📊TATA ELXSI LIMITED (#TATAELXSI)

🏷Market Cap: 52,550 Cr

🏷One of the World’s leading provider of design and technology services across industries including Automotive, Broadcast & communications and Healthcare

💥Business Analysis

A Thread 🧵

🏷Market Cap: 52,550 Cr

🏷One of the World’s leading provider of design and technology services across industries including Automotive, Broadcast & communications and Healthcare

💥Business Analysis

A Thread 🧵

🌁BUSINESS

🏷Part of prestigious TATA Group

🏷Established in 1989, A forward looking IT business

🏷Company earns revenue primarily from providing information technology, engineering design, systems integration & support services, sale of licenses and maintenance of equipment

🏷Part of prestigious TATA Group

🏷Established in 1989, A forward looking IT business

🏷Company earns revenue primarily from providing information technology, engineering design, systems integration & support services, sale of licenses and maintenance of equipment

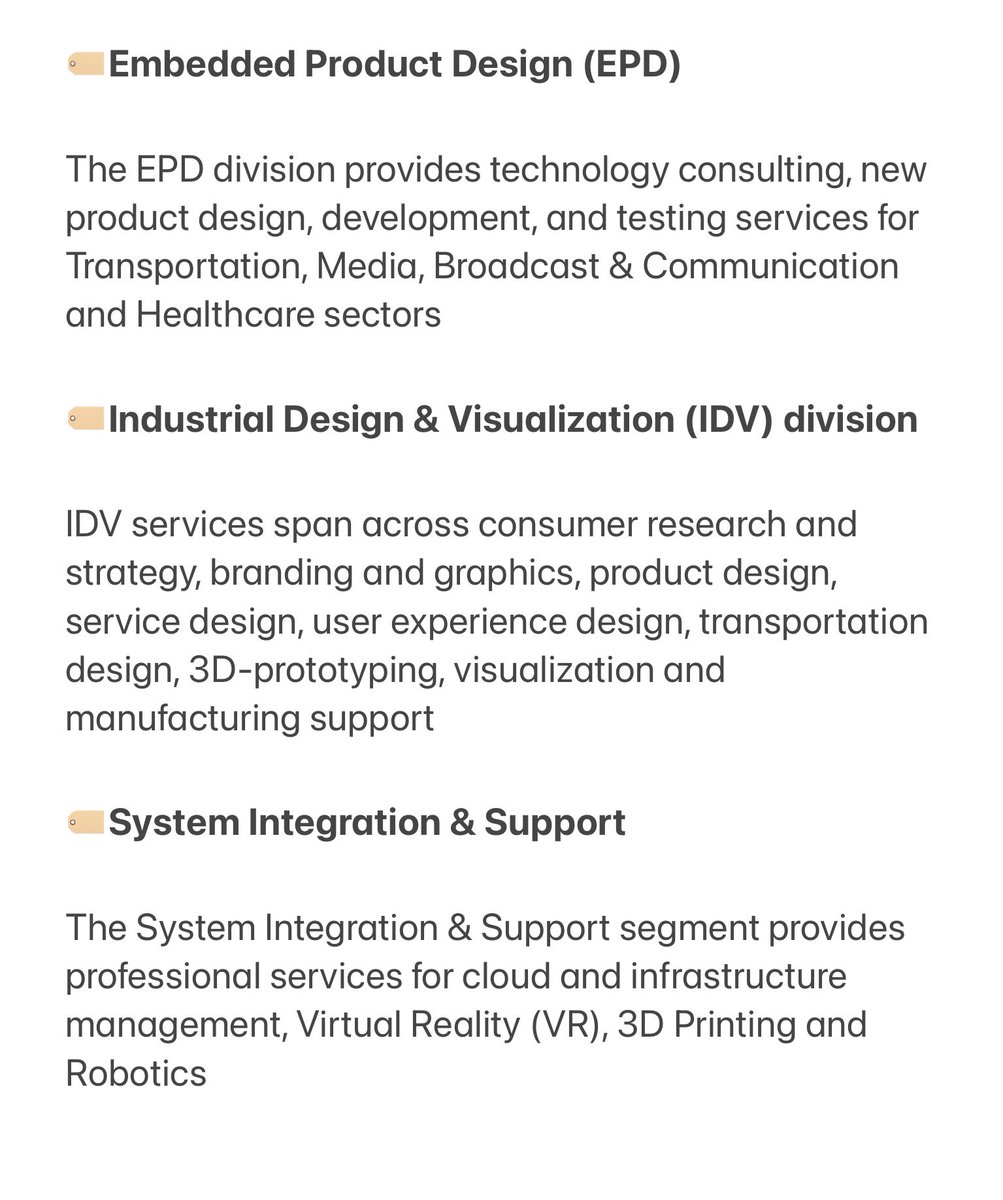

🌁The company operates in 2 segments

1. Software Development & Services

It is further sub divided into EPD and IDV.

🏷Embedded Product Design (EPD)

🏷Industrial Design & Visualisation (IDV) division

2. System Integration & Support (SIS)

1. Software Development & Services

It is further sub divided into EPD and IDV.

🏷Embedded Product Design (EPD)

🏷Industrial Design & Visualisation (IDV) division

2. System Integration & Support (SIS)

🌁MANAGEMENT

🏷Manoj Raghavan (MD & CEO) : 22 Years of experience (2.42 Yrs tenure)

🏷CEO compensation ($USD 578.96K) is below average for companies of similar size

🏷CEO compensation has increased by more than 20% in the past year

🏷Manoj Raghavan (MD & CEO) : 22 Years of experience (2.42 Yrs tenure)

🏷CEO compensation ($USD 578.96K) is below average for companies of similar size

🏷CEO compensation has increased by more than 20% in the past year

🌁SHAREHOLDING PATTERN

🏷Change in promoter holding (Vs last quarter): -0.21%

🏷Change in FII holding (Vs last quarter): -0.78%

🏷Change in DII holding (Vs last quarter): +0.59%

🏷Change in public holding (Vs last quarter): +0.41%

🏷Change in promoter holding (Vs last quarter): -0.21%

🏷Change in FII holding (Vs last quarter): -0.78%

🏷Change in DII holding (Vs last quarter): +0.59%

🏷Change in public holding (Vs last quarter): +0.41%

🌁CONTRIBUTION TO DIFFERENT INDUSTRIES

Company is mainly working for below industries

1. Automotive

2. Broadcast & Communications

3. Healthcare

Company is mainly working for below industries

1. Automotive

2. Broadcast & Communications

3. Healthcare

🌁WELL DIVERSIFIED REVENUE MIX (Q3 FY22)

🏷Geography

Americas: 42.3%, Europe: 32.8%, India: 16.7%, RoW: 8.2%

🏷Segment

Embedded Product Design: 88.9%

Industrial Design & Visualisation: 8.9%

System Integration & Support: 2.2%

🏷Geography

Americas: 42.3%, Europe: 32.8%, India: 16.7%, RoW: 8.2%

🏷Segment

Embedded Product Design: 88.9%

Industrial Design & Visualisation: 8.9%

System Integration & Support: 2.2%

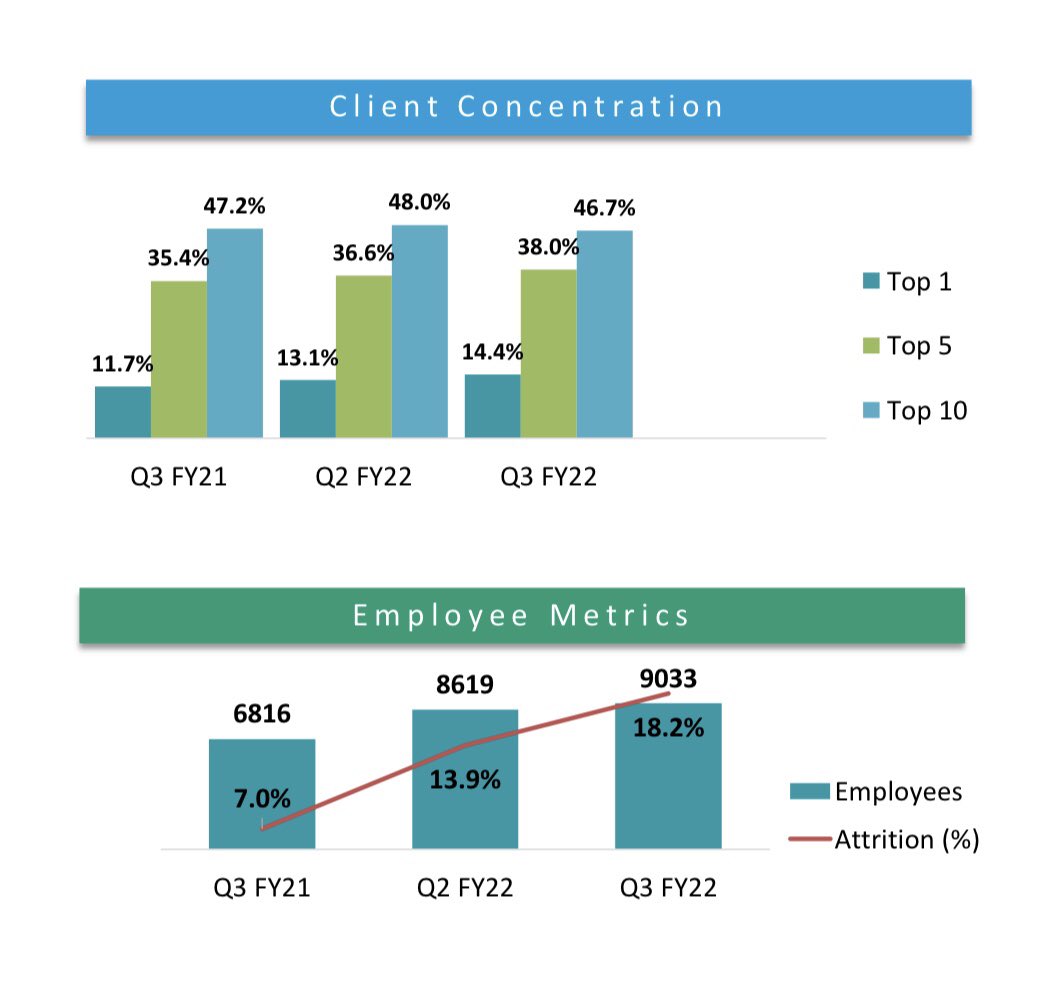

🌁Client concentration & Employee Metrics

🏷People addition in Q3 FY22: 414

🏷Employee utilisation rate ~83%

❌Attrition Rate: 18.2% (LTM)

🏷People addition in Q3 FY22: 414

🏷Employee utilisation rate ~83%

❌Attrition Rate: 18.2% (LTM)

🌁QUARTERLY RESULTS (Q3 FY22)

🏷Sales Growth: 33.2% YoY - Good YoY Sales Growth

🏷Profit: 43.5% YoY - Good YoY Profit Growth

🏷Consistent growth in margins

🏷Strong order book and a healthy deal pipeline

🏷The company is debt free since long

🏷Sales Growth: 33.2% YoY - Good YoY Sales Growth

🏷Profit: 43.5% YoY - Good YoY Profit Growth

🏷Consistent growth in margins

🏷Strong order book and a healthy deal pipeline

🏷The company is debt free since long

🌁FINANCIALS (5 Year CAGR)

🏷Sales Growth: 11.2%

🏷EBITDA Growth: 16.2%

🏷PAT Growth: 18.9%

🏷ROCE: 42.5% (FY21)

🏷ROE: 30.2%

Working capital days of the company in FY21 stood at ~65 days

Free cash flow per share increased to 62 Rs in FY 21

Overall, Numbers look good.

🏷Sales Growth: 11.2%

🏷EBITDA Growth: 16.2%

🏷PAT Growth: 18.9%

🏷ROCE: 42.5% (FY21)

🏷ROE: 30.2%

Working capital days of the company in FY21 stood at ~65 days

Free cash flow per share increased to 62 Rs in FY 21

Overall, Numbers look good.

🌁STRENGTHS

🏷Diversified geographical presence

🏷Established market position

🏷Healthy financial operations

🏷Major contributor to the transformation to Electric Vehicle

🏷Company consistently making profits

🏷Debt free since long

🏷Brokers upgraded recommendation

🏷Diversified geographical presence

🏷Established market position

🏷Healthy financial operations

🏷Major contributor to the transformation to Electric Vehicle

🏷Company consistently making profits

🏷Debt free since long

🏷Brokers upgraded recommendation

🌁WEAKNESS

🏷Trading at Premium Valuation

🏷Promoter and FII reduced the holding in Q3 FY22

🏷Good competition from KPIT and LTTS

🏷~88% revenue from one segment, Embedded Product Design

🏷Trading at Premium Valuation

🏷Promoter and FII reduced the holding in Q3 FY22

🏷Good competition from KPIT and LTTS

🏷~88% revenue from one segment, Embedded Product Design

🌁VALUATION

🏷Price to Earnings (PE): 104 (Above it’s median PE 27.6)

🏷Price to book value: 40.7

🏷PEG Ratio: 5.53

Although there is bright growth prospect, at current levels stock is trading at premium valuation (Overvalued).

🏷Price to Earnings (PE): 104 (Above it’s median PE 27.6)

🏷Price to book value: 40.7

🏷PEG Ratio: 5.53

Although there is bright growth prospect, at current levels stock is trading at premium valuation (Overvalued).

• • •

Missing some Tweet in this thread? You can try to

force a refresh