THREAD: How will #Bitcoin promote human flourishing and decarbonization for 1 Billion people? By turning Earth's oceans into a giant solar panel, through 19th-century Ocean Thermal Energy Conversion (OTEC) technology, that has been stymied by economies of scale. 1/

Every day the sun rises in the East, and its rays make its way across the planet. As the sun makes its way over the Pacific Ocean, solar miners in Texas wind down and hash rate drops enough to make other miners more profitable. This is the perfect time to mine #Bitcoin. 2/

The sun powers oceanic convection and thermohaline circulation while creating a stark asymmetry between shallow and deep ocean temperatures. This temperature delta has enormous potential energy—effectively turning the ocean into a giant solar panel. 3/

OTEC plants can operate continuously, providing a consistent base load supply for the Hawaiian electric grid. Combined with intermittent solar and wind, Hawaiian #Bitcoin mining can monetize curtailed power when supply outpaces demand. 4/

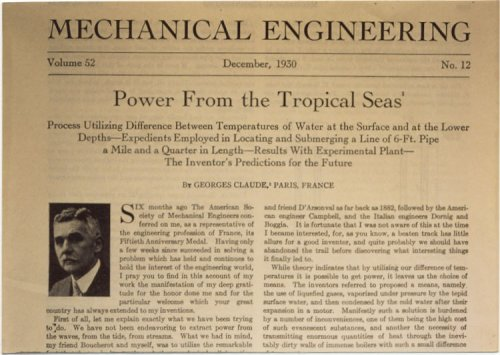

In 1881, Jacques-Arsène d'Arsonval proposed tapping the thermal energy of the ocean after an idea presented by Jules Verne in his novel "Twenty Thousand Leagues Under the Sea" (1869). d'Arsonval's student, Georges Claude, built the first OTEC plant in Cuba in 1930. 5/

Over decades of experimentation, the technology consistently ran into logistics and costs issues. The logistics were solvable. The costs were problematic. As we will see later in this thread, #Bitcoin fixes this. 6/

Hawaii has a unique energy problem in that the islands have independent grids that can't be linked. Furthermore, solar, wind, geothermal—as base load energy sources, at scale—are impractical, intermittent and would take up too much of Hawaii's limited area or harm habitats. 7/

However, solar and wind's intermittency could be monetized by #Bitcoin's flexible load, during periods necessitating curtailment, to help lower the cost of OTEC—particularly when there are no other solar farms to compete with, when the sun is over the Pacific Ocean. 8/

If OTEC was scaled, it could provide consistent, continuous and reliable base load to 1 Billion people who live near tropical deep water oceans. This is huge and would be a significant step to decarbonizing developing nations while promoting human flourishing. 9/

OTEC works by plunging a pipe down deep into the ocean depths, and bringing super-cool water to the surface. The temperature difference is used to vaporize and condense a working fluid, such as ammonia, to drive a turbine-generator and produce electricity. 10/

OTEC has relatively minimal environmental impact. The deep cold water is extremely nutrient-dense and instead of dumping that water onto the surface of the ocean, where it might putrefy, nutrients can be used for other purposes like agriculture and promote land carbon sinks. 11/

OTEC can be built on land, or an oceanographic platform. Hawaii's Makai Ocean Engineering’s OTEC plant is the world’s biggest operational facility of its kind with an annual generation capacity of 100kW—sufficient to power 120 homes in Hawaii. 13/

In order to scale OTEC, it needs to be proven on an intermediate scale. Cost is a major issue. Electricity from a 1.4MW OTEC plant would cost almost $1/kWh. Nobody will buy it and anyone who invests in it is guaranteed to lose all their money. 14/

As OTEC scales, the energy becomes much cheaper. A 10MW plant can produce electricity at 44¢/kWh and a 100MW plant at 18¢/kWh. But how do we get to the 100MW plant when mid-size OTEC plants are too expensive and guaranteed to lose money? Enter #Bitcoin mining. 15/

Meet Nathaniel Harmon @BlockchainHI1. He recognized that if you stranded OTEC on a barge to avoid hurricanes, you could bring down costs, power #Bitcoin miners, cool ASICs for free, overclock them when miners aren't competing with Texas solar, and prove the technology works. 16/

The Hawaiian barge could prove OTEC's reliable/continuous base load and simultaneously perform research on the environmental externalities. #Bitcoin would monetize the stranded energy and protect investors from total loss. /17

At scale, OTEC barges could park off-shore of tropical coastlines, with access to deep water, to provide a continuous base load at around $.05/kWh, with miners cooled on the barge, to balance the intermittent on-shore renewables. /18

Excess power from solar/wind could be directed to an OTEC plant, either on-shore or off-shore, and mined for cooled/overclocked #Bitcoin, with free cold water that powers desalination. This would bring down costs for entire regions, provide energy abundance and fresh water 19/

In tropical environments especially, demand for air conditioning is high all year round. This typically comes at high energy cost, which is in turn often produced from non-renewable sources. OTEC can provide Sea Water Air Conditioning (SWAC). 20/

In total, 1 billion people in tropical latitudes could be served by OTEC base load and #Bitcoin load-balanced renewables. This is but one example of how #Bitcoin can promote human flourishing. Read @Bquittem's "Bitcoin is a Pioneer Species" 21/ medium.com/the-bitcoin-ti…

Want to learn more? Be sure to listen to follow/listen to @thetrocro's interview with @BlockchainHI1 about his story with #Bitcoin and OTEC. He retells how he was partially responsible for the infamous/debunked Mora, et al. paper.😱 22/

anchor.fm/troy-cross0

anchor.fm/troy-cross0

For a more detailed and in-depth look into #Bitcoin OTEC, watch this incredible presentation with Nathaniel Harmon @BlockchainHI1. /23

Finally, last week @CleanUpBitcoin began its "Change The Code" campaign to reduce #Bitcoin's energy consumption. It should be painfully obvious that such a move would make renewable technologies, such as OTEC, unprofitable as they move through their economies of scale. /24

#Bitcoin's ability to monetize energy is absolutely crucial to building out clean energy that will promote human flourishing and promote energy abundance. /25 bitcoinmagazine.com/culture/bitcoi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh