#Dharamsi Morarji Chemical Company (#DMCC) - 100 Years of Sulphur Chemistry 🧪🧪

Like & Retweet for better reach !

CMP - ₹ 442

Like & Retweet for better reach !

CMP - ₹ 442

1. Introduction

The Dharamsi Morarji Chemical Company Limited (DMCC), established in 1919, was the first producer of Sulphuric Acid and Phosphate fertilizers in India. But the company exited from the fertilizer business because of the government policy which was adverse for the

The Dharamsi Morarji Chemical Company Limited (DMCC), established in 1919, was the first producer of Sulphuric Acid and Phosphate fertilizers in India. But the company exited from the fertilizer business because of the government policy which was adverse for the

phosphate fertilizer and there was a preferential subsidy towards other fertilizers.

It is now engaged in manufacturing of bulk chemicals and speciality chemicals used in industries such as pharmaceuticals, agrochemicals, detergents, dyes, textile etc. and are majorly served

It is now engaged in manufacturing of bulk chemicals and speciality chemicals used in industries such as pharmaceuticals, agrochemicals, detergents, dyes, textile etc. and are majorly served

in Asia, US, Europe etc

Increasing the revenue contribution from the speciality chemicals segment.

Increasing the revenue contribution from the speciality chemicals segment.

2. Business segment contribution

The company has 2 business segments: Bulk chemicals & speciality chemicals.

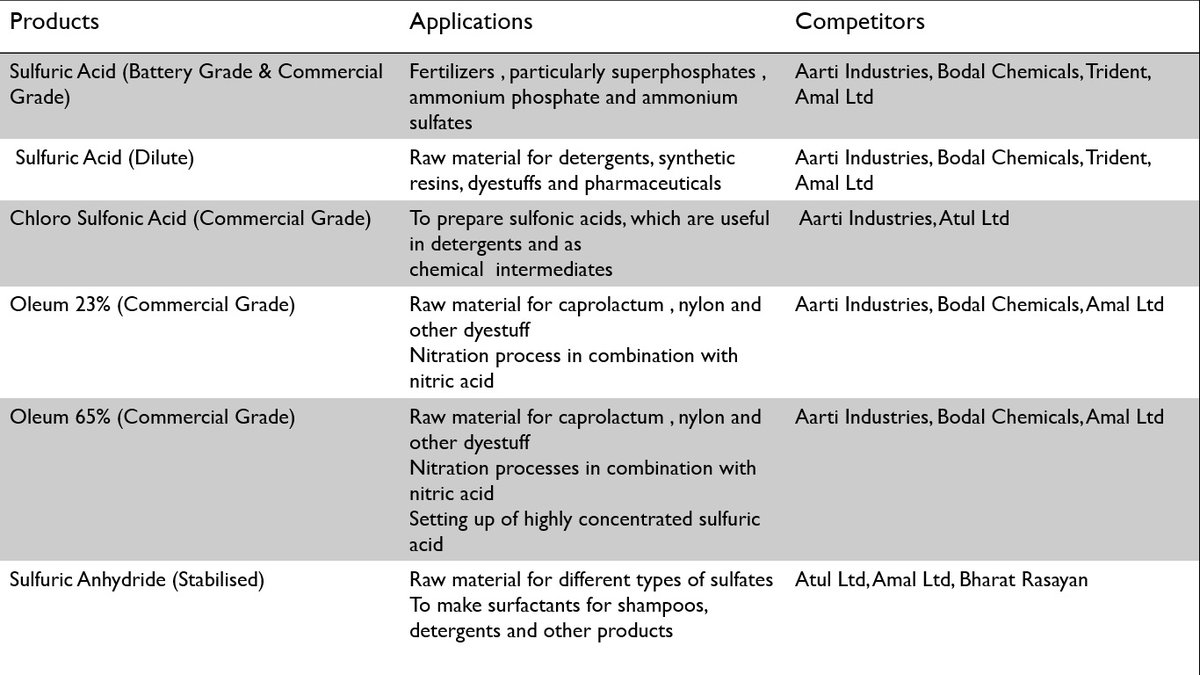

Bulk Chemicals (35% of revenues in FY21): These are high volume, low margin products. The company manufactures Sulphuric acid,

The company has 2 business segments: Bulk chemicals & speciality chemicals.

Bulk Chemicals (35% of revenues in FY21): These are high volume, low margin products. The company manufactures Sulphuric acid,

Sulphuric anhydride, Oleum and Chloro sulphonic acid which find application in detergents, dyes and fertilisers.

Speciality Chemicals (65% of revenues in FY21): These chemicals are created from strong process competencies and technical skills in handling hazardous reactions and

Speciality Chemicals (65% of revenues in FY21): These chemicals are created from strong process competencies and technical skills in handling hazardous reactions and

fetch higher margins. The products manufactured by the Co include Benzene sulphonyl chloride, Sodium vinyl sulfonate, Diethyl sulfate etc.

3. Geographical Mix

India: 68% in FY21

Outside India: 32% in FY21

The company exports to USA, Japan, Belgium, Denmark, France, Germany etc

India: 68% in FY21

Outside India: 32% in FY21

The company exports to USA, Japan, Belgium, Denmark, France, Germany etc

4. Clientele

The company serves a number of clients including Alkyl Amines, IPCA, Apcotex, Aurobindo, Dow, Deepak Nitrite, Pidilite etc.

The company serves a number of clients including Alkyl Amines, IPCA, Apcotex, Aurobindo, Dow, Deepak Nitrite, Pidilite etc.

5. Manufacturing Facilities

The company has two manufacturing facilities located in Roha and Dahej.

Roha: Dedicated to Sulphur Chemistry and equipped with 10 dedicated as well as 3 multi-purpose plants and in-house R&D center.

The company has two manufacturing facilities located in Roha and Dahej.

Roha: Dedicated to Sulphur Chemistry and equipped with 10 dedicated as well as 3 multi-purpose plants and in-house R&D center.

Dahej: Dedicated to Boron Chemistry and equipped with 2 dedicated and 2 multipurpose plants.

6. Focus on R&D

The company has an in-house R&D centre at its manufacturing facility in Roha, with key focus on process improvement (for existing products) and new process development (for product additions). The R&D team is strongly supported by the in-house engineering

The company has an in-house R&D centre at its manufacturing facility in Roha, with key focus on process improvement (for existing products) and new process development (for product additions). The R&D team is strongly supported by the in-house engineering

services team to ensure timely implementation of new products on a commercial scale. DMCC’s R&D is a team of 12 members as of FY21.

Products under pipeline

i) Sulfones

ii) Amides

iii) Thiols

Products under pipeline

i) Sulfones

ii) Amides

iii) Thiols

The sulfones category is currently put on hold. The company had earlier decided to expand capacities in Sulfones. However with a downturn in the international markets for the product category, the plan has been put on hold.

8. Borax Morarji - Misallocation ?

Set up in 1963; JV between DMCC and US Borax (then BCL); listed somewhere in late 70s majority bought out by DMCC.

Manufacturing Boron chemicals - borax, boric acid as well as downstream products like -

Set up in 1963; JV between DMCC and US Borax (then BCL); listed somewhere in late 70s majority bought out by DMCC.

Manufacturing Boron chemicals - borax, boric acid as well as downstream products like -

zinc borate (used in fire resistant cables/paints etc), disodium octaborate tetrahydrate(micro nutrient fertilizer, timber preservative), boric acid

Plant in Dahej, Gujarat.

Focus to grow in specialty boron products.

Losses in 2016 from supply glut led by decline in

Plant in Dahej, Gujarat.

Focus to grow in specialty boron products.

Losses in 2016 from supply glut led by decline in

Chinese imports; Huge finance cost - looking to reduce; shift from Ambernath plant proved costly.

New products in pipeline : Zinc borate, Glycol borates, formulations for specialty micro-nutrient market.

Raw Material Sourcing: The boron business is dependent 100% on import

New products in pipeline : Zinc borate, Glycol borates, formulations for specialty micro-nutrient market.

Raw Material Sourcing: The boron business is dependent 100% on import

of raw materials, there is no boron available locally.

The company's focus was on downstream boron products. They don’t want to invest too much money on technical grid boric acid, for which they will never be globally competitive.

Their idea was to buy that but because of

The company's focus was on downstream boron products. They don’t want to invest too much money on technical grid boric acid, for which they will never be globally competitive.

Their idea was to buy that but because of

restrictions on imports of boric acid. This is not available to the company at a competitive price and unless they get into their own manufacturing of technical grade boric acid in a big way

The company was not very keen on putting about 10 crores which would be required for this. And because again, the moment they started if the global situation changes, then they would have wasted their investment. There's no way they can compete in an open market

Boron imports are not permitted without licenses, you don’t easily get the licenses and this has come under the central insecticide board. They are not granting out licenses easily. So when a company is competing on speciality products globally, they need globally competitive

raw material they are not getting it. So this has hampered the operation of the boron plant completely.

9. Bulk chemical products

DMCC is India’s first manufacturer of sulphuric acid. The product is sold within a limited radius from the manufacturing site. Almost 50% of the bulk chemicals that they manufacture is sold in the market

DMCC is India’s first manufacturer of sulphuric acid. The product is sold within a limited radius from the manufacturing site. Almost 50% of the bulk chemicals that they manufacture is sold in the market

while the remainder is used for captive consumption.

Products: Sulphuric acid, Sulphuric anhydride, Oleum, Chloro sulphonic acid (Continued..)

Products: Sulphuric acid, Sulphuric anhydride, Oleum, Chloro sulphonic acid (Continued..)

12. Availability of sulfur as a raw material

The BS6 norms which have come into effect will affect the availability of sulfur. Compared to the BS4, the BS6 fuel has less sulfur and NOx. While the content of sulfur in BS4 fuel is 50ppm, it is five times lower in the BS6 fuel,

The BS6 norms which have come into effect will affect the availability of sulfur. Compared to the BS4, the BS6 fuel has less sulfur and NOx. While the content of sulfur in BS4 fuel is 50ppm, it is five times lower in the BS6 fuel,

which is at 10ppm. So basically the availability of sulfur will increase in India because of these new norms as they had to remove sulfur from the fuel and that should lead to increased availability and therefore lower prices or at least reduced imports

13. Closure of the sterlite copper smelter

Sterlite operated the largest copper smelter plant in India, in Thoothukudi from 1998 to 2018. The copper smelter plant was long-opposed by the local residents for polluting their environment as well as causing a range of health problem

Sterlite operated the largest copper smelter plant in India, in Thoothukudi from 1998 to 2018. The copper smelter plant was long-opposed by the local residents for polluting their environment as well as causing a range of health problem

in the area. It has the capacity to produce 400,000 tonnes of copper cathode a year. In March-April 2018, there were several mass protests against the company’s plans of a proposed expansion. Then the copper smelter plant at Thoothukudi was shut down in 2018 by the Tamil Nadu

Pollution Control Board over environmental violations. Due to this the demand for sulfuric acid increased which is reflected in the improved EBITDA margins of DMCC in FY19.

15. New Products

The company is working on a couple of new products including amides, thio compounds etc. They introduced Lasamide in 2019. The volumes have not been as good as they should have been but the company expects good volumes of lasamide in the coming years because it

The company is working on a couple of new products including amides, thio compounds etc. They introduced Lasamide in 2019. The volumes have not been as good as they should have been but the company expects good volumes of lasamide in the coming years because it

is again Pharma related so there are audits and approvals and it is a time consuming process. Thiols is still in a bit of a development phase and they are working on a relatively new range of products. R&D is continuing to work on an alternative process for Thiols.DMCC would also

be launching new products in which the EBITDA margin target would be greater than 30%

COVID-19 impact on the business

COVID-19 impact on the sulfone business: Due to covid there was a decline in the demand for a couple of sulfones. Mainly because it's used in thermal paper coating and those coatings are primarily used for example, in airline tickets, in stadium

COVID-19 impact on the sulfone business: Due to covid there was a decline in the demand for a couple of sulfones. Mainly because it's used in thermal paper coating and those coatings are primarily used for example, in airline tickets, in stadium

tickets, in baggage tags and things like that. In 2020 there was a substantial reduction in the demand for such things due to the outbreak of COVID-19.

• • •

Missing some Tweet in this thread? You can try to

force a refresh