Kicking off our #SpringStatement2022 event @JamesSmithRF notes that the Chancellor set himself two tasks:

1. Support for households in the face of the cost of living crisis.

2. Set up the tax cuts to come.

Did he deliver?

1. Support for households in the face of the cost of living crisis.

2. Set up the tax cuts to come.

Did he deliver?

@JamesSmithRF The key economic context is the @OBR_UK forecasting the highest inflation for 40 years this year....

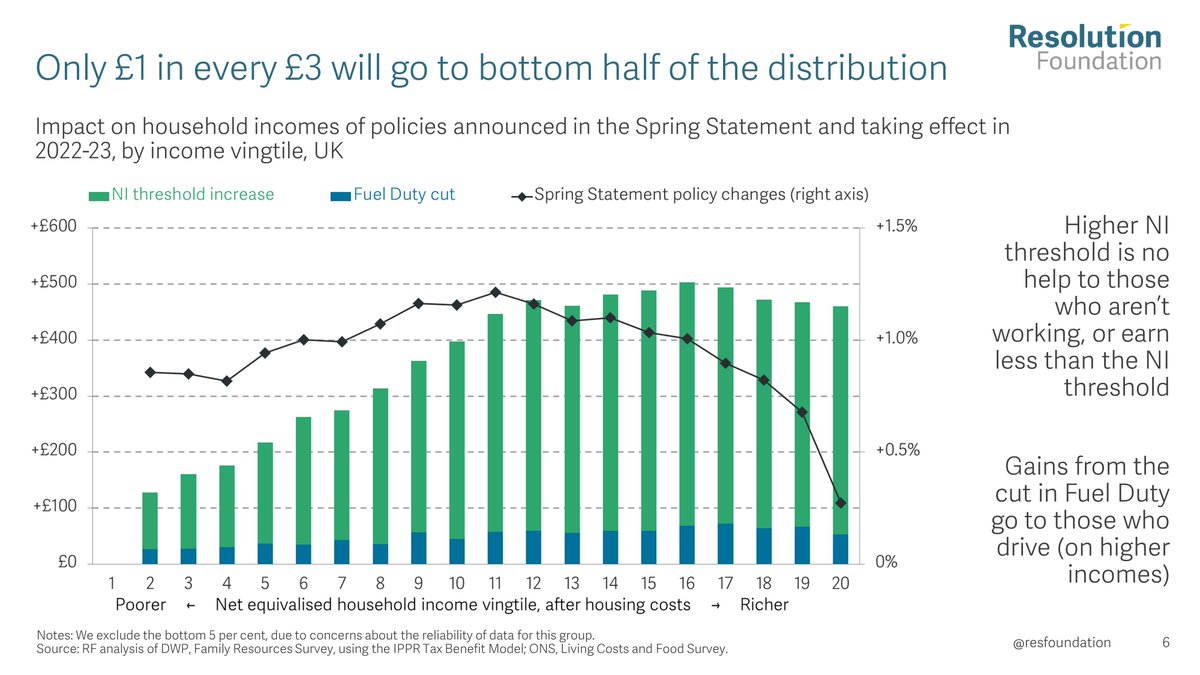

@JamesSmithRF @OBR_UK The Chancellor's policy response centred around a 5p fuel duty cut, a big increase in the NICs threshold and £500 million increase to the Household Support Fund (plus energy bills rebate package announced earlier). Notably nothing to address the £11bn real-terms cuts to benefits.

@JamesSmithRF @OBR_UK The policies announced in the #SpringStatement2022 offered something for everyone - but mainly for richer households who will receive £2 of every £3 spent

@JamesSmithRF @OBR_UK Adding in all policies taking effect in 2022-23, incuding previously announced tax rises. the package is more progressive - but basically offers very little to most households in the face of the biggest cost of living crisis Britain has faced in generations.

@JamesSmithRF @OBR_UK As a result, typical incomes will fall by over £1,000 next year (2022-23) - the biggest falls in generations (and will continue to fall in 2023-24)

@JamesSmithRF @OBR_UK And the lack of support for low-income families in the face of this cost of living crisis means that levels of absolute poverty are set to rise by 1.3 million next year to around 12.5 million - first time we've seen a rise like this outside of recessions...

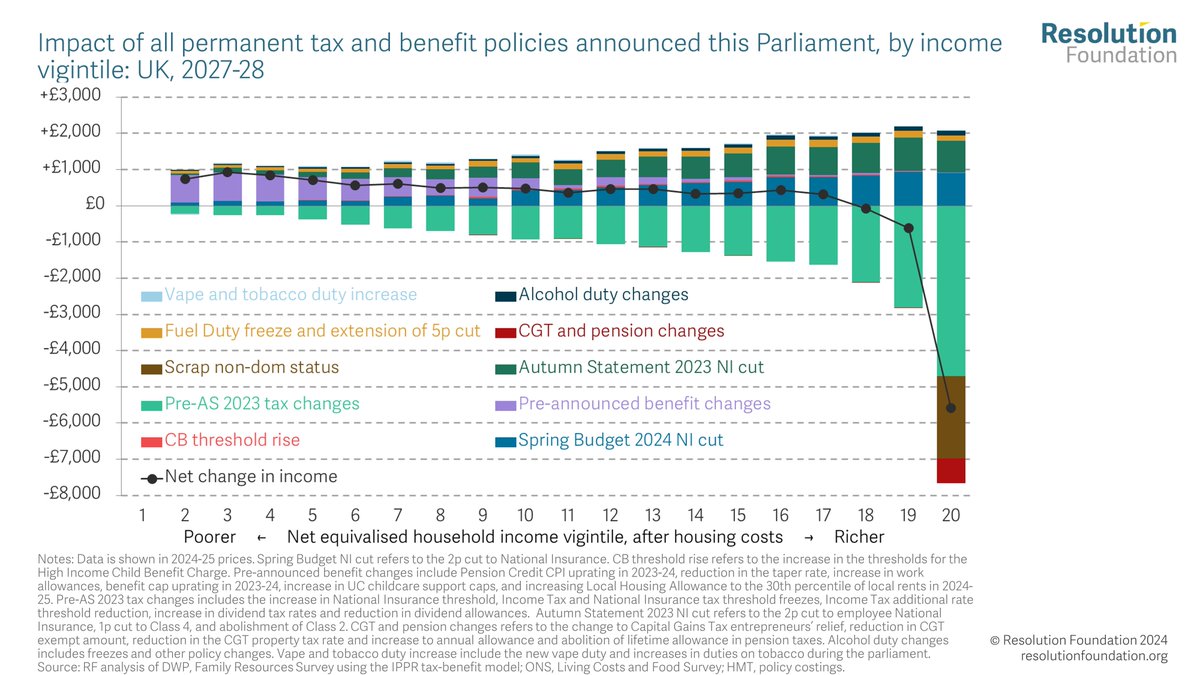

@JamesSmithRF @OBR_UK Turning to tax.... A surprise 1p Income Tax cut is dwarfed by previous tax rises… 7-in-8 workers will pay more income tax and NI in 2024-25.

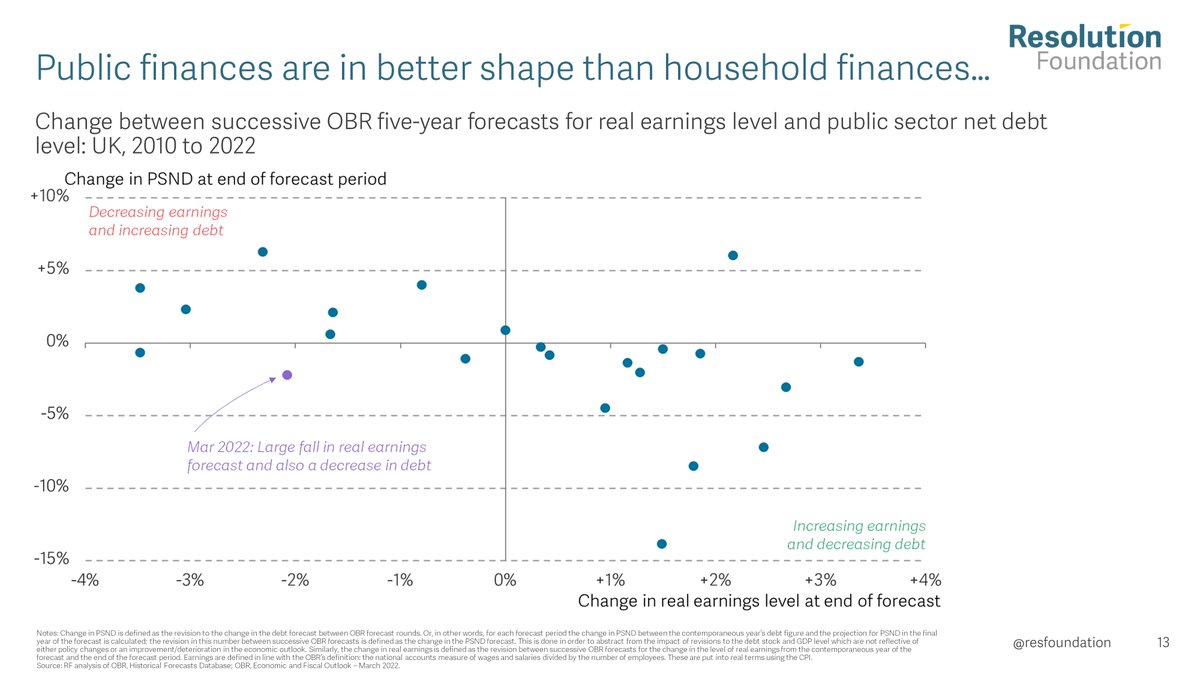

@JamesSmithRF @OBR_UK the improved picture on the public finances is due to the higher tax receipts seen during the pandemic recovery will last - and more than offset higher debt interest payments and tax cuts.

@JamesSmithRF @OBR_UK This means that borrowing is falling rapidly, and the Chancellor has increased his fiscal headroom to £28 billion. Maybe he's keeping his powder dry for further fiscal action later in the year (though the cost of living crisis is happening right now)

@JamesSmithRF @OBR_UK In summary, did the Chancellor do enough to protect families from the cost of living crisis and showcase his tax cutting credentials? In our view, he came up short on both counts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh