What is @AstarNetwork $ASTR, and how have they rapidly grown their TVL to almost 1 billion dollars only a few months after launching?

Let get into it🧵👇

1/16

Let get into it🧵👇

1/16

Astar Network is a scalable and interoperable Layer 1, aiming to become the premier Dapp hub on #PolkaDot.

How do they plan on doing this?

2/16

How do they plan on doing this?

2/16

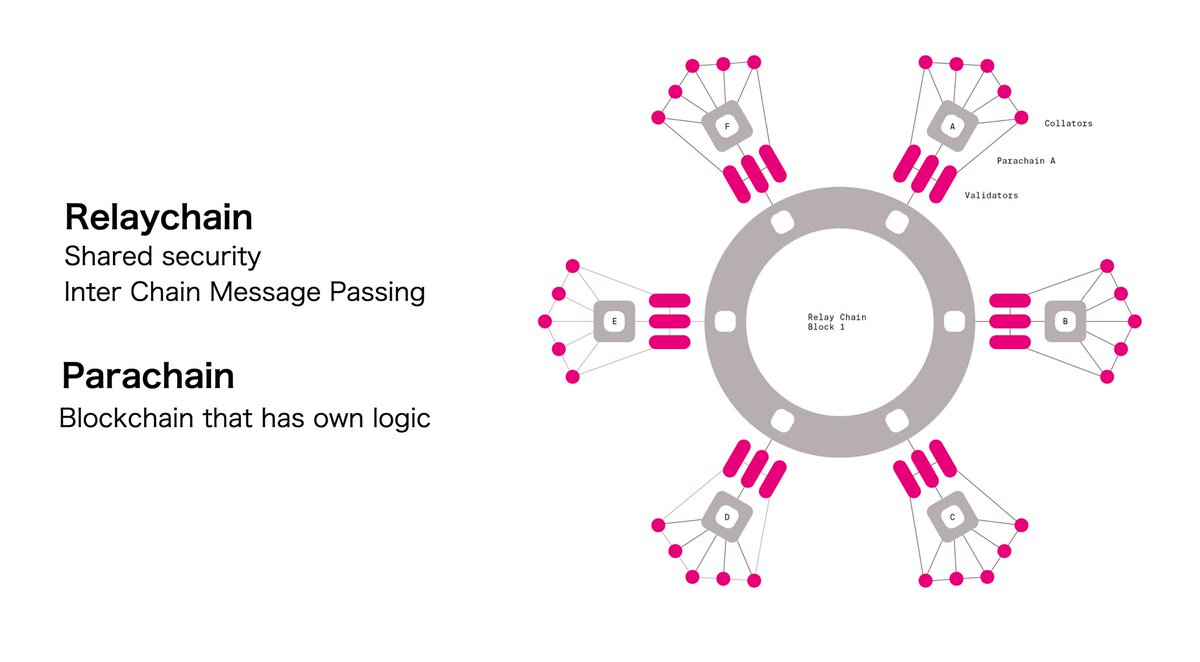

As we know, the Polkadot relay chain itself doesn’t support smart contracts.

It’s important for the ecosystem to have a parachain that enables this for all developers who want to build in the Polkadot ecosystem.

3/16

It’s important for the ecosystem to have a parachain that enables this for all developers who want to build in the Polkadot ecosystem.

3/16

Enter @AstarNetwork:

Not only is Astar EVM compatible, it also supports Web Assembly (WASM) and layer 2 solutions.

That’s right. Astar provides a way for EVM and WASM blockchains to coexist and cooperate, whilst being connected with Polkadot parachains!

This is X-VM:

4/16

Not only is Astar EVM compatible, it also supports Web Assembly (WASM) and layer 2 solutions.

That’s right. Astar provides a way for EVM and WASM blockchains to coexist and cooperate, whilst being connected with Polkadot parachains!

This is X-VM:

4/16

“X-VM (cross-virtual machine) allows smart contracts to execute calls and read storage data from different contract engines (virtual machine) and languages (ex, interacting with Solidity dApps written in from ink! or vise versa) within the same blockchain.”

Game changing🤯

5/16

Game changing🤯

5/16

As if Dapps weren’t incentivized enough to build on @AstarNetwork, (who doesn’t want to be accessible through so many different blockchains?) staking can be done through Dapps! (Dapp staking)

6/16

6/16

Instead of staking to validators, users can choose to nominate their $ASTR tokens on their favorite project.

At every block, half of block rewards go to dApp staking.

These staking rewards are then split 50/50 between users and project developers!

Check this out👇

7/16

At every block, half of block rewards go to dApp staking.

These staking rewards are then split 50/50 between users and project developers!

Check this out👇

7/16

Yup, 25% of ALL block rewards will go to project developers, an absolutely HUGE incentive.

On other chains, Dapps need to raise money through VCs, applying for grant programs, etc.

8/16

On other chains, Dapps need to raise money through VCs, applying for grant programs, etc.

8/16

On Astar, as a dApp grows in popularity, more members of the community will nominate to it, in turn receiving a greater percentage of the block reward!

Talk about competition👀

More than 10 new Dapps are expected to launch this month😏

(Astar DeFi thread coming tmrw👀)

9/16

Talk about competition👀

More than 10 new Dapps are expected to launch this month😏

(Astar DeFi thread coming tmrw👀)

9/16

Layer 2s:

In order to become faster/more scalable, a blockchain can implement some sort of layer 2 scaling solution.

@AstarNetwork’s unique infrastructure allows for compatibility with ALL L2 scaling solutions!

10/16

In order to become faster/more scalable, a blockchain can implement some sort of layer 2 scaling solution.

@AstarNetwork’s unique infrastructure allows for compatibility with ALL L2 scaling solutions!

10/16

Plasma and OVM (optimistic virtual machines) will be heavily utilized on Astar, managing and processing transactions in a Merkle tree outside the chain at high speed, and engraving only the Merkle root on the blockchain.

11/16

11/16

ZK rollups are another, allowing for Privacy+ speed/scalability!

Wrote an entire thread breaking ZKPs down, check it out!

Game changing technology.

12/16

Wrote an entire thread breaking ZKPs down, check it out!

Game changing technology.

12/16

https://twitter.com/BarryFried1/status/1511742345053900800

The best part?

Users can manually choose whichever L2 scaling solution they want, and can make their use case possible with minimum overhead!

13/16

Users can manually choose whichever L2 scaling solution they want, and can make their use case possible with minimum overhead!

13/16

In addition, Astar has received a Web3 grant to build a ZK-plonk, a universal ZK proof allowing for much better DX and UX!

For more info👇

medium.com/astar-network/…

14/16

For more info👇

medium.com/astar-network/…

14/16

@AstarNetwork is certainly setting itself up to become a multi billion dollar blockchain, solving interoperability issues and creating a multichain hub!

Time will tell, though $ASTR looks like it’s got a bright future ahead🚀

Note: 50% of tokens will be released this year

15/16

Time will tell, though $ASTR looks like it’s got a bright future ahead🚀

Note: 50% of tokens will be released this year

15/16

Thank you for reading

Like and retweet this #Astar thread!

Oh, and your gonna want to follow me for daily crypto threads 😏

@BarryFried1

Comment below what to cover next 👇

@astar_hub

@jamiekingston

@Kusamaximalist

@AdamAltcoin

@gunit3124

@DonnieBigBags

@D0tSama

16/16

Like and retweet this #Astar thread!

Oh, and your gonna want to follow me for daily crypto threads 😏

@BarryFried1

Comment below what to cover next 👇

@astar_hub

@jamiekingston

@Kusamaximalist

@AdamAltcoin

@gunit3124

@DonnieBigBags

@D0tSama

16/16

• • •

Missing some Tweet in this thread? You can try to

force a refresh