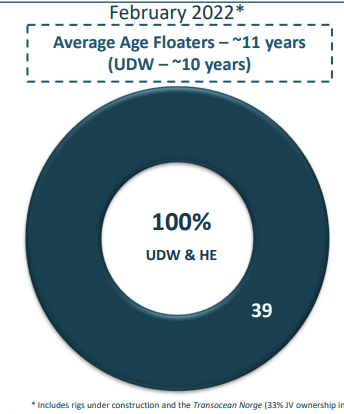

Age profile of $VAL ships in the same segment:

Note that little "1". Means they exclude the options they have to take a couple of newbuilds (they are very likely to take that before end 2023).

Note that little "1". Means they exclude the options they have to take a couple of newbuilds (they are very likely to take that before end 2023).

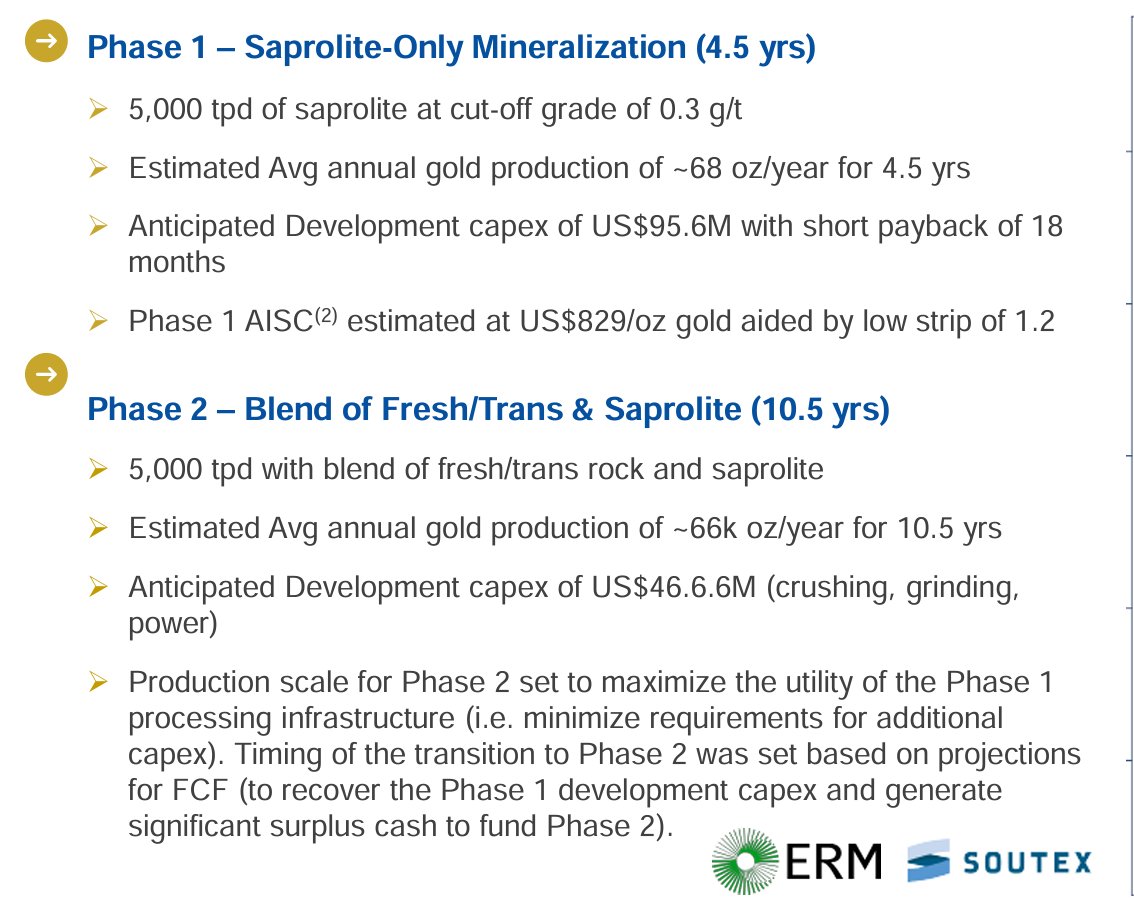

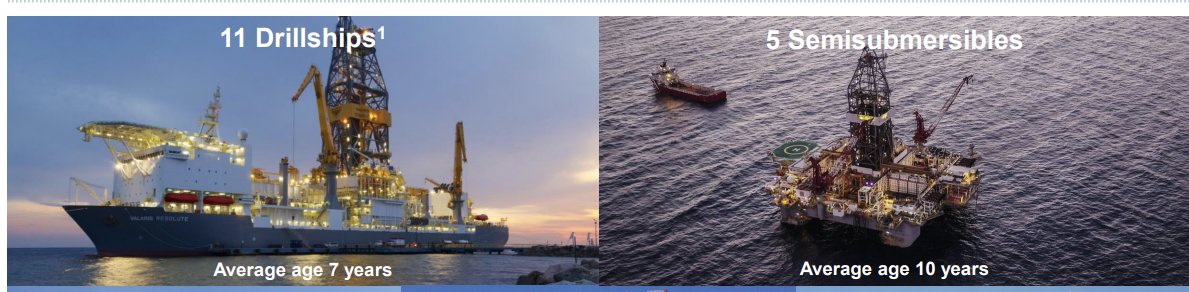

But VAL also have a unique arrangement with the key players in Saudi so they also work with normal & higher spec Jackups. A very profitable JV that I guess we could see spun out eventually to shareholders.

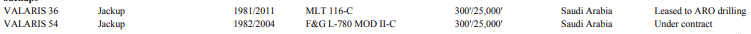

Then you have this which you get painted at Twitter as something important... really old rigs that is a number in the fleet statistics but not relevant when looking at fleet value. Very difficult concept for tweeters to understand.

Some of them are still here bcs they make money.

Some of them are still here bcs they make money.

Like these: 🤔🤔these assets have no value in NAV/fleet value.. but we make great money on them.

Should we scrap them and loose the revenue to make the fleet average look younger? Or should we think that investors can handle such a situation if we tell we can scrap it anytime..

Should we scrap them and loose the revenue to make the fleet average look younger? Or should we think that investors can handle such a situation if we tell we can scrap it anytime..

About that special relationship with the Saudis. Another reason I think $VAL is better. My guess is that some time into this bull market Valaris shareholders will be able to monetize this asset which probably gets little value today.

s23.q4cdn.com/956522167/file…

s23.q4cdn.com/956522167/file…

• • •

Missing some Tweet in this thread? You can try to

force a refresh