Passive Income Protocols (PIPs) will soon be transitioning to the szn 2.

Not a prediction, but a fact.

Which projects will lead the new szn?

🧵👇

Not a prediction, but a fact.

Which projects will lead the new szn?

🧵👇

First, for those who are unsure about what PIPs are.

These protocols are centered around the idea of generating DeFi passive income. You invest once, and you earn perpetual passive rewards.

Examples are #NaaS #DaaS #Autostaking

These protocols are centered around the idea of generating DeFi passive income. You invest once, and you earn perpetual passive rewards.

Examples are #NaaS #DaaS #Autostaking

What is szn 1?

Considering szn 1 being where this space started to gain exposure from the mass, many projects skyrocketed, and many investors achieved financial freedom.

This has worked quite well for early investors, but not so lucky with the later joiners.

Considering szn 1 being where this space started to gain exposure from the mass, many projects skyrocketed, and many investors achieved financial freedom.

This has worked quite well for early investors, but not so lucky with the later joiners.

Ponzi, rugs, forks, unsustainability, and lack of utilities have all become the themes marking the end of szn 1.

What we need is a szn 2 to solve all these issues.

Note that the concept of DeFi passive income is great, the sector itself will stay and explore more possibilities

What we need is a szn 2 to solve all these issues.

Note that the concept of DeFi passive income is great, the sector itself will stay and explore more possibilities

What will szn 2 look like?

Since we have been quite educated and sensitive about sustainability and utilities these days, szn 2 protocols will focus less on forking the old models.

Instead, they will seek external income to reward the investors, not by paying themselves.

Since we have been quite educated and sensitive about sustainability and utilities these days, szn 2 protocols will focus less on forking the old models.

Instead, they will seek external income to reward the investors, not by paying themselves.

Common things you will see in szn 2:

- Less crazy high APYs

- Less tweaking on taxes, fees, node upgrade system

- More innovations

- More treasury investment

- More pro farmers in the project

- More new products get developed, e.g. side chains, new farms, new incubated projects

- Less crazy high APYs

- Less tweaking on taxes, fees, node upgrade system

- More innovations

- More treasury investment

- More pro farmers in the project

- More new products get developed, e.g. side chains, new farms, new incubated projects

Who are the potential big players that should be on your radar?

Below I handpicked a few:

$WAND

$SPHERE

$DEFO

$HNY

$COMB

$PHI

$HUNT

Do comment below on what other projects you think will win the szn 2.

Below I handpicked a few:

$WAND

$SPHERE

$DEFO

$HNY

$COMB

$PHI

$HUNT

Do comment below on what other projects you think will win the szn 2.

1/ $WAND @WANDinvestments

It's an innovative protocol with well-designed tokenomics. It could start a $WAND szn itself tbh.

Key features:

- Multi tokens

- The ever-growing token price

- Protocol owned liquidity & exchange

Epic thread by @economiserly:

It's an innovative protocol with well-designed tokenomics. It could start a $WAND szn itself tbh.

Key features:

- Multi tokens

- The ever-growing token price

- Protocol owned liquidity & exchange

Epic thread by @economiserly:

https://twitter.com/economiserly/status/1508482096771350540

2/ $SPHERE @SphereDeFi

$SPHERE is not a fork. It borrows the rebase and autostaking ideas and has moved far beyond since the start.

Key features:

- Governance token acquisition

- QLaaS

Epic thread by @cryptonaut101 on QLaaS:

$SPHERE is not a fork. It borrows the rebase and autostaking ideas and has moved far beyond since the start.

Key features:

- Governance token acquisition

- QLaaS

Epic thread by @cryptonaut101 on QLaaS:

https://twitter.com/cryptonaut101/status/1513467045819518976

3/ $DEFO @defo_app

If you learned about the node sustainability issues, likely you heard it from @DazaiCrypto. He founded this new project with sustainability in mind.

Key features:

- Sustainable rewards

- Dual tokens

- Ecosystem

Epic thread by him:

If you learned about the node sustainability issues, likely you heard it from @DazaiCrypto. He founded this new project with sustainability in mind.

Key features:

- Sustainable rewards

- Dual tokens

- Ecosystem

Epic thread by him:

https://twitter.com/DazaiCrypto/status/1511646296599240711

3/ $HNY @hiveinvestments

They are Aussies 😉.

It's an existing node project with a strong focus on utilities, investments, incubations, education, etc.

The most recent plan for a new NFT marketplace is bullish.

Epic thread by @VirtualKenji

They are Aussies 😉.

It's an existing node project with a strong focus on utilities, investments, incubations, education, etc.

The most recent plan for a new NFT marketplace is bullish.

Epic thread by @VirtualKenji

https://twitter.com/VirtualKenji/status/1513862311408152579

4/ $COMB @combfinancial

They started from DaaS/NaaS, then pivoted to creating their own farms for sustainability, and now introducing Podz which does liquidity mining and returns the rewards in $FTM, $ETH & $BTC.

Epic thread by @sweetheater on Podz

They started from DaaS/NaaS, then pivoted to creating their own farms for sustainability, and now introducing Podz which does liquidity mining and returns the rewards in $FTM, $ETH & $BTC.

Epic thread by @sweetheater on Podz

https://twitter.com/sweetheater/status/1513189973914054660

5/ $PHI @Prometheus_DEFI

This is a quite undervalued node project imo. Strong focus on sustainability, innovative features, and treasury investment.

They are planning to transition to a pure FaaS/IaaS model and may pay back in stables as the reward.

I'll write a thread soon

This is a quite undervalued node project imo. Strong focus on sustainability, innovative features, and treasury investment.

They are planning to transition to a pure FaaS/IaaS model and may pay back in stables as the reward.

I'll write a thread soon

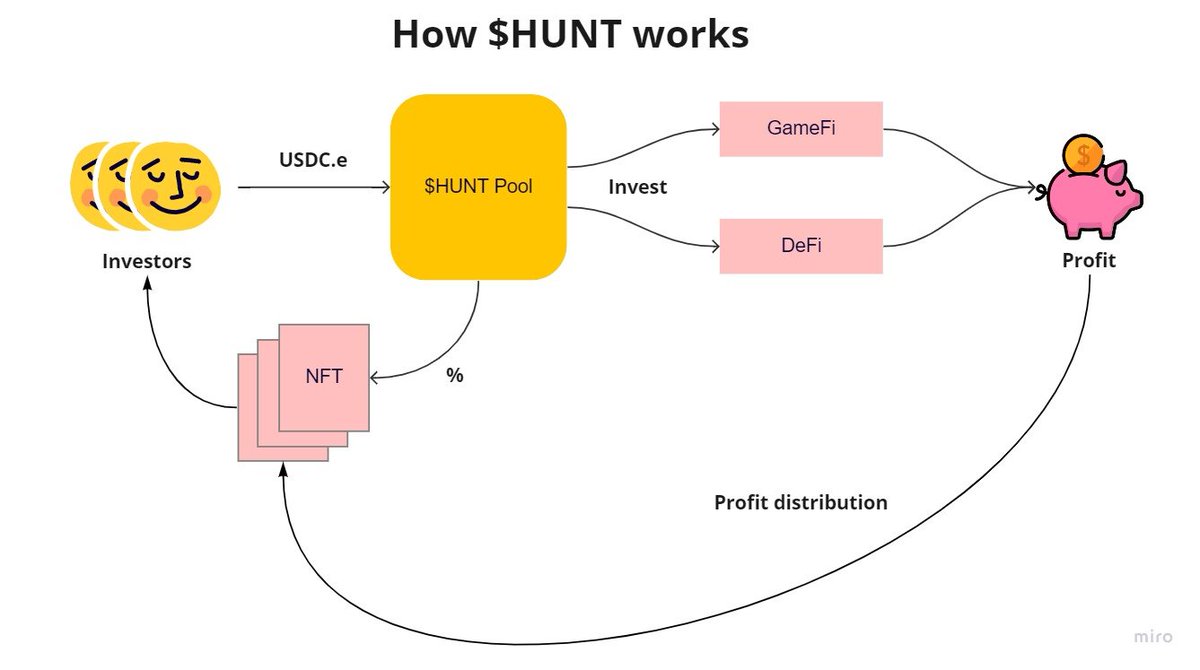

6/ $HUNT @cchaincap

Hunt protocol is the first yield-bearing NFT project in this sector. I do like the fact they got rid of the native token entirely.

The pic shows how it works.

They currently invest in P2E and will cover DeFi in the future.

Thread:

Hunt protocol is the first yield-bearing NFT project in this sector. I do like the fact they got rid of the native token entirely.

The pic shows how it works.

They currently invest in P2E and will cover DeFi in the future.

Thread:

https://twitter.com/melbourne_dao/status/1493048073052094464

• • •

Missing some Tweet in this thread? You can try to

force a refresh