Stoke City lost £43 million from day to day trading in 2020/21 but were able to sell the stadium and training ground for £85m before the 1 July 2021 deadline when property sale profits were no longer allowed for FFP #MelMorrisLikesThis

Sale of stadium meant that Stoke had over £90m in the bank at 31 May 2021. Total losses over the years were £181 million

High property sale value of £85m exceeded the valuation in 2020 due to high maintenance costs in earlier years of the stadium and inflation in the construction industry

Stoke were hit by COVID in terms of ticket sales. Broadcast income, mainly parachute 🪂 payments, were 70% of total revenue.

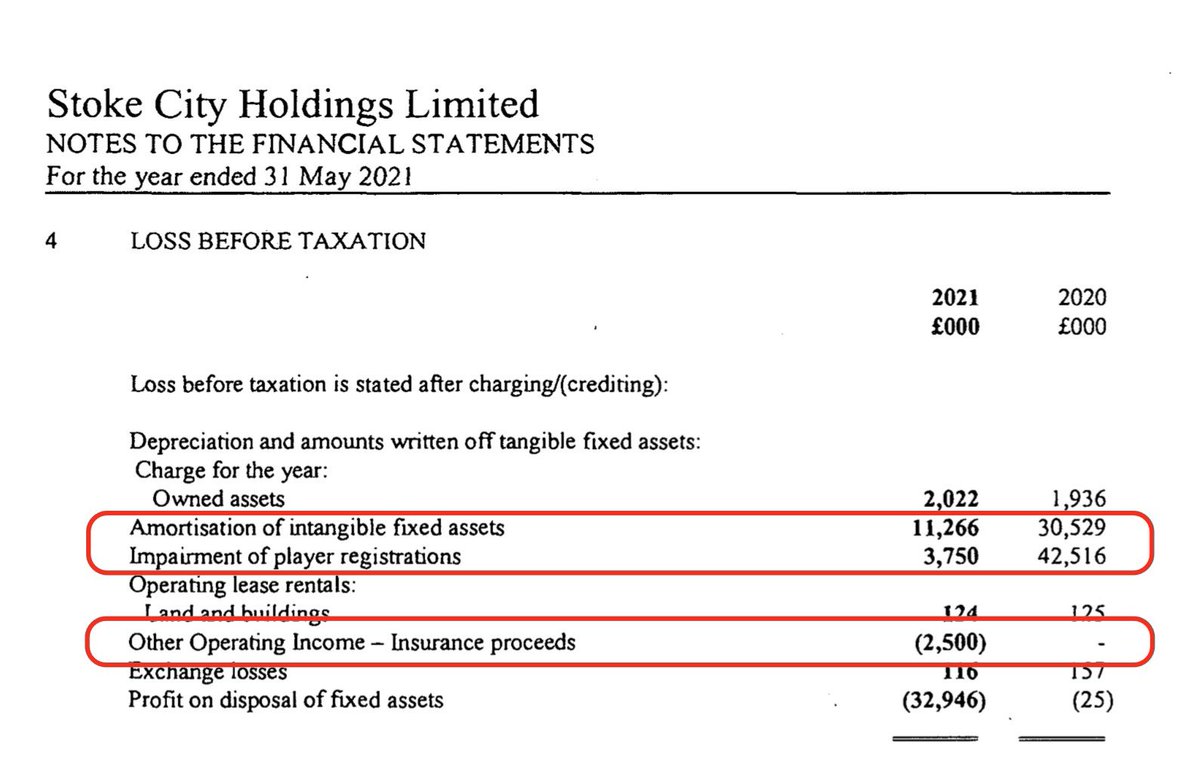

Stoke wrote down player values by £3.75m, lower than the £42.5m the previous season having signed a load of 🦃 🦃 🦃. Amortisation costs ⬇️2/3 as a result. Stoke claimed £2.5m in covid insurance.

Stoke wage bill £50m, which is high for a club in third year in Championship following relegation. Ave weekly wage £23k, which even with current high inflation, should buy you a few packets of oatcakes in Hanley.

Stoke signed players for £5m and had sales (or let go) for £1.5m on players who originally cost £34m 🦃🦃🦃

Stoke owe Bet365 £250m, repayment estimated as taking place on 12th of Never, so Bet365 have effectively kissed goodbye to £160m of it recently

Following sale of stadium etc future rental on properties will be about £4.7m a year…suspect the landlord might add those sums to the amount the club already owes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh