1/ I'm going to pound the table a bit more about and show that shipbuilding capacity is insufficient to replace scrapping let alone accommodate trade volume growth.

But this time we will look at the global aggregate merchant fleet including all sectors.

🧵...

But this time we will look at the global aggregate merchant fleet including all sectors.

🧵...

https://twitter.com/AllVentured/status/1498506632401240067

2/ Across all sectors, the global orderbook is only ~10% of the active fleet compared to ~8% that is already beyond economic life in the new high fuel cost/low emissions requirement paradigm. It the time it takes the ~10% to deliver, ~14% more will approach end of economic life.

3/ In 2022, ships reaching critical decision age whether to scrap or repair for compliance increases significantly and continues to increase each year this decade.

Notice in 2022 and beyond, the capacity of ships delivered fails to match capacity hitting the new 20 year wall.

Notice in 2022 and beyond, the capacity of ships delivered fails to match capacity hitting the new 20 year wall.

4/ The only way owners pay the huge repair and compliance bill keep these old uneconomic assets operating is with very high rates: high enough to amortize a $1.5M per year repair schedule, 30% worse fuel economy, a rate uncertainty premium, and a ROIC cash financing premium.

5/ At high enough rates to keep these old assets trading, modern fuel efficient ships that can be financed will make truly exceptional profits. The largest modern scrubber fitted ships currently earn ~$20k per day more than their oldest equivalents.

6/ Capital investment and constraints on ship ordering drives shipping cycles. Ship ordering lags rates, ship deliveries lag orders ~3 years, and new shipbuilding capacity lags years after that.

We are still losing shipbuilding capacity today:

We are still losing shipbuilding capacity today:

https://twitter.com/AllVentured/status/1414356032826920968?s=20&t=ATq_H0KQCRJL2ESv2xXBbw

7/ The last cycle was demand driven with China joining the WTO and shipbuilding playing catch up for a decade. This one will be supply driven as capacity is now insufficient to replace ships from the last boom and meet more stringent emissions regulations.

Where are we at?

Where are we at?

8/ But this cycle is different. It is a NO BRAINER. Who could have predicted the crazy demand increase in the 2000s cycle?

This time we have the visibility to see that supply is insufficient even under a pessimistic demand scenario of multi-decade low trade growth.

This time we have the visibility to see that supply is insufficient even under a pessimistic demand scenario of multi-decade low trade growth.

9/ What other capital intensive business that has grown consistently with global GDP do you have such visibility of 3+ years out of shrinking supply in lieu of high rates?

There is no short-cycle shale patch to ruin this party.

Only global economic and geopolitical tail risk.

There is no short-cycle shale patch to ruin this party.

Only global economic and geopolitical tail risk.

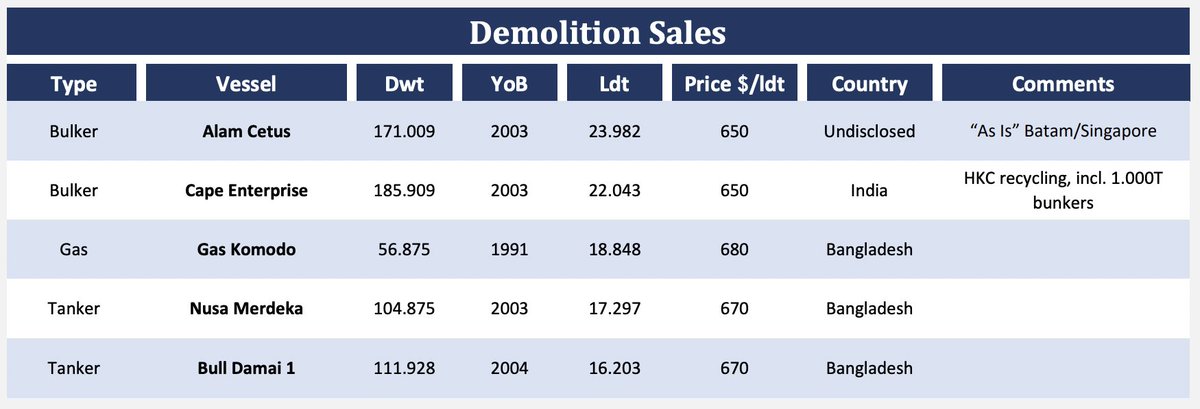

10/ I will point out again that in addition to aggregate shipbuilding capacity being insufficient to keep up with replacements for the global fleet, today's orderbook is heavily skewed toward container and gas carriers.

#tanker and #drybulk deliveries are grossly insufficient.

#tanker and #drybulk deliveries are grossly insufficient.

• • •

Missing some Tweet in this thread? You can try to

force a refresh