Mid-month portfolio snapshot -

$ADYEY $CFLT $DDOG $DLO $GLBE $GTLB $LILM $MNDY $NU $OKTA $PLTR $QS $S $SHOP $SNOW $SOFI $TWLO $U $UPST $ZI #ES_F

$ADYEY $CFLT $DDOG $DLO $GLBE $GTLB $LILM $MNDY $NU $OKTA $PLTR $QS $S $SHOP $SNOW $SOFI $TWLO $U $UPST $ZI #ES_F

New buys - $NU $QS $UPST

Sold $MELI $SE $TOST as competition ramping up and significant growth slowdown expected post '23.

Sold $MELI $SE $TOST as competition ramping up and significant growth slowdown expected post '23.

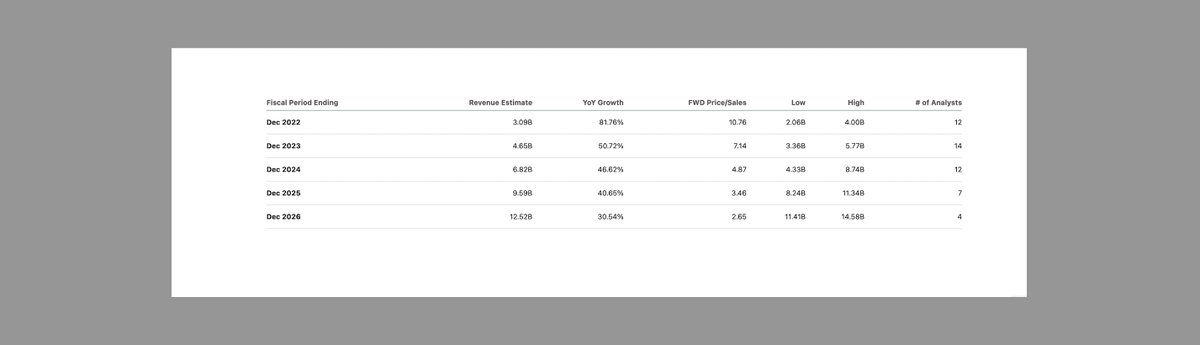

$NU - analysts forecasting strong growth -

Key investors -

Berkshire Hathaway, Sequoia, Tencent, Founders Fund, Tiger Global, Whale Rock Capital + Baillie Gifford.

Disclosure - I'm long $NU

Key investors -

Berkshire Hathaway, Sequoia, Tencent, Founders Fund, Tiger Global, Whale Rock Capital + Baillie Gifford.

Disclosure - I'm long $NU

• • •

Missing some Tweet in this thread? You can try to

force a refresh