Official Account of the Ministry of Finance, Government of India.

5 subscribers

How to get URL link on X (Twitter) App

Besides FM Smt. @nsitharaman representing as Governor for India, Ms Sri Mulyani Indrawati, Indonesia; Mr Niels Annen, Germany; Mr Changyong Rhee, Republic of Korea; & @ADBPresident and Chairperson of the Board of Directors also participated. @IndiainROK

Besides FM Smt. @nsitharaman representing as Governor for India, Ms Sri Mulyani Indrawati, Indonesia; Mr Niels Annen, Germany; Mr Changyong Rhee, Republic of Korea; & @ADBPresident and Chairperson of the Board of Directors also participated. @IndiainROK

FM Smt. @nsitharaman encouraged engagement of JBIC with Indian financial institutions such as Exim Bank @IndiaEximBank, NIIF and lending banks to leverage the strength and complementarities of both countries for facing local, regional and global financial challenges. (2/5)

FM Smt. @nsitharaman encouraged engagement of JBIC with Indian financial institutions such as Exim Bank @IndiaEximBank, NIIF and lending banks to leverage the strength and complementarities of both countries for facing local, regional and global financial challenges. (2/5)

Union Finance Minister Smt. @nsitharaman encouraged potential investors to explore opportunities increasing share of value added food products in India’s export. (2/4)

Union Finance Minister Smt. @nsitharaman encouraged potential investors to explore opportunities increasing share of value added food products in India’s export. (2/4)

FM Smt. @nsitharaman mentioned that India continues to be the most significant country for ADB’s Sovereign and Non-sovereign operations and also expressed support to @ADB_HQ for #innovative financing mechanisms to #enhance the #LendingCapacity of the bank. (2/5)

FM Smt. @nsitharaman mentioned that India continues to be the most significant country for ADB’s Sovereign and Non-sovereign operations and also expressed support to @ADB_HQ for #innovative financing mechanisms to #enhance the #LendingCapacity of the bank. (2/5)

On the sidelines of the #ADBAnnualMeeting, Finance Minister Smt. @nsitharaman will have interaction with global economists and think-tanks, Governors and Finance Ministers of the ADB member countries. (2/4)

On the sidelines of the #ADBAnnualMeeting, Finance Minister Smt. @nsitharaman will have interaction with global economists and think-tanks, Governors and Finance Ministers of the ADB member countries. (2/4)

Some of the benefits of revised definition of small companies are 👇

Some of the benefits of revised definition of small companies are 👇

The meeting was also attended by Union Commerce Minister Shri @PiyushGoyal; Union Railways Minister Shri @AshwiniVaishnaw; @NITIAayog VC, Shri @sumanbery; Secretary @DPIITGoI Shri Anurag Jain; besides Ministers & seniors officials from States concerned in dual mode. (2/4)

The meeting was also attended by Union Commerce Minister Shri @PiyushGoyal; Union Railways Minister Shri @AshwiniVaishnaw; @NITIAayog VC, Shri @sumanbery; Secretary @DPIITGoI Shri Anurag Jain; besides Ministers & seniors officials from States concerned in dual mode. (2/4)

Recognising the inherent potential of the IFSC, the Budget announcement paved the way for allowing world-class foreign universities to offer courses in Financial Management, FinTech, Science, Technology, Engineering and Mathematics in @GIFTCity_ IFSC. (2/6)

Recognising the inherent potential of the IFSC, the Budget announcement paved the way for allowing world-class foreign universities to offer courses in Financial Management, FinTech, Science, Technology, Engineering and Mathematics in @GIFTCity_ IFSC. (2/6)

Finance Minister Smt. @nsitharaman stated that India’s economic growth in the current year is estimated to be 8.9 per cent, highest among all large economies and reflects India’s #resilience and #strong #recovery. (2/4)

Finance Minister Smt. @nsitharaman stated that India’s economic growth in the current year is estimated to be 8.9 per cent, highest among all large economies and reflects India’s #resilience and #strong #recovery. (2/4)

The two discussed India’s continued #recovery from #COVID19, impact of Russia-Ukraine conflict, Single Borrower Limit & exploring the possibility of Guarantees from other G-7 nations, India’s #G20Presidency and @WorldBank leadership in India. (2/6)

The two discussed India’s continued #recovery from #COVID19, impact of Russia-Ukraine conflict, Single Borrower Limit & exploring the possibility of Guarantees from other G-7 nations, India’s #G20Presidency and @WorldBank leadership in India. (2/6)

Mr @MiebachMichael informed Smt. @nsitharaman that @Mastercard has set up huge #DataCentres in India and is focusing on training and digitisation of small businesses. (2/4)

Mr @MiebachMichael informed Smt. @nsitharaman that @Mastercard has set up huge #DataCentres in India and is focusing on training and digitisation of small businesses. (2/4)

The Strategic Priorities for FATF for 2022-24 are:

The Strategic Priorities for FATF for 2022-24 are:

In the backdrop of the emerging challenges, Finance Minister Smt. @nsitharaman conveyed that the global economy may witness some growth deceleration. (2/5)

In the backdrop of the emerging challenges, Finance Minister Smt. @nsitharaman conveyed that the global economy may witness some growth deceleration. (2/5)

MD IMF Ms @KGeorgieva congratulated India on its successful #VaccinationProgramme to control the spread of #COVID19. She also appreciated India for extending #COVID19 relief support to other vulnerable countries. (2/7)

MD IMF Ms @KGeorgieva congratulated India on its successful #VaccinationProgramme to control the spread of #COVID19. She also appreciated India for extending #COVID19 relief support to other vulnerable countries. (2/7)

☑️ Further to this, a net additional amount of Rs. 43,168 crore was also released towards settlement of dues of States’ Share in Central Taxes payable from 1996-97 to 2017-2018. (2/5)

☑️ Further to this, a net additional amount of Rs. 43,168 crore was also released towards settlement of dues of States’ Share in Central Taxes payable from 1996-97 to 2017-2018. (2/5)

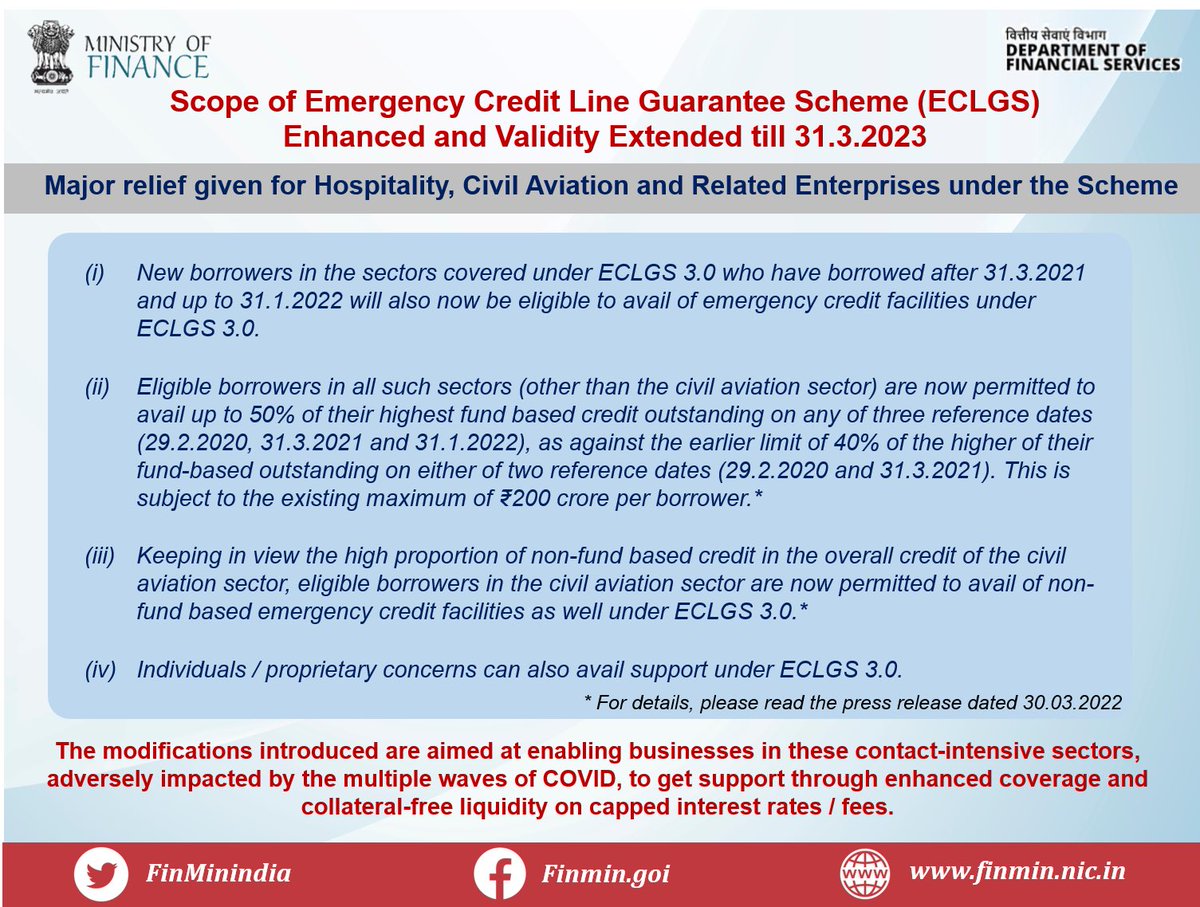

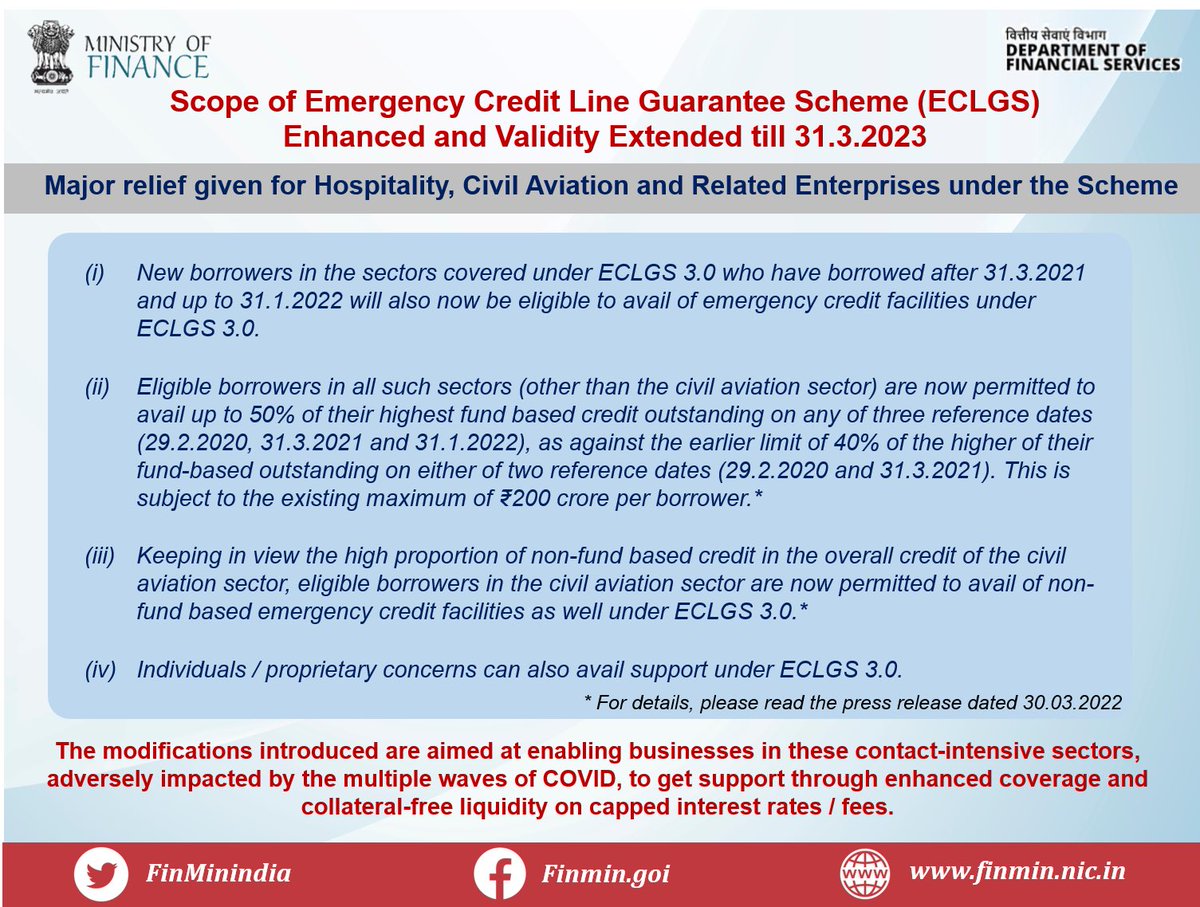

✅ Scope of #ECLGS enhanced & validity extended till 31.3.23

✅ Scope of #ECLGS enhanced & validity extended till 31.3.23

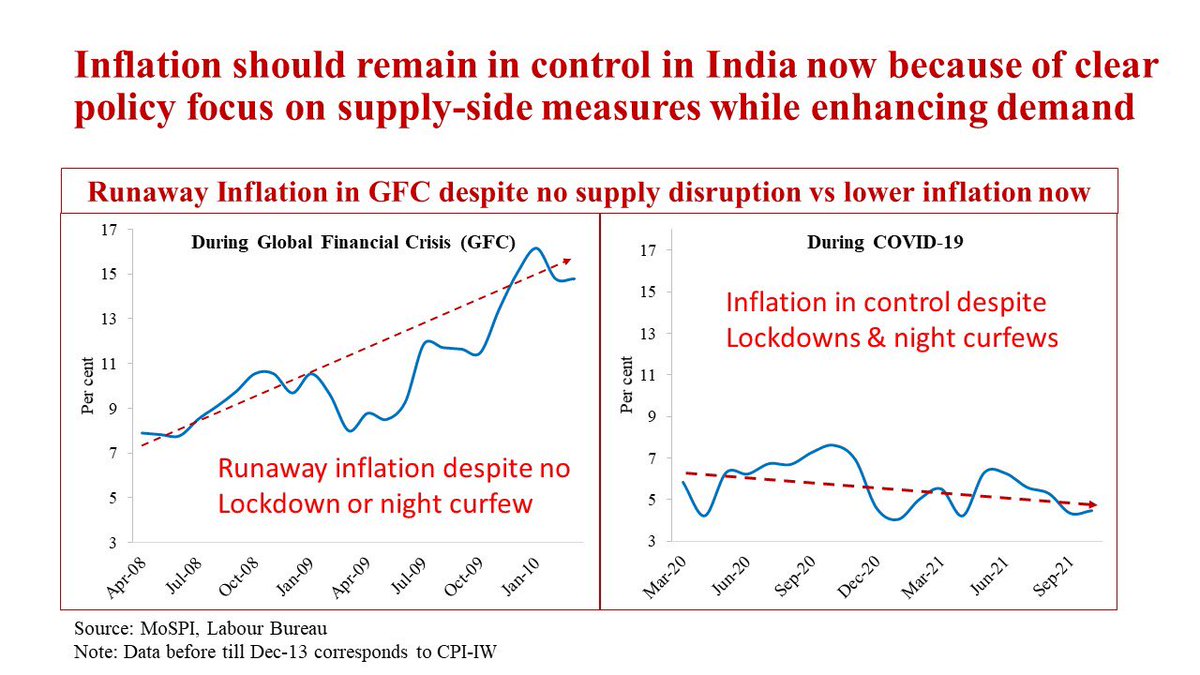

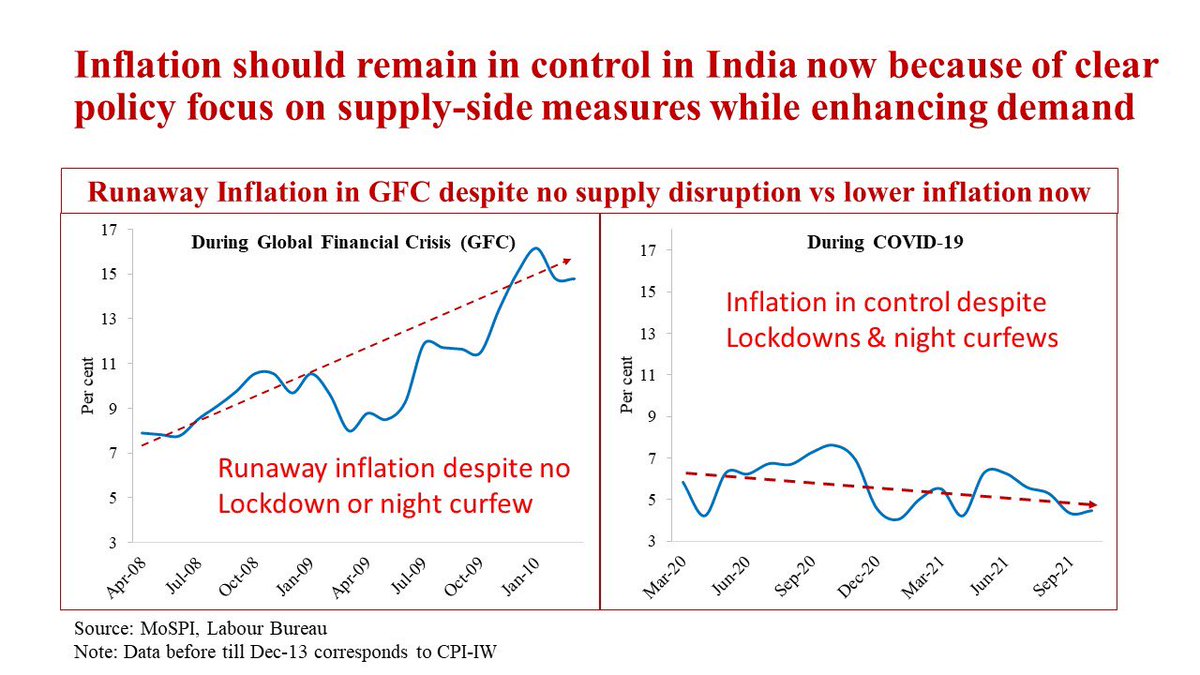

✅ Global inflation stems similarly from exclusive focus on demand in contrast to India, where the focus has been on both demand and supply (2/6)

✅ Global inflation stems similarly from exclusive focus on demand in contrast to India, where the focus has been on both demand and supply (2/6)

What is National Asset Reconstruction Company Limited (NARCL)? Who has set it up?👇

What is National Asset Reconstruction Company Limited (NARCL)? Who has set it up?👇

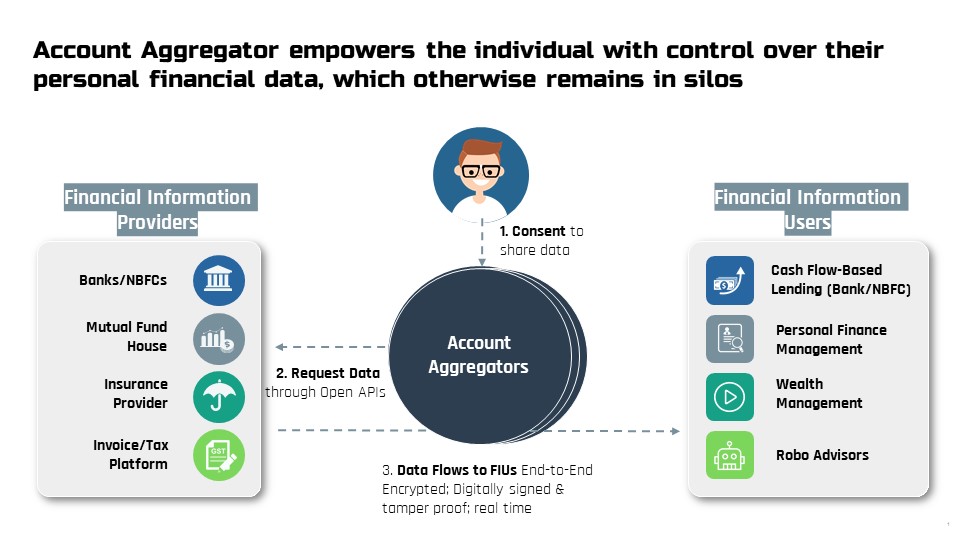

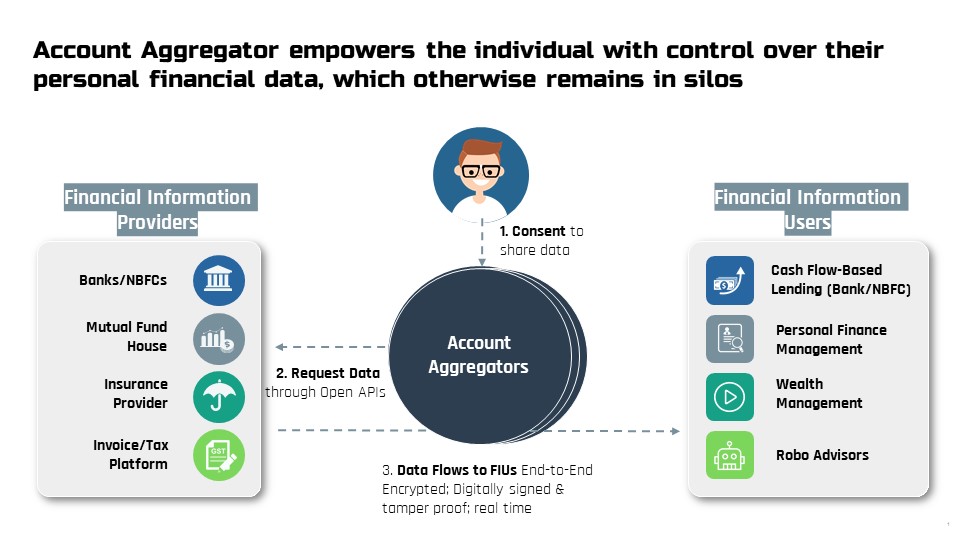

पिछले सप्ताह, भारत ने वित्तीय डेटा-साझा प्रणाली - अकाउंट एग्रीगेटर (एए) नेटवर्क का अनावरण किया।अकाउंट एग्रीगेटर व्यक्ति को अपने व्यक्तिगत वित्तीय डेटा पर नियंत्रण के साथ सशक्त बनाता है, जो डेटा सामान्यतया अलग-थलग और आसान पहुँच से बाहर रहते हैं।

पिछले सप्ताह, भारत ने वित्तीय डेटा-साझा प्रणाली - अकाउंट एग्रीगेटर (एए) नेटवर्क का अनावरण किया।अकाउंट एग्रीगेटर व्यक्ति को अपने व्यक्तिगत वित्तीय डेटा पर नियंत्रण के साथ सशक्त बनाता है, जो डेटा सामान्यतया अलग-थलग और आसान पहुँच से बाहर रहते हैं।

✅Government reaffirms its commitment to continuous improvement in taxpayer services

✅Government reaffirms its commitment to continuous improvement in taxpayer services

Common-use items such as hair oil, toothpaste, and soap have seen their tax rates come down from 29.3% in the pre-GST era to just 18% under GST. #4yearsofGST

Common-use items such as hair oil, toothpaste, and soap have seen their tax rates come down from 29.3% in the pre-GST era to just 18% under GST. #4yearsofGST