Good morning,

As I have listened to the $PEN (Panoro Energy) conf call for the fourth time

register.gotowebinar.com/recording/7716…

I really recommend spending some time with it and the presentation.

mb.cision.com/Public/399/351…

This company produce in 3 countries, all growing.

As I have listened to the $PEN (Panoro Energy) conf call for the fourth time

register.gotowebinar.com/recording/7716…

I really recommend spending some time with it and the presentation.

mb.cision.com/Public/399/351…

This company produce in 3 countries, all growing.

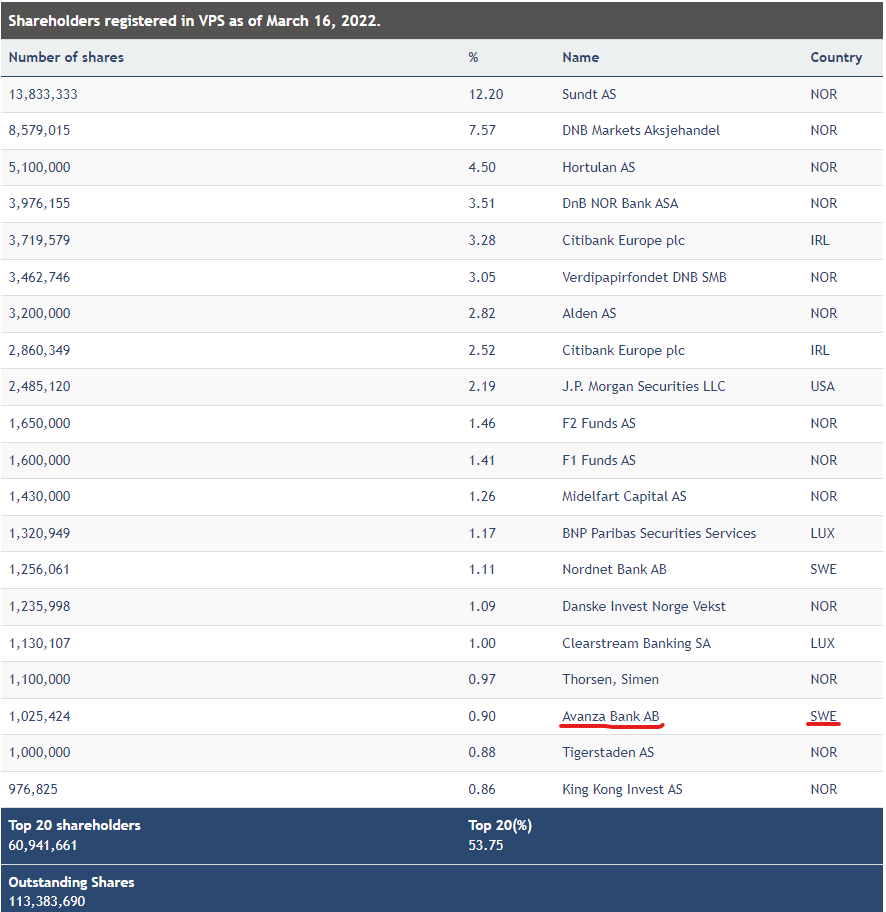

MCAP of $PEN is 423musd and EV about 500musd.

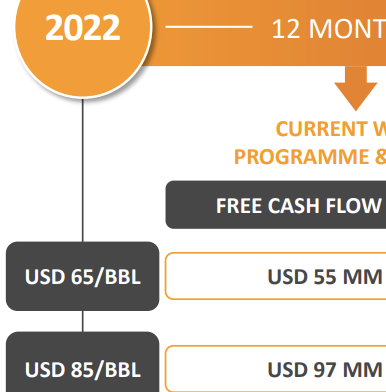

2022 is set to give us FCF meaning after tax, G&A, planned CAPEX but ex amortizations of ~140 musd @ 105usd oil realized which looks like a possible average. That on mid guided production levels= probably conservative numbers

2022 is set to give us FCF meaning after tax, G&A, planned CAPEX but ex amortizations of ~140 musd @ 105usd oil realized which looks like a possible average. That on mid guided production levels= probably conservative numbers

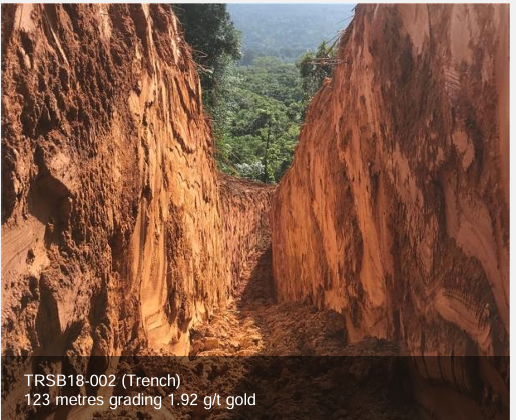

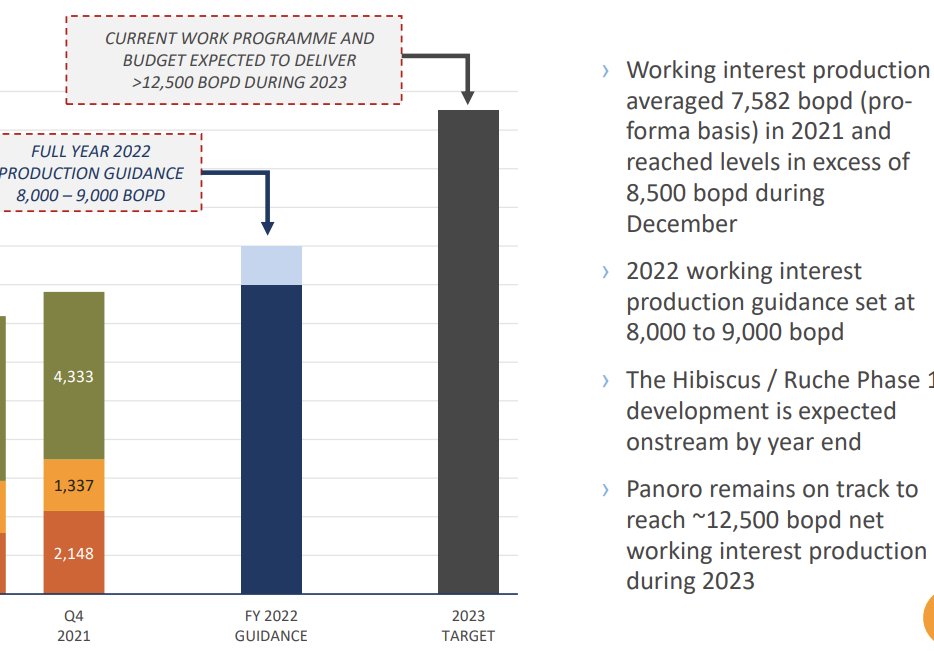

The immediate growth that is coming is in Gabon where they partner with BW Energy. This growth has been delayed due to a long lead time for "gas lift equipment". Meaning large parts of the growth is simply only a delivery of that equipment later this year.

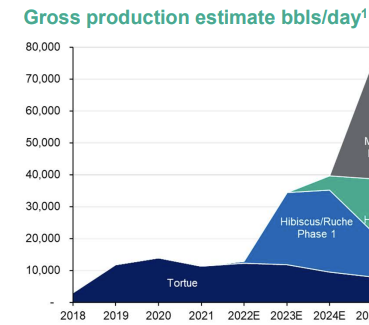

Blue&Green is PEN Gabon

Blue&Green is PEN Gabon

Post that equipment some development drilling. In other words, 2022 is a year that really have sandbagged numbers. We are about to jump... a lot... with little drama around that growth. This means the 2022 FCF says little about FCF built in capacity.

So where are we going? Well, we started with 500musd EV, about to FCF 140 musd this year. What next?

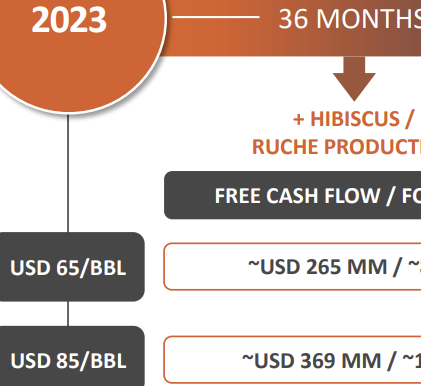

Well, at 85usd oil, the following 3y, with built in planned expansions & mid expected production range:

369 musd on top of that. Obviously anyone can use 105$ oil and get 473musd

Well, at 85usd oil, the following 3y, with built in planned expansions & mid expected production range:

369 musd on top of that. Obviously anyone can use 105$ oil and get 473musd

Personally, I think a 60% larger (production barrels/day) $PEN perhaps 14 months from now + having cashflowed 150 musd or whatever, is highly likely to have doubled in price. Likely more with if they & the Lundin family has success this October in Namibia or if oil is very strong

Listening to the company in the conf call and other places, I also came away with a strong feeling that a year from now we also have a new target, much higher than 12500 bpd for the coming year from the partner here going for growth in EG.

trident-energy.com/strategy-and-a…

trident-energy.com/strategy-and-a…

At the same time in partnership with $EGY and $BWE the prospects look excellent to find more oil around their existing very successful fields:

So... coming 6 months:

1. Production taking off as equipment arrives, most of it unhedged.

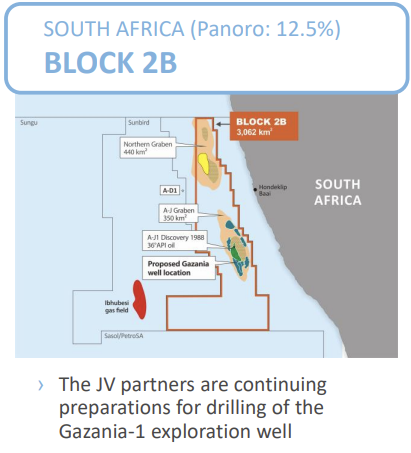

2. High impact drilling with the Lundin family in Namibia.

3. Dividend to be introduced. If Pareto is to be believed, 15-20% yield style.

4. Probably drill & expansion plans 2023 EG

1. Production taking off as equipment arrives, most of it unhedged.

2. High impact drilling with the Lundin family in Namibia.

3. Dividend to be introduced. If Pareto is to be believed, 15-20% yield style.

4. Probably drill & expansion plans 2023 EG

• • •

Missing some Tweet in this thread? You can try to

force a refresh