$MPL Long: a deep dive into this gem 🧵

In addition to the math checking out (50x upside), its a great example of

🔹Blockchain delivering a better product vs legacy solutions

🔹Product market fit: real business with real world use cases and real cash flow

@maplefinance /1

In addition to the math checking out (50x upside), its a great example of

🔹Blockchain delivering a better product vs legacy solutions

🔹Product market fit: real business with real world use cases and real cash flow

@maplefinance /1

Others have done good writeups on an overview of the business and how it works:

@fat_mac2, @0xScolio, @LoganJastremski, @PalmerBTIG, #Delphi_Digital, @BanklessHQ, @TheDefiant, @Blockworks_

I hope to build on that by overlaying a reformed TradFi analyst’s investor framework🧑💼/2

@fat_mac2, @0xScolio, @LoganJastremski, @PalmerBTIG, #Delphi_Digital, @BanklessHQ, @TheDefiant, @Blockworks_

I hope to build on that by overlaying a reformed TradFi analyst’s investor framework🧑💼/2

Investment Setup:

🔹$50/token x 5mm circulating shares = $250mm market cap

🔹Valuation = 25x run-rate revenue

🔹Revenue +75% Q/Q or >10x annualized pace

⬆️Upside: 2-3x near-term to $165, and 50x long-term potential to $2500+

🔻Downside: 50% to $23 /3

🔹$50/token x 5mm circulating shares = $250mm market cap

🔹Valuation = 25x run-rate revenue

🔹Revenue +75% Q/Q or >10x annualized pace

⬆️Upside: 2-3x near-term to $165, and 50x long-term potential to $2500+

🔻Downside: 50% to $23 /3

What is Maple and why should users care?

The key innovations here are credit underwriting and permissioned pools ✅

This solves two major barriers to growth in DeFi lending /4

The key innovations here are credit underwriting and permissioned pools ✅

This solves two major barriers to growth in DeFi lending /4

#1: DeFi lending today uses over-collateralization to solve for permissionless lending, but this is not capital efficient

$MPL de-anonymized underwriting creates CREDIT and allows for undercollateralized lending /5

$MPL de-anonymized underwriting creates CREDIT and allows for undercollateralized lending /5

#2: TradFi adoption of DeFi has been slow because of KYC/AML requirements

$MPL permissioned lending/borrowing pools help TradFi GCs and Risk depts get comfortable /6

$MPL permissioned lending/borrowing pools help TradFi GCs and Risk depts get comfortable /6

Why is this important?

$2tn TAM potential for undercollateralized lending

For comparison:

🔹Global corporate debt roughly = global equities at $135tn

🔹Crypto public market cap is $2tn

🔹Using that same ratio, crypto lending could be $2tn (and growing fast!) /7

$2tn TAM potential for undercollateralized lending

For comparison:

🔹Global corporate debt roughly = global equities at $135tn

🔹Crypto public market cap is $2tn

🔹Using that same ratio, crypto lending could be $2tn (and growing fast!) /7

Business Model: how does $MPL make money?

🔹1% origination fee, split 66bps to $MPL treasury and 33bps to underwriter

🔹In-line with TradFi unsecured originator take rates of 50-100bps (e.g. autos, mortgages)

🔹High-margin fee, no credit risk = high quality business /8

🔹1% origination fee, split 66bps to $MPL treasury and 33bps to underwriter

🔹In-line with TradFi unsecured originator take rates of 50-100bps (e.g. autos, mortgages)

🔹High-margin fee, no credit risk = high quality business /8

Investment Thesis: 3⃣ main points

(A) TAM is huge, SAM expanding with new products

🔹BTC-backed loans: BTC-holders are yield starved because there are few options, so this could be huge

🔹Solana chain launch /9

(A) TAM is huge, SAM expanding with new products

🔹BTC-backed loans: BTC-holders are yield starved because there are few options, so this could be huge

🔹Solana chain launch /9

🔹New borrower verticals – right now $MPL only serves crypto-native market makers. They were just at BTC Miami courting crypto miners. In the future, this could be any corporate (e.g. web2 SAAS?) /10

(B) Fundamentals are amazing and outperforming during the DeFi downturn

🔹1Q21 Originations +77% q/q – leading topline KPI

🔹1Q21 Revenue +77% q/q, or a >10x annualized pace

Summary financials below⬇️

/11

🔹1Q21 Originations +77% q/q – leading topline KPI

🔹1Q21 Revenue +77% q/q, or a >10x annualized pace

Summary financials below⬇️

/11

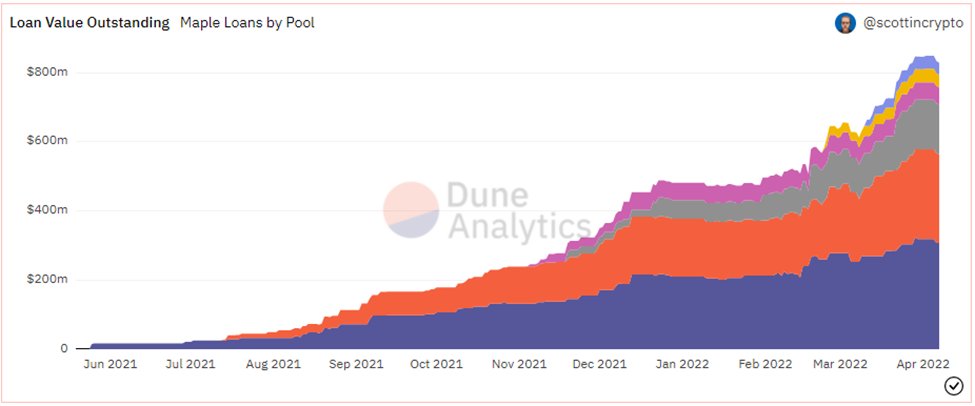

Although TBH all you need to know is this TVL chart

This is really the money shot @scottincrypto, @DuneAnalytics

/12

This is really the money shot @scottincrypto, @DuneAnalytics

/12

(C) Management has been impressive

🔹Delivering on promises: hit $1bn origination goal in <10mths

🔹Communication: community AMAs and Discord are quick and forthright

🔹Capital allocation: executed buybacks in Dec when $MPL was near lows

@syrupsid, @joe_defi, @qthomp /13

🔹Delivering on promises: hit $1bn origination goal in <10mths

🔹Communication: community AMAs and Discord are quick and forthright

🔹Capital allocation: executed buybacks in Dec when $MPL was near lows

@syrupsid, @joe_defi, @qthomp /13

PM question - why now? Four near-term catalysts:

(A) ETH pools just launched, and demand is enormous (recent 2000 wETH capacity consumed within <24hrs), even at not particularly high APYs

(B) BTC pools likely to be added soon (@maplefinance spotted at #BTCMiami) /14

(A) ETH pools just launched, and demand is enormous (recent 2000 wETH capacity consumed within <24hrs), even at not particularly high APYs

(B) BTC pools likely to be added soon (@maplefinance spotted at #BTCMiami) /14

(C) Solana chain launch this quarter, with an airdrop of $SYRUP

(D) MIP-008 just passed, new tokenomics that incorporates a regular buyback program

community.maple.finance/t/mip-008-toke… /15

(D) MIP-008 just passed, new tokenomics that incorporates a regular buyback program

community.maple.finance/t/mip-008-toke… /15

Earnings Power and Price Target - the brass tacks

🔹In 2022, mgmt’s goal is to hit $5bn originations. I think $6bn (+10x y/y).

🔹By 2023, I expect $34bn originations, $84mm revenue and $16mm POSITIVE earnings

🔹10x EV/Revenue or 50x P/E

➡️$164 PT or >200% upside /16

🔹In 2022, mgmt’s goal is to hit $5bn originations. I think $6bn (+10x y/y).

🔹By 2023, I expect $34bn originations, $84mm revenue and $16mm POSITIVE earnings

🔹10x EV/Revenue or 50x P/E

➡️$164 PT or >200% upside /16

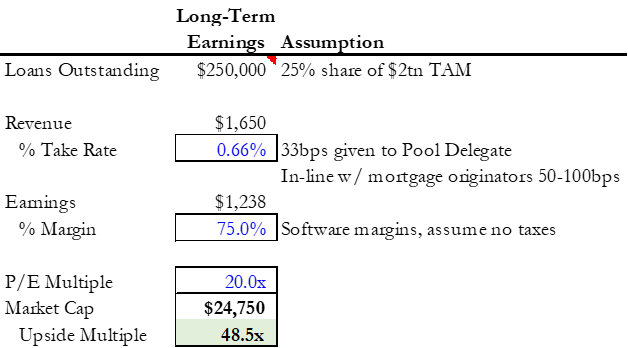

Long-term math = 50-100x upside 👀👀

🔹$2tn TAM x 25% share = $250bn loans

🔹$1.7bn revenue at 66bps take rate (current)

🔹$1.2bn earnings at 75% margin (software)

🔹$25bn Market Cap at 20x P/E (arguably too low?)

➡️50-100x upside depending on dilution

/17

🔹$2tn TAM x 25% share = $250bn loans

🔹$1.7bn revenue at 66bps take rate (current)

🔹$1.2bn earnings at 75% margin (software)

🔹$25bn Market Cap at 20x P/E (arguably too low?)

➡️50-100x upside depending on dilution

/17

Risks/concerns - I'll give 4⃣main ones

(A) Unit economics: lending demand currently being subsidized by $MPL emissions, such that unit economics are still backward (8% emissions incentive vs 66bps revenue). Bulls say growth tactic, bears say unsustainable. /18

(A) Unit economics: lending demand currently being subsidized by $MPL emissions, such that unit economics are still backward (8% emissions incentive vs 66bps revenue). Bulls say growth tactic, bears say unsustainable. /18

(B) Borrower demand may be limited outside of crypto-native market makers

(C) Credit risk – no defaults so far, so TBD how aggregate lender demand reacts if/when there is one. Note $MPL holders have no credit risk exposure (other than active stakers) /19

(C) Credit risk – no defaults so far, so TBD how aggregate lender demand reacts if/when there is one. Note $MPL holders have no credit risk exposure (other than active stakers) /19

(D) Competition: @truefi.io, @goldfinch_fi, DeFi to real world lenders (@centrifuge, @AAve, @MakerDAO), big crypto institutions (@Anchorage)

Nice landscape slide from @ClearChainCap below /20

Nice landscape slide from @ClearChainCap below /20

All comments / feedback are welcome! DMs open

I'm grateful to be here for the ride.

Kudos to the @maplefinance team and my many data sources:

@syrupsid, @joe_defi, @quinnmbarry, @qthomp

@DuneAnalytics, @DefiLlama, @tokenterminal, @scottincrypto, @Globalcoinrsrch

/21

I'm grateful to be here for the ride.

Kudos to the @maplefinance team and my many data sources:

@syrupsid, @joe_defi, @quinnmbarry, @qthomp

@DuneAnalytics, @DefiLlama, @tokenterminal, @scottincrypto, @Globalcoinrsrch

/21

• • •

Missing some Tweet in this thread? You can try to

force a refresh