Of the top 98 wallets that withdrew $CEL from #FTX over the last month, 81 of them are funded and controlled by #CelsiusNetwork.

In other words, #Celsius is manufacturing the appearance of demand for their token.

How do I know? 🧵👇 (1/n)

In other words, #Celsius is manufacturing the appearance of demand for their token.

How do I know? 🧵👇 (1/n)

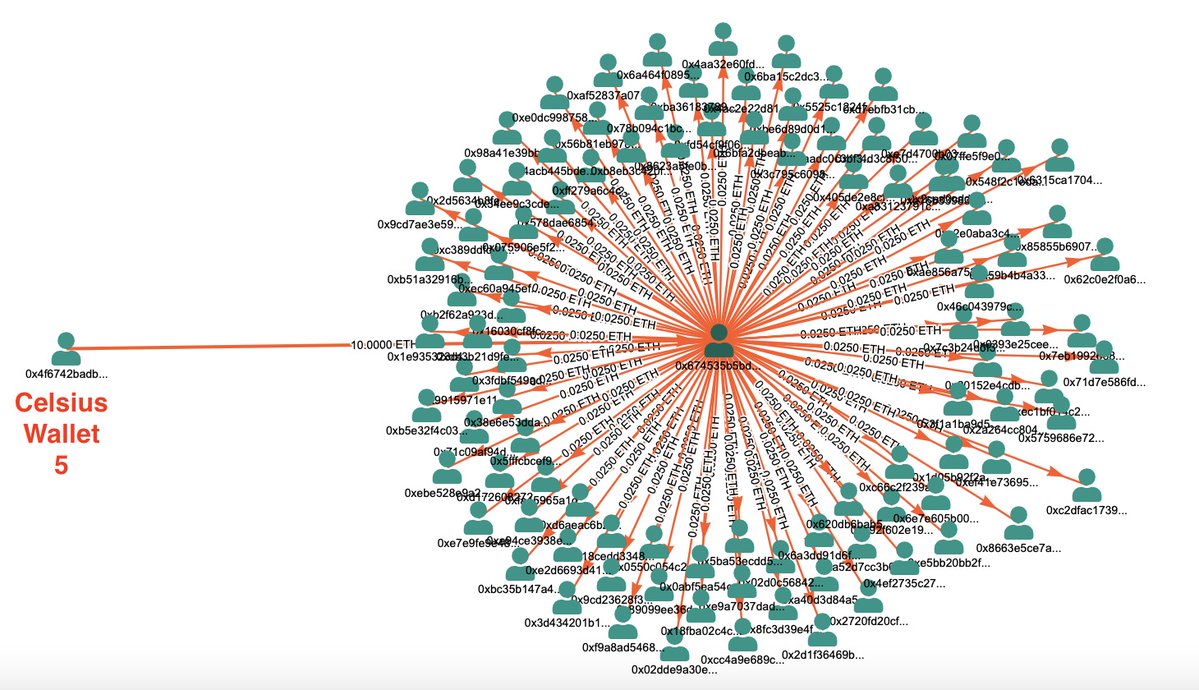

To recap: I recently found a number of wallets that perform one task-

Receive small #Ether transfers from #Celsius Wallet 5, then distribute the #Ether to dozens of downstream wallets. (2/n)

Receive small #Ether transfers from #Celsius Wallet 5, then distribute the #Ether to dozens of downstream wallets. (2/n)

https://x.com/MikeBurgersburg/status/1505221553394524171?s=20&t=otCJAoBhtD1bz_hh_OIxxA

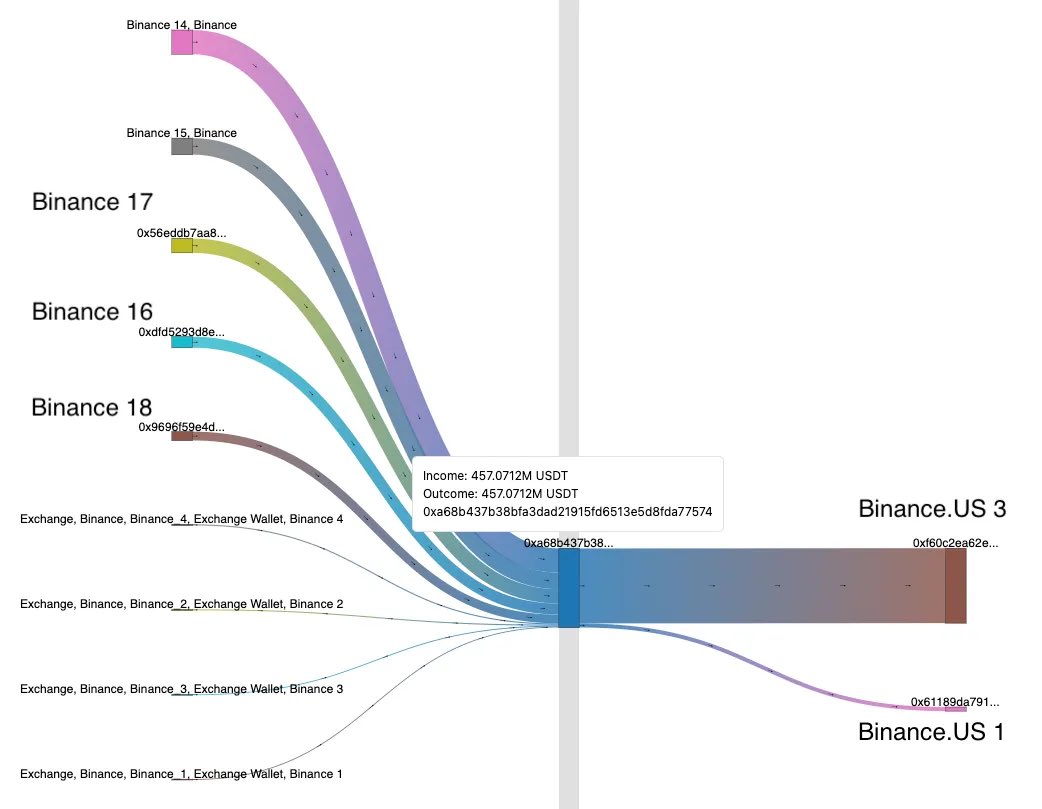

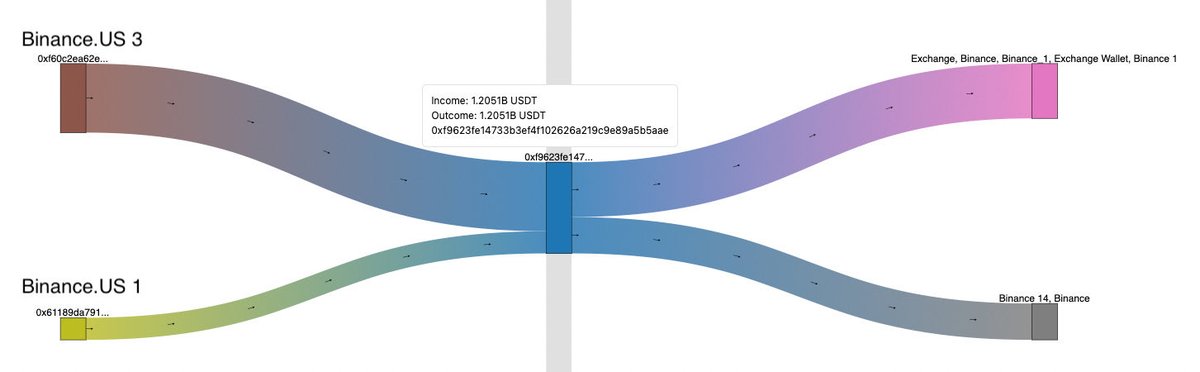

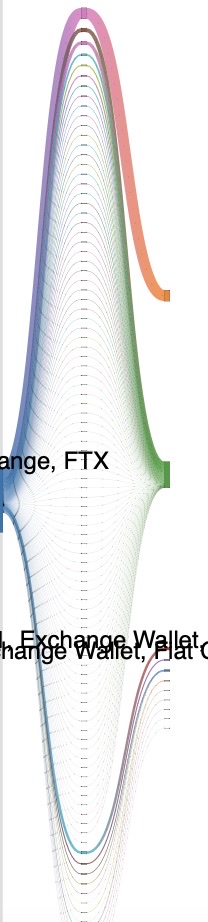

#FTX hosts the largest market for $CEL token in terms of volume. On the surface, it appears that there are many different parties sending and receiving $CEL from the exchange (I know pic sucks, best I could do): 3/n

explorer.bitquery.io/ethereum/addre…

explorer.bitquery.io/ethereum/addre…

However, when you examine the transaction history for these downstream wallets, nearly all of them were funded by small #Ether transfers from one of #Celsius' distributor wallets. (4/n)

These downstream wallets also appear to serve a single task- they withdraw tokens from #FTX, then send them back to #Celsius Wallet 5. (5/n)

Several others, including the largest single withdrawer of $CEL from #FTX, serve as larger #Celsius "rail" wallets- intermediaries between #Celsius and other parties.

The largest withdrawing wallet currently holds $197 million worth of $Cel token: (6/n)

etherscan.io/address/0x845c…

The largest withdrawing wallet currently holds $197 million worth of $Cel token: (6/n)

etherscan.io/address/0x845c…

Of the 3.4 million $CEL withdrawn from #FTX over the last month, 2.8 million ended up right back in #Celsius wallets, mostly in wallet 5:

From this evidence, it looks like #Celsius is manufacturing the appearance of organic demand and customers moving $CEL from #FTX. What other explanation would justify the time and transactional costs of doing things in such a convoluted fashion? (7/7)

🚨🚨🚨#Celsius $CEL #scam 👆

cc @Bitfinexed @DoombergT @web3isgreat @QTRResearch @concodanomics @ncweaver @dgolumbia @CasPiancey @ahcastor @intel_jakal @zachxbt @Quinnvestments @patio11 @SilvermanJacob @BennettTomlin @smdiehl

cc @Bitfinexed @DoombergT @web3isgreat @QTRResearch @concodanomics @ncweaver @dgolumbia @CasPiancey @ahcastor @intel_jakal @zachxbt @Quinnvestments @patio11 @SilvermanJacob @BennettTomlin @smdiehl

🚨🚨🚨 #Celsius $cel #scam 👆

@ben_mckenzie @smdiehl @Frances_Coppola @ClarityToast @RealWillyBot @Tr0llyTr0llFace @VersusBtc @zeroshorts @ahcastor

@ben_mckenzie @smdiehl @Frances_Coppola @ClarityToast @RealWillyBot @Tr0llyTr0llFace @VersusBtc @zeroshorts @ahcastor

Apparently second tweet in thread is getting shadowbanned. Links to previous thread illustrating how the Celsius distribution wallet network operates upstream:

https://twitter.com/MikeBurgersburg/status/1505221553394524171

• • •

Missing some Tweet in this thread? You can try to

force a refresh