Lending @chaoslabs | Not related to SBF | white monster gang

9 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/catinaboxfi/status/1628789439097872394As such, the effective boxFEE “backing” @ t(0) will be a min of .88 - .89 assuming boxETH = 1 ETH (depending on net div loss from concentrated LP)

https://twitter.com/convexfinance/status/1609719315317637122

This makes me wonder — wat feed have money mkts/CDPs (Rari/Abra iirc) been using to price $cvxCRV all this time?

This makes me wonder — wat feed have money mkts/CDPs (Rari/Abra iirc) been using to price $cvxCRV all this time?

So, for example, say bLUSD floor = 1.1 & mkt price = 1.3.

So, for example, say bLUSD floor = 1.1 & mkt price = 1.3.

https://twitter.com/sr_eth/status/1608179906437087233In the event that a respective “JIT rebalance” is realized to be net profitable amongst the MEV/JIT community - congrats, you’ve got competition (2-3% of fees atm)

https://twitter.com/barryfried1/status/1601856243546595329

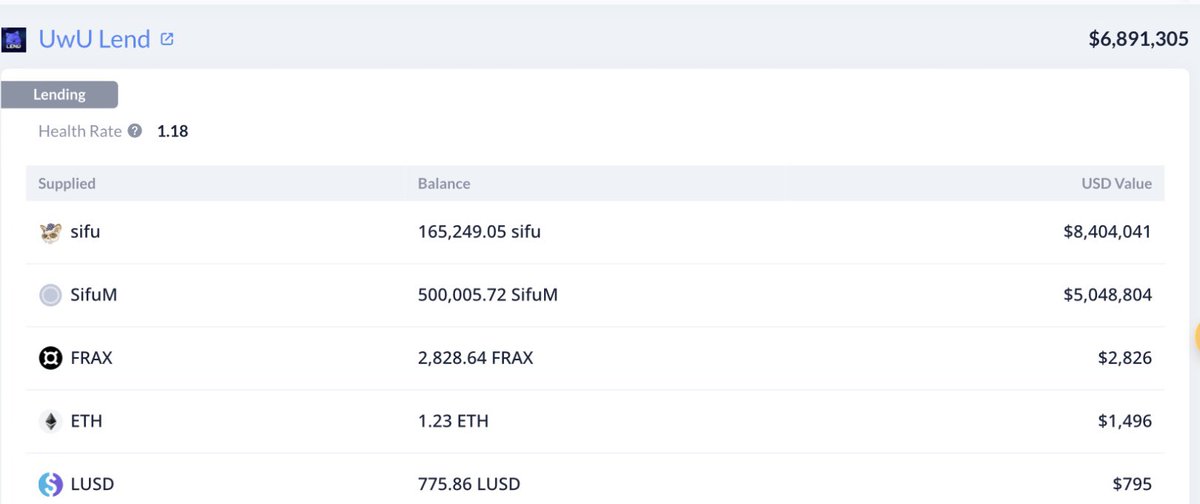

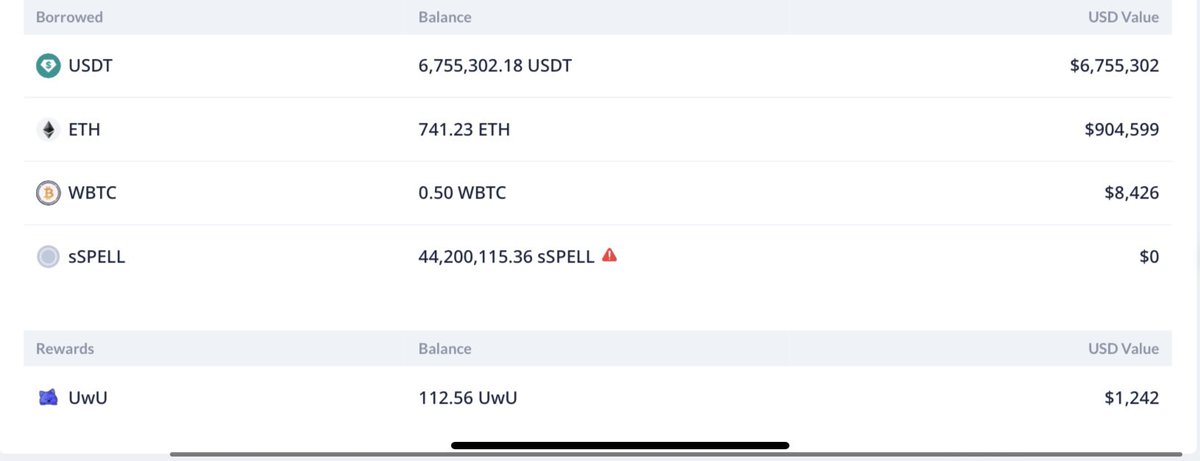

Btw if u wanna see some hilariously brainwashed ppl, check out the uWuLend discord

Btw if u wanna see some hilariously brainwashed ppl, check out the uWuLend discord

If he/Popsicle were to enter the JIT game rn in an attempt to siphon fees off stable LPers -> disincentivize V3 liquidity provision -> Curve stableswap mkt share⬆️, they’d be in the same position as other MEV bots rn (JIT wen economical) — nothing to FURTHER increase JIT

If he/Popsicle were to enter the JIT game rn in an attempt to siphon fees off stable LPers -> disincentivize V3 liquidity provision -> Curve stableswap mkt share⬆️, they’d be in the same position as other MEV bots rn (JIT wen economical) — nothing to FURTHER increase JIT

For example, say we have $100 of ETH collat & >$75 of x debt, thus position eligible for liquidation (liq threshold = 75%)

For example, say we have $100 of ETH collat & >$75 of x debt, thus position eligible for liquidation (liq threshold = 75%)

https://twitter.com/napgener/status/1596932768885518338

(No, Aave isn’t a “worthless protocol that’ll go to zero” lmao)

(No, Aave isn’t a “worthless protocol that’ll go to zero” lmao)

https://twitter.com/lookonchain/status/1594940438204411904

@avi_eisen this u

@avi_eisen this u

I swear this shit gonna be at like 1000% later today lmao (esp if ppl keep pulling liq)

I swear this shit gonna be at like 1000% later today lmao (esp if ppl keep pulling liq)

https://twitter.com/vitalikbuterin/status/1592454899434147841In other words, what he’s (obvs) implying is that SBF/Hitler being vegetarians (or any extremely irrelevant “belief” for that matter) had absolutely nothing to do with the underlying motive/outcome, thus we shouldn’t group it as such (drugs are obvs a diff story)

Note: assuming current price/ETH + the illiquid $y2k IFO price of $2.5

Note: assuming current price/ETH + the illiquid $y2k IFO price of $2.5

https://twitter.com/Bob_Baxley/status/1589073808136474624Here’s a diff example:

https://twitter.com/barryfried1/status/1570046616756797440

Edit:

Edit:

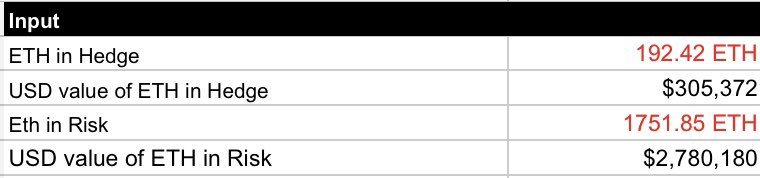

In other words, w current Risk:Hedge ratio, Risk depositors will earn 16.15% ROI if MIM3CRV ratio doesn’t drop drastically btwn Nov 7-14th (ofc there’s other MIM liq, tho Mainnet Curve is the main source) + 22k $Y2K per risk vault (IFO) * $2.5/tkn = share of $55k (154% APR atm)

In other words, w current Risk:Hedge ratio, Risk depositors will earn 16.15% ROI if MIM3CRV ratio doesn’t drop drastically btwn Nov 7-14th (ofc there’s other MIM liq, tho Mainnet Curve is the main source) + 22k $Y2K per risk vault (IFO) * $2.5/tkn = share of $55k (154% APR atm)