After reading this thread you will come to know:

What is Delta

How to read Delta

Calculating the option's price from Delta

What is Delta hedge

Basic Delta hedge strategies

What is Delta

How to read Delta

Calculating the option's price from Delta

What is Delta hedge

Basic Delta hedge strategies

The price of an option does not move up or down in thin air rather there are various factors that determine the price of an option.

These factors are quantified into certain parameters known as Greeks.

These factors are quantified into certain parameters known as Greeks.

There are four Greeks used in options namely Delta, Gamma, Vega, and Theta. Each Greek has its own importance. In this thread, we will have a detailed discussion on Delta

1/ What is Delta?

Have a look at the following graphical presentation. There is Reliance 15minutes chart on the left and Reliance 2340 call option chart on the right.

Have a look at the following graphical presentation. There is Reliance 15minutes chart on the left and Reliance 2340 call option chart on the right.

These charts show us that an upward movement in the price of an underlying (Reliance stock) leads to an increase in the call option’s price.

The question is how is the movement in the price of an option determined?

Delta is the ratio that determines the change in price of an option with that of an underlying stock or index. We will discuss how this happens

But let’s first discuss a bit more about the basics of Delta

Delta is the ratio that determines the change in price of an option with that of an underlying stock or index. We will discuss how this happens

But let’s first discuss a bit more about the basics of Delta

2/ Reading Delta

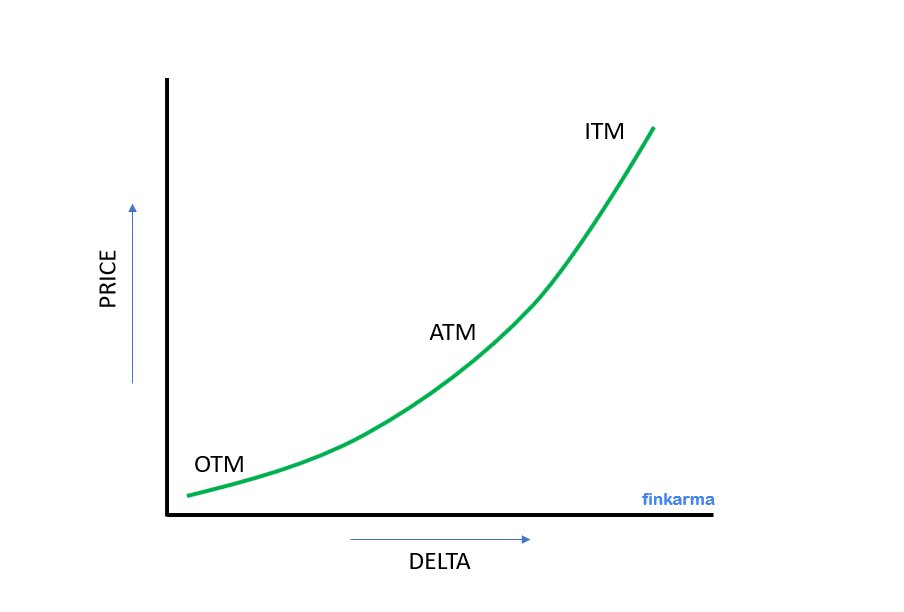

The value of an option’s Delta fluctuates between 1 and -1. The deeper an option goes to the strike price, in the money (ITM), the more the Delta moves towards 1 or -1.

The value of an option’s Delta fluctuates between 1 and -1. The deeper an option goes to the strike price, in the money (ITM), the more the Delta moves towards 1 or -1.

Generally, Delta of an at the money (ATM) option will be around 0.5 or -0.5. Also, Delta for an out of the money (OTM) option will be less than 0.5 or more than -0.5 (or towards zero), see in the above picture.

In this example, the market price of Reliance is 2400. You can observe from the above option table of Reliance, the Delta of CE increases as the option goes deep ITM.

For example, the Delta of 2260 CE is more than 2400CE.

For example, the Delta of 2260 CE is more than 2400CE.

Delta decreases as the CE goes OTM. For example, delta of 2520 CE is far less than 2400 CE. The same is true for PE options that is, high delta for ITM and less for OTM.

3/ But what does a higher and lower Delta mean?

In simple words, the higher the delta, the higher will be the movement of the option with respect to the underlying.

In simple words, the higher the delta, the higher will be the movement of the option with respect to the underlying.

For example, if Reliance stock moves up then an ITM CE (higher delta) will add more premium than an ATM CE (lesser delta) and an ATM CE will add more premium than an OTM CE (even lesser delta).

Still confused? We will do it with the help of examples.

Still confused? We will do it with the help of examples.

We know that a CE adds more premium (increases in value) as the stock goes higher and it loses premium as the stock goes down

But there is another important question. How much an option will move for a one-point move in the stock price?

The following examples will make it clear

But there is another important question. How much an option will move for a one-point move in the stock price?

The following examples will make it clear

Say Reliance is currently trading at 2400.

Let’s first take the case of CE options.

OTM CE

2460CE

Price = 17

Delta = 0.3

Reliance moves up from 2400 to 2410, that is 10 points

CE moves up by 10 x 0.3 = 3pts

2460CE = 17 + 3 = Rs.20

Let’s first take the case of CE options.

OTM CE

2460CE

Price = 17

Delta = 0.3

Reliance moves up from 2400 to 2410, that is 10 points

CE moves up by 10 x 0.3 = 3pts

2460CE = 17 + 3 = Rs.20

ATM CE

Reliance 2400CE

Price = Rs.41.2

Delta = 0.55.

Reliance moves up by 10 pts

Then 2400CE will move up by 10 x 0.55 = 5.5pts

So, 2400CE value will be 41.2 + 5.5 = Rs.46.7

Reliance 2400CE

Price = Rs.41.2

Delta = 0.55.

Reliance moves up by 10 pts

Then 2400CE will move up by 10 x 0.55 = 5.5pts

So, 2400CE value will be 41.2 + 5.5 = Rs.46.7

ITM CE

But if we have 2260CE which is deep in the money

Price = 151.65

Delta = 0.94

Reliance moves up from 2400 to 2410. Then for this 10pts move

2260CE will move by 10 x 0.94 = 9.4pts

So, 2260CE = 151.65 + 9.4 = Rs.161.05

But if we have 2260CE which is deep in the money

Price = 151.65

Delta = 0.94

Reliance moves up from 2400 to 2410. Then for this 10pts move

2260CE will move by 10 x 0.94 = 9.4pts

So, 2260CE = 151.65 + 9.4 = Rs.161.05

Now let’s discuss the case of put options.

But let me make it clear for new option readers that buying a PE means that we are bearish on the market. PE will add more premium as the stock goes down. Conversely, it loses premium as the stock goes up.

But let me make it clear for new option readers that buying a PE means that we are bearish on the market. PE will add more premium as the stock goes down. Conversely, it loses premium as the stock goes up.

OTM PE

2340PE

Price = 11.95

Delta = - 0.21

Reliance goes down from CMP 2400 to 2390 = -10 pts

PE moves up by = -10 x - 0.21 = 2.1pts

2340PE price = 11.95 + 2.1 = 14.05

2340PE

Price = 11.95

Delta = - 0.21

Reliance goes down from CMP 2400 to 2390 = -10 pts

PE moves up by = -10 x - 0.21 = 2.1pts

2340PE price = 11.95 + 2.1 = 14.05

ATM PE

2400PE

Price = 29.9

Delta = - 0.43

Fall in Reliance = -10pts

Increase in PE = -10 x - 0.43 = 4.3

2400PE = 29.9 + 4.3 = 34.2

2400PE

Price = 29.9

Delta = - 0.43

Fall in Reliance = -10pts

Increase in PE = -10 x - 0.43 = 4.3

2400PE = 29.9 + 4.3 = 34.2

ITM PE

2520PE

Price = 114.45

Delta = - 0.85

Reliance moves = -10pts

PE moves = - 10 x - 0.85 = 8.5pts

2520PE = 114.45 + 8.5 = 122.95

2520PE

Price = 114.45

Delta = - 0.85

Reliance moves = -10pts

PE moves = - 10 x - 0.85 = 8.5pts

2520PE = 114.45 + 8.5 = 122.95

I hope it is clear from the above examples which option adds more premium and by how much.

So now we understand that by knowing the delta of an option we can estimate the price of that option for a specific increase/decrease in the price of the underlying.

So now we understand that by knowing the delta of an option we can estimate the price of that option for a specific increase/decrease in the price of the underlying.

Now let us discuss a few basic delta option strategies that can be useful for traders and investors to hedge against high volatility.

4/ What is Delta Hedge?

Delta is the ratio that determines the change in price of an option with respect to change in price of an underlying.

Professional traders utilize this information to hedge their positional risk against directional movement of a stock or index.

Delta is the ratio that determines the change in price of an option with respect to change in price of an underlying.

Professional traders utilize this information to hedge their positional risk against directional movement of a stock or index.

Delta strategies are aimed at minimizing the movement of an option’s price in relation to the underlying and thereby offsetting the risk.

In other words, delta strategies can be used as a hedge against volatility.

In other words, delta strategies can be used as a hedge against volatility.

Do not worry if this seems complex at this point. You will grasp more as we proceed further. But let’s first understand why selecting a strike price of an option is very important.

5/ Selecting an Option is Important?

We understand that an ITM option has a higher delta compared to an ATM. an ATM option has a higher delta compared to an OTM.

We understand that an ITM option has a higher delta compared to an ATM. an ATM option has a higher delta compared to an OTM.

It simply means that an ITM option will reflect more change, in relation to the underlying, compared to an ATM or OTM option

Let’s take an example.

Say you have a bullish bias for SBI

You buy an ATM 515CE of SBI at Rs.8 whose delta is 0.5.

The stock price starts falling and so does the option’s price.

With 1 rupee decline in SBI, the option price falls by 0.5

So, the option is falling at half rate

Say you have a bullish bias for SBI

You buy an ATM 515CE of SBI at Rs.8 whose delta is 0.5.

The stock price starts falling and so does the option’s price.

With 1 rupee decline in SBI, the option price falls by 0.5

So, the option is falling at half rate

Let’s say the stock keeps on falling and reaches 500.

At that time the option price could be 3 and its delta could be 0.25.

You must be wondering that why option price is not [8 – (15 x 0.5)] = 0.5

At that time the option price could be 3 and its delta could be 0.25.

You must be wondering that why option price is not [8 – (15 x 0.5)] = 0.5

This is because as the stock is falling, the ATM option is now going deep OTM.

Its delta would keep on declining from 0.5 towards say 0.25. Means, decrease in the rate of fall.

Its delta would keep on declining from 0.5 towards say 0.25. Means, decrease in the rate of fall.

Now if, in same month, SBI reverts back to 515 near expiry. Your option might not regain Rs.8 (your cost) level.

This is because this time the option had a low delta (0.25), to begin with. So, with every 1rupee gain in SBI, the option would gain 0.25 only (plus time decay).

This is because this time the option had a low delta (0.25), to begin with. So, with every 1rupee gain in SBI, the option would gain 0.25 only (plus time decay).

Thus, buying OTM options can be a risky affair. Your OTM options will make money only when there is strong momentum, in the direction of your trade, and it goes ITM.

A delta-neutral strategy can minimize such a direction risk and protect your capital. Let’s see how.

A delta-neutral strategy can minimize such a direction risk and protect your capital. Let’s see how.

6/ Delta Neutral Strategy

As the name suggests, a delta-neutral strategy brings the delta of your position to zero. This can be done by adjusting the number of calls, puts, and shares so as to bring down the net delta to zero.

Let’s do this with the help of examples.

As the name suggests, a delta-neutral strategy brings the delta of your position to zero. This can be done by adjusting the number of calls, puts, and shares so as to bring down the net delta to zero.

Let’s do this with the help of examples.

7/ What is Meant by Delta Neutral?

Assume that we have two options:

SBI 515CE = Rs.8.6

Delta = 0.5 and

Lot size = 1500

and

SBI 500PE = 3.5

Delta = - 0.25

Assume that we have two options:

SBI 515CE = Rs.8.6

Delta = 0.5 and

Lot size = 1500

and

SBI 500PE = 3.5

Delta = - 0.25

In order to achieve our goal, we need to divide the delta of CE with PE option.

Ratio = Delta CE / Delta PE = 0.5 / -0.25 = -2

Ratio = Delta CE / Delta PE = 0.5 / -0.25 = -2

The value here indicates that we need 2 PE options for each CE option that we need to buy. Because

0.5 + (-0.25) + (-0.25)

= 0.5 – 0.25 – 0.25

= 0.5 – 0.5 = 0 (delta becomes 0)

0.5 + (-0.25) + (-0.25)

= 0.5 – 0.25 – 0.25

= 0.5 – 0.5 = 0 (delta becomes 0)

Therefore, your delta will be

1 x 515CE = 0.5 (delta) x 1500 (lot size) x 1 (number of lots) = 750

2 x 500PE = - 0.25 x 1500 x 2 = -750

Net delta = 0

Similarly, if you are buying 5 CE options then you will have to buy 10 PE option to create a delta neutral strategy

1 x 515CE = 0.5 (delta) x 1500 (lot size) x 1 (number of lots) = 750

2 x 500PE = - 0.25 x 1500 x 2 = -750

Net delta = 0

Similarly, if you are buying 5 CE options then you will have to buy 10 PE option to create a delta neutral strategy

8/ Neutralize Delta Through Shares

In another scenario let us assume that you have 5CE and 5PE options in the above case. Then what will be your delta?

5CE = 0.5 (delta) x 1500 (lot size) x 5 (number of lots) = 3750

5PE = - 0.25 x 1500 x 5 = -1875

In another scenario let us assume that you have 5CE and 5PE options in the above case. Then what will be your delta?

5CE = 0.5 (delta) x 1500 (lot size) x 5 (number of lots) = 3750

5PE = - 0.25 x 1500 x 5 = -1875

You can see that in this case delta of CE is not neutralizing the delta of PE.

Now you add the above figures. That is,

3750 – 1875 = 1875

In order to make this position delta neutral we need to sell 1875 shares of SBI against these options.

Now you add the above figures. That is,

3750 – 1875 = 1875

In order to make this position delta neutral we need to sell 1875 shares of SBI against these options.

In the above scenario you need to make suitable adjustments to the number of calls, puts so as to short the available lot size which might not be feasible in all cases.

The above problem can be resolved by selling the CE and PE options and then buying the required number of shares against this position in the cash segment as follows.

9/ A More Practical Approach

In this scenario say SBI is trading at 515

You short 515CE @ Rs.8.6 with delta 0.5

SBI lot size = 1500

Number of shares that you need to buy against the short CE

= lot size x delta

= 1500 x 0.5 = 750

In this scenario say SBI is trading at 515

You short 515CE @ Rs.8.6 with delta 0.5

SBI lot size = 1500

Number of shares that you need to buy against the short CE

= lot size x delta

= 1500 x 0.5 = 750

This way by shorting 515CE against 750 shares of SBI, you are creating a delta neutral position.

But what will happen when SBI rallies to 525 near expiry?

But what will happen when SBI rallies to 525 near expiry?

In that case the 515CE could be around 12.35 (not 13.6 assuming there was some time decay near expiry)

Loss in CE = (8.6 - 12.35) x 1500 = - 5,625

Gain in 750 shares = 750 x 10 (as SBI moved from 515 to 525) = 7500

Net Gain = 7500 – 5625 = +1875

Loss in CE = (8.6 - 12.35) x 1500 = - 5,625

Gain in 750 shares = 750 x 10 (as SBI moved from 515 to 525) = 7500

Net Gain = 7500 – 5625 = +1875

It needs to be mentioned here that your gain will increase if the volatility declines

Means SBI moves from 515 to 525 at a very slow pace

In this case delta will not increase at a higher rate and the call option will not add theoretical premium due to premium decay near expiry.

Means SBI moves from 515 to 525 at a very slow pace

In this case delta will not increase at a higher rate and the call option will not add theoretical premium due to premium decay near expiry.

The examples discussed are for educational purposes only. You need to test these strategies in the live market before investing your money into them.

Delta neutral positions may become a difficult exercise for new traders.

Position may need to be adjusted as the trade proceeds. Also, options trading without understanding Theta could be dangerous. So, stay tuned with us for more.

Position may need to be adjusted as the trade proceeds. Also, options trading without understanding Theta could be dangerous. So, stay tuned with us for more.

Please follow us and do like & retweet this thread with your friends over social media.

Thanks for reading.

Thanks for reading.

• • •

Missing some Tweet in this thread? You can try to

force a refresh