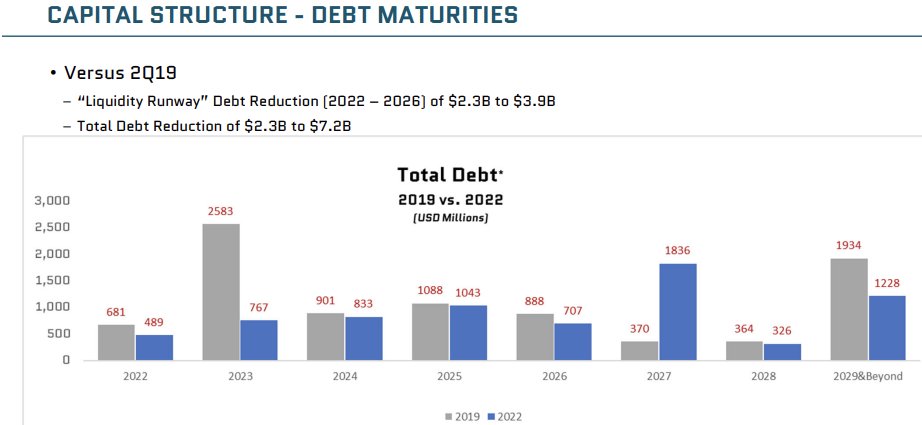

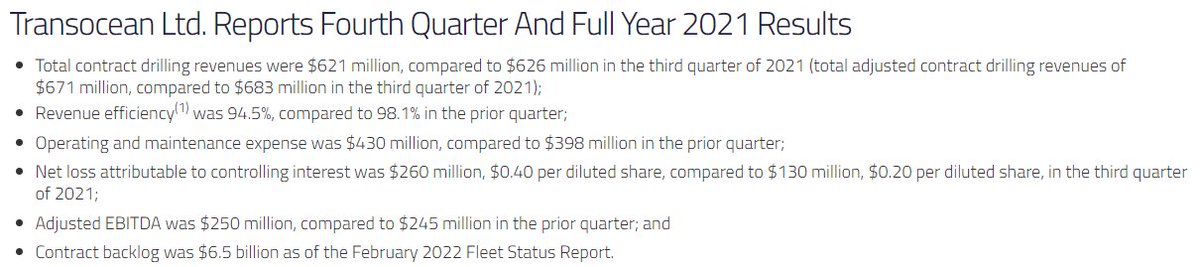

Seriously... $RIG is a high risk company... high utilization on long legacy contracts producing this:

Adjusted EBITDA was $250 million, compared to $245 million in the prior quarter

vs

the blue bars below:

Night and day vs VAL's Risk vs Reward imo.

Adjusted EBITDA was $250 million, compared to $245 million in the prior quarter

vs

the blue bars below:

Night and day vs VAL's Risk vs Reward imo.

When you are done adding together the blue bars and comparing that to the EBITDA their great backlog is giving them.. you can compare it to having more cash than debt and the debt being due 2028

Seriously, what am I missing here? Is the huge backlog full of contracts that will gradually re-set higher? I mean, they can not have booked a huge backlog with stuff like this? What is the path to a huge improvement?

That A LOT of debt compared to what they manage to earn. I can only repeat... what is good about a huge backlog? Unless someone can present large annual stepups in rates coming years...

"Adjusted EBITDA was $250 million, compared to $245 million in the prior quarter"

Q4 "Interest expense, net of amounts capitalized, was $107 million, compared with $110 million in the prior quarter"

Q4 "Interest expense, net of amounts capitalized, was $107 million, compared with $110 million in the prior quarter"

$RIG does not need a current huge backlog.. they need to get out of current contracts and make new ones at much higher levels. This in order to afford interest & amortizations.

• • •

Missing some Tweet in this thread? You can try to

force a refresh