If you invest wisely, Cryptocurrency can give you life-changing gains.

But how should you be investing if you have a small budget?

Here's your playbook to make the most out of a small budget:

But how should you be investing if you have a small budget?

Here's your playbook to make the most out of a small budget:

Today I'll be covering:

• Growing vs. preserving

• Building a low budget portfolio

• Accumulating airdrops

• Lowering your fees

• Increasing your income

Let's dive in.

• Growing vs. preserving

• Building a low budget portfolio

• Accumulating airdrops

• Lowering your fees

• Increasing your income

Let's dive in.

MOST people should...

1. Focus on Increasing their Income

2. Decrease their Expenses

3. Dollar Cost Average into Blue Chips

4. Be Patient and Make it in 5 to 10 years

5. Not invest in what they can't afford to lose

This is the best path for 90% of people.

1. Focus on Increasing their Income

2. Decrease their Expenses

3. Dollar Cost Average into Blue Chips

4. Be Patient and Make it in 5 to 10 years

5. Not invest in what they can't afford to lose

This is the best path for 90% of people.

Harsh Truth

Degens are gonna degen.

It's kinda like having a little brother.

I tell him he should avoid fighting, but he's going to fight his bully anyway.

I might as well teach him how to fight than see him get his ass kicked 🤷♂️

Degens are gonna degen.

It's kinda like having a little brother.

I tell him he should avoid fighting, but he's going to fight his bully anyway.

I might as well teach him how to fight than see him get his ass kicked 🤷♂️

Maximizing Growth

Let's say you have $3k to invest, and you put it into BTC.

Even if it 5x from here, it's not life-changing money for most people.

You're trying to make it.

When you have a small budget, you need to make a few high conviction bets on higher-risk coins.

Let's say you have $3k to invest, and you put it into BTC.

Even if it 5x from here, it's not life-changing money for most people.

You're trying to make it.

When you have a small budget, you need to make a few high conviction bets on higher-risk coins.

An Investing Framework:

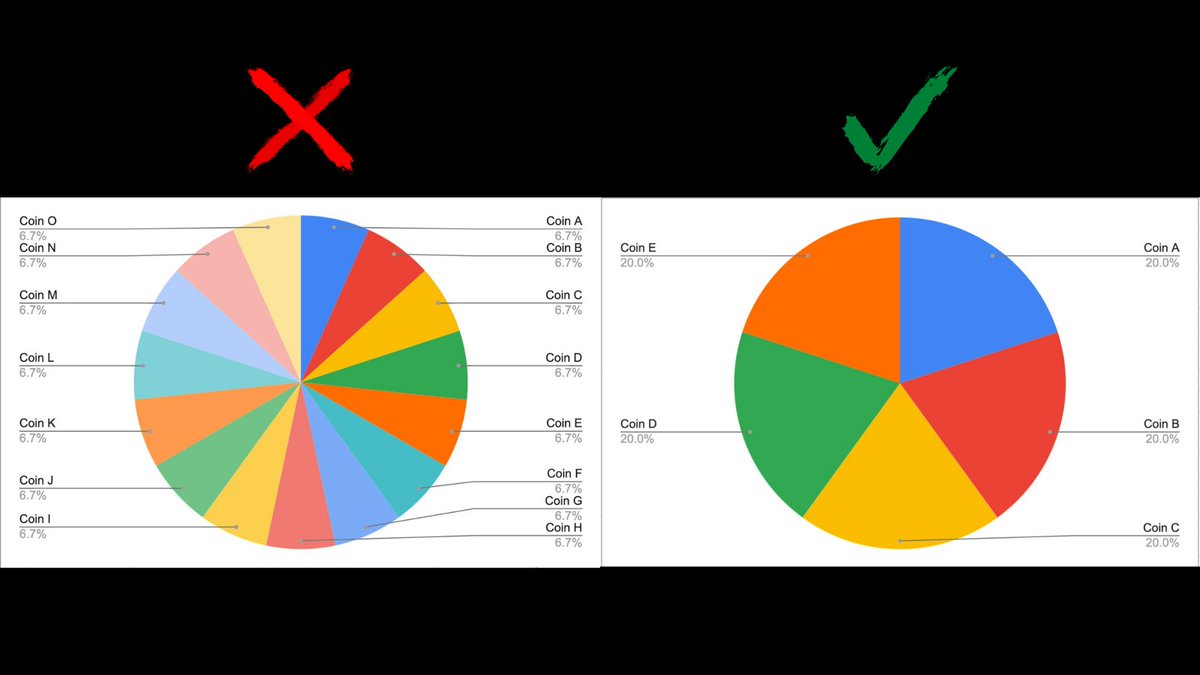

1) Concentrate to GROW your portfolio.

2) Diversify to PRESERVE your portfolio.

Since you're working with a smaller portfolio, you should invest in a smaller amount of protocols.

1) Concentrate to GROW your portfolio.

2) Diversify to PRESERVE your portfolio.

Since you're working with a smaller portfolio, you should invest in a smaller amount of protocols.

Warren Buffet's Portfolio - 5 stocks made up 75% of his portfolio.

Investing in 1-3 projects is too risky - a rug pull or exploit can wipe your gains.

I recommend investing in around 4-6 projects starting off.

Investing in 1-3 projects is too risky - a rug pull or exploit can wipe your gains.

I recommend investing in around 4-6 projects starting off.

Growing the Portfolio

You start with a few projects.

Hopefully, your $ grows and you take profits.

Later on, your portfolio should become more diversified and balanced over time.

You don't want to have all your gains wiped out in a dip.

You start with a few projects.

Hopefully, your $ grows and you take profits.

Later on, your portfolio should become more diversified and balanced over time.

You don't want to have all your gains wiped out in a dip.

https://twitter.com/thedefiedge/status/1508475791134257153

Riding the Next Waves

Your goal is to predict the next waves and try to ride them.

Solunavax has pumped? Well, what are the NEXT L1s?

DeFiKingdoms has exploded? Well, what's the NEXT GameFi game?

Position yourself to take advantage of the next metagame and narratives.

Your goal is to predict the next waves and try to ride them.

Solunavax has pumped? Well, what are the NEXT L1s?

DeFiKingdoms has exploded? Well, what's the NEXT GameFi game?

Position yourself to take advantage of the next metagame and narratives.

Some Ways to Find Gems

• Private groups

• Watching Whale Wallets

• Focusing on a subsector

• Onchain metrics such as watching $ inflow

• Some accounts focus on lower market cap coins

• Rotating to take advantage of ecosystem incentives

Find your edge.

• Private groups

• Watching Whale Wallets

• Focusing on a subsector

• Onchain metrics such as watching $ inflow

• Some accounts focus on lower market cap coins

• Rotating to take advantage of ecosystem incentives

Find your edge.

Warning:

Masterminds are great when they're organic.

Be careful of the kind where you pay someone to give you alpha.

1. You might be their exit liquidity.

2. You should learn to hunt for your own alpha.

Try to network and form your own private masterminds.

Masterminds are great when they're organic.

Be careful of the kind where you pay someone to give you alpha.

1. You might be their exit liquidity.

2. You should learn to hunt for your own alpha.

Try to network and form your own private masterminds.

Find Dapps on Upcoming Ecosystems

This is one strategy I've used to a lot of success.

1) Find an up-and-coming ecosystem with increasing TVL.

2) Look for the most solid dapps.

3) Be early.

4) Take profits.

This is one strategy I've used to a lot of success.

1) Find an up-and-coming ecosystem with increasing TVL.

2) Look for the most solid dapps.

3) Be early.

4) Take profits.

For example last year:

• FTM -> Liquid Driver

• Harmony -> DeFiKingdoms

• Avax -> Wonderland

Yea, I know Wonderland ended up being 💩 - no one bats 100%. Risks come with the territory.

The key is to be early and take profits.

• FTM -> Liquid Driver

• Harmony -> DeFiKingdoms

• Avax -> Wonderland

Yea, I know Wonderland ended up being 💩 - no one bats 100%. Risks come with the territory.

The key is to be early and take profits.

Here's an example using LQDR

Accumulate when things are quiet, but there are catalysts/tailwinds heading their way.

Position yourself and let the gains come to you.

Don't chase gains - chances are it might be too late and you're fomo'ing in.

Accumulate when things are quiet, but there are catalysts/tailwinds heading their way.

Position yourself and let the gains come to you.

Don't chase gains - chances are it might be too late and you're fomo'ing in.

"But ser, I don't have a time machine"

Ok, I hear ya.

Right now there's a lot of buzz around Aurora, Cronos, and Metis.

(not financial advice)

I'd go to @defillama and take a look at the DAPPS.

From there, I'd research to see which ones have the most potential.

Ok, I hear ya.

Right now there's a lot of buzz around Aurora, Cronos, and Metis.

(not financial advice)

I'd go to @defillama and take a look at the DAPPS.

From there, I'd research to see which ones have the most potential.

A few things I'm looking for:

• The team

• The metrics

• Tokenomics

• The roadmap

• Their marketing

• Community vibes

• Their seed investors

• Ecosystem momentum

• Unique value proposition

• The team

• The metrics

• Tokenomics

• The roadmap

• Their marketing

• Community vibes

• Their seed investors

• Ecosystem momentum

• Unique value proposition

This Strategy Doesn't Always Work

For some ecosystems like Solana and Terra, their DAPPS haven't quite exploded yet.

It would've been better to keep it simple and hold the Layer 1 tokens.

For some ecosystems like Solana and Terra, their DAPPS haven't quite exploded yet.

It would've been better to keep it simple and hold the Layer 1 tokens.

Laser Focus on a Niche

You don't have the budget to spread around. Instead, laser focus on a subsector that you believe in.

Ex.

• Understanding the @MetisDAO system

• Mastering GameFi on @Avalancheavax

You want to understand your sector better than 99% of other investors.

You don't have the budget to spread around. Instead, laser focus on a subsector that you believe in.

Ex.

• Understanding the @MetisDAO system

• Mastering GameFi on @Avalancheavax

You want to understand your sector better than 99% of other investors.

GameFi Arbitrage

Some people are making 5 figures a month playing @AxieInfinity.

This is what my friend did with games like @defikingdoms and @playcrabada.

He didn't have much money, but he had the time.

Some people are making 5 figures a month playing @AxieInfinity.

This is what my friend did with games like @defikingdoms and @playcrabada.

He didn't have much money, but he had the time.

He used that time to understand the mechanics and arbitraged different heroes / NFTs.

There are market inefficiencies because not many people understand the mechanics.

So he'd invest in a cheap hero / NFTs, level it up, and flip it.

There are market inefficiencies because not many people understand the mechanics.

So he'd invest in a cheap hero / NFTs, level it up, and flip it.

Make Sure You Take Profits

Hopefully, a few of your bets pay off.

Take profits according to your risk tolerance.

Put them into blue chips or stable coins to lock your profits in.

Hopefully, a few of your bets pay off.

Take profits according to your risk tolerance.

Put them into blue chips or stable coins to lock your profits in.

Chase After Airdrops

Sometimes protocols distribute free tokens called Airdrops to users.

Why do they do this? It's a marketing tactic and a way for them to generate buzz.

It's only to addresses that meet certain parameters.

Here are two well-known examples:

Sometimes protocols distribute free tokens called Airdrops to users.

Why do they do this? It's a marketing tactic and a way for them to generate buzz.

It's only to addresses that meet certain parameters.

Here are two well-known examples:

1) Looksrare: A competitor to Opensea. They did an airdrop to anyone that had >3 ETH trading volume on Opensea.

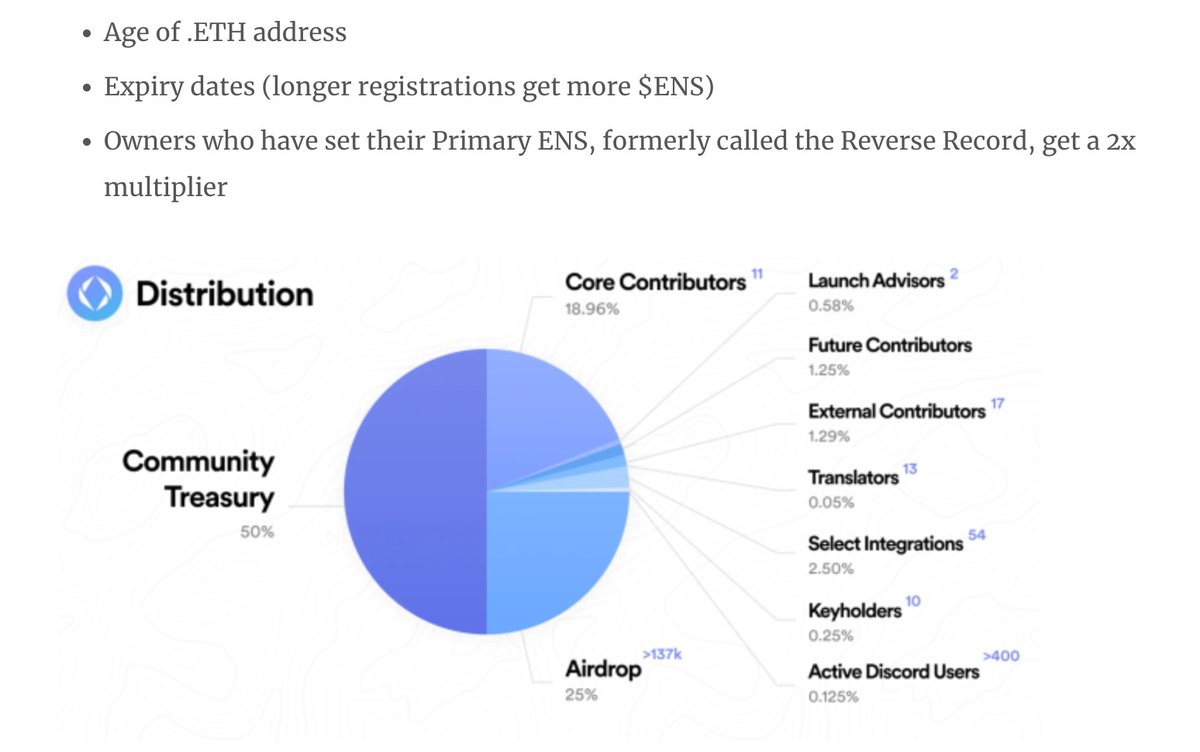

2) ENS: airdropped anyone with a .ETH address. Age of address + longer expiry received higher amounts.

Some people got airdrops worth 5 or even 6 figures.

2) ENS: airdropped anyone with a .ETH address. Age of address + longer expiry received higher amounts.

Some people got airdrops worth 5 or even 6 figures.

People are anticipating two big airdrops this year:

1) @metamask

2) @arbitrum

If I had to guess, using an M.M. wallet alone won't get you an airdrop.

They'll probably focus on users who use the SWAP feature within the wallet.

1) @metamask

2) @arbitrum

If I had to guess, using an M.M. wallet alone won't get you an airdrop.

They'll probably focus on users who use the SWAP feature within the wallet.

Cosmos is Full of Airdrops

One ecosystem that has a ton of airdrops right now is @Cosmos.

You can track them with Twitter accounts like @Cosmos_Airdrops.

Go see a few requirements and you'll see a pattern.

One ecosystem that has a ton of airdrops right now is @Cosmos.

You can track them with Twitter accounts like @Cosmos_Airdrops.

Go see a few requirements and you'll see a pattern.

https://twitter.com/Cosmos_Airdrops/status/1512092007363080194

WARNING:

Bad actors use airdrops as a way of scamming and phishing people.

1) They airdrop fake tokens

2) They try to get you to go to a fake phishing site.

Do your due diligence on airdrop tokens.

Whenever there's an airdrop, go to the official sites to see if it's legit.

Bad actors use airdrops as a way of scamming and phishing people.

1) They airdrop fake tokens

2) They try to get you to go to a fake phishing site.

Do your due diligence on airdrop tokens.

Whenever there's an airdrop, go to the official sites to see if it's legit.

Lower Your Fees

1) If you're using Coinbase, using Coinbase Pro is cheaper fees.

2) If you're on Binance, holding the BNB tokens can lower your trading fees.

3) Bridging or Swapping? Research the cheapest ways

A penny saved is a penny earned.

1) If you're using Coinbase, using Coinbase Pro is cheaper fees.

2) If you're on Binance, holding the BNB tokens can lower your trading fees.

3) Bridging or Swapping? Research the cheapest ways

A penny saved is a penny earned.

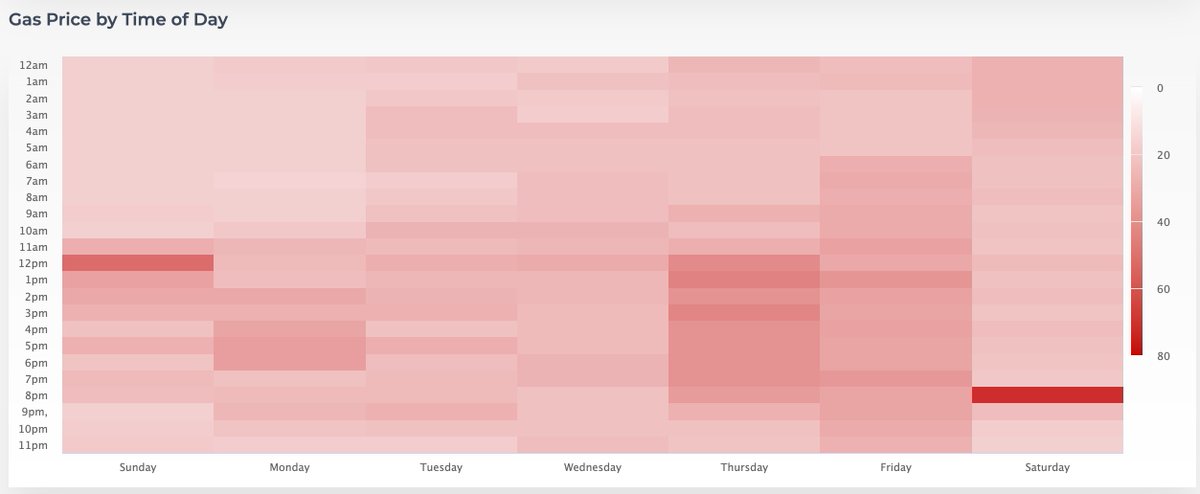

Lower Your Gas Fees

Gas fees can change during the time of the day, and the day of the week.

Think about it like driving in traffic and facing rush hour.

If you need to transact, do it during off-peak times.

Gas fees can change during the time of the day, and the day of the week.

Think about it like driving in traffic and facing rush hour.

If you need to transact, do it during off-peak times.

Use DeFi in Cheaper Ecosystems

If you're newer, then using an ecosystem like @FantomFDN will be easier on your budget.

The transaction fees are pennies - trying to use DeFi on ETH mainnet will kill your budget.

If you're newer, then using an ecosystem like @FantomFDN will be easier on your budget.

The transaction fees are pennies - trying to use DeFi on ETH mainnet will kill your budget.

Put More Coals in the Fire

I can't stress this enough - find ways to earn more income.

Let's say your goal is $1m in Crypto.

It's FAR easier trying to earn $100k and 10x your portfolio.

Then to start with $1k and try to 1000x trade your way to $1m.

I can't stress this enough - find ways to earn more income.

Let's say your goal is $1m in Crypto.

It's FAR easier trying to earn $100k and 10x your portfolio.

Then to start with $1k and try to 1000x trade your way to $1m.

If you already have a good job, then negotiate for a higher salary or job hop to somewhere that pays more.

Or try to create a second stream of income.

JUST KEEP BUYING.

Or try to create a second stream of income.

JUST KEEP BUYING.

https://twitter.com/thedefiedge/status/1504878408362201089

A Short Time Window on an Asymmetric Bet

It's the golden age right now and there's a short window. Regulations will come and things will become more difficult.

Stay focused.

Delay gratification.

If you play your hand right, you can set yourself up for the rest of your life.

It's the golden age right now and there's a short window. Regulations will come and things will become more difficult.

Stay focused.

Delay gratification.

If you play your hand right, you can set yourself up for the rest of your life.

"Ser, Can You Recommend Small Caps?"

No.

My account's too big now and I can move small-cap prices.

1. I get accused of shilling my bags

2. Whales/bots buy and dump on you.

It's a no-win situation for me - I rather teach you how to find the gems yourself.

No.

My account's too big now and I can move small-cap prices.

1. I get accused of shilling my bags

2. Whales/bots buy and dump on you.

It's a no-win situation for me - I rather teach you how to find the gems yourself.

There's a Learning Curve

I've rarely seen people make it in their 1st cycle.

It's usually 2-3 cycles when they start hitting their stride.

You're going to make mistakes. It's part of the process.

Learn from them and upgrade your mental trading software.

I've rarely seen people make it in their 1st cycle.

It's usually 2-3 cycles when they start hitting their stride.

You're going to make mistakes. It's part of the process.

Learn from them and upgrade your mental trading software.

Why People Fail:

• Cognitive biases / Emotions

• Taking advice from the wrong people

• Thinking something's alpha when it's not

• Investing more than they can afford to lose

• Everyone thinks they're better investors than they are.

Trading is hard.

• Cognitive biases / Emotions

• Taking advice from the wrong people

• Thinking something's alpha when it's not

• Investing more than they can afford to lose

• Everyone thinks they're better investors than they are.

Trading is hard.

Takeaways:

• Don't FOMO

• Airdrops can be lucrative

• Concentrate to grow wealth

• Laser focus on a sub-sector

• Ride waves and find your own alpha

• Don't fade dollar-cost averaging into blue-chips

• Don't FOMO

• Airdrops can be lucrative

• Concentrate to grow wealth

• Laser focus on a sub-sector

• Ride waves and find your own alpha

• Don't fade dollar-cost averaging into blue-chips

I hope you've found this thread helpful.

Follow me @thedefiedge for more unique DeFi insights.

I'd appreciate it if you could Like/Retweet the first tweet below:

Follow me @thedefiedge for more unique DeFi insights.

I'd appreciate it if you could Like/Retweet the first tweet below:

https://twitter.com/thedefiedge/status/1514997156179943426

And if you want more insights, I have an email newsletter that I write weekly.

It's free to subscribe:

thedefiedge.com

It's free to subscribe:

thedefiedge.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh