The Resolution Foundation is an independent think-tank dedicated to lifting living standards in the UK.

4 subscribers

How to get URL link on X (Twitter) App

This is having real-world impacts.

This is having real-world impacts.

Key takeaways to remember ⤵️

Key takeaways to remember ⤵️

Mary highlights a key challenge - we know we need to invest a LOT to modernise our infrastructure. But we don't know what investments will actuallly pay off. That's a key challenge for both investors and policy makers...

Mary highlights a key challenge - we know we need to invest a LOT to modernise our infrastructure. But we don't know what investments will actuallly pay off. That's a key challenge for both investors and policy makers...

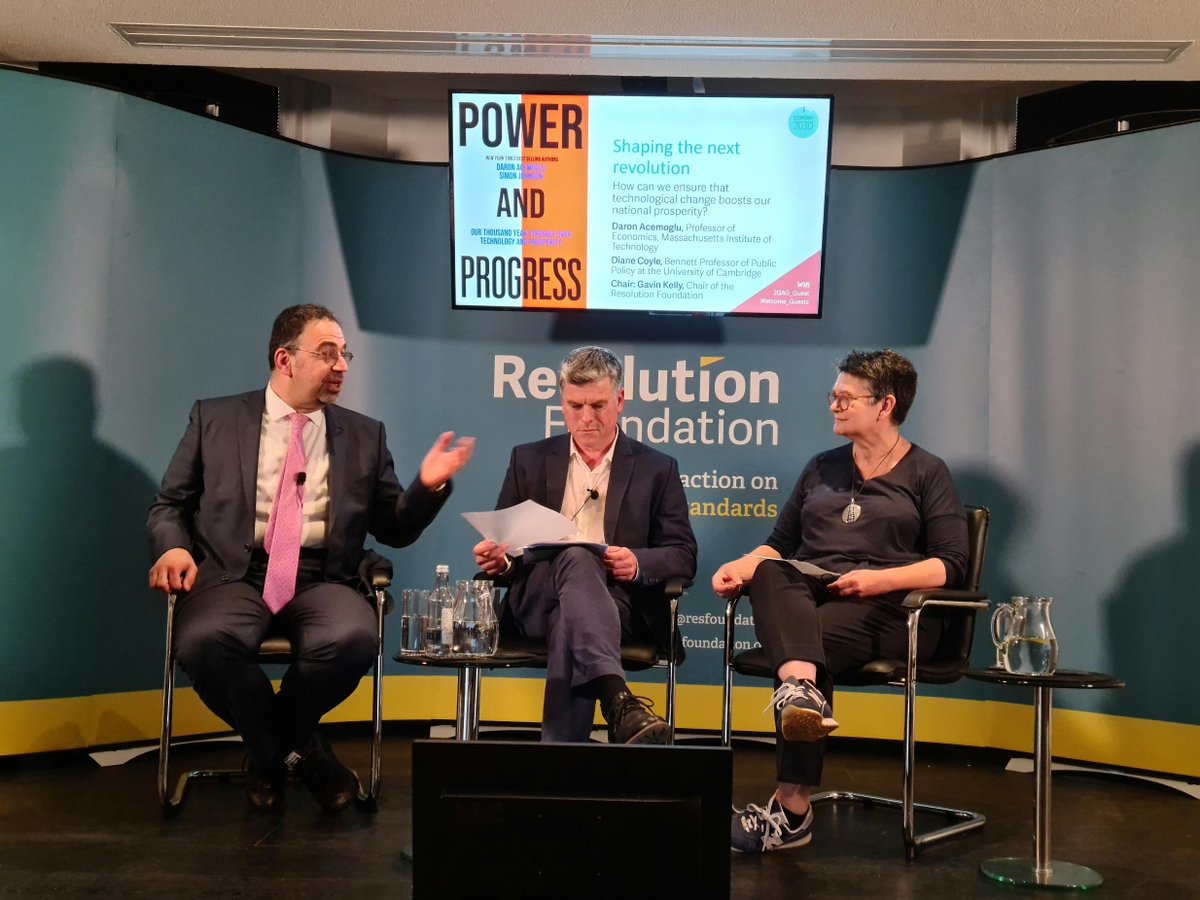

@DAcemogluMIT We (@DrDaronAcemoglu & @baselinescene ) don't have the answers to how we can shape the AI revolution (and don't believe anyone who says they do). But we do know that workers need a voice in shaping the revolution if its to deliver shared prosperity....

@DAcemogluMIT We (@DrDaronAcemoglu & @baselinescene ) don't have the answers to how we can shape the AI revolution (and don't believe anyone who says they do). But we do know that workers need a voice in shaping the revolution if its to deliver shared prosperity....

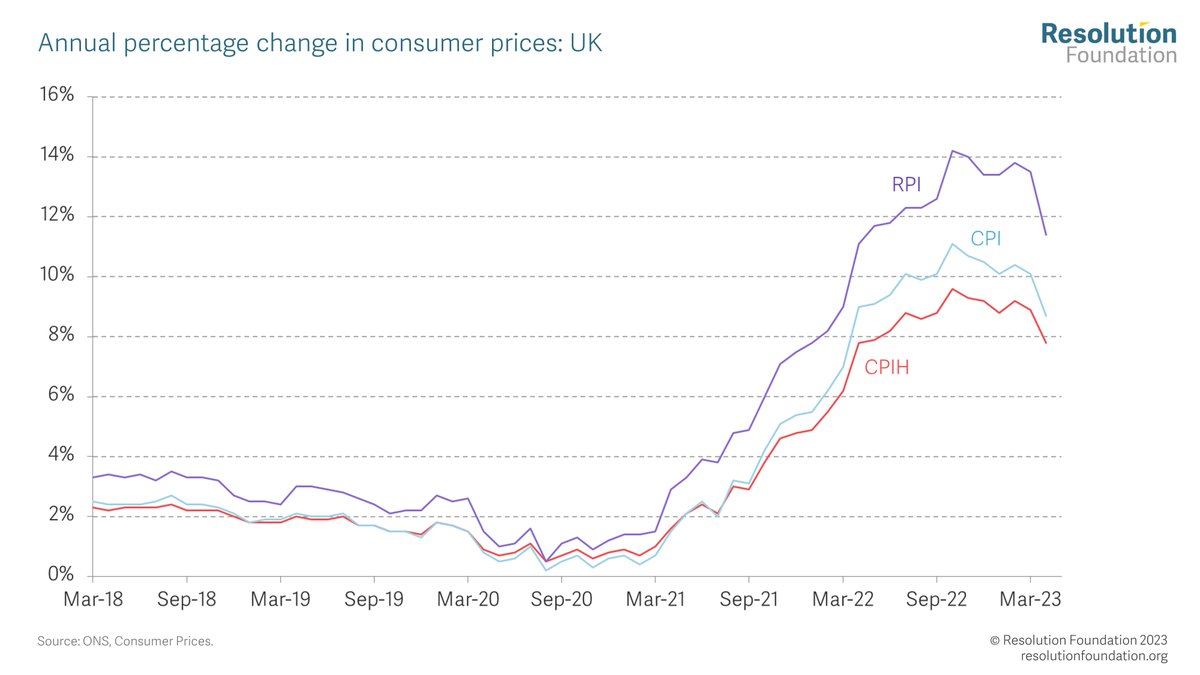

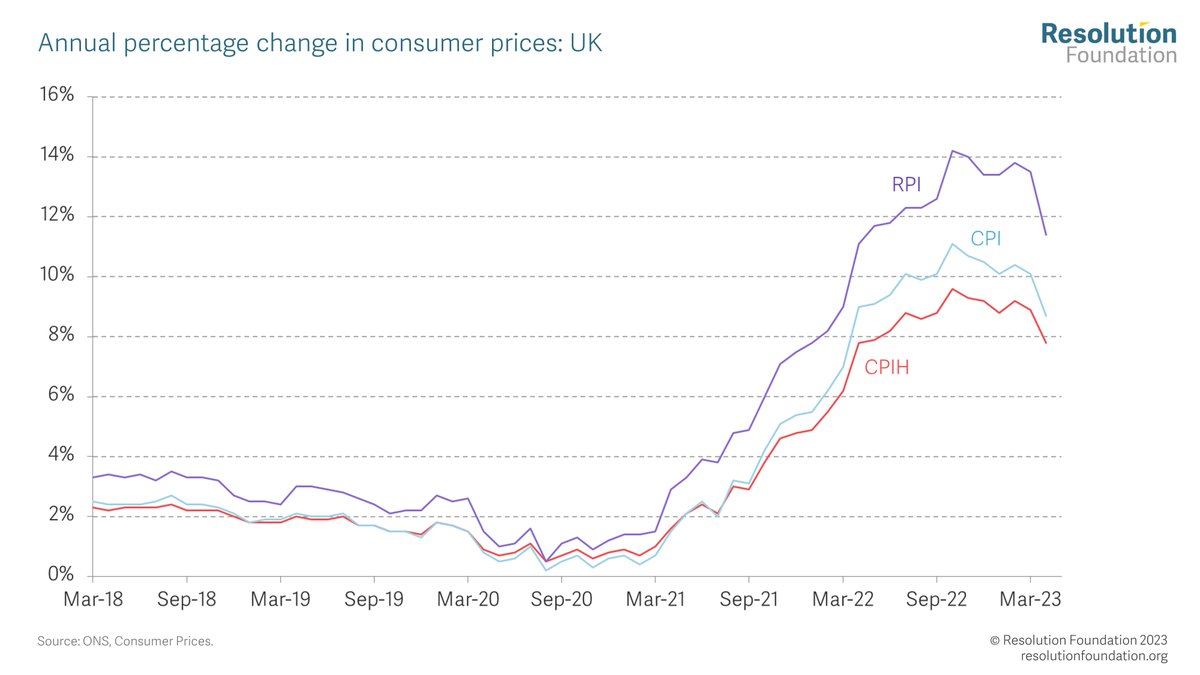

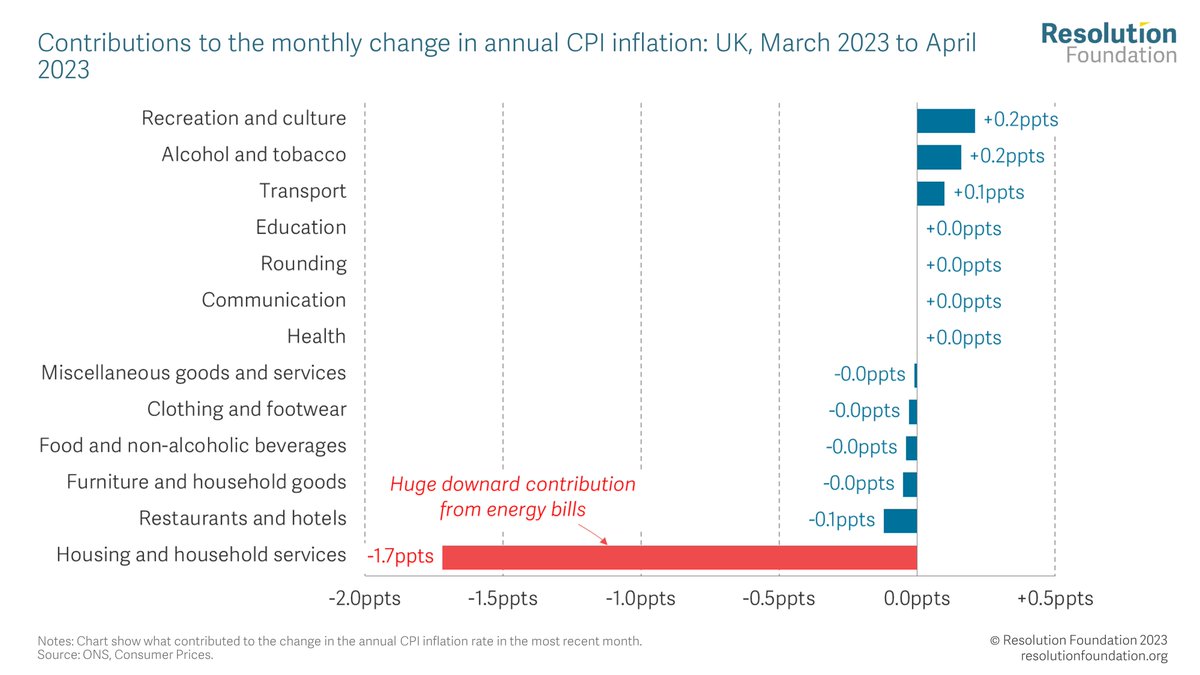

The 1.4ppt drop in CPI inflation on the month was driven by a huge (and expected) fall in energy prices as the big rise a year ago drops out of the annual calculation. This is six times the average absolute change in CPI inflation.

The 1.4ppt drop in CPI inflation on the month was driven by a huge (and expected) fall in energy prices as the big rise a year ago drops out of the annual calculation. This is six times the average absolute change in CPI inflation.

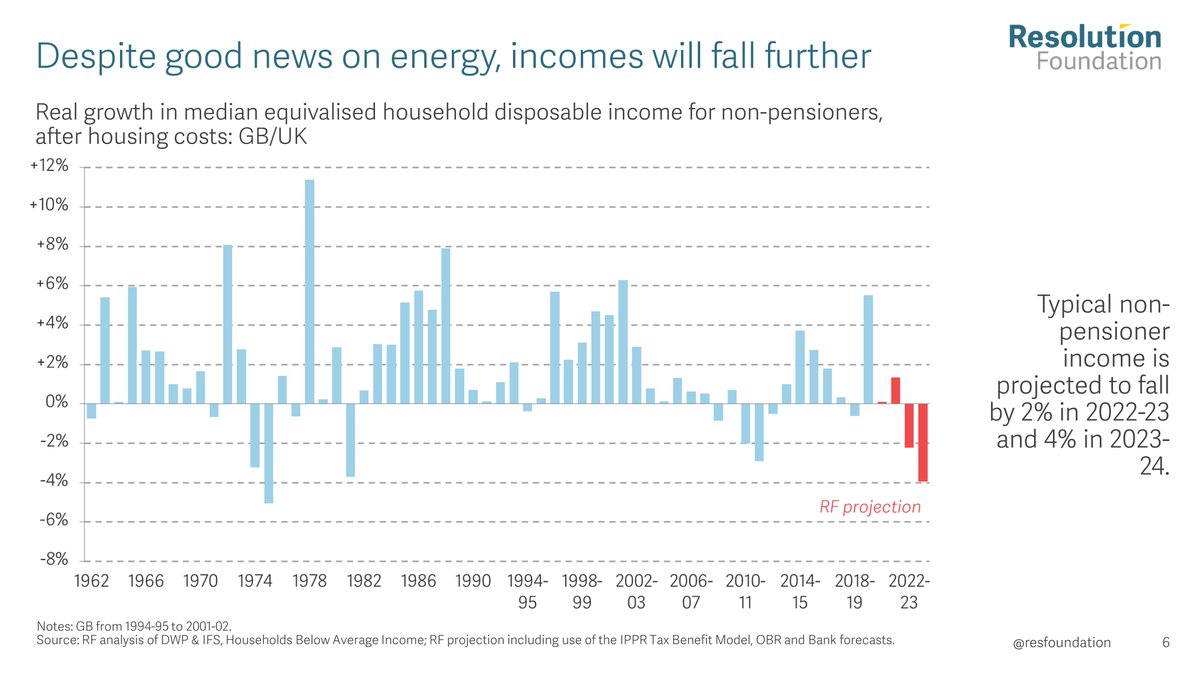

However, despite the good news on energy costs, typical household working-age household disposable incomes are still on track to fall by 2% in 2022-23 and 4% n 2022-23 - a simply huge living standards squeeze...

However, despite the good news on energy costs, typical household working-age household disposable incomes are still on track to fall by 2% in 2022-23 and 4% n 2022-23 - a simply huge living standards squeeze...

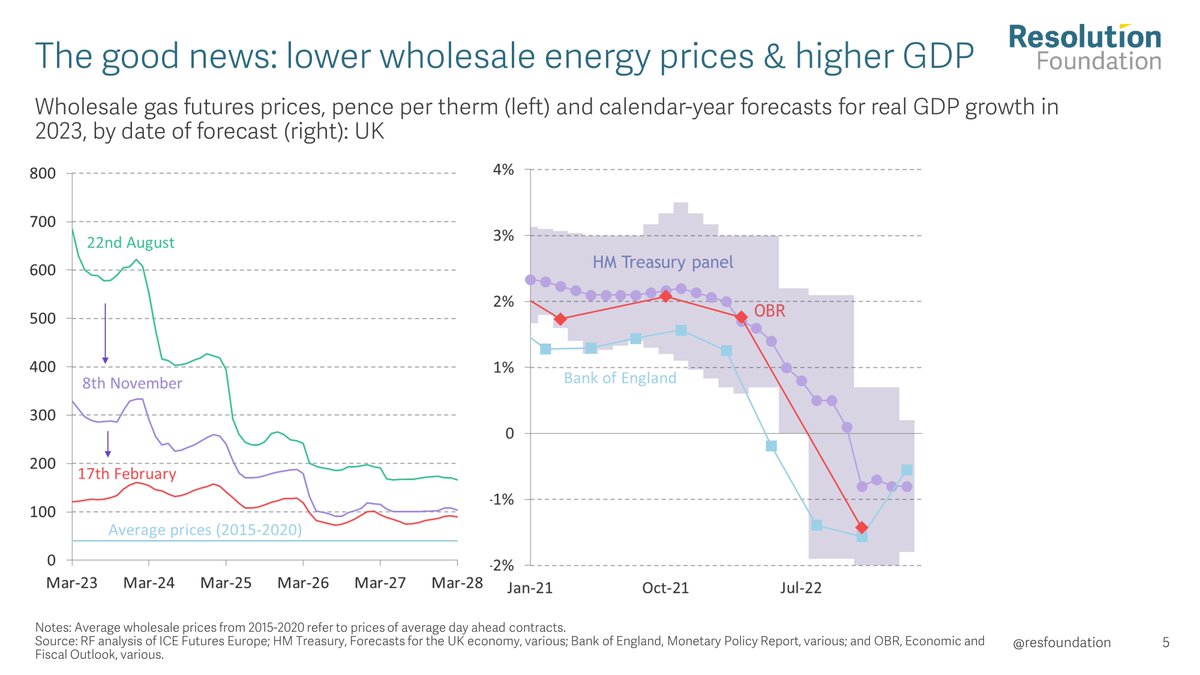

@TorstenBell Kicking off her presentation @carapacitti starts with the good news - lower wholesale energy prices & higher GDP. A recession in 2023 is still forecast, but it's likely to be the shallowest one since the 1950s....

@TorstenBell Kicking off her presentation @carapacitti starts with the good news - lower wholesale energy prices & higher GDP. A recession in 2023 is still forecast, but it's likely to be the shallowest one since the 1950s....

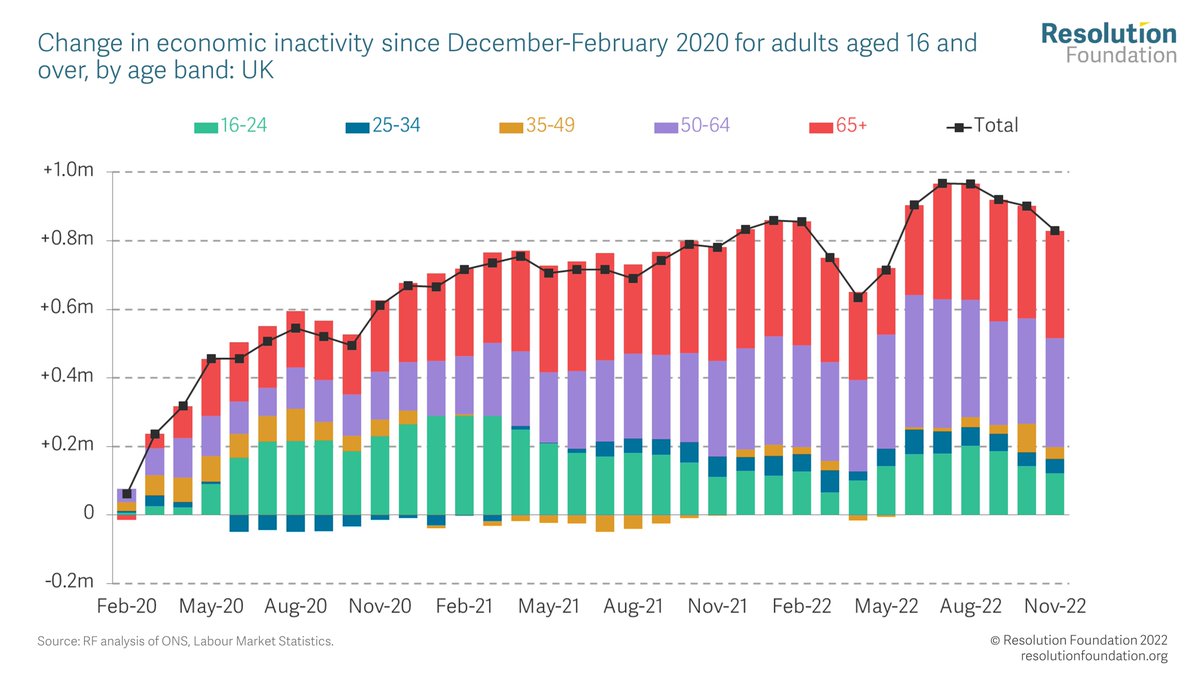

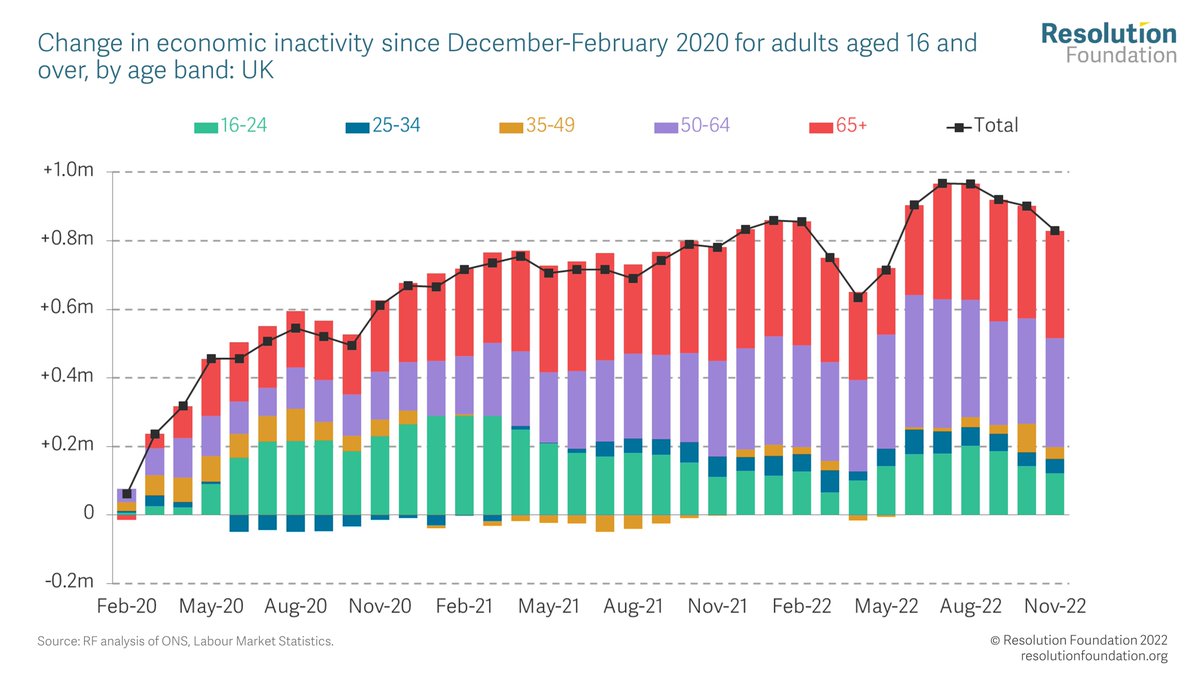

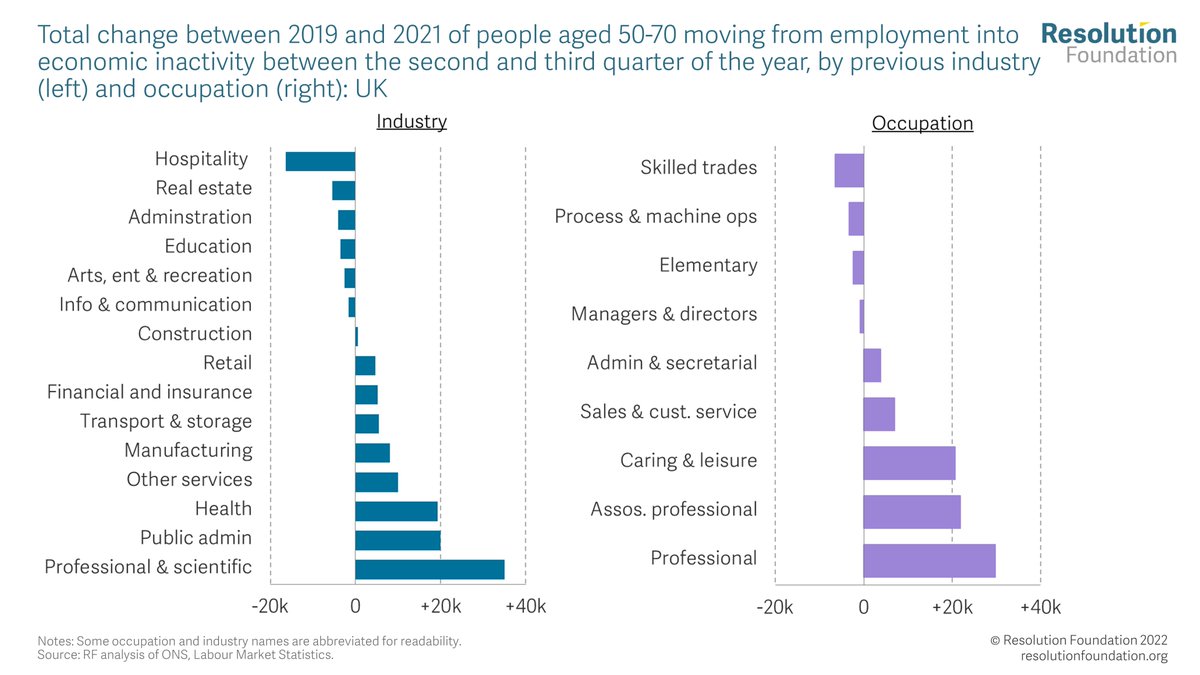

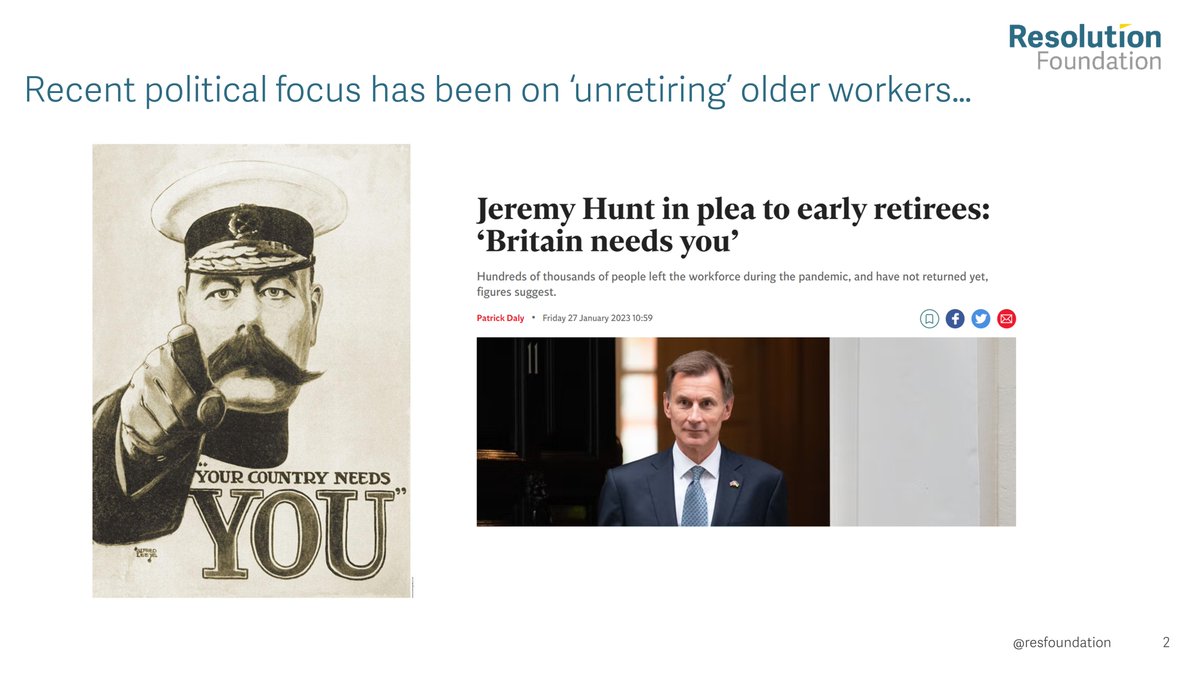

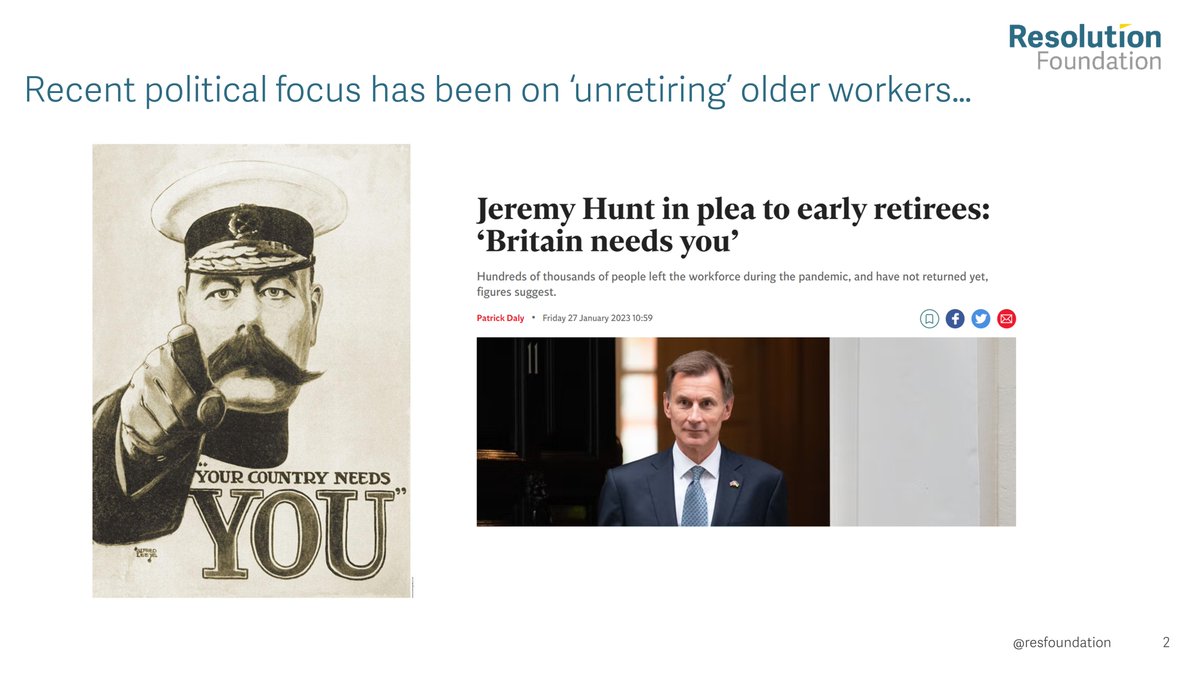

The cohort of older workers who have left the labour market since the start of the pandemic have disproportionately come from high-paying, professional industries; many of these adults will be living comfortably, and government policy is unlikely to prompt them to ‘un-retire’.

The cohort of older workers who have left the labour market since the start of the pandemic have disproportionately come from high-paying, professional industries; many of these adults will be living comfortably, and government policy is unlikely to prompt them to ‘un-retire’.

#2 - Focusing on inactivity among older workers probably isn't the best plan (even if the Government seems keen to pursue this line). Our report finds older workers are unlikely to want to ‘unretire’, especially if they are financially secure.

#2 - Focusing on inactivity among older workers probably isn't the best plan (even if the Government seems keen to pursue this line). Our report finds older workers are unlikely to want to ‘unretire’, especially if they are financially secure.

#2 - Focusing on inactivity among older workers probably isn't the best plan (even if the Government seems keen to pursue this line). Our report finds older workers are unlikely to want to ‘unretire’, especially if they are financially secure.

#2 - Focusing on inactivity among older workers probably isn't the best plan (even if the Government seems keen to pursue this line). Our report finds older workers are unlikely to want to ‘unretire’, especially if they are financially secure.

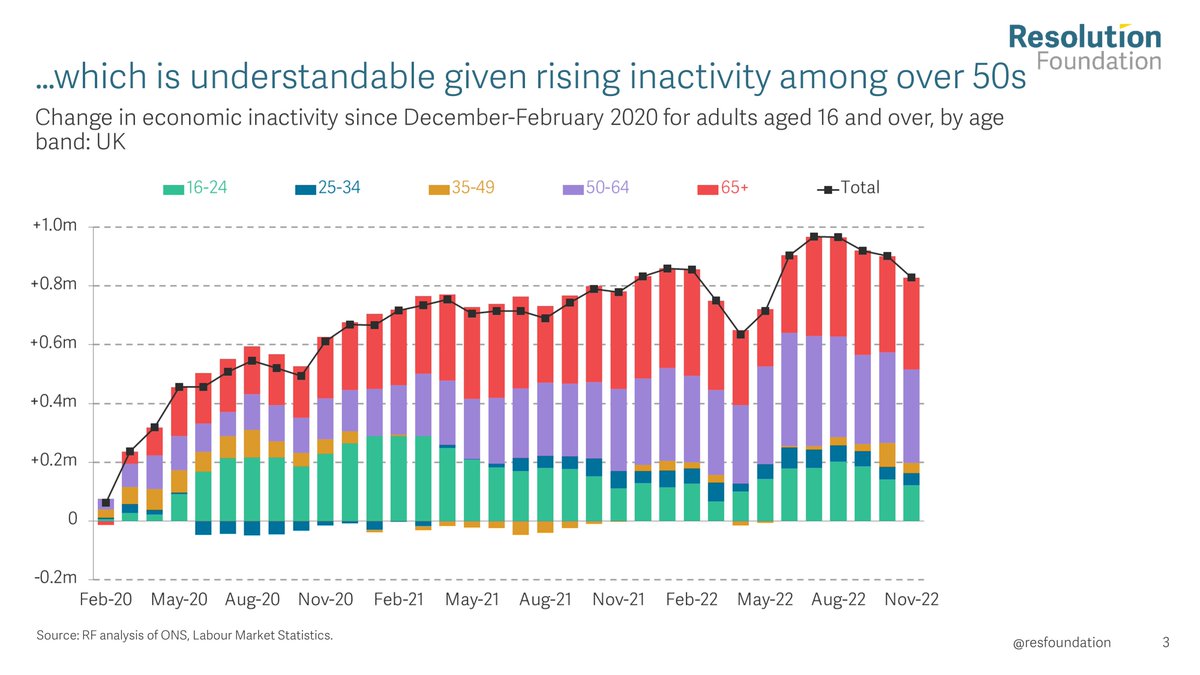

@_louisemurphy This focus is understandable given the big rise in economic inactivity among those aged 50 and over - who account for three-quarters of the rise since 2019.

@_louisemurphy This focus is understandable given the big rise in economic inactivity among those aged 50 and over - who account for three-quarters of the rise since 2019.

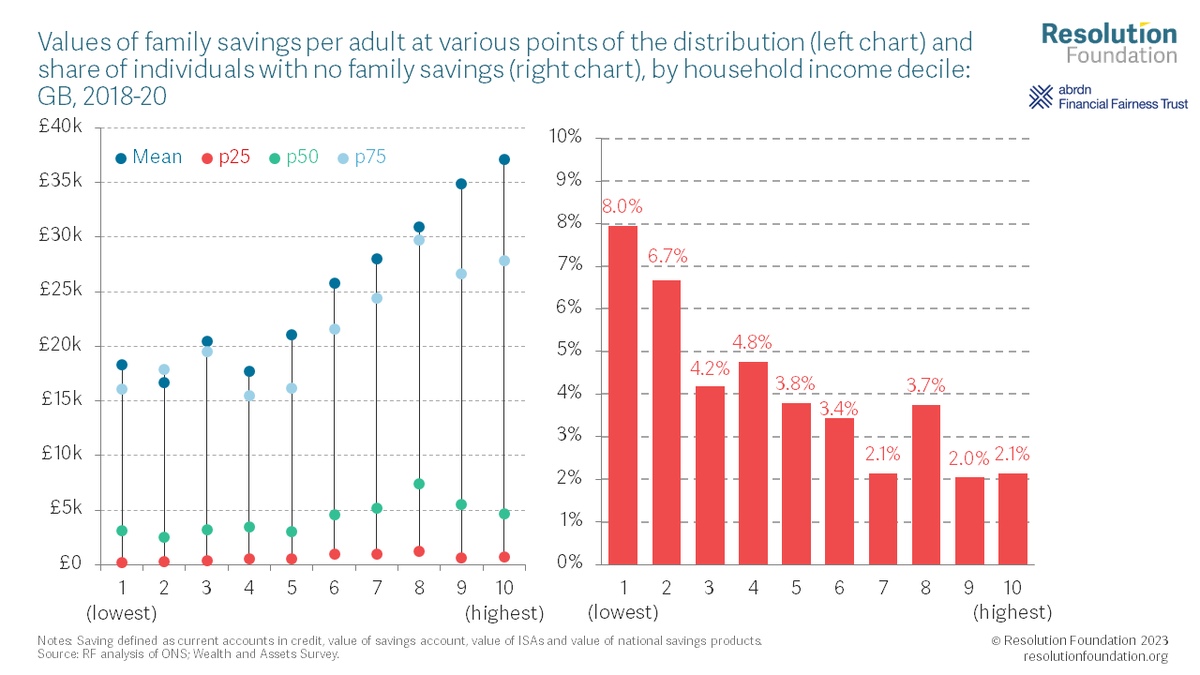

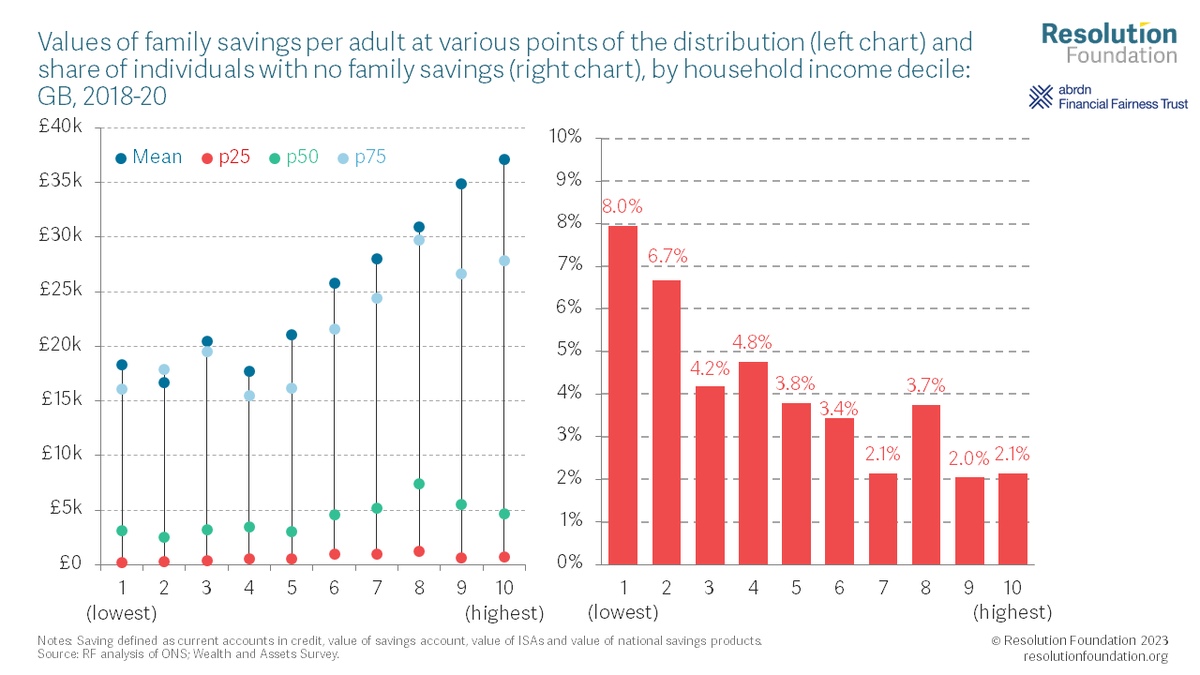

For example, 41% of the £1.3 billion of foregone tax revenue from savings allowances goes to the richest tenth of households, reflecting their far higher levels of saving.

For example, 41% of the £1.3 billion of foregone tax revenue from savings allowances goes to the richest tenth of households, reflecting their far higher levels of saving.

Households in the bottom half of the income distribution typically have savings of just £3,000 per adult, while around 750,000 lower-income families have no savings at all.

Households in the bottom half of the income distribution typically have savings of just £3,000 per adult, while around 750,000 lower-income families have no savings at all.