@sfplanning just released drafts of the keystone pieces of city's housing element: (1) analysis of site capacity (as zoned), (2) analysis of constraints.

tl,dr: big progress on conceptual level, huge problems in practice.

This 🧵 covers sites; stay tuned for constraints. 1/22

tl,dr: big progress on conceptual level, huge problems in practice.

This 🧵 covers sites; stay tuned for constraints. 1/22

The big & welcome news is that SF, like LA, undertook to comply w/#AB1397 by modeling sites' probability of development during planning period & discounting sites' nominal zoned capacity by p(dev). 2/

https://twitter.com/CSElmendorf/status/1411037893297012739

The leadership of SF and LA on this issue, coupled with @California_HCD's rejection of nearly all housing elements from SoCal cities, is going put pressure on other cities to get on board the p(dev) train. 3/

This is *so* important, b/c for last 40 years, cities have gotten away with junk plans premised on patently false assumption that if a site could be developed during planning period, it would be developed. 4/

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

Reality check: in Bay Area, a typical 5th cycle "housing element site" had less than a 1-in-10 chance of development during planning period.

A site zoned for 100 homes should have counted for 10 or fewer, but it was counted for 100. 5/

escholarship.org/uc/item/6786z5…

A site zoned for 100 homes should have counted for 10 or fewer, but it was counted for 100. 5/

escholarship.org/uc/item/6786z5…

The false p(dev) = 1 assumption allowed nearly all cities in expensive places to avoid rezoning for additional capacity. /6

lewis.ucla.edu/research/a-rev…

lewis.ucla.edu/research/a-rev…

But as LA and now SF have discovered, a city that's realistic about p(dev) will have to rezone. A lot.

Or at least it should... /7

Or at least it should... /7

SF hired an economics consultant to fit a p(dev) model to data from 2001-2018 and, as described, the model seems reasonable. So far, so good. /8

Consultant concluded that SF has p(dev)-adjusted capacity for ***less than 21,000 new homes, under current zoning, over the next 30 years.***

Whereas the city's state-assigned housing target exceeds 80,000 homes over just the next 8 years! /9

Whereas the city's state-assigned housing target exceeds 80,000 homes over just the next 8 years! /9

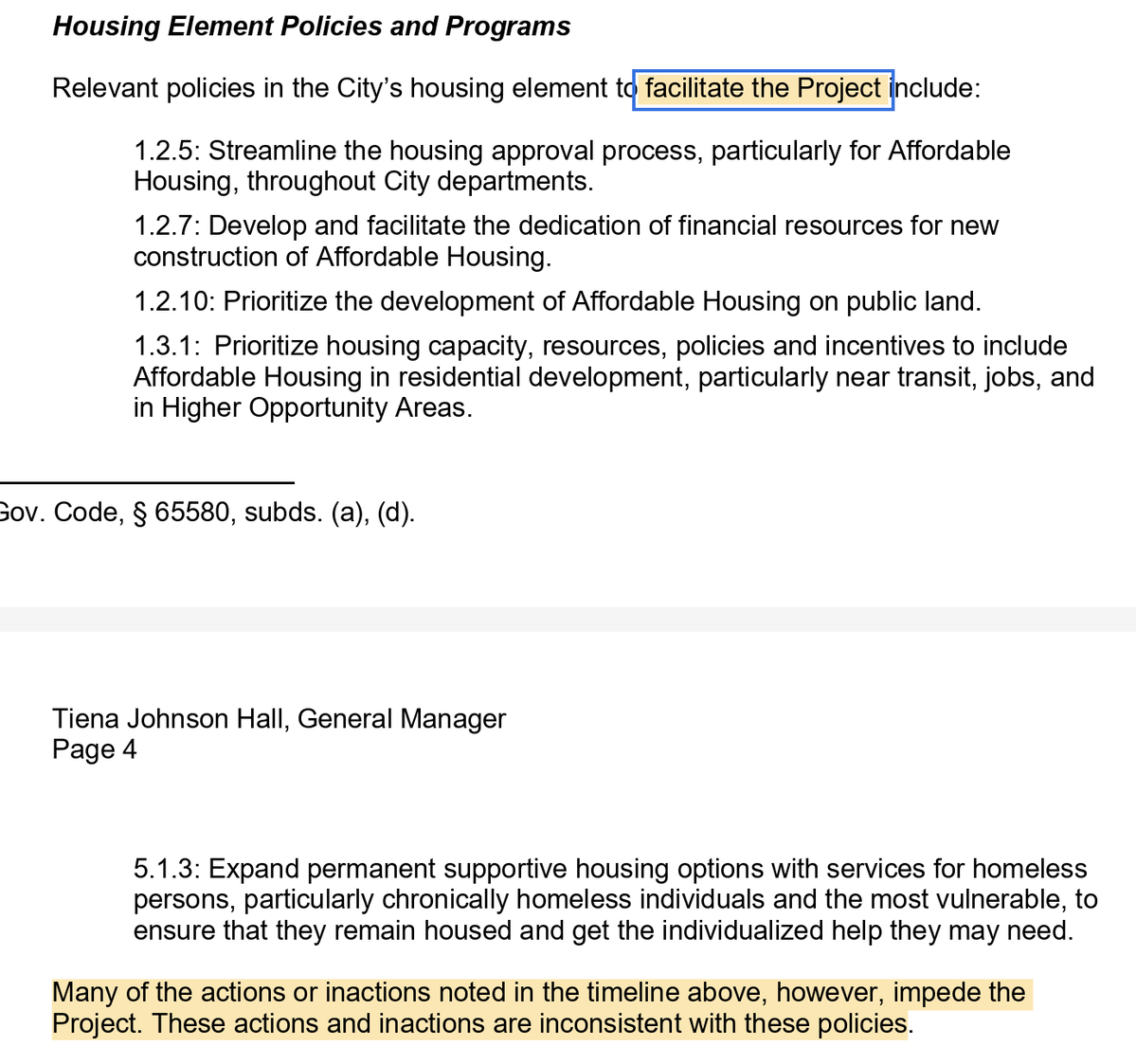

So, big rezoning? There ought to be! But SF purports to backfill most of deficit w/ handwavy, "trust us" assumptions about other sources of capacity, ultimately committing to rezone for only ~22,000 more units.

The money table is on p. 8. Let's break it down. /10

The money table is on p. 8. Let's break it down. /10

For starters, city posits that 50% of modeled capacity over next 30 years will materialize in next 8 years.

Rationale: state law is now better for development, so a model fit w/2001-18 data understates capacity under current law. Ok, that's directionally correct. /10

Rationale: state law is now better for development, so a model fit w/2001-18 data understates capacity under current law. Ok, that's directionally correct. /10

But even using that indulgent assumption, SF has "modeled" capacity for only about 10k homes, leaving massive shortfall (another 72k-84k units).

And this is where things get real wacky. /11

And this is where things get real wacky. /11

First, city posits that sites which "met criteria provided by mayor's office" for funding 100% affordable projects have p(dev) = 0.50!

City provides *zero* information about rate at which such sites have been developed in the past. /12

City provides *zero* information about rate at which such sites have been developed in the past. /12

It takes real chutzpah to assert, w/o any evidence or even info about city's financial capacity to acquire these sites, that sites targeted for social housing have vastly higher p(dev) than other sites.

But this "saves" S.F. from rezoning for 8600 more units. /13

But this "saves" S.F. from rezoning for 8600 more units. /13

Now to the biggest skeletons: the "development pipeline."

City credits itself w/nearly 50,000 units from "housing ... projects that have been proposed or that have already received [planning] approvals but that have not received building permits." /14

City credits itself w/nearly 50,000 units from "housing ... projects that have been proposed or that have already received [planning] approvals but that have not received building permits." /14

What's the basis for these numbers? "[D]iscussion with city agencies working on the [pipeline] projects to assess units likely to be delivered over RHNA period."

That is, "trust us." /15

That is, "trust us." /15

Notably absent: any analysis of what share of "pipeline" projects from last housing element got developed during the last planning period. (SF's last plan counted ~35,000 "filed or approved" units.) /16

Finally, after all the massaging of numbers, SF concludes that it ought to rezone for ~22,000 more homes, & that for fair-housing reasons, they should be located on west side of city.

Some housing advocates are rejoicing. /17

Some housing advocates are rejoicing. /17

https://twitter.com/derivativeburke/status/1507449583483248643

But: in connection w/ analysis of constraints (more on that later), SF hired consultant for pro-forma analysis of different types of housing projects in different areas...and the consultant concluded that *nothing pencils out on the west side*. /18

On basis of that study, @sfplanning says that w/ current permitting process, impacts fees, exactions, & construction costs, the *only* kind of project that's economically feasible is a 24+ story high-rise in city's highest-demand neighborhoods. /19

Yet SF "plans" to meet its ~22,000 unit shortfall (after hand-waving) by rezoning west-side corridors for 55'-85' projects that per city's own analysis would have *negative* rate of return.

This is a cruel joke. Except it's no joke. /20

This is a cruel joke. Except it's no joke. /20

Here's the big picture: to meet its 82k unit target, San Francisco must *triple* its typical annual housing production.

Rezoning the west side for 22,000 economically infeasible homes won't cut it. /21

Rezoning the west side for 22,000 economically infeasible homes won't cut it. /21

@California_HCD should nix this plan unless SF:

(1) backs up its "pipeline" & "mayor's office" projections w/ public data, &

2) commits to ministerial review + waiver of fees/exactions/standards that render projects economically infeasible until city reaches RHNA target.

/end

(1) backs up its "pipeline" & "mayor's office" projections w/ public data, &

2) commits to ministerial review + waiver of fees/exactions/standards that render projects economically infeasible until city reaches RHNA target.

/end

@LondonBreed @ONeillMoiraK @elpaavo @sidkap_ @s_damerdji @MatteFleischer @hknightsf @SFjkdineen @kerryc_latimes @dillonliam @manuelatobiasm @Scott_Wiener @DavidChiu @AsmPhilTing @loridroste @GVelasquez72 @CaHousingGuy @ShannanWestCA

• • •

Missing some Tweet in this thread? You can try to

force a refresh