We're entering a new phase of interoperability and composability which will lead to a future phase of applications.

A thread on the state of crypto bridges today (@nomadxyz_ vs. @StargateFinance) and where they may take us 🧵/9

A thread on the state of crypto bridges today (@nomadxyz_ vs. @StargateFinance) and where they may take us 🧵/9

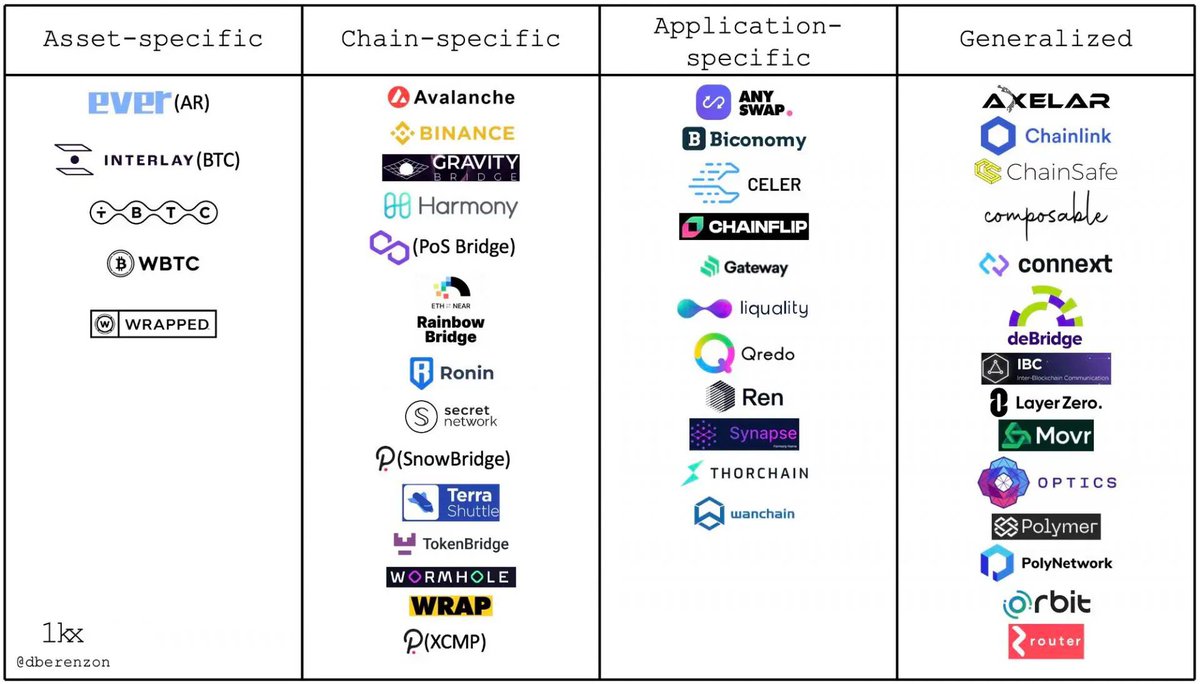

1/ Today, there are over 65 bridges in cryptocurrency working to move assets across chains in a multi-chain world 🌐⛓

d-core.net/asset-review-s…

d-core.net/asset-review-s…

2/ In Nomad's recent $22M funding announcement, the team discusses the space entering a new infrastructure cycle (must read below) following the deployment of Layer 1s like #SOL, #AVAX, #NEAR, etc.

usv.com/writing/2018/1…

usv.com/writing/2018/1…

3/ As developers+users push for cross-chain tools & apps, a new 🌊of infra will largely depend on interoperability & composability

For this, bridges 🌉 act as asset teleportation tools, which escrow assets on the 🏠chain and mint synthetic assets on the other chain for use

For this, bridges 🌉 act as asset teleportation tools, which escrow assets on the 🏠chain and mint synthetic assets on the other chain for use

4/ Historically, 🌉 used cross chain atomic transactions⚛️; they took hours and didn't actually move assets from chains

This led to new tech: header relays (IBC, tBTC) - although PoW or PoS in your local chain was💲to build, operate & maintain

This led to new tech: header relays (IBC, tBTC) - although PoW or PoS in your local chain was💲to build, operate & maintain

5/ Nomad uses header relays & adjusted it using optimistic roll-ups with a 30min dispute window. It sees an attestation of data, and while the timer is running, honest participants have a chance to respond to the attestation and/or submit fraud proofs⏱

blog.nomad.xyz/nomad-raises-2…

blog.nomad.xyz/nomad-raises-2…

6/ How is this different? Nomad allows for fraud & depends on local verification by participants within 30min to report fraudulent activity, keeping costs low. In doing so, it depends on users recognizing that fraud is costly, public, & can be blocked 🛠

docs.nomad.xyz/#how-does-noma…

docs.nomad.xyz/#how-does-noma…

7/ For users that want to use assets before 30min, Nomad partnered w/ @ConnextNetwork, which acts as a market maker, providing liquidity & taking on risk within the 30min🪟 Connext is the front end to Nomad's back-end settlement layer and acts similar to a classic atomic swap ⚛️

8/ @nomadxyz_ has found a way to maintain security while allowing users to move assets across chains. How does this compare to @StargateFinance and @LayerZero_Labs? Stay tuned for the next thread 💪

9/ To end where we started - the bridge ecosystem is crowded and misses key security functionalities that these two players aim to solve. As we move to interoperability + composability, these players will be the building blocks of our next wave of applications.

• • •

Missing some Tweet in this thread? You can try to

force a refresh