You're going to get wrecked if you don't understand Tokenomics.

But what IS Tokenomics and what should you watch out for?

Here's everything you need to know about Tokenomics:

(+ a free Tokenomics checklist)

But what IS Tokenomics and what should you watch out for?

Here's everything you need to know about Tokenomics:

(+ a free Tokenomics checklist)

What I'll be covering today:

• What is Tokenomics?

• Evaluating through Supply, Demand, and Incentives

• Tokenomics examples

• Free Tokenomics Checklist

Let's level up!

• What is Tokenomics?

• Evaluating through Supply, Demand, and Incentives

• Tokenomics examples

• Free Tokenomics Checklist

Let's level up!

What IS Tokenomics?

Tokenomics studies the factors that drive the demand for tokens.

It includes:

• math

• supply vs. demand

• incentives

• value accrual

• Human behavior & game theory

Tokenomics = Tokens + Econonmics

Tokenomics studies the factors that drive the demand for tokens.

It includes:

• math

• supply vs. demand

• incentives

• value accrual

• Human behavior & game theory

Tokenomics = Tokens + Econonmics

Some of my worst investments were because I didn't understand Tokenomics.

• The tokens were inflationary without enough utility.

• Concentration of tokens by VCs & whales led to retail getting dumped on.

Studying Tokenomics will help improve your crypto investments.

• The tokens were inflationary without enough utility.

• Concentration of tokens by VCs & whales led to retail getting dumped on.

Studying Tokenomics will help improve your crypto investments.

The easiest lens to start with Tokenomics is understanding Supply and Demand.

There are 10k @BoredApeYC out there with a floor price of 111 ETH.

What would happen if the supply DOUBLED and there are now 20k apes?

The price would crash due to more supply.

Scarcity is good.

There are 10k @BoredApeYC out there with a floor price of 111 ETH.

What would happen if the supply DOUBLED and there are now 20k apes?

The price would crash due to more supply.

Scarcity is good.

The Dollar

The U.S. Government printed 40% of the US Money Supply in 2020.

• Money flooded the market.

• The supply of housing remained roughly the same. (They couldn't build during COVID).

That's why 🏠 prices are out of control in the U.S.

The U.S. Government printed 40% of the US Money Supply in 2020.

• Money flooded the market.

• The supply of housing remained roughly the same. (They couldn't build during COVID).

That's why 🏠 prices are out of control in the U.S.

Supply Side of Tokenomics

Here's what you should watch out for:

• How many tokens are in existence?

• How many tokens will there be in total?

• Who has the supply? WHEN can they sell?

• How will the supply change over time?

• What are their policies for changing?

Here's what you should watch out for:

• How many tokens are in existence?

• How many tokens will there be in total?

• Who has the supply? WHEN can they sell?

• How will the supply change over time?

• What are their policies for changing?

How Newbies get Wrecked

They see meme coins at $.000000002 and think they'll be rich once it hits a Dollar.

Understanding the market cap would show that it's impossible.

Hitting $1 would mean it's bigger than the world's entire money supply.

They see meme coins at $.000000002 and think they'll be rich once it hits a Dollar.

Understanding the market cap would show that it's impossible.

Hitting $1 would mean it's bigger than the world's entire money supply.

https://twitter.com/thedefiedge/status/1481385350698262533

Supply Metrics You Should Know

• Supply: How many tokens exist NOW

• Max supply: The most that can exist

• Market Cap: Current Price * circulating supply

• Fully Diluted MC: Price * max supply.

• Supply: How many tokens exist NOW

• Max supply: The most that can exist

• Market Cap: Current Price * circulating supply

• Fully Diluted MC: Price * max supply.

Why are the Above Metrics Important?

The metrics help you understand the future supply and scarcity.

For example, I wouldn't feel great if the circulating supply was only at 40%.

That means the supply will increase by 60%

More coins created will put pressure on the price.

The metrics help you understand the future supply and scarcity.

For example, I wouldn't feel great if the circulating supply was only at 40%.

That means the supply will increase by 60%

More coins created will put pressure on the price.

/1 Sound Money - Bitcoin

There will only be 21m Bitcoin in existence, and no one can create more Bitcoin.

• Bitcoin's supply is capped

• Demand is increasing

• The price should increase

This is why people compare Bitcoin to gold often.

There will only be 21m Bitcoin in existence, and no one can create more Bitcoin.

• Bitcoin's supply is capped

• Demand is increasing

• The price should increase

This is why people compare Bitcoin to gold often.

Bitcoin Halvings

Besides token supply, make sure you consider the emissions rate.

At what SPEED are new tokens printed?

Although miners created new Bitcoin, the emissions have slowed down.

At each halving event, the reward emissions for Bitcoin gets cut in half.

Besides token supply, make sure you consider the emissions rate.

At what SPEED are new tokens printed?

Although miners created new Bitcoin, the emissions have slowed down.

At each halving event, the reward emissions for Bitcoin gets cut in half.

/2 Inflationary Token - Dogecoin

The supply of Dogecoin is increasing each year, and there's no CAP on the supply.

This isn't good for Tokenomics because it's the opposite of Scarcity.

(Note: The price of Dogecoin still went up last year despite bad tokenomics)

The supply of Dogecoin is increasing each year, and there's no CAP on the supply.

This isn't good for Tokenomics because it's the opposite of Scarcity.

(Note: The price of Dogecoin still went up last year despite bad tokenomics)

/3 Deflationary Token

Some coins can become deflationary when the supply DECREASES over time.

The protocol can buy back tokens, and burn them.

A burned coin = is lost forever.

↓ supply should increase the value of the token (in theory)

Some coins can become deflationary when the supply DECREASES over time.

The protocol can buy back tokens, and burn them.

A burned coin = is lost forever.

↓ supply should increase the value of the token (in theory)

Burberry Burns its Bags

Burberry creates luxury handbags, and exclusivity is part of its appeal.

Some of their handbags don't sell - rather than sell them at a discount, they burn their bags.

This keeps the bags "exclusive"

A real-life example of the "burning" mechanism.

Burberry creates luxury handbags, and exclusivity is part of its appeal.

Some of their handbags don't sell - rather than sell them at a discount, they burn their bags.

This keeps the bags "exclusive"

A real-life example of the "burning" mechanism.

Can Ethereum Becoming Ultrasound? 🦇 🔊

•The Merge to Proof of Stake lowers the inflation supply of ETH

•EIP-1559 takes a bit of the transaction fees and burns it.

These combined (and higher demand) means Ethereum could become deflationary.

@drakefjustin

•The Merge to Proof of Stake lowers the inflation supply of ETH

•EIP-1559 takes a bit of the transaction fees and burns it.

These combined (and higher demand) means Ethereum could become deflationary.

@drakefjustin

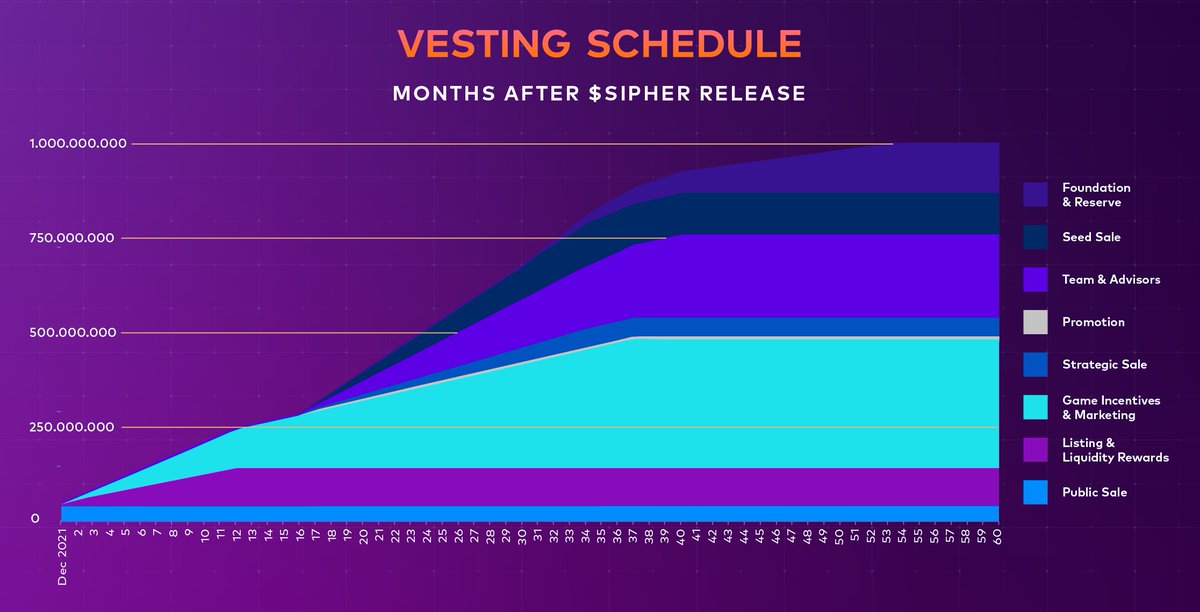

Allocation & Distribution

How are the initial tokens distributed? There are roughly 2 ways:

Pre Mined:

1. The team distributes tokens to itself.

2. Distribution to insiders such as the team and venture capitalists

Fair Launch:

100% fair. Everyone has equal access.

How are the initial tokens distributed? There are roughly 2 ways:

Pre Mined:

1. The team distributes tokens to itself.

2. Distribution to insiders such as the team and venture capitalists

Fair Launch:

100% fair. Everyone has equal access.

Why Does This Matter?

VCs and Insiders could dump their tokens and cause a price crash.

Vesting means when they're allowed to sell the tokens.

You want to make sure that the early backers are INCENTIVIZED with the protocol long-term.

VCs and Insiders could dump their tokens and cause a price crash.

Vesting means when they're allowed to sell the tokens.

You want to make sure that the early backers are INCENTIVIZED with the protocol long-term.

VCs Aren't Evil

By the way, I'm not trying to label insiders as bad.

They can help create VALUE for the founding team through advice, distribution, and connections.

Not all VCs are equal.

Some want to create value for their investments, others want a quick payday.

By the way, I'm not trying to label insiders as bad.

They can help create VALUE for the founding team through advice, distribution, and connections.

Not all VCs are equal.

Some want to create value for their investments, others want a quick payday.

The Teams Can Also Sell Their Tokens

1. Those huge incentive funds? It comes from selling tokens.

2. They sell to raise capital. People forget that some salaries and expenses get paid in fiat.

Selling from the team leads to downward pressure on prices.

1. Those huge incentive funds? It comes from selling tokens.

2. They sell to raise capital. People forget that some salaries and expenses get paid in fiat.

Selling from the team leads to downward pressure on prices.

The Other Half of the Equation: DEMAND

Demand: The factors that drive the desire for people to buy, and the price they're willing to pay.

Despite the inflation, the U.S. $ is in high demand because of its UTILITY.

The world's running on USD (for now)

Demand: The factors that drive the desire for people to buy, and the price they're willing to pay.

Despite the inflation, the U.S. $ is in high demand because of its UTILITY.

The world's running on USD (for now)

What Drives the Demand for Tokens?

I'd put demand into (3) broad categories.

• Utility

• Value Accrual

• The Memes and Narratives

I'd put demand into (3) broad categories.

• Utility

• Value Accrual

• The Memes and Narratives

Utility - Gas Fees

This is payment to use the network.

• Want to buy an NFT on @opensea? You'll need ETH to pay for the gas fees.

• Want access to the sick degen farms on @fantomfoundation? You need FTM.

The more popular the network / DAPP, the higher the demand.

This is payment to use the network.

• Want to buy an NFT on @opensea? You'll need ETH to pay for the gas fees.

• Want access to the sick degen farms on @fantomfoundation? You need FTM.

The more popular the network / DAPP, the higher the demand.

Utility - Fun

GameFi has insane potential once the games ACTUALLY become fun.

Look at how much money GTA and Fortnite are printing.

I'm excited for Triple-A games like @illuvium. That's how we onboard more normies.

p.s. Are any crypto MOBAs coming?

GameFi has insane potential once the games ACTUALLY become fun.

Look at how much money GTA and Fortnite are printing.

I'm excited for Triple-A games like @illuvium. That's how we onboard more normies.

p.s. Are any crypto MOBAs coming?

Utility - Adoption

Crypto is slowly adding in more real-world usage thus driving demand.

• Bitcoin exploded when TSLA added it to its balance sheet to hedge against inflation.

• Dogecoin spiked when AMC announced they'd accept it.

• Terra is pushing for $UST adoption

Crypto is slowly adding in more real-world usage thus driving demand.

• Bitcoin exploded when TSLA added it to its balance sheet to hedge against inflation.

• Dogecoin spiked when AMC announced they'd accept it.

• Terra is pushing for $UST adoption

Value Accrual

The protocol's kicking ass.

The protocol's printing money.

But investors are not getting a piece of the action.

We saw this happen with most DeFi 1.0 giants such as Uniswap and Compound.

People want value, not just governance tokens.

The protocol's kicking ass.

The protocol's printing money.

But investors are not getting a piece of the action.

We saw this happen with most DeFi 1.0 giants such as Uniswap and Compound.

People want value, not just governance tokens.

Value Accrual - xStaking

Last year we saw the rise of xTokens.

Staking the token will earn you a % of the platform revenue fee.

• xSushi @SushiSwap

• fBeets @beethoven_x

• sSpell @MIM_Spell

This added more value to the Tokens.

Last year we saw the rise of xTokens.

Staking the token will earn you a % of the platform revenue fee.

• xSushi @SushiSwap

• fBeets @beethoven_x

• sSpell @MIM_Spell

This added more value to the Tokens.

Value Accrual - Governance

DeFi 1.0 saw a lot of protocols print tokens that had no utility other than governance.

People would farm the APRs and then sell the tokens.

This is how SushiSwap took so many users away from Uniswap when they first launched.

DeFi 1.0 saw a lot of protocols print tokens that had no utility other than governance.

People would farm the APRs and then sell the tokens.

This is how SushiSwap took so many users away from Uniswap when they first launched.

Stopping the Mercenaries

People can be mercenaries in DeFi.

The Farm APRs drop over time, and you might rotate to a farm with more percentage.

The protocol still needs liquidity.

So how do they incentivize people to HOLD their tokens, instead of chasing APR's?

People can be mercenaries in DeFi.

The Farm APRs drop over time, and you might rotate to a farm with more percentage.

The protocol still needs liquidity.

So how do they incentivize people to HOLD their tokens, instead of chasing APR's?

Incentivizing Long Term Holding

We saw a lot of new innovations last year in how protocols motivate long-term holding.

Having these in place lowers the selling pressure of the token.

Let's look at some of them:

We saw a lot of new innovations last year in how protocols motivate long-term holding.

Having these in place lowers the selling pressure of the token.

Let's look at some of them:

The Main Mechanism These Days is Locking

How do you stop selling pressure?

You ask people to lock their tokens up (sometimes for years)

The key is figuring out the INCENTIVES for people to do that.

(1) there are risks in locking up

(2) the opportunity costs of liquidity

How do you stop selling pressure?

You ask people to lock their tokens up (sometimes for years)

The key is figuring out the INCENTIVES for people to do that.

(1) there are risks in locking up

(2) the opportunity costs of liquidity

Holding - veTokens (Curve)

Curve had a big innovation when it introduced veTokens.

Ve = Vote Escrow.

• Locking up your tokens = Voting power.

• The LONGER you lock it up, the MORE Voting power. (up to 4 yrs)

So why care about the voting power?

Curve had a big innovation when it introduced veTokens.

Ve = Vote Escrow.

• Locking up your tokens = Voting power.

• The LONGER you lock it up, the MORE Voting power. (up to 4 yrs)

So why care about the voting power?

Well, Stablecoins are the backbone of DeFi. And Protocols are in a war to get more liquidity / adoption for their stablecoins.

Each week, Curve has a vote on which pools get the most rewards.

And some of these protocols will bribe you to vote for them!

Each week, Curve has a vote on which pools get the most rewards.

And some of these protocols will bribe you to vote for them!

Holding - Farm Boosting

We're seeing AMM's adopt this model of farm boosting @traderjoe_xyz, @beethoven_x. @Spirit_Swap

Locking up tokens gives you the right to vote for the pools.

Protocols are in a war now to acquire governance power to benefit themselves.

We're seeing AMM's adopt this model of farm boosting @traderjoe_xyz, @beethoven_x. @Spirit_Swap

Locking up tokens gives you the right to vote for the pools.

Protocols are in a war now to acquire governance power to benefit themselves.

Holding - Unstake You Lose it

Platypus Finance introduced one of the most interesting mechanisms for Ve.

• Staking $PTP gets you $vePTP. This gives you a higher APR on your stablecoin yields.

• Unstaking $vePTP? You lose ALL your vePTP.

Not easy to sell then.

Platypus Finance introduced one of the most interesting mechanisms for Ve.

• Staking $PTP gets you $vePTP. This gives you a higher APR on your stablecoin yields.

• Unstaking $vePTP? You lose ALL your vePTP.

Not easy to sell then.

Holding - Rebasing

@OlympusDAO introduced the concept of rebasing, and other protocols desecrated the concept.

Rebasing is a form of gamification.

It LOOKS like you're getting 50k% APR. In reality, it's paid out through the tokens. Your % of the market cap remains the same.

@OlympusDAO introduced the concept of rebasing, and other protocols desecrated the concept.

Rebasing is a form of gamification.

It LOOKS like you're getting 50k% APR. In reality, it's paid out through the tokens. Your % of the market cap remains the same.

Holding - Rewards / Raffles

@DefiKingdoms allows staking which is revenue share.

They also have:

• Staking xJewel / xCrystal enters you into lotteries for airdrops. This includes valuable Gen 0 heroes (worth a TON)

• The more you stake, the more raffle tickets you earn.

@DefiKingdoms allows staking which is revenue share.

They also have:

• Staking xJewel / xCrystal enters you into lotteries for airdrops. This includes valuable Gen 0 heroes (worth a TON)

• The more you stake, the more raffle tickets you earn.

Holding - Unlock / Lock Rates

@DefiKingdoms is a game that's in progress.

How do they prevent people from dumping tokens of a game?

They automatically lock part of it.

Crystalvale just launched. You can get 4k APR, but IF you claim now, 95% of it is locked for a year.

@DefiKingdoms is a game that's in progress.

How do they prevent people from dumping tokens of a game?

They automatically lock part of it.

Crystalvale just launched. You can get 4k APR, but IF you claim now, 95% of it is locked for a year.

Does everything get dumped a year from now?

Not quite.

• Once it unlocks, it's not unlocked all at once. It's vested out.

• They're using that time to add UTILITY to the game such as PVE and PVP.

They're hoping a year from now, the game will be more finished.

Not quite.

• Once it unlocks, it's not unlocked all at once. It's vested out.

• They're using that time to add UTILITY to the game such as PVE and PVP.

They're hoping a year from now, the game will be more finished.

Memes and Narratives

Human desire is strange.

I watched a YouTube video of someone paying $2k for a golden steak from Salt Bae.

Coins CAN pump despite horrible tokenomics.

Sometimes the meme, narratives, and marketing can be THAT strong.

Human desire is strange.

I watched a YouTube video of someone paying $2k for a golden steak from Salt Bae.

Coins CAN pump despite horrible tokenomics.

Sometimes the meme, narratives, and marketing can be THAT strong.

The Curious Case of Dogecoin

Dogecoin had an insane rise last year.

The richest man in the world, Elon, had a strange obsession with Dogecoin.

And it peaked with his appearance on Saturday Night Live.

People bought hoping Elon would keep pumping Dogecoin up.

Dogecoin had an insane rise last year.

The richest man in the world, Elon, had a strange obsession with Dogecoin.

And it peaked with his appearance on Saturday Night Live.

People bought hoping Elon would keep pumping Dogecoin up.

People Buy What They Think Will Make Them Money

Take your nerd hat off, and put your human hat on.

There are some protocols with GREAT tokenomics, but their prices are garbage.

It could be because of the Narratives - People are chasing the next bright shiny object.

Take your nerd hat off, and put your human hat on.

There are some protocols with GREAT tokenomics, but their prices are garbage.

It could be because of the Narratives - People are chasing the next bright shiny object.

Bad Tokenomics - PancakeSwap

PancakeSwap hit its peak a year ago and has been on a downward trend.

1. It’s an inflationary token. (supply)

2. There’s no utility for the token.(demand)

Pancake “prints” Cake and the users immediately sell it.

PancakeSwap hit its peak a year ago and has been on a downward trend.

1. It’s an inflationary token. (supply)

2. There’s no utility for the token.(demand)

Pancake “prints” Cake and the users immediately sell it.

Tokenomics Overhaul

I'm fascinated when protocols overhaul their Tokenomics.

Trader Joe had a basic tokenomics structure when it first launched.

They overhauled their model in Quarter 1.

Before it was stake Joe, and you get a % of the protocol's revenue.

Here's what's new:

I'm fascinated when protocols overhaul their Tokenomics.

Trader Joe had a basic tokenomics structure when it first launched.

They overhauled their model in Quarter 1.

Before it was stake Joe, and you get a % of the protocol's revenue.

Here's what's new:

Stake Joe and now...

• rJOE - Get access to launch pads

• sJOE - earn a % of platform revenue paid in stablecoins

• veJOE - farm boosts + governance. (unstake, you lose it just like PTP)

They're increasing demand by varying incentives.

Could this reverse TJ's fortunes?

• rJOE - Get access to launch pads

• sJOE - earn a % of platform revenue paid in stablecoins

• veJOE - farm boosts + governance. (unstake, you lose it just like PTP)

They're increasing demand by varying incentives.

Could this reverse TJ's fortunes?

Other Thoughts:

• Imagine writing a thread on "Economics." This is a huge topic, and there's a lot I wasn't able to cover.

• I'm getting bored of DeFi tokenomics - it's becoming a game of musical chairs with creative handcuffs.

• GameFi tokenomics are a diff beast.

• Imagine writing a thread on "Economics." This is a huge topic, and there's a lot I wasn't able to cover.

• I'm getting bored of DeFi tokenomics - it's becoming a game of musical chairs with creative handcuffs.

• GameFi tokenomics are a diff beast.

Tokenomics Checklist

I created a checklist for you.

(I got you fam)

You should have a checklist to evaluate every aspect of a protocol.

This helps keep you make objective decisions.

I created a checklist for you.

(I got you fam)

You should have a checklist to evaluate every aspect of a protocol.

This helps keep you make objective decisions.

Takeaways:

• Master the fundamentals because it's going to get more complicated.

• View Tokenomics through the lens of supply, demand, and long-term incentives.

• While Tokenomics is important, it's not the end be all. Narratives and hype can outweigh tokenomics.

• Master the fundamentals because it's going to get more complicated.

• View Tokenomics through the lens of supply, demand, and long-term incentives.

• While Tokenomics is important, it's not the end be all. Narratives and hype can outweigh tokenomics.

Whew, that's it!

(1) I don't make money from my writing.

Give me a like / retweet on the 1st tweet, and that will incentivize me long term to increase the supply of content 😄

(2) Join 18,000+ people who get exclusive content from me.

Subscribe at: TheDefiEdge.com

(1) I don't make money from my writing.

Give me a like / retweet on the 1st tweet, and that will incentivize me long term to increase the supply of content 😄

(2) Join 18,000+ people who get exclusive content from me.

Subscribe at: TheDefiEdge.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh