Understand Options’ Gamma -

“A tool that assists to measure an option’s momentum”

A detailed thread 🧵

#Options #Greeks

“A tool that assists to measure an option’s momentum”

A detailed thread 🧵

#Options #Greeks

After reading this thread you will know:

Delta – Gamma Relationship

Gamma Concept

Gamma Measurement

Practical Examples

Delta – Gamma Relationship

Gamma Concept

Gamma Measurement

Practical Examples

1/ DELTA & GAMMA RELATIONSHIP

Gamma is one of the four Greeks that primarily influence an option’s price. From our previous post on Delta, we learned that Delta determines the change in the price of an option w.r.t change in underlying stock or index.

Gamma is one of the four Greeks that primarily influence an option’s price. From our previous post on Delta, we learned that Delta determines the change in the price of an option w.r.t change in underlying stock or index.

Therefore, Delta is crucial to determine the price of an option.

(Delta post)

(Delta post)

https://twitter.com/finkarmaIN/status/1511699650083840012?s=20&t=5dvwImdlQMkuvl6woTuWRQ

In other words, Delta measures the speed with which the price of an option changes in relation to the underlying.

Gamma is a tool that measures the rate of change of that speed over time. Don’t worry you will get it as we proceed further

Gamma is a tool that measures the rate of change of that speed over time. Don’t worry you will get it as we proceed further

It is also a fact that Delta is not a constant. It varies as the price of the underlying moves up and down

Ex. Say Nifty is at 17560 and the OTM strike 17600CE @ 42 is having a Delta of 0.4 This data says that with every 1 point move in Nifty the 17600CE will move by 0.4 points

Ex. Say Nifty is at 17560 and the OTM strike 17600CE @ 42 is having a Delta of 0.4 This data says that with every 1 point move in Nifty the 17600CE will move by 0.4 points

But what will be the option’s price if Nifty moves to 17660?

Will it be Rs42 + (17660-17560) x 0.4 =82?

If your answer is yes then you need to think again…

Will it be Rs42 + (17660-17560) x 0.4 =82?

If your answer is yes then you need to think again…

As the index moves from 17560 to 17660, the 17600CE will become ITM and its Delta will be higher than 0.4 (we will cover this in this thread)

Here comes a question. How much will be the value of Delta, and how to find it?

This is where Gamma comes into play.

Here comes a question. How much will be the value of Delta, and how to find it?

This is where Gamma comes into play.

2/ GAMMA

Gamma measures the rate of change of Delta over certain price movements.

Thereby, helping option traders to predict an option price in the coming future.

Gamma measures the rate of change of Delta over certain price movements.

Thereby, helping option traders to predict an option price in the coming future.

The formula to measure Gamma is:

Gamma = (D1 – D2) / (P1-P2)

Where D1 is the Delta at price P1 and D2 is the Delta at price P2

Gamma = (D1 – D2) / (P1-P2)

Where D1 is the Delta at price P1 and D2 is the Delta at price P2

Ex. If Delta (D1) of 17700CE at spot 17600 is 0.20 and

Delta (D2) of 17700CE at spot 17700 is 0.50 then

Gamma = (0.2 – 0.5) / (17600 – 17700)

Gamma = 0.3 / 100 = 0.003

Delta (D2) of 17700CE at spot 17700 is 0.50 then

Gamma = (0.2 – 0.5) / (17600 – 17700)

Gamma = 0.3 / 100 = 0.003

The value 0.003 here means that Delta will move by 0.003 points with every 1 point move in the spot price.

Gamma is a constant. This means, its value does not change w.r.t the underlying.

But its value would be different for different strike options and stays between 0 to1

Gamma is a constant. This means, its value does not change w.r.t the underlying.

But its value would be different for different strike options and stays between 0 to1

3/ GAMMA DISTRIBUTION ACROSS STRIKES

The value of Gamma would be the highest for ATM options. Its value would be minimal for deep ITM and OTM options

The value of Gamma would be the highest for ATM options. Its value would be minimal for deep ITM and OTM options

You can observe from the above table that Gamma is 0.0027 for ATM 17550CE whereas 0.0013 for OTM 17750CE.

Also, it is 0.0025 for ATM 17550PE and 0.0013 for ITM 17750PE

Also, it is 0.0025 for ATM 17550PE and 0.0013 for ITM 17750PE

If you have some confusion regarding strikes then read option basics in the following thread:

https://twitter.com/finkarmaIN/status/1513149529016569858?s=20&t=fOTCYqNDvxSdnHEk8RJkTw

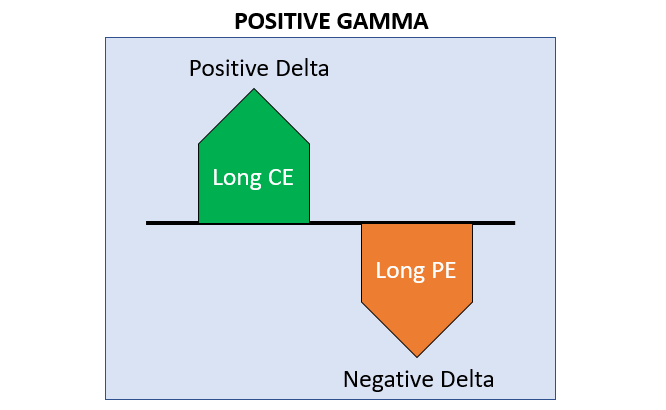

4/ POSITIVE AND NEGATIVE GAMMA

Long positions in CE or PE is said to have positive Gamma, whereas it is considered as negative for a short position in options

Long positions in CE or PE is said to have positive Gamma, whereas it is considered as negative for a short position in options

The following picture represents a positive Gamma scenario.

A long CE with positive Delta and a long PE with negative Delta, both have positive Gamma

A long CE with positive Delta and a long PE with negative Delta, both have positive Gamma

The delta of CE will become more positive (increase in value) as the stock goes higher.

Also, the delta of PE will become more negative (due to an increase in value) as the stock goes down. But Gamma still remains positive.

Also, the delta of PE will become more negative (due to an increase in value) as the stock goes down. But Gamma still remains positive.

5/ HIGH IS NOT ALWAYS GOOD

Our brains have been so tuned since childhood that it perceives ‘more’ as ‘better’. Unfortunately, this is not the case with Gamma.

A high Gamma means wide swings in the option w.r.t change in the underlying.

Our brains have been so tuned since childhood that it perceives ‘more’ as ‘better’. Unfortunately, this is not the case with Gamma.

A high Gamma means wide swings in the option w.r.t change in the underlying.

If the swings are wide, predicting favorable risk-reward opportunities would become difficult for traders

High Gamma means less stability to an option and hence less chances for it to expire ITM

High Gamma means less stability to an option and hence less chances for it to expire ITM

Gamma moves towards zero and Delta moves towards 1 as an option goes deep ITM

Gamma also moves towards zero for deep OTM options as Delta undergoes minimal change with stock price

Gamma would be highest on ATM options

Gamma also moves towards zero for deep OTM options as Delta undergoes minimal change with stock price

Gamma would be highest on ATM options

6/ ILLUSTRATIVE EXAMPLES

Let us understand the movement of an option price; change in Delta, and the role played by Gamma with the help of examples

Let us say that Nifty spot is at 17560 (P1)

OTM 17600CE is @ Premium = Rs42 with

Delta (D1) = 0.4 and

Gamma (G) = 0.0026

Let us understand the movement of an option price; change in Delta, and the role played by Gamma with the help of examples

Let us say that Nifty spot is at 17560 (P1)

OTM 17600CE is @ Premium = Rs42 with

Delta (D1) = 0.4 and

Gamma (G) = 0.0026

Now spot moves to 17600 (P2)

Change in price = P2 – P1 = 17600 – 17560 = 40pts

Change in Premium = D1 x Change in price = 0.4 x 40 = 16 pts

Change in price = P2 – P1 = 17600 – 17560 = 40pts

Change in Premium = D1 x Change in price = 0.4 x 40 = 16 pts

New premium = Old Premium + change in premium = 42 + 16 =58

Change in Delta = G x change in price = 0.0026 x 40 = 0.1

New Delta (D2) = 0.4 + 0.1 = 0.5

Change in Delta = G x change in price = 0.0026 x 40 = 0.1

New Delta (D2) = 0.4 + 0.1 = 0.5

You can notice that as the spot price moves to 17600 our 17600CE becomes ATM and Delta increases to 0.5..perfect!

Now spot moves to 17660 (P3)

Change in price = P3 – P2 = 17660 – 17600 = 60pts

Change in Premium = D2 x Change in price = 0.5 x 60 = 30 pts

Change in price = P3 – P2 = 17660 – 17600 = 60pts

Change in Premium = D2 x Change in price = 0.5 x 60 = 30 pts

New premium = Old Premium + change in premium = 58 + 30 = 88

Change in Delta = G x change in price = 0.0026 x 60 = 0.156

New Delta (D2) = 0.5 + 0.156 = 0.656

At this point, our call option is ITM and Delta is more than 0.5 and approaching 1 as the spot is getting higher.

Change in Delta = G x change in price = 0.0026 x 60 = 0.156

New Delta (D2) = 0.5 + 0.156 = 0.656

At this point, our call option is ITM and Delta is more than 0.5 and approaching 1 as the spot is getting higher.

7/ Now go back to the example in section 1 and compare it with the above example.

In that example, we ignored the variable ‘Change in Delta’. But when we took that variable into account, we get a more accurate price measurement

In that example, we ignored the variable ‘Change in Delta’. But when we took that variable into account, we get a more accurate price measurement

8/ It needs to be mentioned here that the values calculated above are only approximate.

This is because we are measuring the change in Delta against 50 pts move in spot, whereas there will be small changes in Delta with every 1 point move in spot, thus effecting premium

This is because we are measuring the change in Delta against 50 pts move in spot, whereas there will be small changes in Delta with every 1 point move in spot, thus effecting premium

9/ We did this on purpose to make our examples more simple, clear, and easy to understand.

The purpose of this thread was to present option Greeks in a simplified format and we hope we were able to serve that purpose.

The purpose of this thread was to present option Greeks in a simplified format and we hope we were able to serve that purpose.

10/ Fortunately, you won't have to do the above calculations for finding Delta or Gamma.

These days many option geek softwares are available for that purpose, which can accurately print the values of Delta, Gamma, Theta, Implied Volatility against any strike in the live market

These days many option geek softwares are available for that purpose, which can accurately print the values of Delta, Gamma, Theta, Implied Volatility against any strike in the live market

We will cover simplified option strategies in our coming posts

Do share and like this thread with your friends

Follow us @FinkarmaIN and stay tuned for more useful threads in the coming days.

Thanks for reading

Do share and like this thread with your friends

Follow us @FinkarmaIN and stay tuned for more useful threads in the coming days.

Thanks for reading

• • •

Missing some Tweet in this thread? You can try to

force a refresh