We are seeing a possible exploit on @BeanstalkFarms - symbol $BEAN which has dropped 100%

#slippage

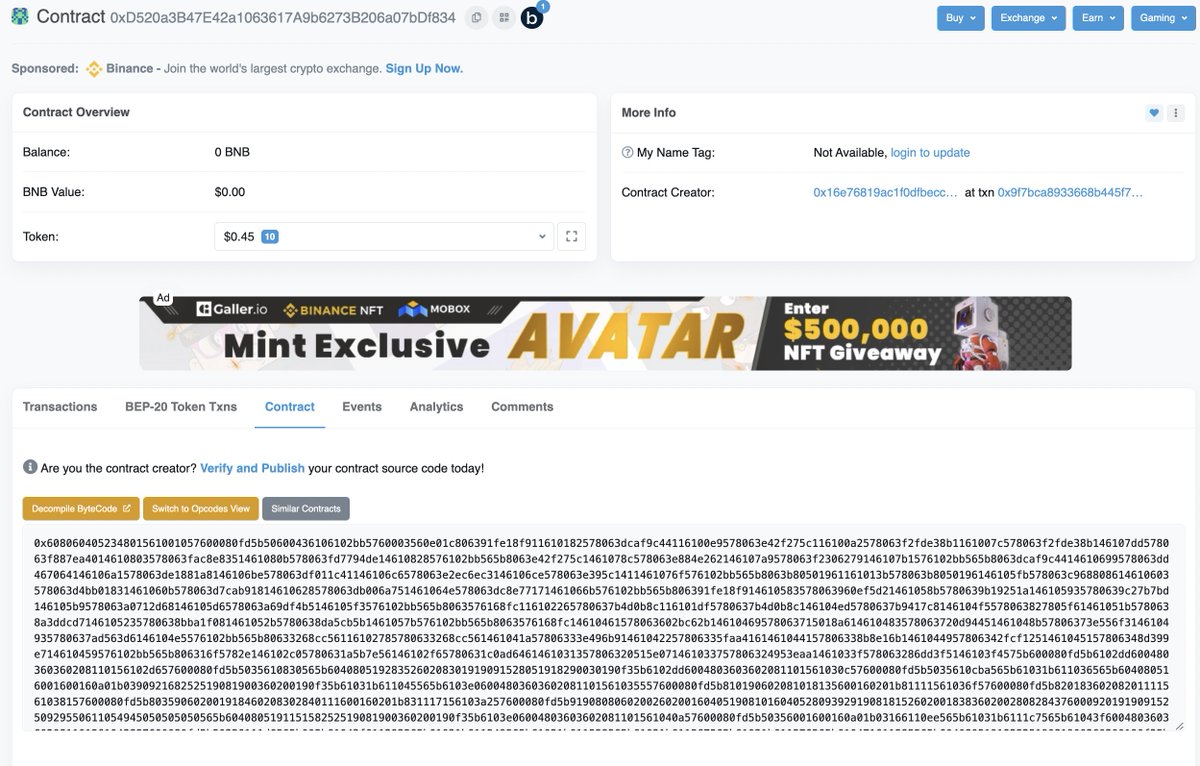

Address: 0xdc59ac4fefa32293a95889dc396682858d52e5db0x48f33863b1defc7b294717498c634ba9a5fb58a7

Be careful out there!

#slippage

Address: 0xdc59ac4fefa32293a95889dc396682858d52e5db0x48f33863b1defc7b294717498c634ba9a5fb58a7

Be careful out there!

Flashloan attack on Beanstalk has drained their fund of approx $100 Million

Attacker wallet: etherscan.io/txs?a=0x1c5dcd…

“Publius” the discord owner has stated the project has no money to carry on and ‘its dead’.

Attacker wallet: etherscan.io/txs?a=0x1c5dcd…

“Publius” the discord owner has stated the project has no money to carry on and ‘its dead’.

The hacker has moved roughly $30M (~9700 #ETH) to @TornadoCash

Follow the funds yourself with SkyTrace: certik.com/skytrace/eth:0…

Follow the funds yourself with SkyTrace: certik.com/skytrace/eth:0…

Attack Flow

1. The attacker flashloaned 350M $Dai, 500M $USDC, 150M $USDT, 32M $Bean, 11.6M $LUSD

2. Attacker then added the flashloaned amount (~350M Dai, 500M USDC, 150M USDT) to Curve.fi pool as liquidity and received 979,691,328 DAI/USDC/USDT(3Crv) LP tokens

1. The attacker flashloaned 350M $Dai, 500M $USDC, 150M $USDT, 32M $Bean, 11.6M $LUSD

2. Attacker then added the flashloaned amount (~350M Dai, 500M USDC, 150M USDT) to Curve.fi pool as liquidity and received 979,691,328 DAI/USDC/USDT(3Crv) LP tokens

3. The Attacker used all the gained assets from the flashloan to vote the #BIP18 proposal.

4. After passing the proposal, they immediately invoked the emergencyCommit() to execute the BIP18 proposal.

4. After passing the proposal, they immediately invoked the emergencyCommit() to execute the BIP18 proposal.

5. the attacker was then able to drain the 36,084,584 $BEAN, 0.54 UNIV2(BEAN-WETH), 874,663,982 BEAN3Crv and 60,562,844 BEANLUSD-f.

6. The attacker used the drained assets (in Step5) to repay the #flashloan

6. The attacker used the drained assets (in Step5) to repay the #flashloan

The root cause of the exploit is that the BEAN3Crv-f and BEANLUSD-f (used for voting) in the Silo system could be created via flashloan.

Due to the lack of an anti-flashloan mechanism in the Beanstalk protocol, the attackers were able to borrow tokens that are supported by the protocol and voted for malicious proposals.

• • •

Missing some Tweet in this thread? You can try to

force a refresh