I didnt add an example to show the power of @THORSwap and the $rune asset and how the yields are dynamic to how the protocol functions. so here is some napkin math.....

https://twitter.com/Rentahomefast/status/1504956061815656453

2/ example:

lets say rune is 1$ and the MC is 1,000,000$ just for this example)

Now the yield for the $BTC pool is paying 20%.

lets say a user deposits $1,000,000 of btc......that would go to 10% because the TVL doubled. wouldnt it?

lets say rune is 1$ and the MC is 1,000,000$ just for this example)

Now the yield for the $BTC pool is paying 20%.

lets say a user deposits $1,000,000 of btc......that would go to 10% because the TVL doubled. wouldnt it?

3/ No, remember the formula every 1$ deposited=$3 on rune MC

so if this is the case then the rune price would go to $4 because the MC got juiced to 4,000,000$......

so since the Apy is based in rune the new apy instead of 20% would be 80% / 2 because higher TVL

so =40% APY

so if this is the case then the rune price would go to $4 because the MC got juiced to 4,000,000$......

so since the Apy is based in rune the new apy instead of 20% would be 80% / 2 because higher TVL

so =40% APY

4/ Now it doesnt stop there remember with higher TVL this brings lower slippage

lower slippage=more traders

more traders=more swap fees for LP's

More swap fees= Higher APR

Higher APR= more TVL

more TVL= juice rune price and bring more traders

-rinse and repeat 😉

lower slippage=more traders

more traders=more swap fees for LP's

More swap fees= Higher APR

Higher APR= more TVL

more TVL= juice rune price and bring more traders

-rinse and repeat 😉

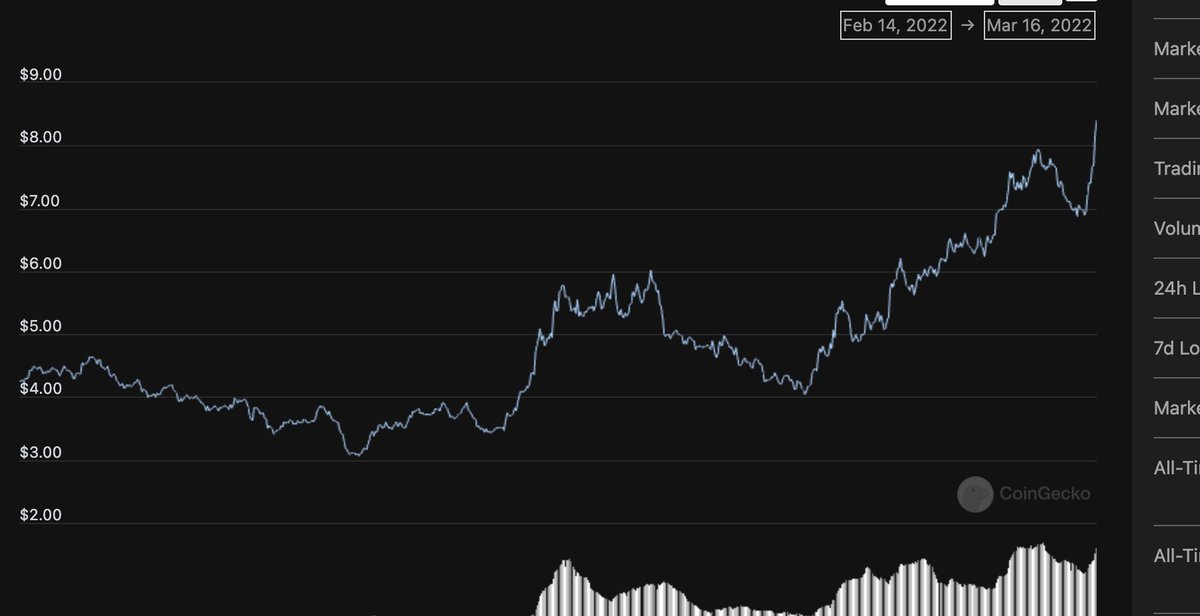

5/ So obviously this is a lower marketcap example so as the numbers get larger the yield rise will not be as significant but this illustrates the power of thorchain and the Flywheel it is creating

#raisethecaps #rune #thorchain

@THORSwap

@THORChain

#raisethecaps #rune #thorchain

@THORSwap

@THORChain

I also want to note there are several catalysts coming to $rune NFA but as always Twt what haps

if you enjoyed this thread....share it with a degen near you

also you can find an archive of twitter threads and youtube vids here linktr.ee/drakeondigital

if you enjoyed this thread....share it with a degen near you

https://twitter.com/Rentahomefast/status/1505369429697310723

also you can find an archive of twitter threads and youtube vids here linktr.ee/drakeondigital

oh and wisdom one liner time

Better a dry crust with peace and quiet

than a house full of feasting, with strife.

proverbs 17:1

Better a dry crust with peace and quiet

than a house full of feasting, with strife.

proverbs 17:1

• • •

Missing some Tweet in this thread? You can try to

force a refresh