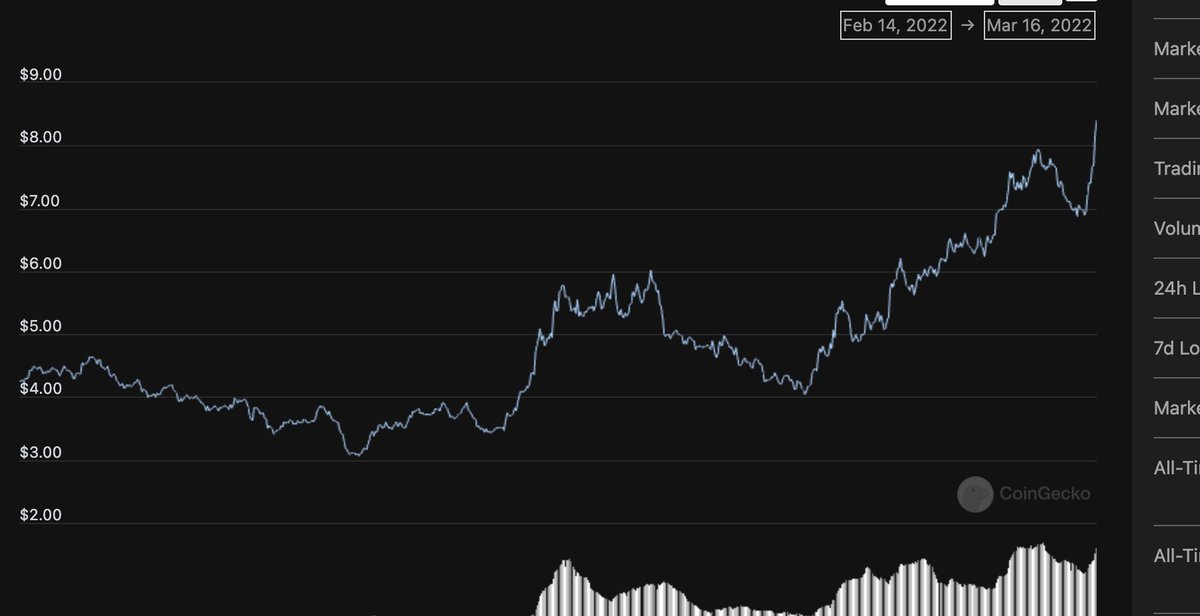

FTM......

What will be a catalyst that makes it go?

1. wen aave

2.wen felix exchange

3.wen coinbase

4.bribe wars heating up

5.🔥 community

6.ultimate DEFI chain

7.lowest mc to tvl ratio

8.wen gamefi

9.hands down fastest chain

10.options thoon?

11. whats next? 👇

What will be a catalyst that makes it go?

1. wen aave

2.wen felix exchange

3.wen coinbase

4.bribe wars heating up

5.🔥 community

6.ultimate DEFI chain

7.lowest mc to tvl ratio

8.wen gamefi

9.hands down fastest chain

10.options thoon?

11. whats next? 👇

2/ well lets talk about the upcoming catalyst with @DeusDao and @LiquidDriver. Will this be the battle of the gigga brains @Dr_Liquid_ and @lafachief or will they be complementary.....well IMO it will be complementary. Let me explain

3/ so what is liquid driver,

A TLDR is that it is a autocompounder that basically juices the yields compared to what they would normally be aka (curve/convex) see pic below (the 1st is lqdr, the 2nd is spooky)

A TLDR is that it is a autocompounder that basically juices the yields compared to what they would normally be aka (curve/convex) see pic below (the 1st is lqdr, the 2nd is spooky)

4/ notice the difference in the aprs, they are not as significant for the lower pools (mainly because not boosted farms but when you play with the spirit farm you will see the difference.....big difference here, like night and day.... This is what lqdr specializes in

5/ LQDR is able to do this because the protocol (in this case) offers boosted farms where governance token holders vote on a specific pool to get emissions (yes just like curve). Lqdr is accumulating the governance tokens and locking them up so they can vote on select pools

6/ being major holders of governance tokens like $spirit, also $fxs, $deus and many others they can "drive liquidity".....oohhhh so thats why its called liquid driver 😉

7/ so here is the sauce on lqdr, they will be launching shadow farms which instead of auto compounding into the lp pool it will actually auto stake the governance tokens instead of selling them and compounding the rewards........lets give an example of spirit

8/ normally to stake spirit you have to lock it up....you can do 1 week if you want but you will basically get like no rewards 😂, and you can lock for 4 years and get nuts and ham rewards but bruh your locked up for 4 yrs.....thats a long time in crypto

9/ so before shadow farms if you wanted to get a high apr and keep exposure to a protocol well you would compound into the lp....talk about imperm loss 😔 ....... now with shadow farms Lqdr will "stake your spirit" and not be locked up by taking advantage of their linspirit pools

10/ Now I know what ur sayin well cant I just do that, well you can but dont forget to auto comp 2 times a day, make sure you have enough money to make the gas fees worth it, and be okay with depending on the token having them locked up....oh and make sure you have a bunch of

10b/money to buy a bunch of the governance tokens to boost your own pools.Remember to get the boosted pools you have to have enough tokens staked compared to the amt you deposited as well as having tons of tokens staked to vote on the pool you want.. If you cant beat em join em👇

10c/

Good luck they own over 27% of spirit tokens 😉

Good luck they own over 27% of spirit tokens 😉

11/ also im not sure about you but I like to do what I do best and let the others do the rest.....I mean I am good a clicking buttons but ehhhh sometimes my fingers hurt, and yeah doesnt help im a cheapo toooooo.

so glad the screw worked for this one

so glad the screw worked for this one

11b/Now this is a simulation using higher APRs so the difference is more substantial but using an apr like 65% and below it will not be as noticeable, But it will still be a difference.

he main things to point out on shadow farms is

-boosted pools

-option to be long the token and earn a yield with the position being liquid

-being able to leverage your position (I will explain)

-convenience

-almost no gas fees(just the initial deposit/withdrawl)

-boosted pools

-option to be long the token and earn a yield with the position being liquid

-being able to leverage your position (I will explain)

-convenience

-almost no gas fees(just the initial deposit/withdrawl)

12/ Now lets talk about leveraged farming with the @DeusDao integration .....this will be the sauce. With the integration you will be able to use your LP's to mint the DEI stable coin to purchase more tokens and leverage your position....yes they will have sliders

I like sliders

I like sliders

13/so you will be able to gain a higher farming apr that what you normally would.....see example......but instead of having to earn in the leveraged protocols governance token you would be earning it in the token that you are farming with...so spirit/ftm = maximum spirit gainz

14/ so this is also going to create a supply crunch on the $deus token because to mint dei you need to have some deus.....so with more demand for Dei the more Deus is burned......dont get me started on the synth platform with Deus (thread thoon)

15/ Now this is saucy and all but what does this mean for lqdr, well of all the farming lqdr stakers are getting a share of the 4.5% performance fee that is charged (this is taken from profits) ( if you think about it its profits you would have not normally had)

15b/ Now as for the current emissions, with shadow farms replacing the LQDR token emissions, the protocol can now get closer to its goal of 0 emissions......aka no inflation. This will create a supply and demand crunch as more may want a piece of the pie

16/. Is that it?....

Na dont forget instead of having to lock up your lqdr tokens you can actually get a venft that can be resold on the secondary market.....so now more will be incentivized to "lock tokens" , get rewards, and still be able to sell their locked positon

Na dont forget instead of having to lock up your lqdr tokens you can actually get a venft that can be resold on the secondary market.....so now more will be incentivized to "lock tokens" , get rewards, and still be able to sell their locked positon

17/ Oh wait there is one more thing, They are partnering with @GrowthDefi to create a clqdr (liquid staked interest bearing lqdr token) that can be used to get a loan against (aka locking up more tokens)

you will also be able to open a CDP vault with lqdr token as well

you will also be able to open a CDP vault with lqdr token as well

18/ I really could go on and on but this is getting long....remember invest in people not ponzis. I wonder what will come with giga brains @Dr_Liquid_ and @lafachief of deus get together

cool people share

WOLT

proverbs 16:16

How much better to get wisdom than gold,

to get insight rather than silver!

https://twitter.com/Rentahomefast/status/1506036124082397188

WOLT

proverbs 16:16

How much better to get wisdom than gold,

to get insight rather than silver!

• • •

Missing some Tweet in this thread? You can try to

force a refresh