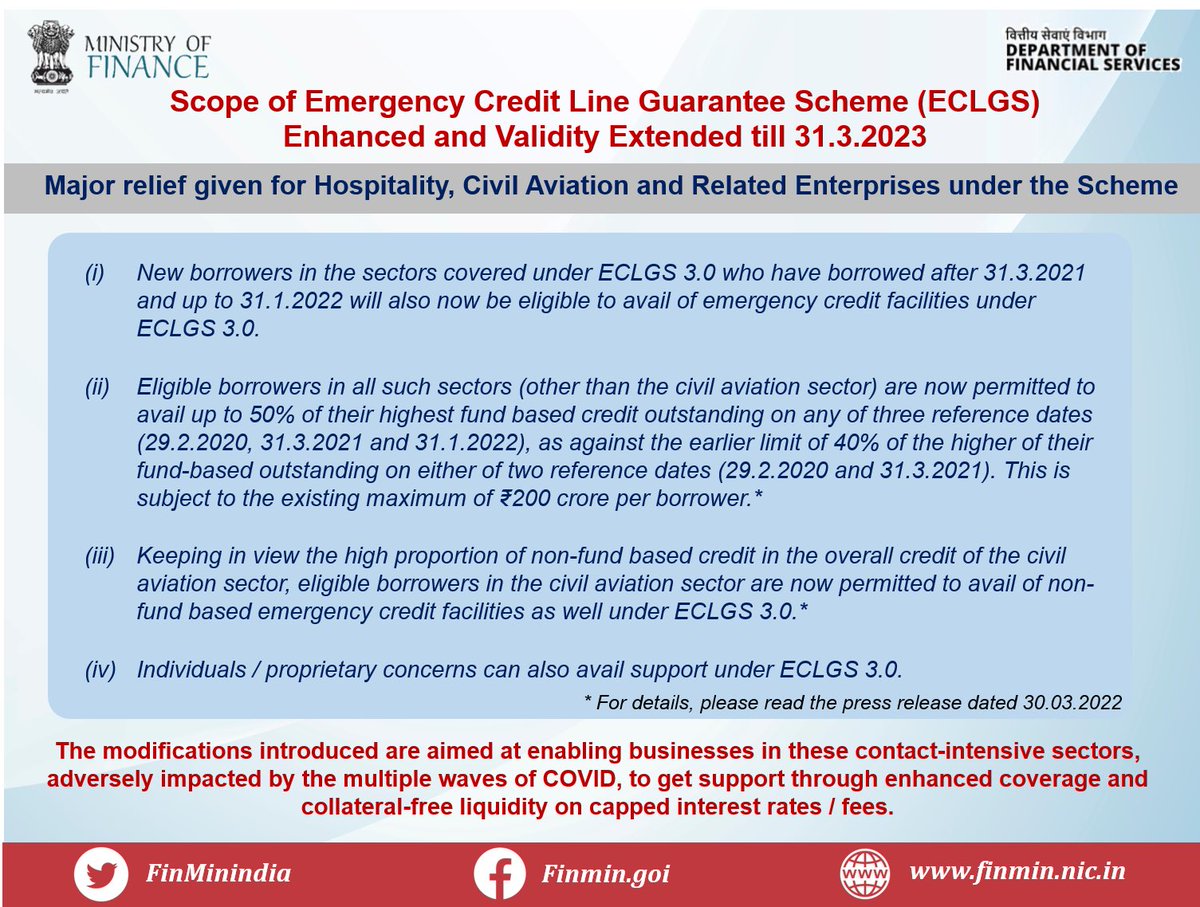

National Credit Guarantee Trustee Company Limited #NCGTC today extended the Emergency Credit Line Guarantee Scheme #ECLGS beyond March 2022, till March 2023

Read More ➡️ pib.gov.in/PressReleaseIf…

(1/8)

Read More ➡️ pib.gov.in/PressReleaseIf…

(1/8)

✅ Scope of #ECLGS enhanced & validity extended till 31.3.23

✅ #ECLGS benefits expanded to Hospitality, Travel, Tourism & Civil Aviation sectors

✅ Rs 3.19 lakh cr. loans sanctioned under #ECLGS as on 25.03.22; about 95% of guarantees issued for loans sanctioned to #MSMEs (2/8)

✅ #ECLGS benefits expanded to Hospitality, Travel, Tourism & Civil Aviation sectors

✅ Rs 3.19 lakh cr. loans sanctioned under #ECLGS as on 25.03.22; about 95% of guarantees issued for loans sanctioned to #MSMEs (2/8)

#ECLGS extended following the announcement by Union Finance Minister Smt. @nsitharaman in Union Budget 2022-23 regarding the extension of #ECLGS upto March 2023. (3/8)

FM Smt. @nsitharaman had also chaired post Budget consultations with the Travel, Tourism and Hospitality sector and the Civil Aviation sector delegations to understand specific issues related to credit flow on 25th February 2022. (4/8)

These modifications would ensure that businesses in the hospitality and related sectors which have been adversely impacted by the multiple waves of COVID-19 pandemic get support through enhanced coverage and collateral free liquidity. (5/8)

#ECLGS, since its launch, has extended relief to over 1.17 crore Micro, Small and Medium Enterprises #MSMEs and businesses. (6/8)

As on 25.3.2022, loans sanctioned have crossed Rs. 3.19 lakh crore under the Scheme and out of total guarantees issued, about 95% of the guarantees issued are for loans sanctioned to Micro, Small and Medium Enterprises. (7/8)

In order to operationalise the above changes in the scheme, the National Credit Guarantee Trustee Company Ltd. #NCGTC will issue necessary guidelines for Lending Institutions. (8/8)

• • •

Missing some Tweet in this thread? You can try to

force a refresh