Unveiling the Power of Equity Trading. Join us on the path to Trading Excellence.

6 subscribers

How to get URL link on X (Twitter) App

Even though this indicator could be really useful when it comes to making trading decisions, most people don't bother to get to know how it works and end up basing their decisions on bad info.

Even though this indicator could be really useful when it comes to making trading decisions, most people don't bother to get to know how it works and end up basing their decisions on bad info.

1/ Pre-Breakout Talk

1/ Pre-Breakout Talkhttps://twitter.com/AliAbdaal/status/1530897530866786304?t=eDuS6MXrTNhPR3ytOuSW_A&s=09

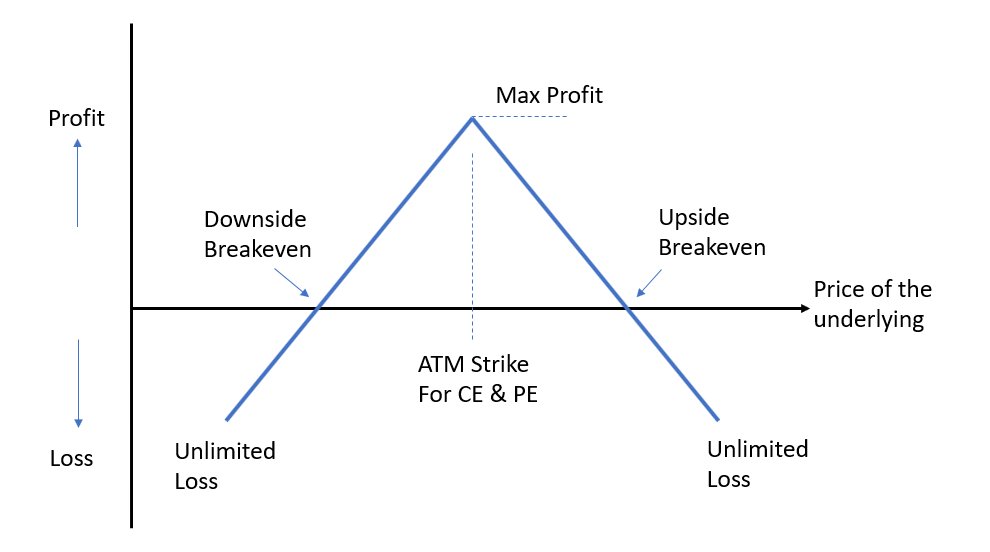

1/ Big Brother of Short Strangle (SS)

1/ Big Brother of Short Strangle (SS)

1/ Fear of Pulling the trigger

1/ Fear of Pulling the trigger

After reading this thread you will come to know

After reading this thread you will come to know

Objective of the issue :

Objective of the issue :

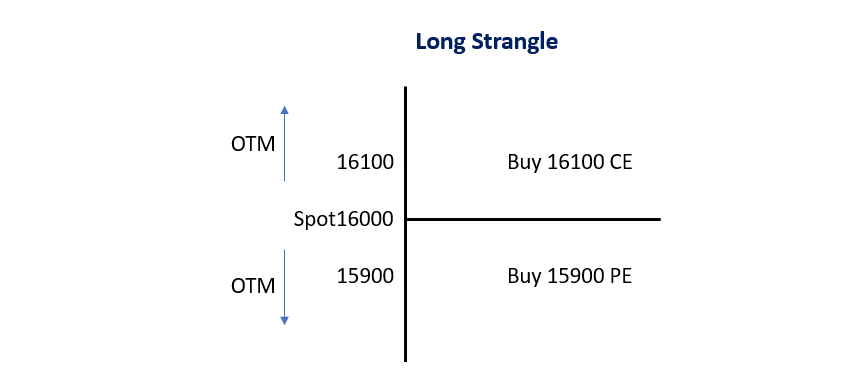

1/ Strangles

1/ Strangles

Objective of the issue :

Objective of the issue :

Objective of the issue:

Objective of the issue:https://twitter.com/GurleenKaur_19/status/1524683530495619073?t=_-XNsksYsSGbzXZi684R2w&s=09

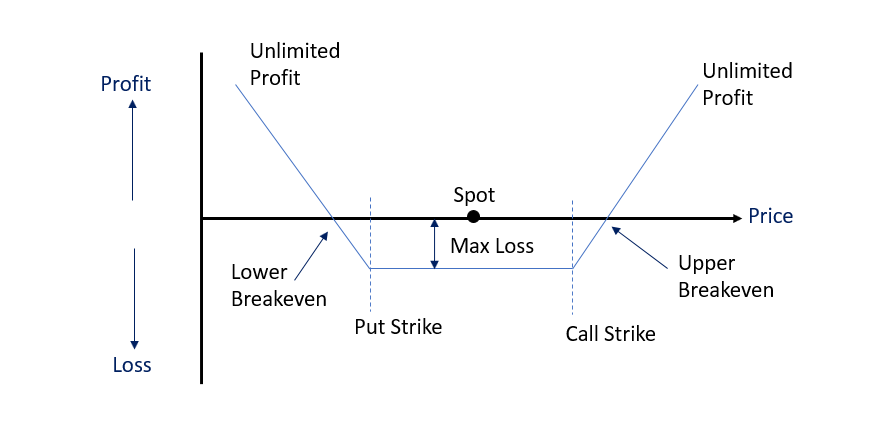

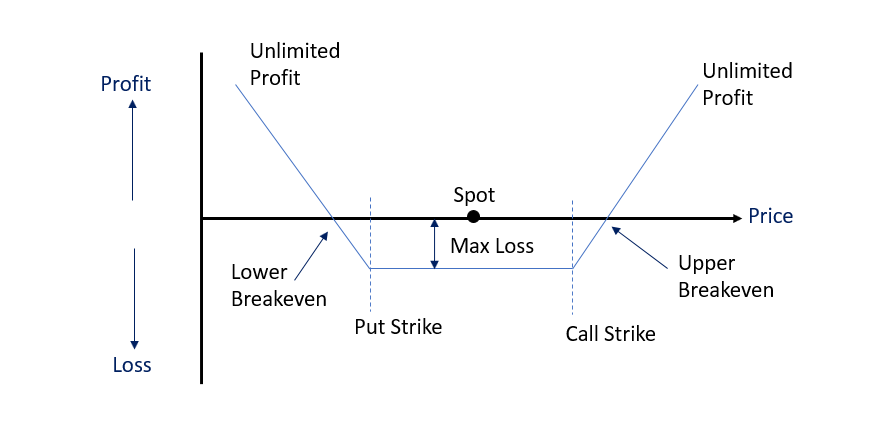

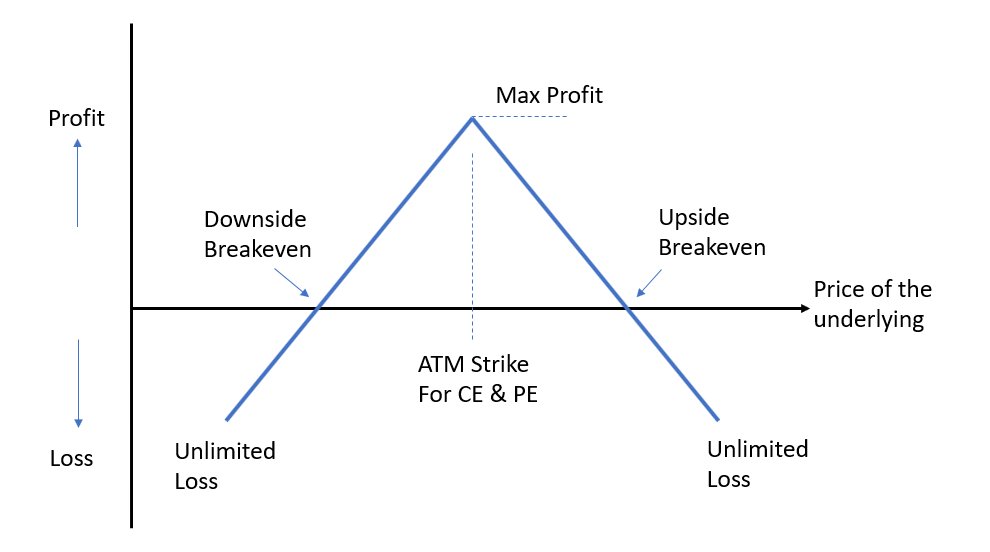

1/ Our previous thread was dedicated to the long straddle options strategy which had the potential for unlimited gains with limited risk.

1/ Our previous thread was dedicated to the long straddle options strategy which had the potential for unlimited gains with limited risk.

1. Jumping onto the advanced stuff, before sharpening their basics first.

1. Jumping onto the advanced stuff, before sharpening their basics first.

Objective:

Objective:

Objective of the issue:

Objective of the issue:

1/ In our previous threads we discussed about Option Greeks, Call options, Put options, Bull Call spreads and Bull Put spreads.

1/ In our previous threads we discussed about Option Greeks, Call options, Put options, Bull Call spreads and Bull Put spreads.