1/ Peri-retirement in NHS & Pension Tax 🧵 + free tool- #doesntpaytostay

This is a *super* important thread. Sorry it's complicated, pls read ALL carefully & share/RT. Its vitally important you #knowYOURnumbers so @BMA_Pensions built a free tool to help - you could save >£100k

This is a *super* important thread. Sorry it's complicated, pls read ALL carefully & share/RT. Its vitally important you #knowYOURnumbers so @BMA_Pensions built a free tool to help - you could save >£100k

2/ @TheBMA @BMA_Pensions have been saying for years, that its crucially important we RETAIN the senior experienced workforce. There are a number of important levers to do this, including pay, pensions & pension taxation.

3/ As the annual & lifetime allowances have been whittled away over the years, the number of senior doctors opting for early retirement has increased as it simply #doesntpaytostay- particularly for those affected by BOTH the annual & lifetime allowances

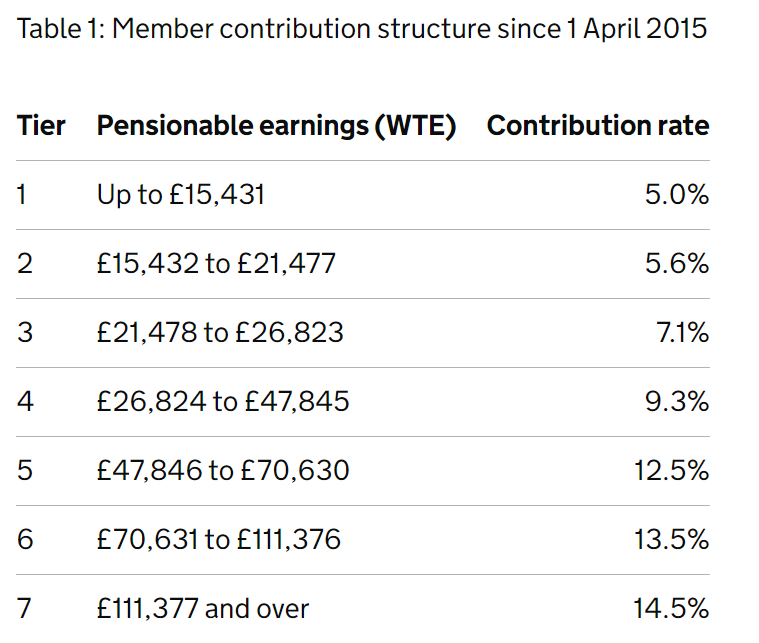

4/ As we have repeatedly pointed out to treasury & elsewhere in government, higher rate tax relief is removed *in its entirety* by unprecedented steep tiering not seen in ANY other public sector scheme

5/ This will remain the case when new contributions structures for @nhs_pensions are introduced in October 2022 - the NHS will continue to have the steepest tiering of all public sector schemes. That's completely unjustified in a CARE scheme and removes *all* higher rate relief

6/ Despite having removed all higher rate relief from tiering, this (non-existent) higher rate relief is then removed by the Annual Allowance (and tapering for higher earners) and again the (non-existent) relief is limited via the lifetime Allowance.

7/ The net result of that, as per @The_BMA modelling with our actuarial advisors, is high earners in the NHS scheme can end up paying up to 10x the amount towards the pension for each pound of pension. This is clearly completely unfair and completely unjustified.

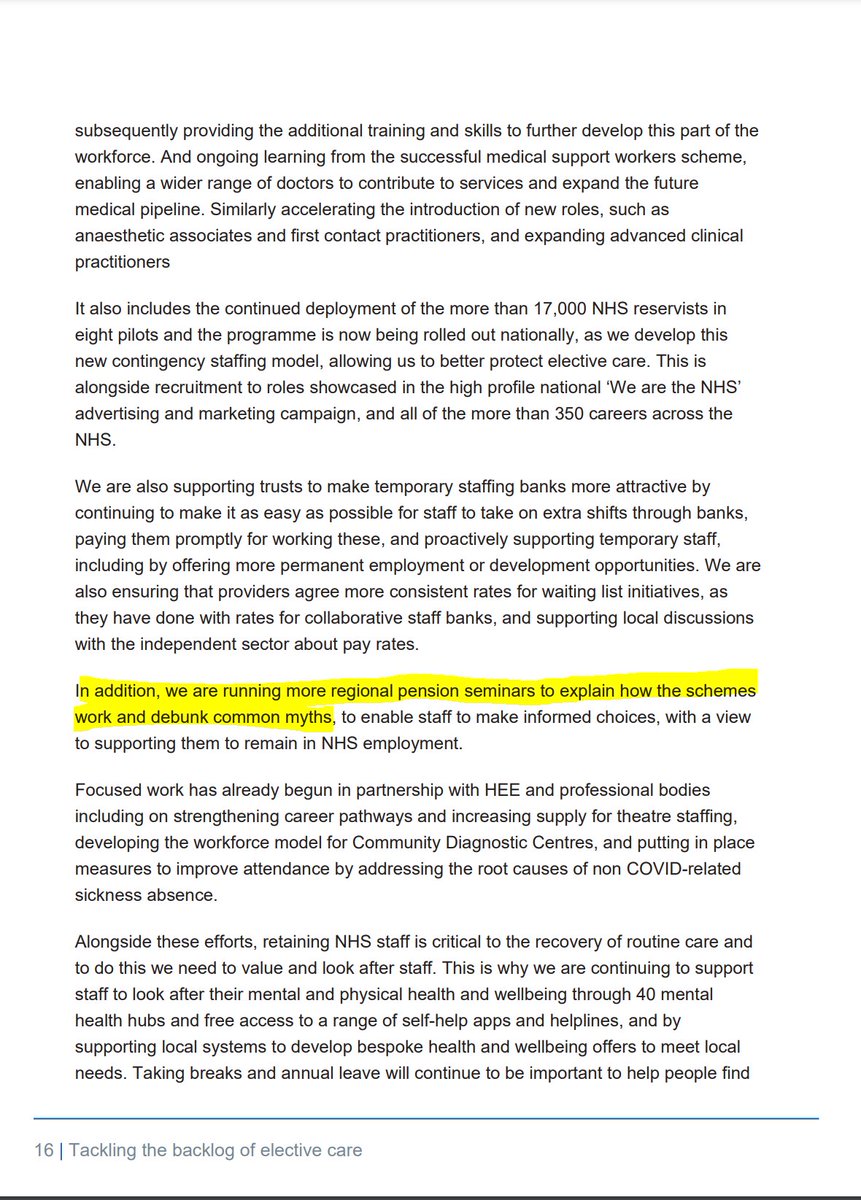

8/ The NHS is clearly in a difficult place. As the waiting list graphs above in tweet 2 show, it is somewhat disingenuous to call this "COVID-19" backlog. These problems have been building for years, & punitive pension taxation is the elephant in the room.

9/ Despite this, pensions get only a passing mention in the plans to resolve the backlog- the only stated plan to improve this situation "regional pension seminars to explain how the schemes

work and debunk common myths, to enable staff to make informed decisions"

work and debunk common myths, to enable staff to make informed decisions"

10/ At @The_BMA we agree it is vital our members make "informed decisions". So we have made a simple & free to use tool to allow 1995 officer members >59 to explore their options. We are grateful to @gdcuk for cross checking & agreeing the underlying maths.

11/ Sorry the tool is not for 2008 scheme members who have a later retirement age and can access 'late retirement factors' (and a more complicated pension that cant be accomodated in a simple ready reckoner), nor GPs who have a 1995 CARE pension.

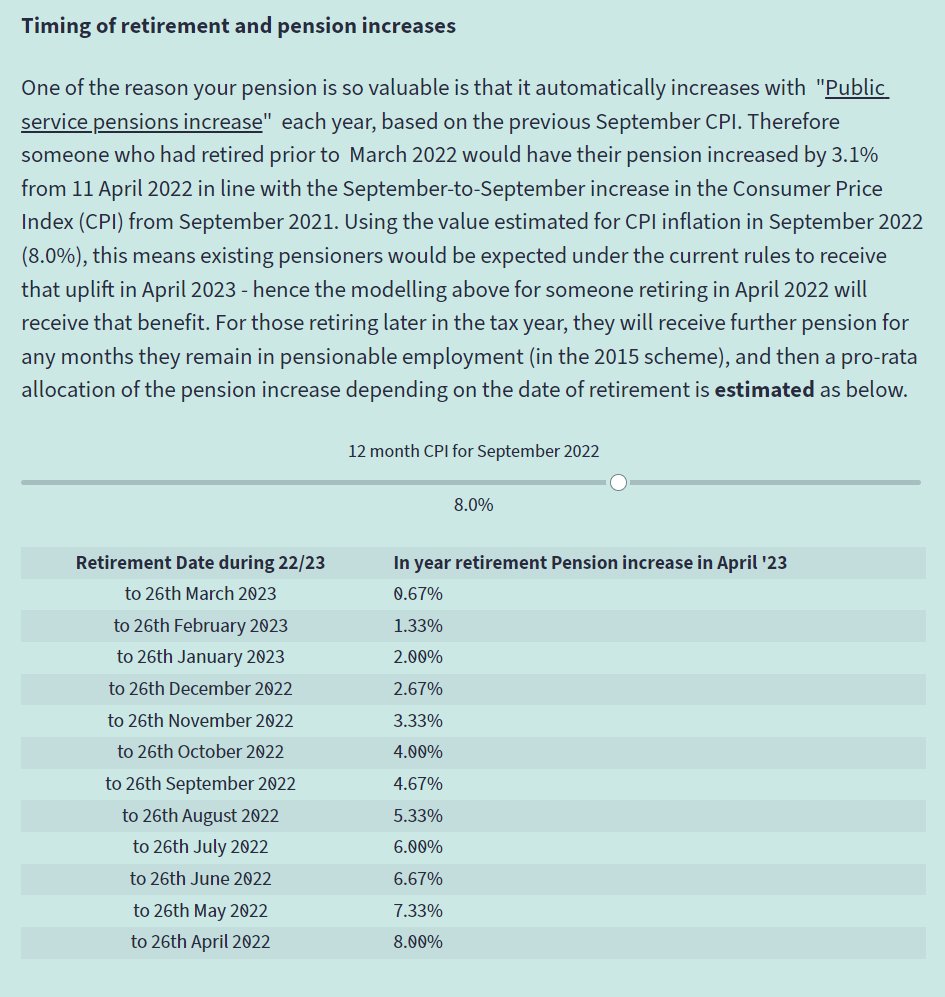

12/ The tool has two "case studies" - one is the same as case study used recently by NHSEI & another (shown below) - who is a 60 year old consultant at the top of the payscale with CEA7 & 5% on call.

13/ By default the tool shows retirement in April '22 versus delaying retirement to April '23. We have suggested figures for inflation in September (8%), and the current proposed pay award recommended by DHSC (2%). You can model your own predictions.

14/ This risks an unprecedented pay cut not only to pay, but also final salary pension - & therefore each month that is worked in 22/23 potentially "bakes in" any pay cut to final salary (& your pension).

15/ Conversely the date of your retirement in 22/23 is based on your date of retirement, and the prevailing rate of inflation in September of each year - estimated as follows based on what September CPI will be (again you can choose your own estimates).

16/ So what does it mean for our example consultant? They could retire now and achieve a pension (after LTA reduction) of £60,196. After uprating by September 2022 CPI that would be £65,011 in April 2023.

17/ Or by delaying retirement by 1 year they would get extra pension in the new 2015 scheme which would need reduction as retiring before state pension age, but by baking in a subinflatonary pay award, pension in April 2023 will be £62,843

18/ So the effect of delaying retiremenent has resulted in a pension LOWER by £2,168 - every of year of their retirement. This doesn't include the £60,196 you have given up in pension by not retiring age 60 .

19/ That example also doesnt include any potential AA liability- if you want to see potential AA charges you can provide carry forward/ threshold income to see what effect that has - so in the example below the consultant would also get a £9.8k charge!

20/ So this example consultant would need to pay another £20k in pension contributions, plus an AA charge, all to receive a LOWER pension. For them it clearly #doesntpaytostay - but its important to look at your own numbers.

bma.org.uk/doesntpaytostay

bma.org.uk/doesntpaytostay

21/ Many senior clinicians will still have a lot to give and may wish to stay in the service with "Retire & Return" - we have included a net pay modeller to estimate net pay & pension if you return - in this example they get comparable net pay at 6.5 PAs but #knowyournumbers

22/ Clearly the numbers in the tool may shock many people. This year is unusual due to high inflation (and potentiual therefore for an unprecedented pay cut which is driving this modelling based on the DHSC pay recommendation).

23/ But high inflation will also cause havoc with Annual Allowance (due to disconnect between inflation years used in AA and revaluation) & other factors which we have been warning government like the scheme design (lack of "late retirement factors").

24/ So what do @TheBMA think the govmnt needs to do if they want to really improve retention & encourage people to stay beyond 60. Lots of people will get 7 more years in 1995 thanks to McCloud which will focus minds. Govmnt need to act **NOW**.

25/ 1️⃣ FIX PENSION TAX. For high earners, particularly those affected by both the LIFETIME ALLOWANCE and ANNUAL ALLOWANCE, this SERIOUSLY reduces the value of building up additional pension when over both of these limits.

26/ The Lifetime Allowance was frozen in 2021 (it previously kept up with inflation). With high inflation, the LTA is becoming seriously eroded over time.

27/ Government knew this was a problem for judges, who had similar recruitment / retention issues to doctors- and they fixed it with a tax unregistered scheme.

They could do the same for doctors / other high earners in the scheme.

They could do the same for doctors / other high earners in the scheme.

28/ It’s completely fair to taxpayers as well - you wouldn’t get tax relief on contributions, but then pension earned in that scheme is not tested against the Annual or Life Time Allowances.

29/ Once a member of staff moved over to the “tax unregistered” scheme they could carry on working as many hours as they wish, for as long as they wish, without worrying about falling foul of complex pension taxation rules.

30/ With record waiting lists, the only way to make a dent in the short and medium time is to improve retention - this could make a serious difference to that.

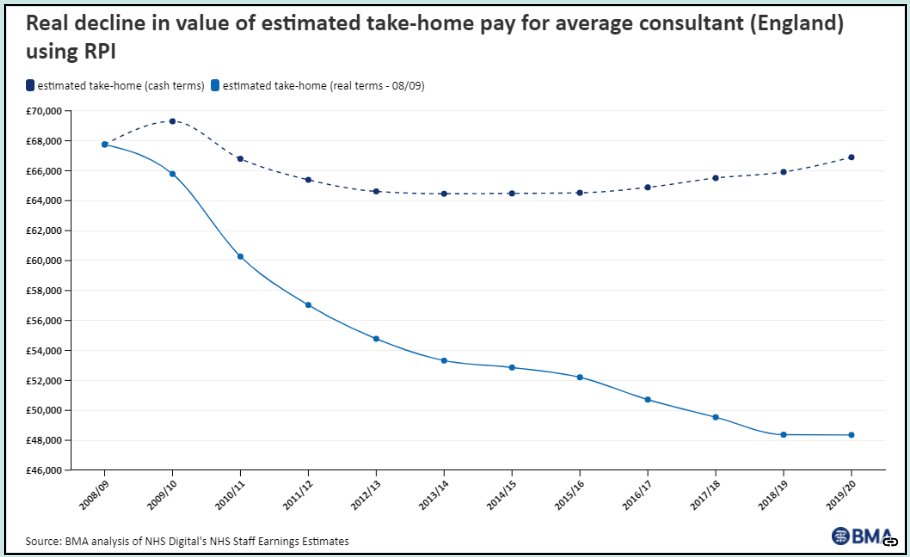

31/ 2️⃣ FIX PAY- your final salary pension (consultants not GPs) is linked to your pay. In real terms, your pay has gone down circa 30% in a decade. The longer you wait till retirement, you risk further sub-inflationary pay cuts being baked into your pension.

32/ With inflation running higher than expected this year, there’s a risk of a record breaking sub-inflationary pay award - and the pay recommendations from DHSC do not make good reading that this will be fixed anytime soon.

33/ 3️⃣ FIX PENSIONS. There's a serious anomaly in the 1995 section. You have been paying into the pension assuming you draw pension at 60. If you don't retire at 60, under current rules you are BURNING pension.

34/ Yes the final salary link remains, but you should get an ACTUARIALLY INCREASED pension if you retire later. Thats the exact opposite of the 4-5% year reduction you get by going early. Not only is this fair, it is exactly what happens in the 2008 and 2015 sections👇.

36/ There you have it @sajidjavid @RishiSunak @Jeremy_Hunt. If you haven't already, please read this entire thread carefully. We believe there is an existential threat to the NHS. But this is all fixable, by government. @NHSMillion

37/ To summarise #saveournhs

1️⃣ FIX PENSION TAX - like you have for judges

2️⃣ FIX PAY - down 30% in a decade - with high inflation biggest risk ever to pay & pensions

3️⃣ FIX PENSIONS - late retirement factors

1️⃣ FIX PENSION TAX - like you have for judges

2️⃣ FIX PAY - down 30% in a decade - with high inflation biggest risk ever to pay & pensions

3️⃣ FIX PENSIONS - late retirement factors

38/ If govmnt really want to fix retention (& they *really* need to), they must resolve these issues. If it #doesntpaytostay people will leave. Make sure you #knowyournumbers

Please share widely / RT / Quote RT

Please share widely / RT / Quote RT

• • •

Missing some Tweet in this thread? You can try to

force a refresh