This paper is now out. Planned before @Annaisaac made #nondoms cool again, we use confidential, anonymised HMRC data to look at🧐

🔸who the nondoms are

🔸what they do (incl a look at bankers)

🔸where they are from

🔸where they live

🧵 1/N

warwick.ac.uk/fac/soc/econom…

🔸who the nondoms are

🔸what they do (incl a look at bankers)

🔸where they are from

🔸where they live

🧵 1/N

warwick.ac.uk/fac/soc/econom…

https://twitter.com/arunadvaniecon/status/1511720918501969921

First up: what is a non-dom?🤷

Non-doms are people who live here, like you or me. May spend whole year in UK, working, having families. What makes them diff is that they claim their permanent home is abroad (and can hopefully substantiate this).

Non-doms are people who live here, like you or me. May spend whole year in UK, working, having families. What makes them diff is that they claim their permanent home is abroad (and can hopefully substantiate this).

What does this get them❓

Benefit of non-dom status is can claim "remittance basis": no tax on foreign investments

That's what @Independent story yday was about: claim that Chancellor's wife didn't pay UK tax on her substantial non-UK income from shares

Benefit of non-dom status is can claim "remittance basis": no tax on foreign investments

That's what @Independent story yday was about: claim that Chancellor's wife didn't pay UK tax on her substantial non-UK income from shares

https://twitter.com/Annaisaac/status/1511747061888307206

As a brief aside, citizenship has *nothing* to do with whether you choose to/not to claim remittance basis in the UK. Most non-citizens are not claiming it, and some citizens ARE claiming it (and, to be clear, this is allowed)

https://twitter.com/arunadvaniecon/status/1511756421335072771

Ok, enough background. What did we learn?🧑🎓

First up, there are many more ppl in UK who have benefited from non-dom status than you might think. For every 2 ppl claiming non-dom in 2018, another 5 ppl living in UK had previously claimed.

First up, there are many more ppl in UK who have benefited from non-dom status than you might think. For every 2 ppl claiming non-dom in 2018, another 5 ppl living in UK had previously claimed.

2017 reforms removed eligibility for some, so was widely reported that number of nondoms had fallen (blue above), but can see from the green that they didn't leave, just stopped claiming status

They are also very rich💰💰💰

4 out of every 10 people with income above £5million has benefitted from non-dom status

4 out of every 10 people with income above £5million has benefitted from non-dom status

From the (longer) paper, get the answer to that poll📊

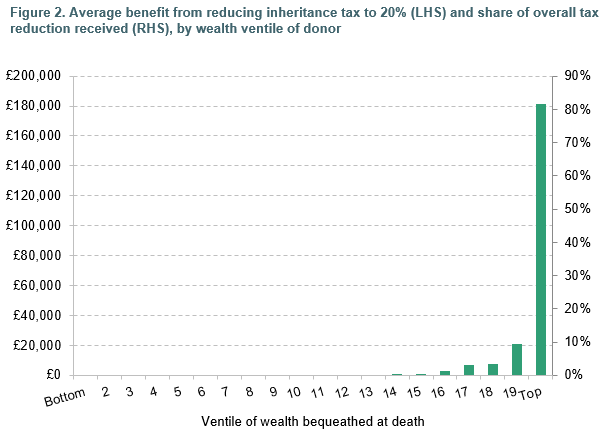

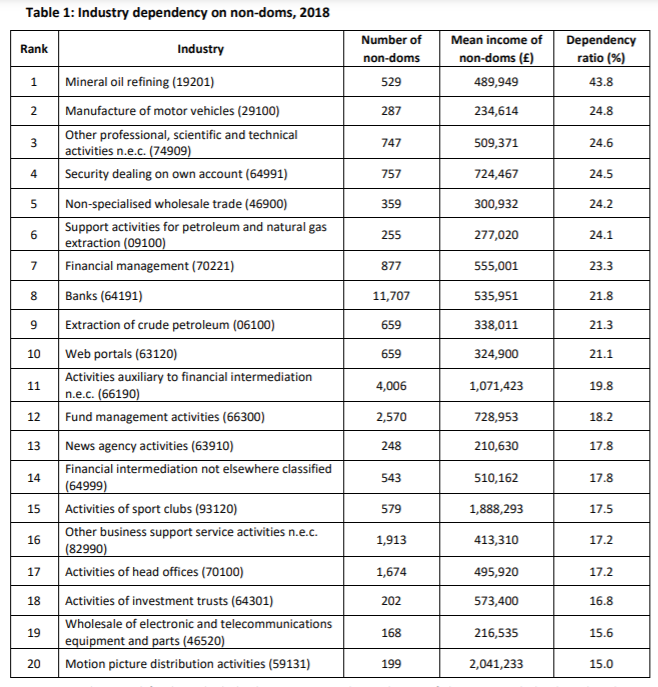

Looking at dependence of industries on non-doms, see that ore than one in five bankers has benefitted from non-dom status

warwick.ac.uk/fac/soc/econom…

Looking at dependence of industries on non-doms, see that ore than one in five bankers has benefitted from non-dom status

warwick.ac.uk/fac/soc/econom…

Pretty striking in that figure are the ⚽️ and 📽️ stars: not only are there a lot of non-doms, but they take home a cool £2m on average.

Non-doms are from EU🇪🇺, US🇺🇸, and ex-colonies.

Share of non-doms from India🇮🇳 has had by far the fastest growth - interesting given the current #nondom news

Share of non-doms from India🇮🇳 has had by far the fastest growth - interesting given the current #nondom news

Not surprising that most live in London. But Aberdeen (oil), Manchester (sports), Oxbridge (education and research) also light up, and have particular industries associated with them

Within central London they live in perhaps the most obvious areas. We put together this map, but then I saw a tweet thread that gave me a better idea how to visualise it

https://twitter.com/carlbaker/status/1511250941286273024

Here is what it looks like to live in one of the top local area for non-doms (City of London 001F), where more than 25% of tax filers claim non-dom status

Also more than a quarter in Kensington and Chelsea 016B.

These pics don't exactly look like the Middle England of the thread that inspired this...

These pics don't exactly look like the Middle England of the thread that inspired this...

So what should we take from all this?

Use of the remittance basis is a perk that benefits the very wealthiest. At the moment there are no official stats on what it costs us, nor what the benefits are. So we're doing our own work to get some numbers, coming over 2022. 👀

N/N

Use of the remittance basis is a perk that benefits the very wealthiest. At the moment there are no official stats on what it costs us, nor what the benefits are. So we're doing our own work to get some numbers, coming over 2022. 👀

N/N

• • •

Missing some Tweet in this thread? You can try to

force a refresh