Quick market recon thread as I board my plane back home:

Just on way back from @RealVision #macroexperience event in San Diego and have a few observations…

Just on way back from @RealVision #macroexperience event in San Diego and have a few observations…

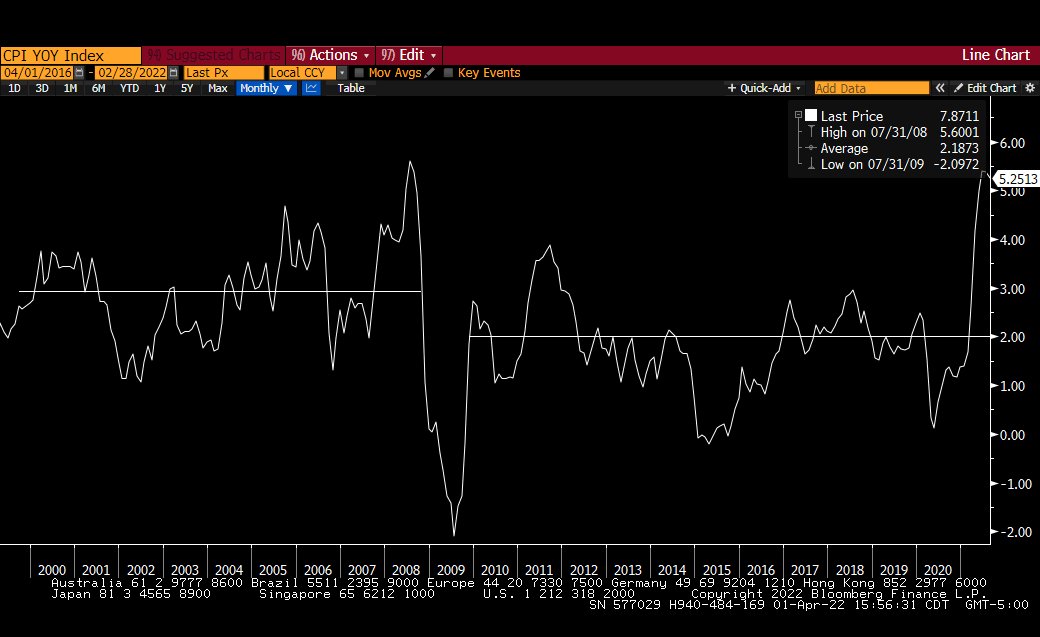

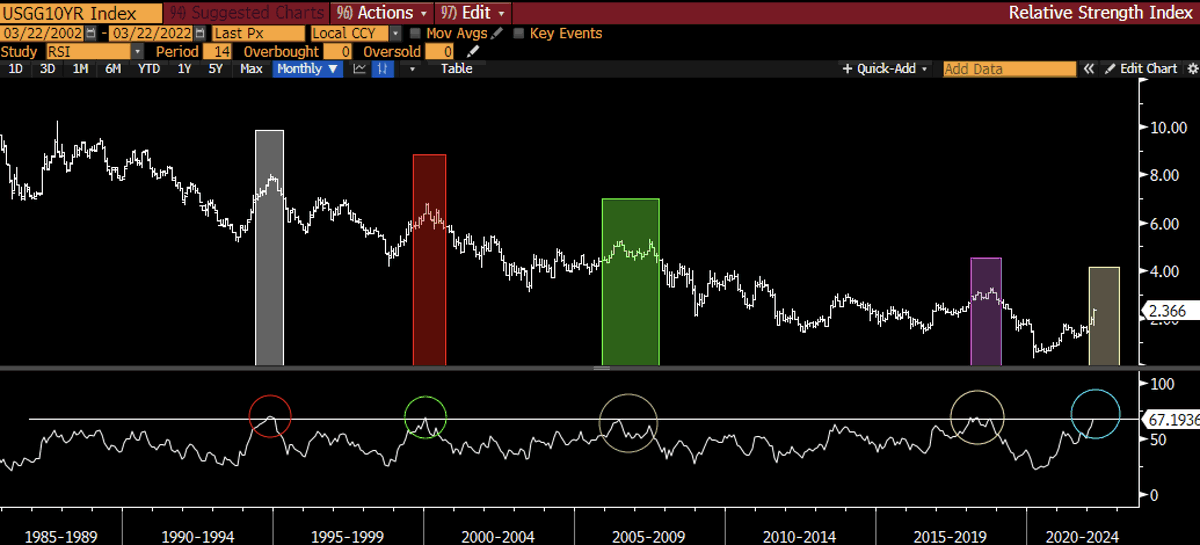

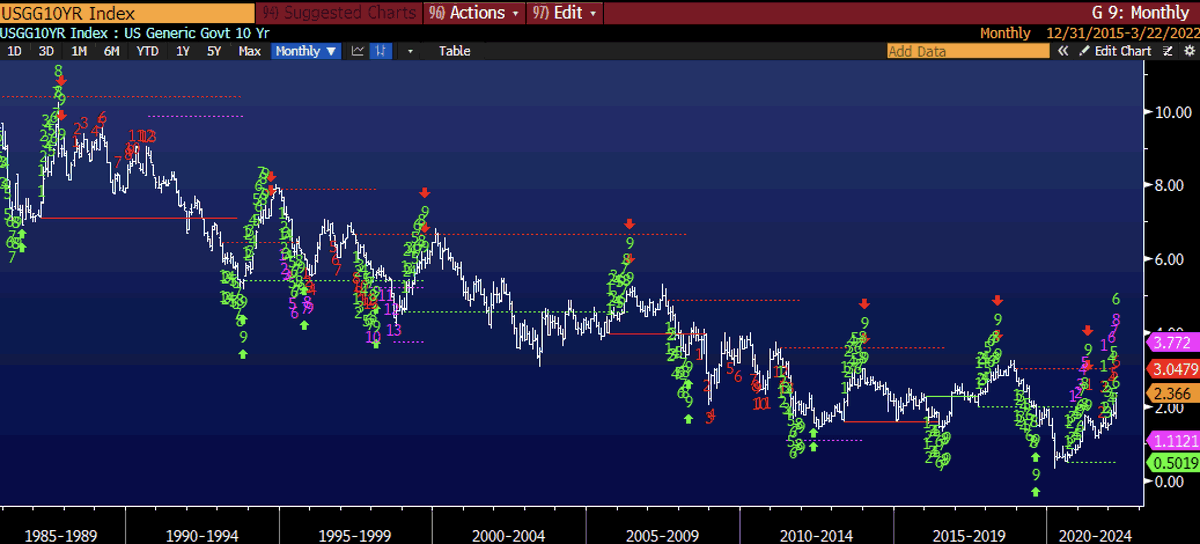

Almost everyone now believes inflation is unanchored on a secular basis and the Chart of Truth will fail and the previous cycle high in rates will get taken out for the first time in 35+ years…

Many people I respect expect rates to get to levels we couldn’t believe a couple of years ago. Calls of 5% plus.

Same sentiment for commodity inflation with lots of expectations of $150 oil, food shortages, etc

Same sentiment for commodity inflation with lots of expectations of $150 oil, food shortages, etc

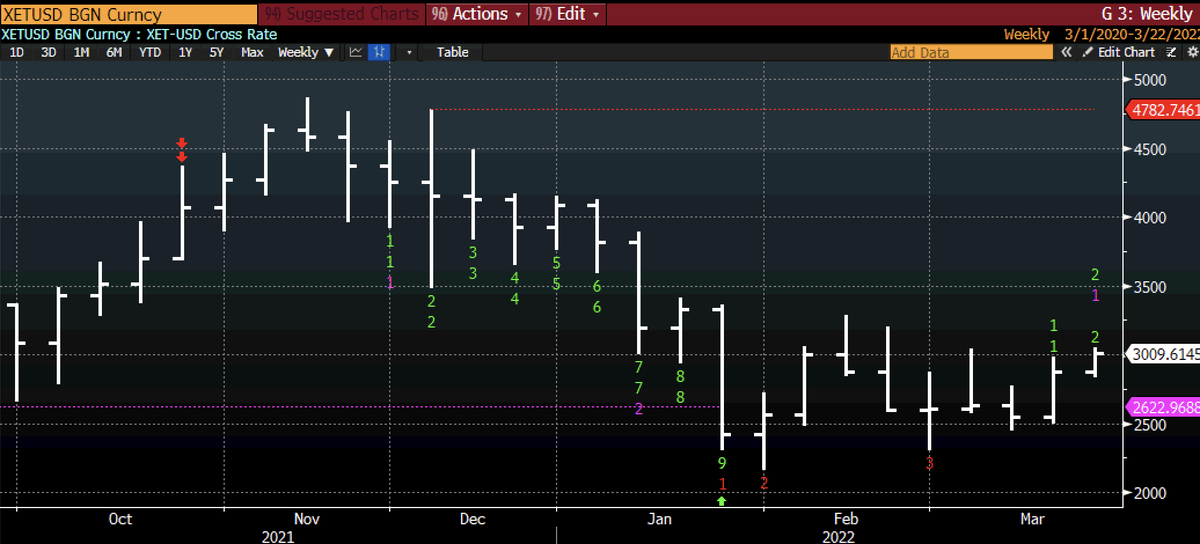

Adding to that are huge concerns around equities (especially growth stocks),housing etc.

I’ve not seen a secular (not cyclical) shift in sentiment this extreme before.

Doesn’t mean they are wrong but probability of the worst being priced in has risen sharply.

However…

I’ve not seen a secular (not cyclical) shift in sentiment this extreme before.

Doesn’t mean they are wrong but probability of the worst being priced in has risen sharply.

However…

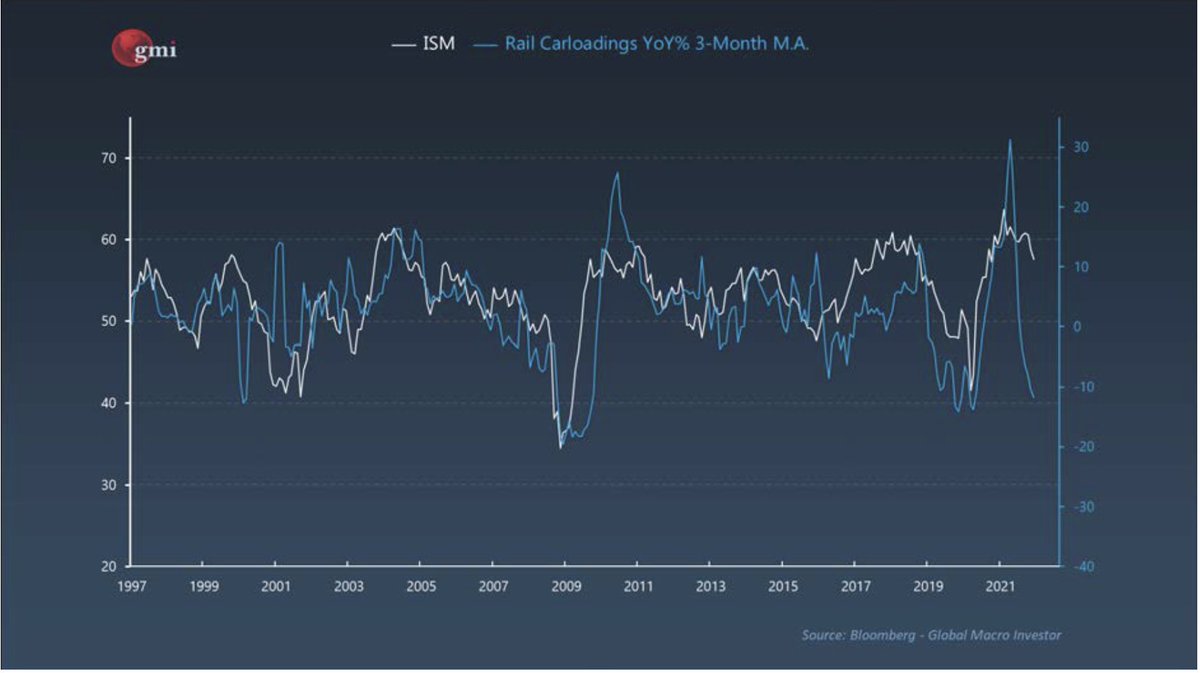

My view remains that the bond market has already done the work of the Fed, growth is slowing and markets will adjust to supply issues over time.

However, a recession on the horizon with added QT can lower equity values further but if the Fed pauses due to growth evaporation…

However, a recession on the horizon with added QT can lower equity values further but if the Fed pauses due to growth evaporation…

Then equities rally, especially Exponential Age growth stocks which are 2 SD oversold vs their log trends.

It’s a bloody complex picture and variations in outcomes are broad but I’m more constructive than most.

I still think secular deflation keeps secular inflation in check.

It’s a bloody complex picture and variations in outcomes are broad but I’m more constructive than most.

I still think secular deflation keeps secular inflation in check.

We had 400% rises in commodities in 2002 to 2008 and inflation averaged less than 3%.

We saw even looser fiscal and monetary policy against even more massive supply issues in 1945 to 1955 and inflation averaged 1.8% (after a short post-war spike).

Let’s see…

We saw even looser fiscal and monetary policy against even more massive supply issues in 1945 to 1955 and inflation averaged 1.8% (after a short post-war spike).

Let’s see…

• • •

Missing some Tweet in this thread? You can try to

force a refresh