My thoughts on the state of the Andromeda ecosystem and why I believe its best days lie ahead. Big ol' TLDR 🧵1/25 (DW, there are memes)

@MetisDAO @MetisNews247 @PeakFinance_DAO

@MetisDAO @MetisNews247 @PeakFinance_DAO

2/ The Andromeda experienced 5 days of tremendous growth in TVL, around $243,690,704 USD according to l2beat.com. It is no secret it has since been in decline.

3/ Since then, we have seen a tapering off of TVL across the ecosystem. This was in part due to the depreciation of $METIS in value as more degen overnight forks capitulated across the ecosystem.

4/ What you're witnessing, in case this is your first time, is a liquidity locust event. Reminiscent of April 2020 on #BSC where 2 new Pancakeswap forks would appear daily. Was fun for awhile.

Until liquidity locusts moved on to the next high APY opportunity.

Until liquidity locusts moved on to the next high APY opportunity.

5/ This was an important lesson for $BSC. Specifically, large sums of capital will capture significant share of emissions from new protocols and dump on participants with smaller stakes. Making 10% out of $100,000 in capital is more profound than making $100 from a $1000 deposit.

6/ In a very short period of time, TVL lost their appetite for overnight fork jobs, the model lost its flavour and failed to demonstrate sustainability.

8/ Now, has Andromeda played a role in facilitating these types of event?

Undoubtedly yes.

But here's what we need to understand. Networks require balance in and out-flows of liquidity to be profitable and sustainable.

Undoubtedly yes.

But here's what we need to understand. Networks require balance in and out-flows of liquidity to be profitable and sustainable.

9/ It is in @MetisDAO's interest to incentive liquidity for those that believe in the $METIS token and the underlying network.

Further, if you believe in decentralization and permissionless networks where anyone can launch a project, you accept it comes with the territory.

Further, if you believe in decentralization and permissionless networks where anyone can launch a project, you accept it comes with the territory.

10/ There are rugs. Many many rugs.

On the base level what is happening is people are chasing APRs and high-yields. The high % return evokes emotions that prompt you to ignore key considerations, such as:

On the base level what is happening is people are chasing APRs and high-yields. The high % return evokes emotions that prompt you to ignore key considerations, such as:

11/

- Is the team doxed? If not, why stand by their product if they wont?

- Is there are reason to hold what Im farming beyond speculation?

- What are the current or intended use cases?

- Does team have the means to pull it off?

- What is the time horizon for this investment?

- Is the team doxed? If not, why stand by their product if they wont?

- Is there are reason to hold what Im farming beyond speculation?

- What are the current or intended use cases?

- Does team have the means to pull it off?

- What is the time horizon for this investment?

12/ The level of engagement in Andromeda communities has mostly deteriorated as people shift focus from fundamentals to chasing high APYs. So allow me to remind you why we're all here in Andromeda:

13/

- It will be the first truly decentralized L2

- IPFS storage unlocks more complex offerings and functions

- DACs will be a gamechanger at all levels of human organization

- The use case for businesses is strong. While we speculate on APRs, businesses are leveraging the tech

- It will be the first truly decentralized L2

- IPFS storage unlocks more complex offerings and functions

- DACs will be a gamechanger at all levels of human organization

- The use case for businesses is strong. While we speculate on APRs, businesses are leveraging the tech

14/

- EVM equivalence makes METIS agile cross-chain.

- It is backed by @Natalia_Ameline and @ElenaCryptoChic. These women are absolute titans in crypto. Decades of experience that breaks down barriers to entry.

It's in noone's interest that Andromeda be just for the crypto-bros

- EVM equivalence makes METIS agile cross-chain.

- It is backed by @Natalia_Ameline and @ElenaCryptoChic. These women are absolute titans in crypto. Decades of experience that breaks down barriers to entry.

It's in noone's interest that Andromeda be just for the crypto-bros

15/ So let's look at the lessons of other chains to give us an idea of what's happening here, let's consider the state of some chains following liquidity locust events:

16/

- No one on #BSC can hold a candle to @PancakeSwap for a DEX or @VenusProtocol for borrowing/lending.

- Niches emerge, @OfficialTCGCoin will dominate P2E on #BSC

- @SpookySwap $ @tombfinance can't be touched on $FTM

- @traderjoe_xyz & @AaveAave lead $AVAX @avalancheavax

- No one on #BSC can hold a candle to @PancakeSwap for a DEX or @VenusProtocol for borrowing/lending.

- Niches emerge, @OfficialTCGCoin will dominate P2E on #BSC

- @SpookySwap $ @tombfinance can't be touched on $FTM

- @traderjoe_xyz & @AaveAave lead $AVAX @avalancheavax

17/ The price of a network token often highly correlates with the total TVL on the network.

The value of TVL on #Andromeda is 1.37 the value of $METIS.

Network value for $ETH x 3.2. $BNB x 5.24. $FTM x 0.53. $AVAX x 2.1.

The value of TVL on #Andromeda is 1.37 the value of $METIS.

Network value for $ETH x 3.2. $BNB x 5.24. $FTM x 0.53. $AVAX x 2.1.

18/ There are still a bunch of reasons to buy $METIS with @AaveAave @chainlink @graphprotocol coming into the fray. They historically bring a lot of TVL into ecosystems they migrate to. Check $FTM MCAP @FantomFDN TVL around @AaveAave launch.

19/ Why was @AaveAave significant?

Well, remember how we said 10% is worth a lot more to someone with $100k than someone farming $1000 USD that expects the moon.

$AAVE community are generally whales with sophisticated approaches to obtaining yield. They understand sustainability.

Well, remember how we said 10% is worth a lot more to someone with $100k than someone farming $1000 USD that expects the moon.

$AAVE community are generally whales with sophisticated approaches to obtaining yield. They understand sustainability.

20/ SO now we've witnessed the same liquidity locust play out on Andromeda there are key questions to ask yourself:

- Have @MetisDAO learnt lessons from this? I can confirm they have and have changed the manner they endorse projects.

- Have @MetisDAO learnt lessons from this? I can confirm they have and have changed the manner they endorse projects.

21/ - Will the project I'm invested in now play a role in the future? Will @MaiaDAOMetis Hermes, @tethysfinance, and @netswapofficial come out on top? Or will @HeraAggregator takethem all along for the ride?

- Will @starstreamfin overcome @beefyfinance's Andromeda integration?

- Will @starstreamfin overcome @beefyfinance's Andromeda integration?

22/

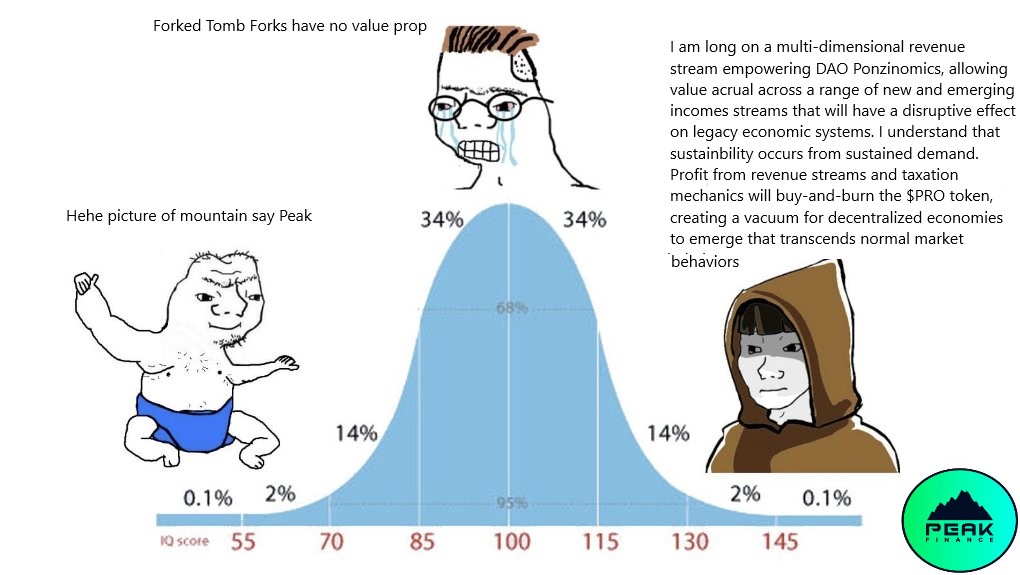

- Full disclosure, I am Cofounder @PeakFinance_DAO so I'm openly biased.

But if you believe $METIS will rise, would it not be better to park into novel investment vehicles like $PEAK, effectively purchasing $METIS at a discount?

Recognize the opportunity in fear.

- Full disclosure, I am Cofounder @PeakFinance_DAO so I'm openly biased.

But if you believe $METIS will rise, would it not be better to park into novel investment vehicles like $PEAK, effectively purchasing $METIS at a discount?

Recognize the opportunity in fear.

23/

- Further, is there utility beyond what you see in front of you? Is it a dead-end fork, or do they have utility in the works?

- Is there a reason beyond speculation to purchase the token? I.e. I need $METIS for gas fees, I don't buy low to sell high in this instance.

- Further, is there utility beyond what you see in front of you? Is it a dead-end fork, or do they have utility in the works?

- Is there a reason beyond speculation to purchase the token? I.e. I need $METIS for gas fees, I don't buy low to sell high in this instance.

24/ - Is the project still trying to tap into some innate instinct with high APRs to exploit one's propensity for greed? Or is there long-term potential?

- Does the project actually care about my views? Do I have a meaningful voice?

- How do they respond to challenges?

- Does the project actually care about my views? Do I have a meaningful voice?

- How do they respond to challenges?

25/ These are the lessons investors learn on alternate chains and TVL naturally gravitates toward the most disruptive and viable products.

For this reason I believe there are better days ahead for $METIS.

Adversity leads to resilience if handled the right way.

WAGMI Metisians.

For this reason I believe there are better days ahead for $METIS.

Adversity leads to resilience if handled the right way.

WAGMI Metisians.

• • •

Missing some Tweet in this thread? You can try to

force a refresh