It’s hard to overstate the scale of the cost of living crisis coming - but the Chancellor has prioritised burnishing his tax-cutting credentials over support for the low-to-middle income households hardest hit by this crisis - THREAD

Rising inflation is forecast to make the year ahead very difficult for family finances. Real household income per person is set to fall by 2.2 per cent in 2022-23, the largest financial year fall on record going back to 1956-57.

The current fall in real wages is not projected to end until late 2023, and will leave average wages no higher than in 2007.

The highest inflation in 40 years also means that real household disposable income per person – a key measure of living standards – is forecast to fall faster in 2022-23 than in any other financial year on record (back to 1956-57) even after measures announced in today.

Given this situation, the Chancellor has chosen to significantly expand his previously announced energy cost support measures, that now add up to a total of £19.4 billion.

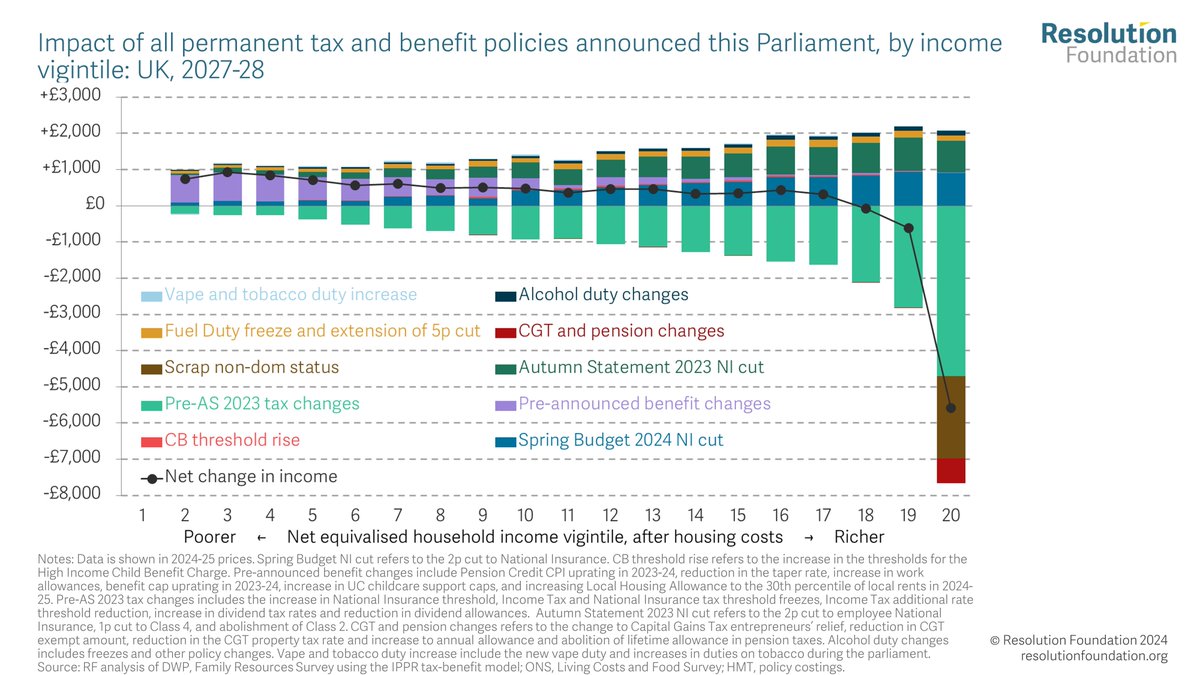

However, this package of immediate support is poorly targeted at those most likely to struggle with the rising cost of living, with only £1 in every £3 announced today going to the bottom half of the income distribution.

Read our full reaction here - and keep an eye out for our full overnight analysis, which we'll be publishing first thing tomorrow - and presenting at our 9:00am event, which you can sign up to watch here: resolutionfoundation.org/events/waiting…

• • •

Missing some Tweet in this thread? You can try to

force a refresh