Full time investor mainly US & No listed shipping + CA Mining. Use Twitter to gather info, tweet info/views that concerns my own investments-Never advice. Nomad

5 subscribers

How to get URL link on X (Twitter) App

Mako has about 79m shares and cost 3.15C$ or a mcap of 180m USD.

Mako has about 79m shares and cost 3.15C$ or a mcap of 180m USD.

Truly an amazing story about most easy gold in the world having been mined 100s of years ago, but in this case was covered by ice now gone making it possible to find:

Truly an amazing story about most easy gold in the world having been mined 100s of years ago, but in this case was covered by ice now gone making it possible to find:

Can you imagine mining dirt from surface instead of dealing with hard rock? Fortunately we can illustrate the difference in numbers. Low CAPEX, cheap to run gives you 57% IRR... after tax...

Can you imagine mining dirt from surface instead of dealing with hard rock? Fortunately we can illustrate the difference in numbers. Low CAPEX, cheap to run gives you 57% IRR... after tax...

https://twitter.com/SmallCapIntro/status/1760331350001819649Almost 1.4m shares, all bought in the market as the CEO unfortunately turned down a fair PP offer. In a way I understood him. I can't understand either that the stock is not higher.

I guess one could say that GALP MCAP increased 1 billion EUR with a 80% stake.

I guess one could say that GALP MCAP increased 1 billion EUR with a 80% stake.

Trailing 4 quarter dividend from $OET is almost exactly 50 NOK.

Trailing 4 quarter dividend from $OET is almost exactly 50 NOK.

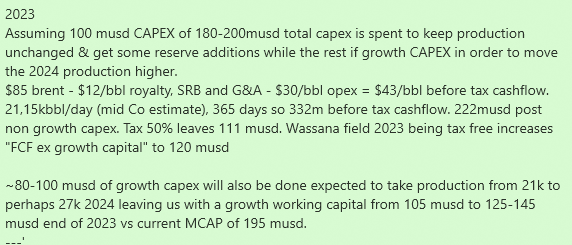

Imo,

Imo,

https://twitter.com/OriginalBraila/status/1702769881521746185There are some hard facts: 1. Abnormal little order book of large tankers 2. Fleet has aged as scrap material has gone to sanction trades 3. Yards are full for years 4. Environmental rules kick in 5. More oil needs to go from Atlantic basin to Asia coming years All yet to kick in

- 2008 is also important as it was about then China became a large producer of VLCC. The first say 5 years at they were of lower quality and hence can expect to increase that 15y DD effect.

- 2008 is also important as it was about then China became a large producer of VLCC. The first say 5 years at they were of lower quality and hence can expect to increase that 15y DD effect.