Thread: What I'd Do If I Was 18 To Take Advantage Of Inflation And Currency Debasement

🧵

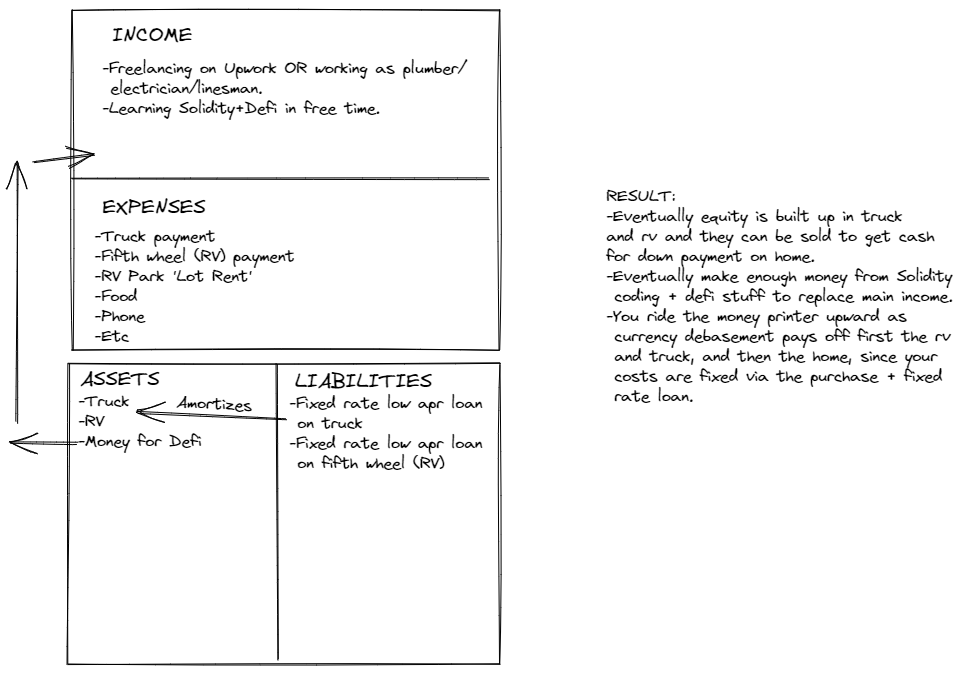

With all the talk about inflation and eating lentils, I wanted to do a fun #FrenchChart thread on what I'd do if I was just starting out with no money in our crazy economy.

1/x

🧵

With all the talk about inflation and eating lentils, I wanted to do a fun #FrenchChart thread on what I'd do if I was just starting out with no money in our crazy economy.

1/x

This will be focused on those living in the US, but its probably applicable in other Western countries as well.

Now... the most important thing is getting our income up, but first we need to figure out a way to avoid the financially draining rental rat-race.

2/x

Now... the most important thing is getting our income up, but first we need to figure out a way to avoid the financially draining rental rat-race.

2/x

Step One: Presuming you have a w2 job of some sort, go join a local Credit Union or small local bank.

Step Two: Download one of those apps that helps you game your credit score.

3/x

Step Two: Download one of those apps that helps you game your credit score.

3/x

Step Three: Once you get your credit score above 700 (very doable), go to the credit union and get pre-approved for low apr, fixed rate loans on a) a solid dependable used truck, and b) a solid dependable fifth wheel (rv).

4/x

4/x

Step Five: Buy a solid, dependable used truck for around 30k using the low apr, fixed rate loan from the Credit Union.

Again, trick is to get some insanely low apr loan from Credit Union. As example, the last vehicle loan I had was 2.5% apr over 6 years(!).

5/x

Again, trick is to get some insanely low apr loan from Credit Union. As example, the last vehicle loan I had was 2.5% apr over 6 years(!).

5/x

Step Six: Buy a dependable, used fifth wheel (rv) using low apr, fixed rate, low or no down payment loan from Credit Union.

These are imo the best value in the entire US economy right now. More livable than most apartments and at insanely low prices comparatively.

6/x

These are imo the best value in the entire US economy right now. More livable than most apartments and at insanely low prices comparatively.

6/x

Step Seven: Park truck + rv at local rv park. Live in rv.

The combined payments + lot rent should be less than a 2br apartment in same area, and you'll be building up equity in them rather than throwing away money on rent.

7/x

The combined payments + lot rent should be less than a 2br apartment in same area, and you'll be building up equity in them rather than throwing away money on rent.

7/x

The argument against this is that they're depreciating assets, and while 10 years ago I think that would have been valid, at this point inflation/currency debasement is going to massively outpace their depreciation, given you have the price + low apr locked in.

8/

8/

You're also locking in your living costs (apart from the lot rent to park it which should be pretty low), so you don't have to worry about rent going up 15% per year.

Again, park in some nice pretty rv park outside your city, maybe next to a river or something.

9/x

Again, park in some nice pretty rv park outside your city, maybe next to a river or something.

9/x

Step Eight: Pick solid opportunity to make money.

Either a) become a plumber/electrician/linesman, all of which should pay well into 6 figures and much more as the primarily Boomer workforce in these industries retires.

10/x

Either a) become a plumber/electrician/linesman, all of which should pay well into 6 figures and much more as the primarily Boomer workforce in these industries retires.

10/x

Or b) if you're 100% internet native and the idea of IRL work horrifies you, then start freelancing on Upwork.

I've paid hundreds of thousands of $ to Upwork freelancers and feel strongly that the average 18 y/o with good communication skills can make livable wage on it.

11/x

I've paid hundreds of thousands of $ to Upwork freelancers and feel strongly that the average 18 y/o with good communication skills can make livable wage on it.

11/x

This isn't going to be overnight, its a skillset and you need to figure out what service to offer (photoshop, video editing, article writing, etc) but honestly its not that much harder than going out and finding + learning a job that pays comparable.

12/x

12/x

Plus, w/the living situation described, as a young dude with no dependents, you can likely live on as little as 20-30k if needed.

Even supporting yourself with Upwork 100% on your own making 40k is imo a better setup for success than grinding at 70k for a j.o.b. job.

13/

Even supporting yourself with Upwork 100% on your own making 40k is imo a better setup for success than grinding at 70k for a j.o.b. job.

13/

The two routes are very different, but a) (skilled trades) is valuable because it is the rare skills that cannot be outsourced via globalization...

And- again- it should have insane demand over next 15 years due to demographic inversion.

14/x

And- again- it should have insane demand over next 15 years due to demographic inversion.

14/x

Otoh b) (freelancing online) is valuable bc it skips right past the globalization curve that is flattening global wage differences between countries, as you just jump right into the battle i.e. competing with smart+hungry Filipinos and Pakistanis on equal footing.

15/x

15/x

Step Nine: Spend all your free time learning smart-contract coding/defi.

Follow @Route2FI, @phtevenstrong, @noahseidman, dive into @DappUniversity, etc.

Crypto's growing at 100%+ per year and learning to use it + code it is the most valuable skill in our economy imo.

16/x

Follow @Route2FI, @phtevenstrong, @noahseidman, dive into @DappUniversity, etc.

Crypto's growing at 100%+ per year and learning to use it + code it is the most valuable skill in our economy imo.

16/x

At this point we'll be making decent money either from skilled trades or freelancing, our living expenses will be paying down our truck+fifth wheel loans, and we'll hopefully be making even more money via smart contract coding/defi in our spare time.

17/x

17/x

Nb4 'not everyone can be a coder', I agree 100%.

You can def replace coding/defi with any number of great IRL side-hustles that folks like @sweatystartup and @SpiritofPines talk about.

If you're willing to work hard and hustle the opportunities are out there.

18/x

You can def replace coding/defi with any number of great IRL side-hustles that folks like @sweatystartup and @SpiritofPines talk about.

If you're willing to work hard and hustle the opportunities are out there.

18/x

Finally, we reach Step 10: Which is to sell the fifth wheel (and maybe the truck) and use that money as a down payment on a house.

Depending on how much you have saved up, this could be anywhere from 2-4 years from start of plan.

19/x

Depending on how much you have saved up, this could be anywhere from 2-4 years from start of plan.

19/x

At this point you'll now be on the right side of the US real estate carry trade, and benefitting from what are effectively government-subsidized insanely low interest rate loans (ie that eventually end up on the country's balance sheet in one way or another).

20/x

20/x

While you're paying 4% fixed apr on your house (thanks to the financialization of the economy), currency debasement will continue at 15-20% per year through the 2020's.

Then you can keep stacking $BTC, $ETH, gold, and silver a'la @CryptoHayes and @LukeGromen :)

21/x

Then you can keep stacking $BTC, $ETH, gold, and silver a'la @CryptoHayes and @LukeGromen :)

21/x

Conclusion: Certainly not saying all of the above is 'easy', but its what I'd do if I was 18 and starting out in this clown world economy we're in.

College>globocorp>renting high-priced apartments is ngmi in today's world, need to re-think all we've been taught :)

22/x

College>globocorp>renting high-priced apartments is ngmi in today's world, need to re-think all we've been taught :)

22/x

• • •

Missing some Tweet in this thread? You can try to

force a refresh