Here is a little thread on how I use @CryptoNoan 's strategy.

1. I don't trade every single time a channel breaks.

2. I figure where I would get out of the trade

3. Find confluence for that trade

(1)

1. I don't trade every single time a channel breaks.

2. I figure where I would get out of the trade

3. Find confluence for that trade

(1)

Here I have identified a channel on #API3 on the 4H timeframe. In this case, I have also marked the local highest close, as well as 4H supply/demand

(2)

(2)

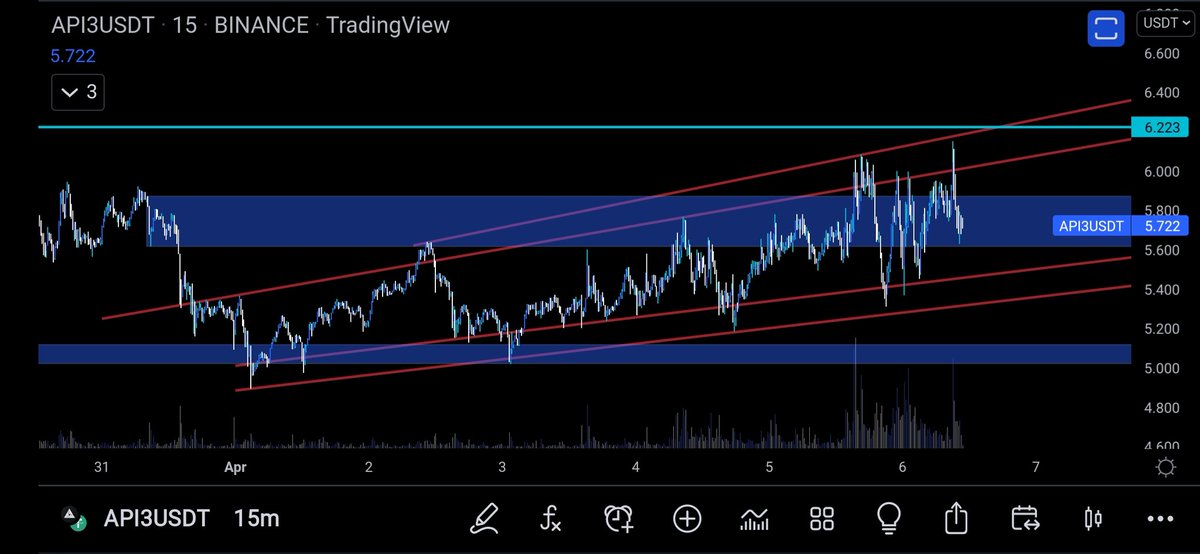

I switch to a lower timeframe, in this case 15m, amd see if my channels matchup

Yep, they're fine.

(3)

Yep, they're fine.

(3)

Now if I could be bothered, I could start tradig LTF channels within the range, eventuslly catching a solid move

(4)

(4)

Now rules... Looking to break the channel high or low, not on 4H but ltf.

- break ascending channel at top, trade straight away

- break descending channel to the bottom, trade straight away

In these case we can have a quick move and scalp us some stop losses

(5)

- break ascending channel at top, trade straight away

- break descending channel to the bottom, trade straight away

In these case we can have a quick move and scalp us some stop losses

(5)

Rules continued...

Break channel and supply or demand at the same, as well as creating and fvg within the channel, prior to break, more likely a solid move is incoming

Break channel and supply or demand at the same, as well as creating and fvg within the channel, prior to break, more likely a solid move is incoming

- if channel is flat with 0 wicks, then wait for retest

- same with ascending or descending channels, if they have been wicked/faked out previously, then wait for retest

- same with ascending or descending channels, if they have been wicked/faked out previously, then wait for retest

Finally

Before trades, ask yourself where is coin struggling? Where do we go to grip liquidity?

Volume?

Funding rate?

Support/resistance broken too?

Before trades, ask yourself where is coin struggling? Where do we go to grip liquidity?

Volume?

Funding rate?

Support/resistance broken too?

Practice makes better. The is no perfect in this game.

Without practice you can't figure out what works for you. I use @CryptoNoan strategy, but find my own way of adding confluence at the right times.

With practice, you will find your way too.

Without practice you can't figure out what works for you. I use @CryptoNoan strategy, but find my own way of adding confluence at the right times.

With practice, you will find your way too.

• • •

Missing some Tweet in this thread? You can try to

force a refresh