It's the weekend!

Grab a cup of coffee, in this thread I will explain

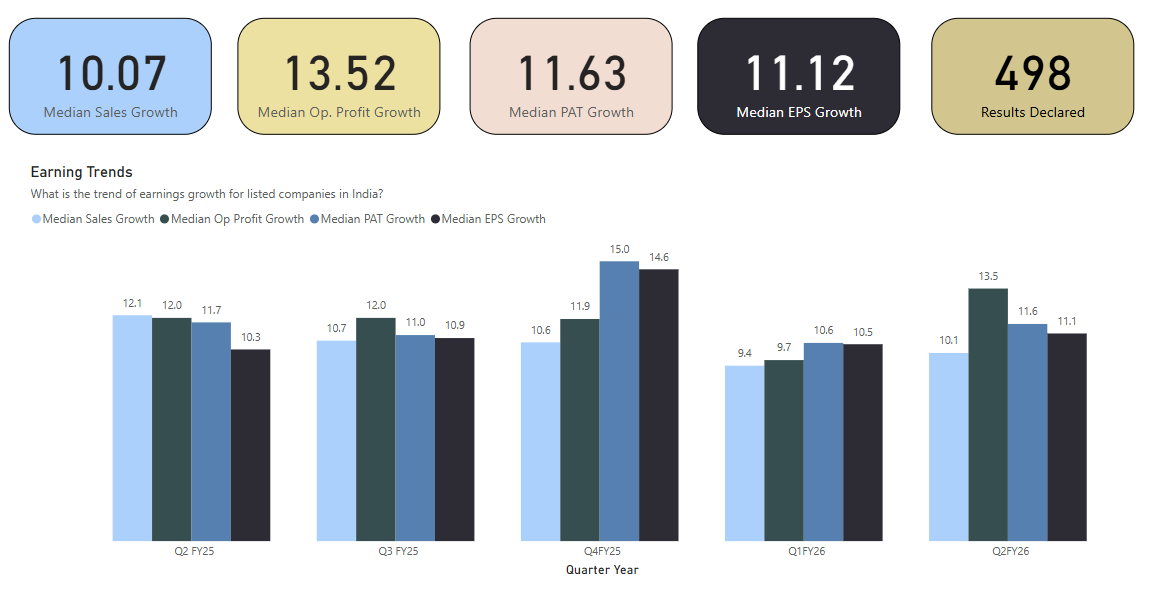

1. What is a Yield Curve?

2. Why is it an important indicator of Recession?

3. Is an Economic Recession around the corner?

Lets dive right in!

Grab a cup of coffee, in this thread I will explain

1. What is a Yield Curve?

2. Why is it an important indicator of Recession?

3. Is an Economic Recession around the corner?

Lets dive right in!

Before we understand a Yield Curve, lets get some of the basic terminology out of the way

1. What is a Bond?

A bond is a fixed income financial instrument which represents a loan made by an investor to a borrower

The investor typically receives payment in the form of interest and a lumpsum (principal) on maturity

The interest rate on a bond is known as coupon rate.

A bond is a fixed income financial instrument which represents a loan made by an investor to a borrower

The investor typically receives payment in the form of interest and a lumpsum (principal) on maturity

The interest rate on a bond is known as coupon rate.

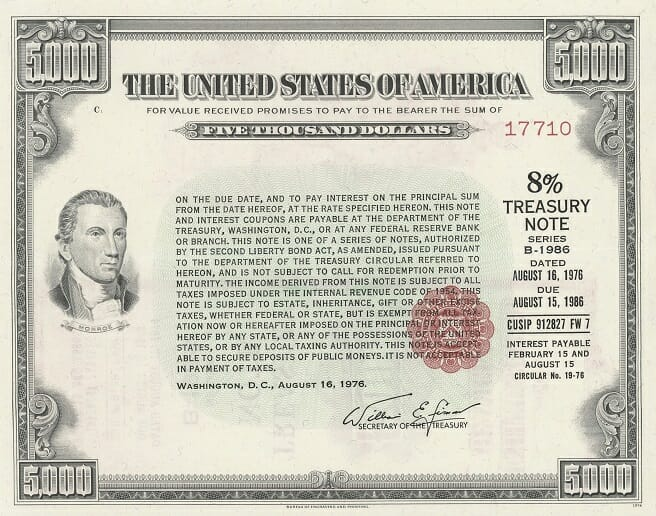

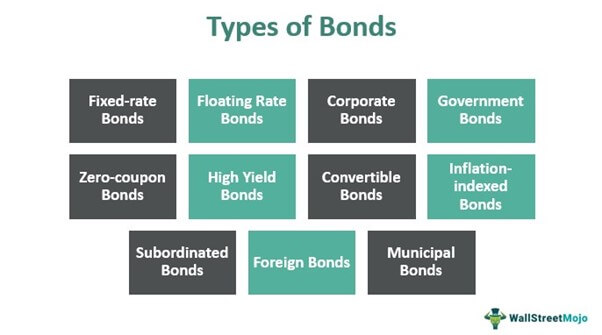

There are many types of bonds like

1. Zero Coupon : Pays both interest and principal at maturity

2. Sovereign Bonds : Issued by a Government or a Quasi Government Institution

3. Corporate Bonds : Issued by corporate like banks, established companies etc.

1. Zero Coupon : Pays both interest and principal at maturity

2. Sovereign Bonds : Issued by a Government or a Quasi Government Institution

3. Corporate Bonds : Issued by corporate like banks, established companies etc.

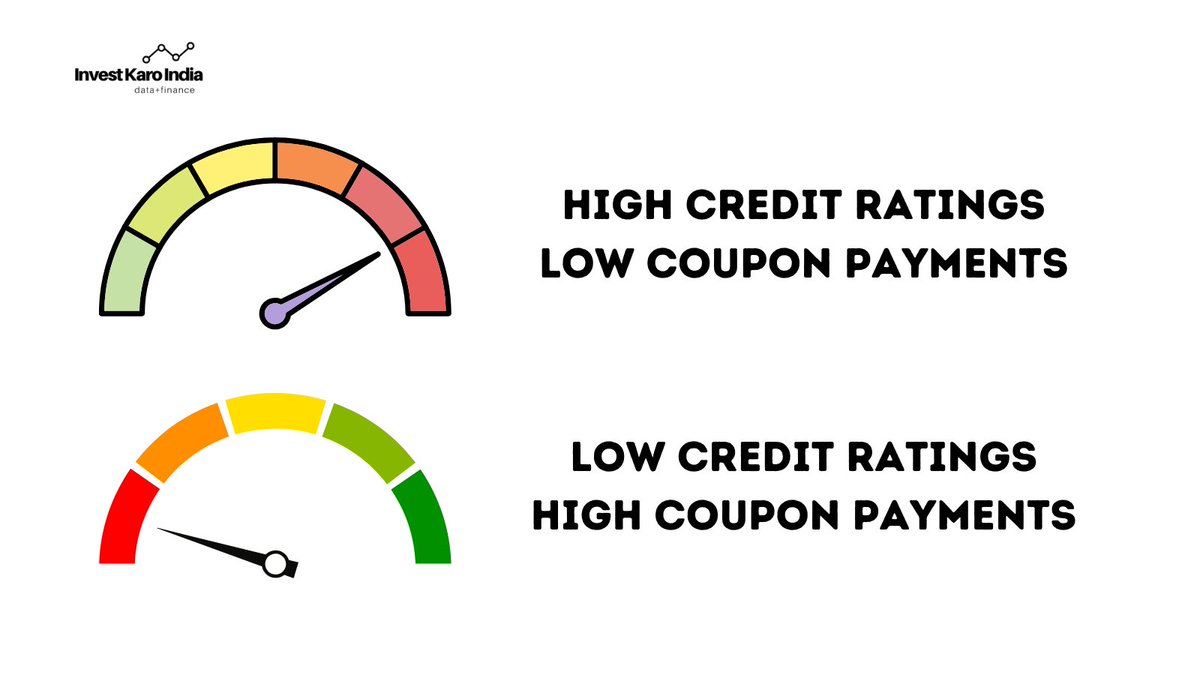

Coupon (Interest Rates) on a bond are decided based on the issuer's credit rating

The higher the credit worthiness of the issuer, the lower the coupon rate

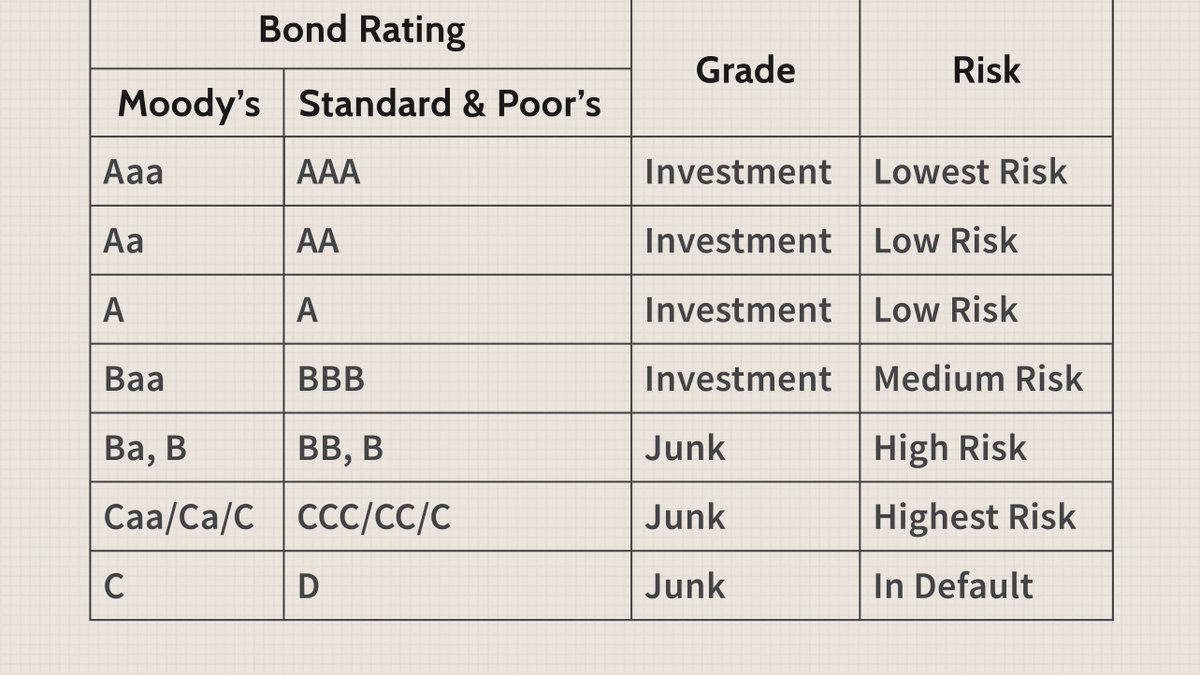

Credit Rating on a Bond is usually assigned by credit rating agencies like Moody's or Standard & Poor's (S&P)

The higher the credit worthiness of the issuer, the lower the coupon rate

Credit Rating on a Bond is usually assigned by credit rating agencies like Moody's or Standard & Poor's (S&P)

US Treasury Bonds are always assigned a rating of AAA (Triple A) as they are backed by the Government and are considered default free

Anything with a credit rating of BBB (Triple B) or lower is considered as 'junk bond' or a 'high yield bond' as they have high risk of default

Anything with a credit rating of BBB (Triple B) or lower is considered as 'junk bond' or a 'high yield bond' as they have high risk of default

2. What is Yield?

Yield is simply the return an investor of a bond realizes over the course of the bond holding period

Yield is simply the return an investor of a bond realizes over the course of the bond holding period

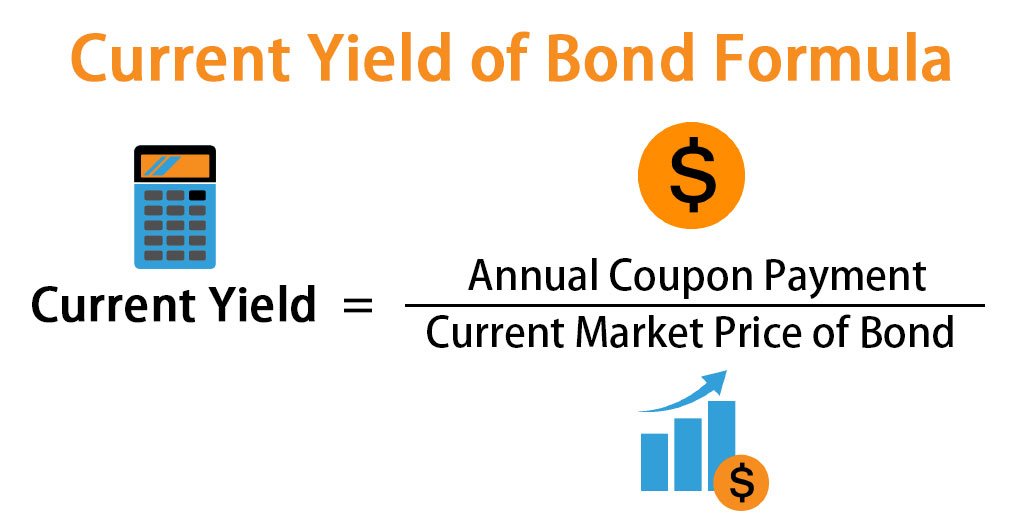

Formula for calculation of a Bond Yield

Bond Yield = Interest Payments / Bond Price

Since, coupon (interest) payments on a bond along with tenure of a bond is fixed

your yield on a bond simply depends on the change in its price

Bond Yield = Interest Payments / Bond Price

Since, coupon (interest) payments on a bond along with tenure of a bond is fixed

your yield on a bond simply depends on the change in its price

Let me explain this concept with an example of a Dividend Yield (easier to relate to)

The logic and concept followed for calculation and estimating a Dividend Yield can be directly applied to a bond yield as well.

The logic and concept followed for calculation and estimating a Dividend Yield can be directly applied to a bond yield as well.

Take for example, Dividend Yield calculation of ITC

ITC as per its policy issues out 85% of its profits as Dividends to its Shareholders, this comes to around ~Rs 10/share

When ITC was trading

at 180/share, the Div. Yield was 5.5%

at 254/share, Div. Yield is 3.93%

ITC as per its policy issues out 85% of its profits as Dividends to its Shareholders, this comes to around ~Rs 10/share

When ITC was trading

at 180/share, the Div. Yield was 5.5%

at 254/share, Div. Yield is 3.93%

In the above calculation, the dividend didn't change but because the price in denominator of our formula changed, it led to a change in Dividend Yield

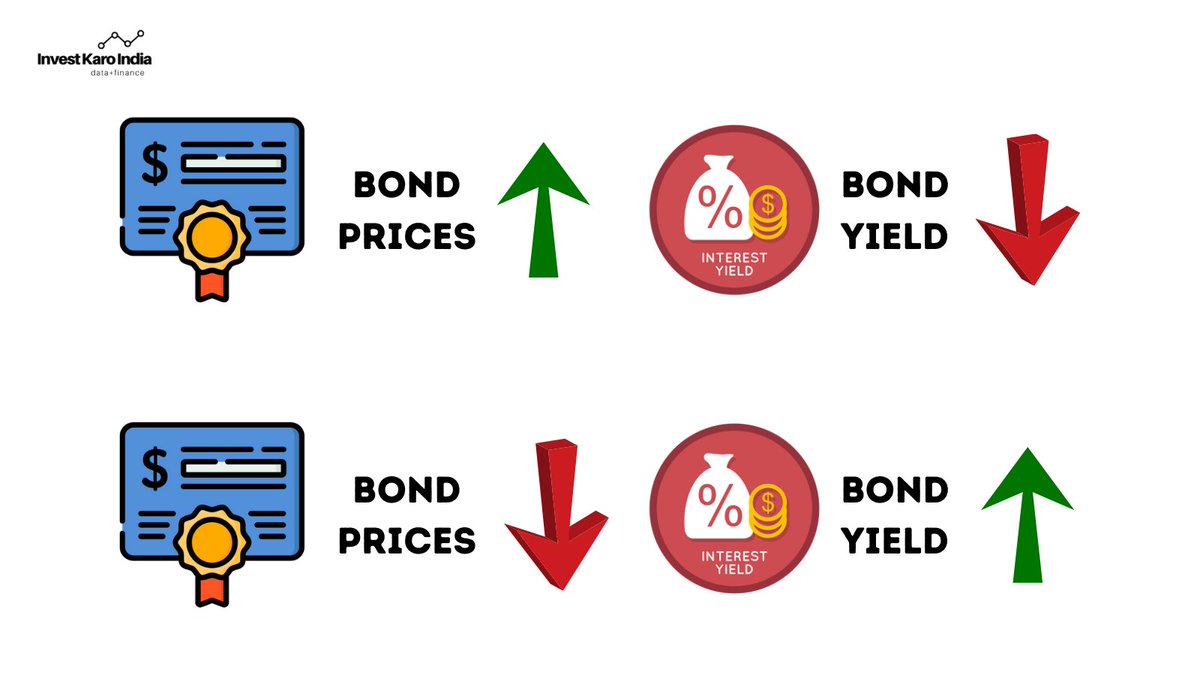

If Bond Prices go up, the Yield on the bond will decrease

If Bond Price come down, the Yield on the bond will increase

If Bond Price come down, the Yield on the bond will increase

Just like stock prices, bond prices keep on changing depending on economy, Central Bank interest rates, demand + supply etc.

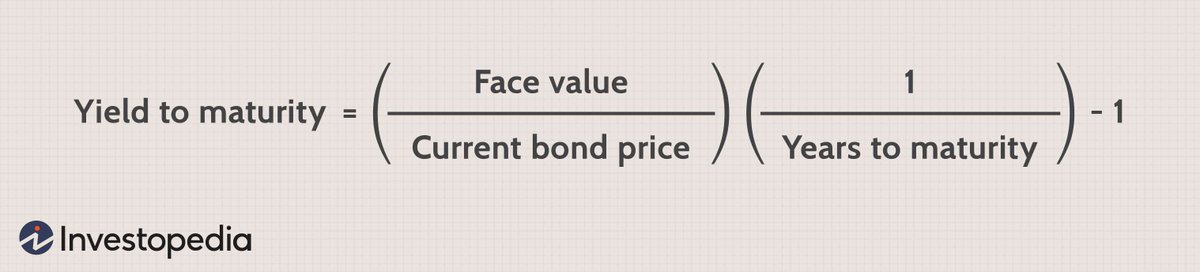

3. What is a Yield to Maturity?

Suppose if you buy a 10 year Govt Bond that pays 5% interest yearly for Rs 1000

If instead of selling the bond when bond price rises to Rs 1100, you held on to your bond until its maturity date till end of 10 years

Suppose if you buy a 10 year Govt Bond that pays 5% interest yearly for Rs 1000

If instead of selling the bond when bond price rises to Rs 1100, you held on to your bond until its maturity date till end of 10 years

The present value of all the coupon (interest) payments that you will receive on the bond along with the principal repayment at the end of 10 years, is called Yield to Maturity.

You can learn more about the concept of present value at the below link investopedia.com/terms/p/presen…

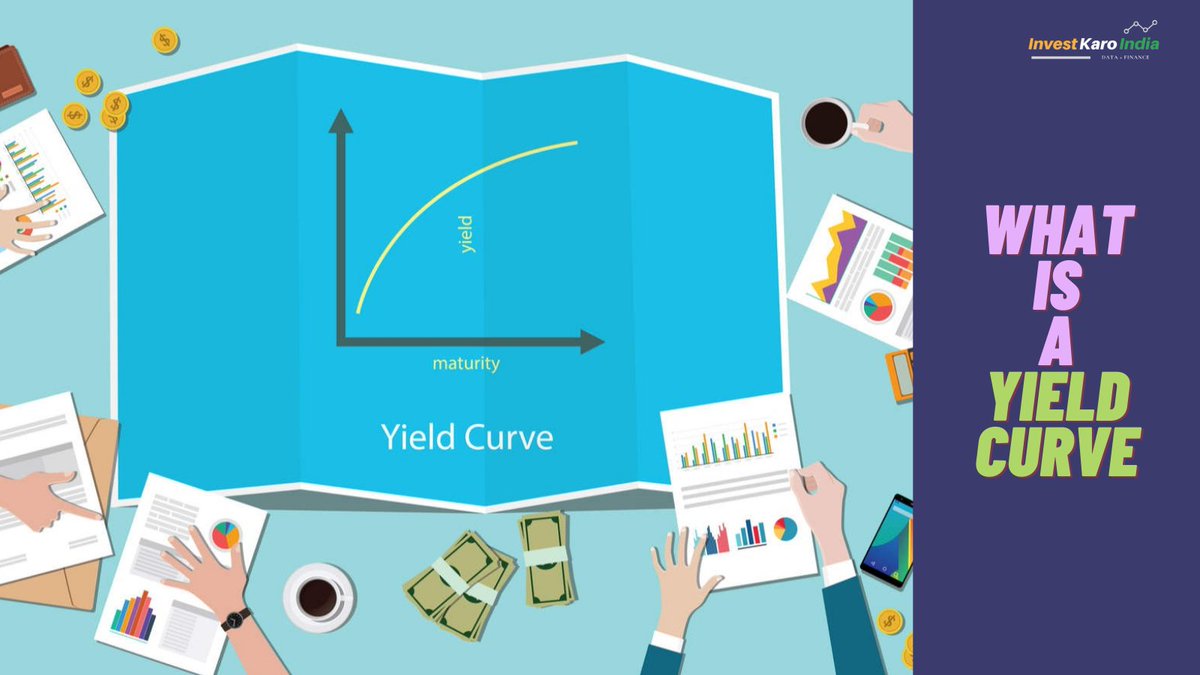

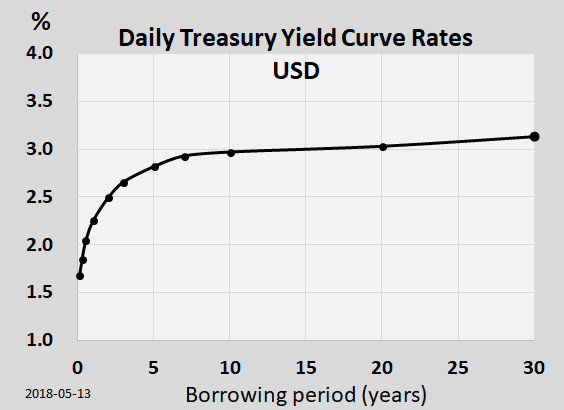

4. What is Yield Curve?

A Yield Curve is just a graphical representation of Yields of various bonds with similar credit rating but differing maturities

A Yield Curve is just a graphical representation of Yields of various bonds with similar credit rating but differing maturities

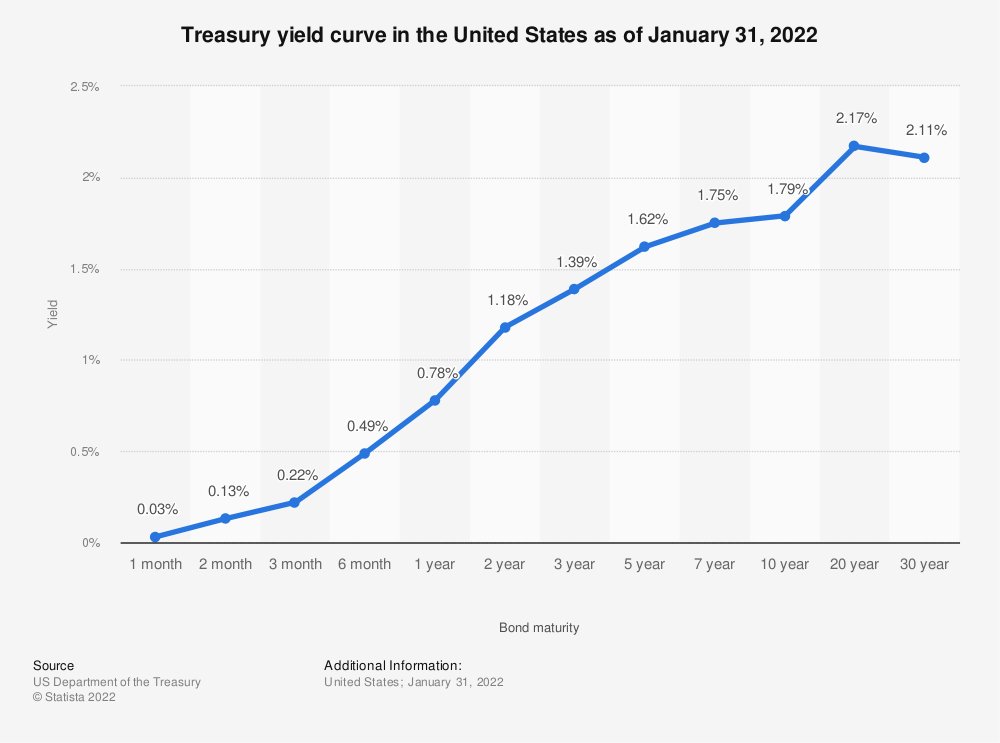

When the media talks about a Yield Curve, they are primarily talking about the US Treasury Yield Curve

which depicts the Bond Yields on US Treasury Bonds for varying maturity dates ranging from 1 Month to 30 Years

which depicts the Bond Yields on US Treasury Bonds for varying maturity dates ranging from 1 Month to 30 Years

So now that you have understood the basics, lets try and answer a burning question

Why is Yield Curve used to predict a Recession?

Why is Yield Curve used to predict a Recession?

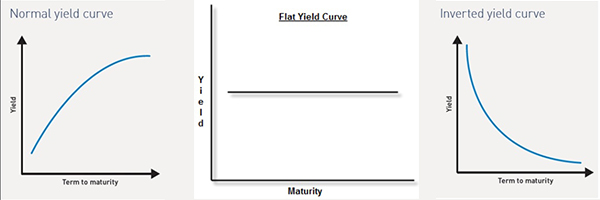

Yield Curve are typically of three types:

a. Upwards Sloping (Most of the Time)

b. Flat (Rare)

c. Inverted Yield Curve (Very Rare)

a. Upwards Sloping (Most of the Time)

b. Flat (Rare)

c. Inverted Yield Curve (Very Rare)

The shape of the Yield Curve is dependent on a simple logic

Yields on longer term bonds should be much higher compared to Yields on shorter term bonds

as

with longer term bonds you are taking more risk and hence need more interest as return

Yields on longer term bonds should be much higher compared to Yields on shorter term bonds

as

with longer term bonds you are taking more risk and hence need more interest as return

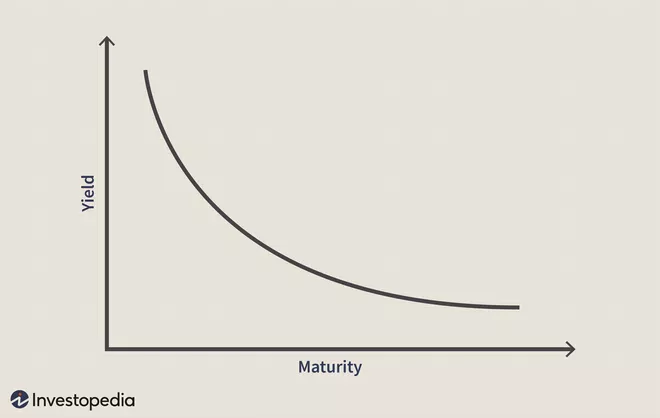

Inverted Yield Curves happen when yields on short term bonds rise above Yields on Long Term Bonds

implying that near term risk in the economy is higher compared to long term

implying that near term risk in the economy is higher compared to long term

Because near term economy is considered risky

Bond Investors start dumping their short term bonds in favour for longer duration bonds

Bond Investors start dumping their short term bonds in favour for longer duration bonds

As such

Demand for Short Term Bonds decreases, causing Bond Prices to collapse and Yields to Increase

While

Demand for Longer Term Bonds Increases, causing Bond Prices to rise and Yields to Decrease

Thus, creating the inverted Yield Curve.

Demand for Short Term Bonds decreases, causing Bond Prices to collapse and Yields to Increase

While

Demand for Longer Term Bonds Increases, causing Bond Prices to rise and Yields to Decrease

Thus, creating the inverted Yield Curve.

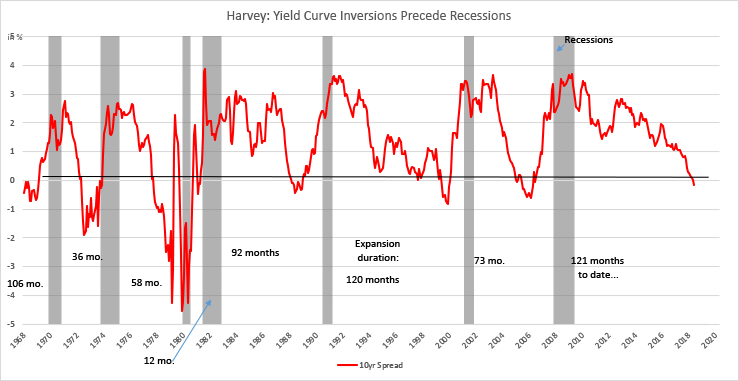

Inverted Yield Curves are an excellent tool to predict upcoming Recessions as per US Federal Reserve

Here are some of their publications on this subject

frbsf.org/wp-content/upl…

fredblog.stlouisfed.org/2018/10/the-da…

chicagofed.org/publications/c…

Here are some of their publications on this subject

frbsf.org/wp-content/upl…

fredblog.stlouisfed.org/2018/10/the-da…

chicagofed.org/publications/c…

An Inverted Yield Curve has successfully predicted every recession since 1957

It even inverted right before the pandemic!

It even inverted right before the pandemic!

Typically an economic recession follows after 7 to 24 months since the Yield Curve Inversion

Most recently the US Treasury 2 and 10 yr Yield Curve Inverted on 29th March 2022

imply the onset of a recession anytime between end of 2022 to 2024.

Most recently the US Treasury 2 and 10 yr Yield Curve Inverted on 29th March 2022

imply the onset of a recession anytime between end of 2022 to 2024.

This brings me to the last Question of this thread

IS AN ECONOMIC RECSSION AROUND THE CORNER?

IS AN ECONOMIC RECSSION AROUND THE CORNER?

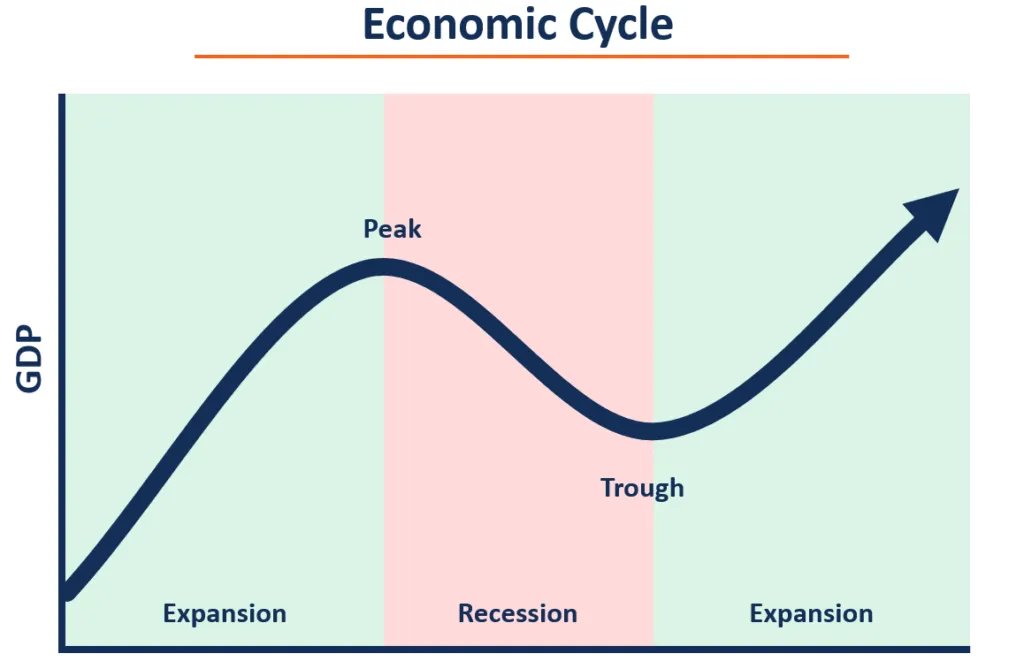

Short Answer : Nobody knows

All Economies, work on a Peak to Trough cycle and as much as Expansions are part of the Economic Cycle, so are Recessions

Without Recessions, we wouldn't have the opportunity to reset and economy would overheat and turn into a bubble which when popped could bring depression.

Without Recessions, we wouldn't have the opportunity to reset and economy would overheat and turn into a bubble which when popped could bring depression.

For a Recession to happen, you need several ingredients

1. Slowing Economic Growth

2. High Unemployment Rate

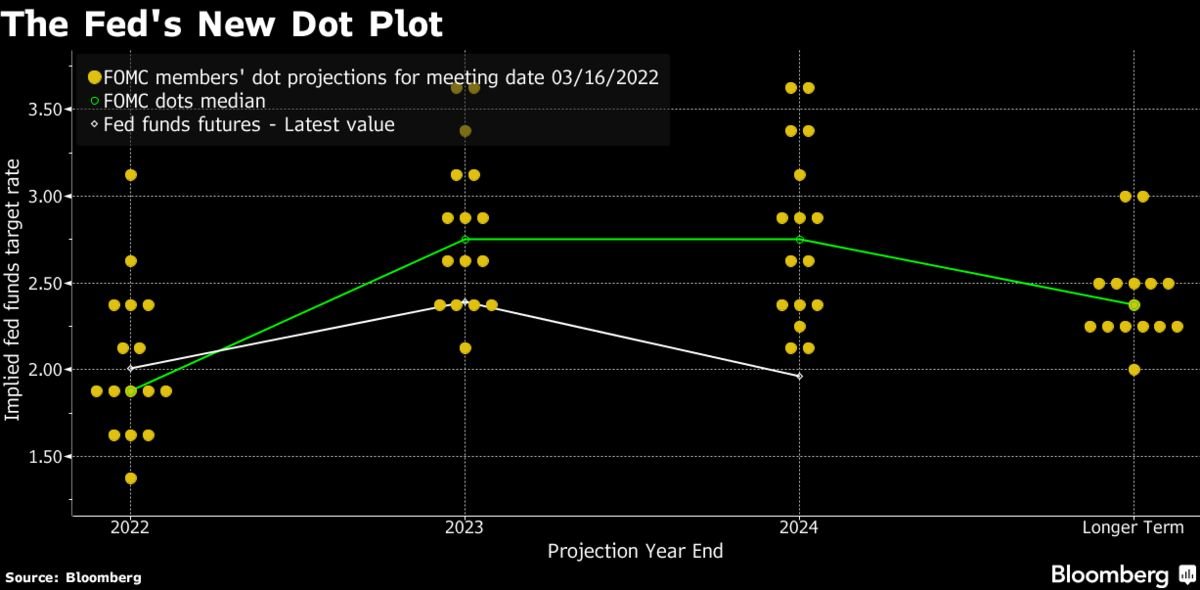

3. High to Medium Fed Interest Rates

1. Slowing Economic Growth

2. High Unemployment Rate

3. High to Medium Fed Interest Rates

None of the characteristics today satisfy the onset of a Recession

And Fed Interest Rates are at the bottom they have ever been with the only option for Fed to Increase them and not decrease them as they would to prevent a recession

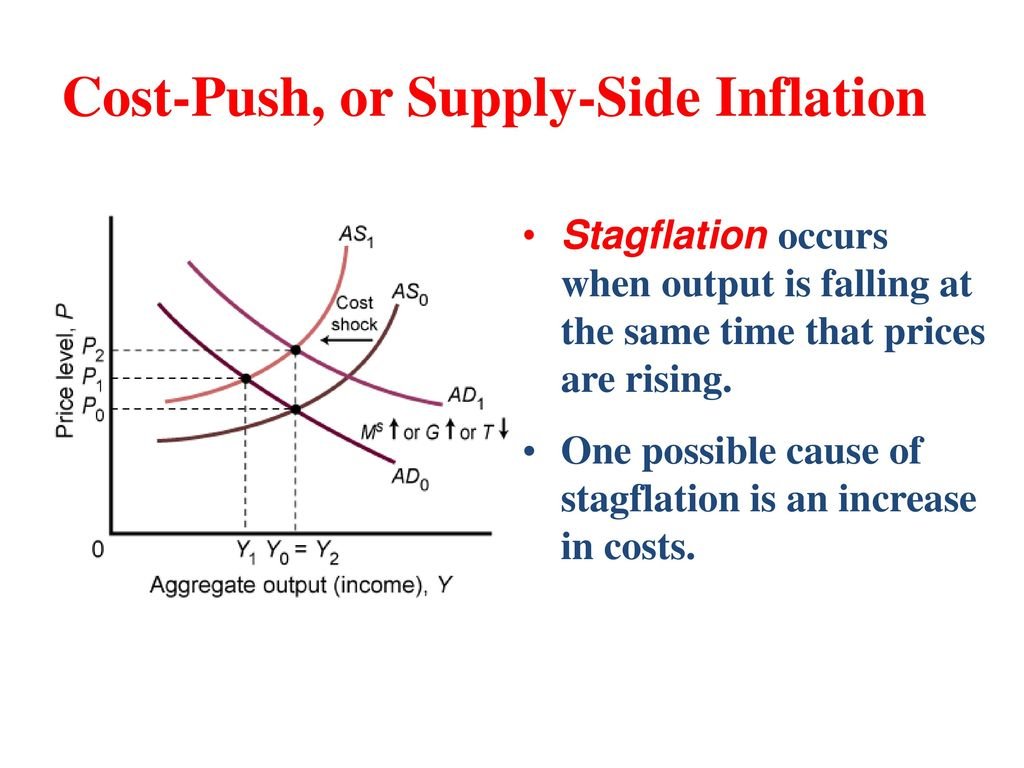

Inflation is rampant throughout the world today but that inflation is not caused by lack or overdemand in the economy (as it would during a peak of an economic cycle)

The inflation today is purely a result of supply side shortages cause by the onset of the pandemic

The inflation today is purely a result of supply side shortages cause by the onset of the pandemic

Considering all of the above, will we face a recession as predicted by the Yield Curve?

I don't know and I am not sure if anybody does.

I don't know and I am not sure if anybody does.

Thank you for reading!

I hope you've found this thread helpful. Follow me @itsTarH for more.

Please Like/Retweet the first tweet below if you can:

I hope you've found this thread helpful. Follow me @itsTarH for more.

Please Like/Retweet the first tweet below if you can:

https://twitter.com/itsTarH/status/1510184486406799361

I write a new thread every weekend simplifying investing concepts.

All my previous work, can be found here

All my previous work, can be found here

https://twitter.com/itsTarH/status/1401095938945425410?s=20&t=TE54StiBZNg7cy6719IPGg

I also write occasional deep dives and long form articles on stocks and emerging investing trends, you can subscribe to them for free here

getrevue.co/profile/itstarh

getrevue.co/profile/itstarh

Occasionally, conduct webinars that deep dive into a sector in its true sense

Here is a 5 hour long webinar on Green and Renewable Energy ☀️

Lots of India, Chinese and US companies covered along with Global Demand and Supply scenario

research.investkaroindia.in/s/store/course…

Here is a 5 hour long webinar on Green and Renewable Energy ☀️

Lots of India, Chinese and US companies covered along with Global Demand and Supply scenario

research.investkaroindia.in/s/store/course…

Thank you for reading, see you in the next thread 🧵

You can read the unrolled version of this thread here: typefully.com/itsTarH/8D7Mdyv

• • •

Missing some Tweet in this thread? You can try to

force a refresh