If You are Trading Tightness by just looking at 3 or 4 Tight days. You are giving very less chance to yourself of getting those 8-10 R+ Trades. You need some good R gains to which will make up for your all small losses.

what you should focus to get those high R trades ⬇️

what you should focus to get those high R trades ⬇️

Another way to learn Tight Stop Loss Trading is to study all trades by @iManasArora . Look at his Entries , try nd find out reason for his Entries nd Exits..when you Master one set up, yes you can trade with 1% or smaller SL.

STUDY Past Big Winners nd check how stock moves:

STUDY Past Big Winners nd check how stock moves:

Focus on bigger picture , look for the uptrending stock which are coming out of from the BASE or look for the stock which are consolidating near Breakout area.

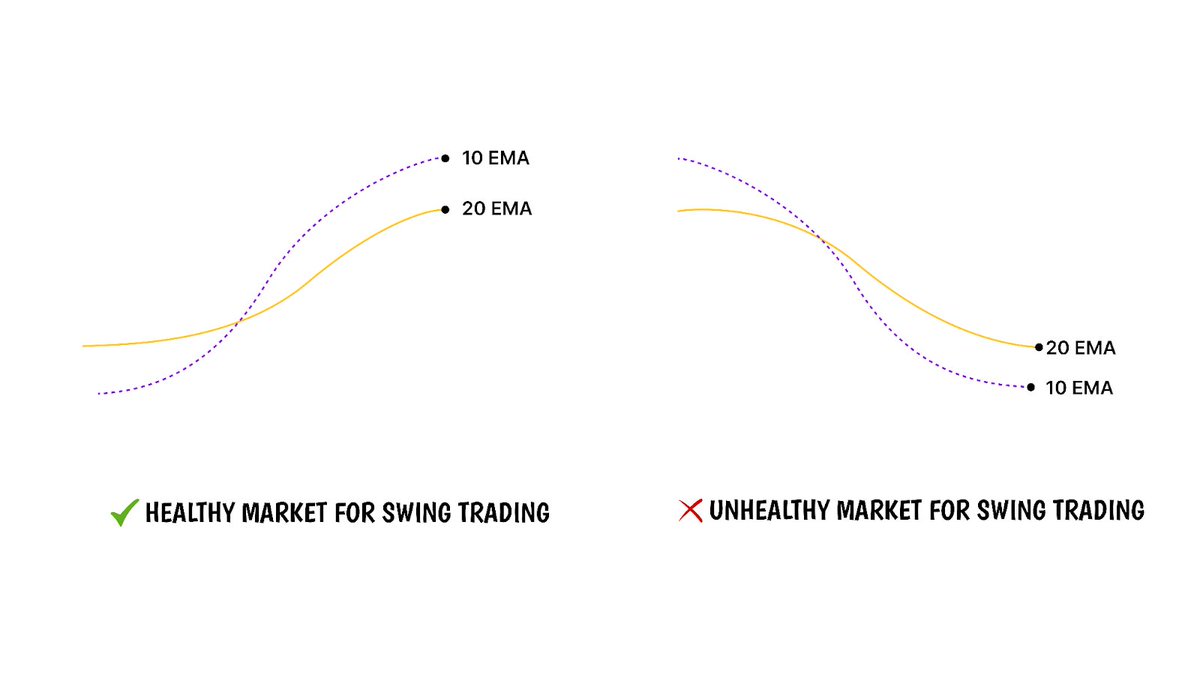

Stock which are giving Tight days near 10 or 20 EMA.

Here are some examples for better understanding :

Stock which are giving Tight days near 10 or 20 EMA.

Here are some examples for better understanding :

• • •

Missing some Tweet in this thread? You can try to

force a refresh