CGD companies are facing huge problems which are affecting their profitability

~ Higher domestic gas prices from producers ( $2.9 to $6.1)

~ Not getting fully from domestic supplier, have to import which are 6X costly

#GAIL #ONGC #GUJRATAGAS #ADANITOTAL #ADANIGAS #ATGL #RIL

~ Higher domestic gas prices from producers ( $2.9 to $6.1)

~ Not getting fully from domestic supplier, have to import which are 6X costly

#GAIL #ONGC #GUJRATAGAS #ADANITOTAL #ADANIGAS #ATGL #RIL

~ Govt has not allocated supplies from domestic supplier to CGD since April-21

Companies which will affect Adani Total Gas, Mahanagar Gas, Indraprasth Gas, Gujarat Gas

google.com/amp/s/energy.e…

Companies which will affect Adani Total Gas, Mahanagar Gas, Indraprasth Gas, Gujarat Gas

google.com/amp/s/energy.e…

While producer like RIL & ONGC will benefit from recent gas price increase

Natural Gas price increased from $2.9 mBtu to $6.10 mBtu

This will increase earings of ONGC by ₹23000cr & of RIL by ₹15000cr

m.economictimes.com/industry/energ…

Natural Gas price increased from $2.9 mBtu to $6.10 mBtu

This will increase earings of ONGC by ₹23000cr & of RIL by ₹15000cr

m.economictimes.com/industry/energ…

Credit Suisse downgraded City Gas Sector

Use of import gas for CNG

2022 : 12%

2025 : 50%

City gas unit EBITDA

2022 : ₹7/SCM

2025 : ₹5.25/SCM

Use of import gas for CNG

2022 : 12%

2025 : 50%

City gas unit EBITDA

2022 : ₹7/SCM

2025 : ₹5.25/SCM

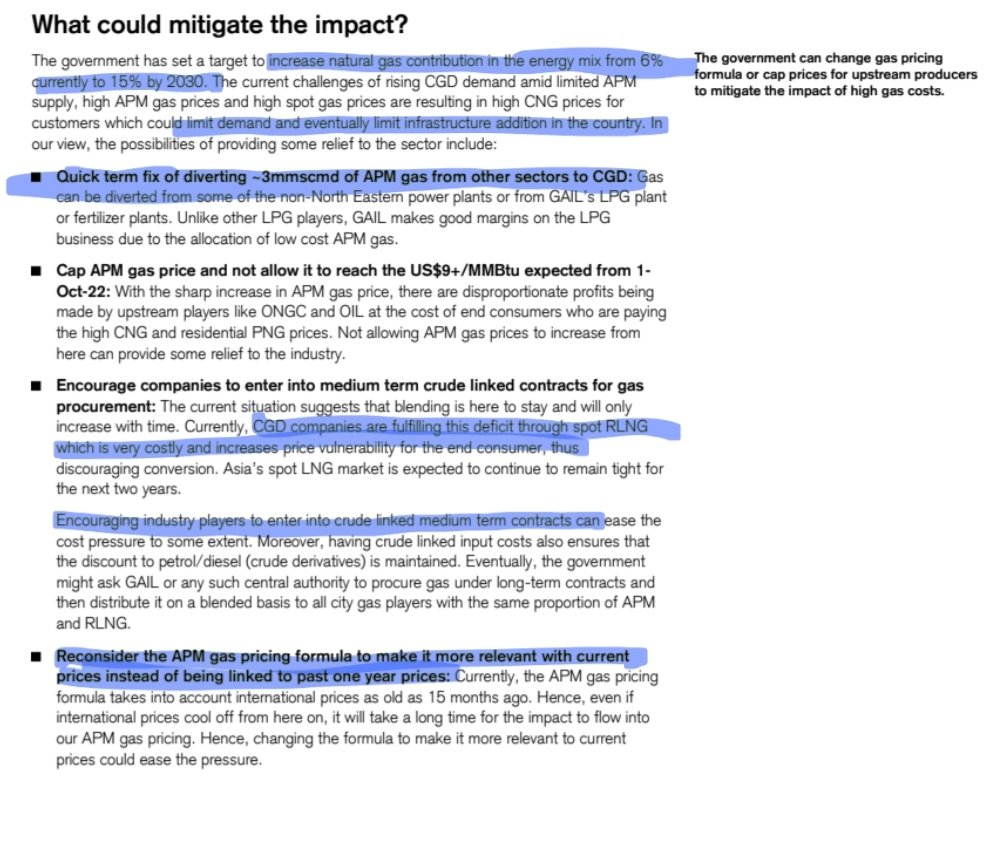

India Ratings on CGD : City Gas Players to Face Margin Pressures and Demand Headwinds

https://twitter.com/IndiaRatings/status/1521719202419073024?t=Qa-xJKnRp_wXYQlSxNRWhw&s=19

CGDs blending ratio is around 25% of non domestic gas which may move to blending ratio of 50% country level / fertilizer

Pic 2 : demand increased but domestic gas consumption decreased

New round (9 to 11) of bids will increase and may not get gas allocation

Pic 2 : demand increased but domestic gas consumption decreased

New round (9 to 11) of bids will increase and may not get gas allocation

Any diversion from fertilizers sector to CGD will increase government subsidy bill (FY21 - ₹1Tn)

Even at current prices subsidy bill could touch ₹2tn

Even at current prices subsidy bill could touch ₹2tn

Can CGDs hike gas prices to offset margin ?

Mostly no. Why?

- Already hiked gas prices

- further hike will make Gas less attractive to other fuels

- consumers may shift to other alternate fuels

- domestic homes will not opt for cgd

Mostly no. Why?

- Already hiked gas prices

- further hike will make Gas less attractive to other fuels

- consumers may shift to other alternate fuels

- domestic homes will not opt for cgd

Reliance & Many other brokers expect gas orices to reach at levels of $9/mmbtu from current $6.1/mmbtu by Oct-23.

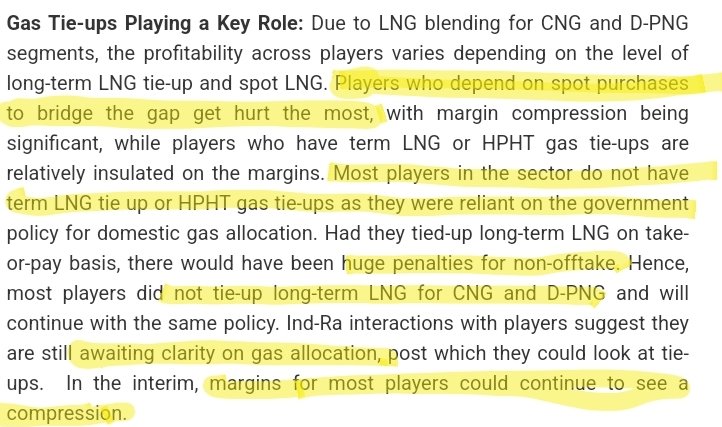

They cannot enter into long term contract even though spots contracts hurt them for LNG..double whammy

They cannot enter into long term contract even though spots contracts hurt them for LNG..double whammy

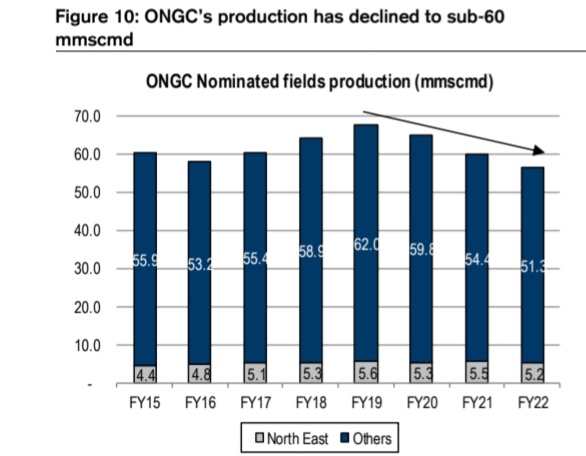

Can't we increase domestic gas production?

No, because of challenges and difficulties in exploration.

See below even though new ONGC gas fields will come up but there increased production will be offset by decreased production from existing gas fields.

No, because of challenges and difficulties in exploration.

See below even though new ONGC gas fields will come up but there increased production will be offset by decreased production from existing gas fields.

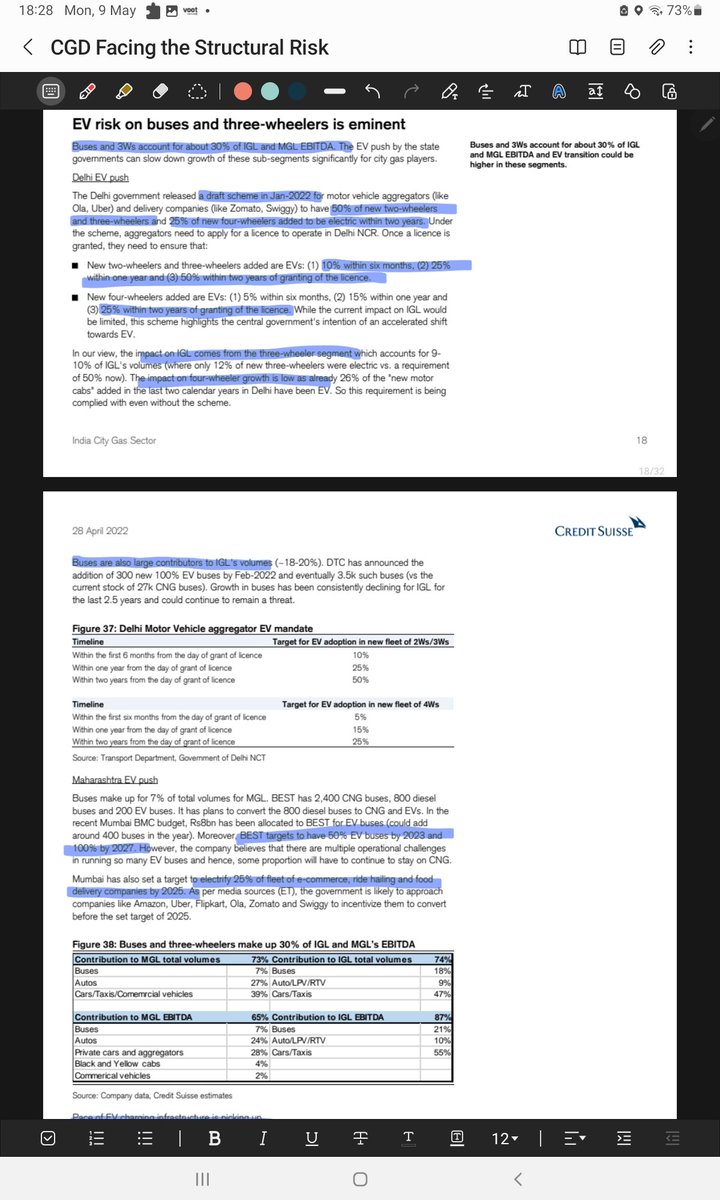

Rise of EV adoption is also risk : the push of EV adoption is kire aggressive in Dekhi & Maharashtra where most of CNG stations are.

This will hurt MGL & IGL most

This will hurt MGL & IGL most

Capex not stopping even though impending downcycle bcoz most of this capex has been already committed to Govt via auctions.

For Ex - 29 out of 33 CGD licenses won in later roubds where gas supply from domestic src nearly impossible

Here is #IGL capex trend

For Ex - 29 out of 33 CGD licenses won in later roubds where gas supply from domestic src nearly impossible

Here is #IGL capex trend

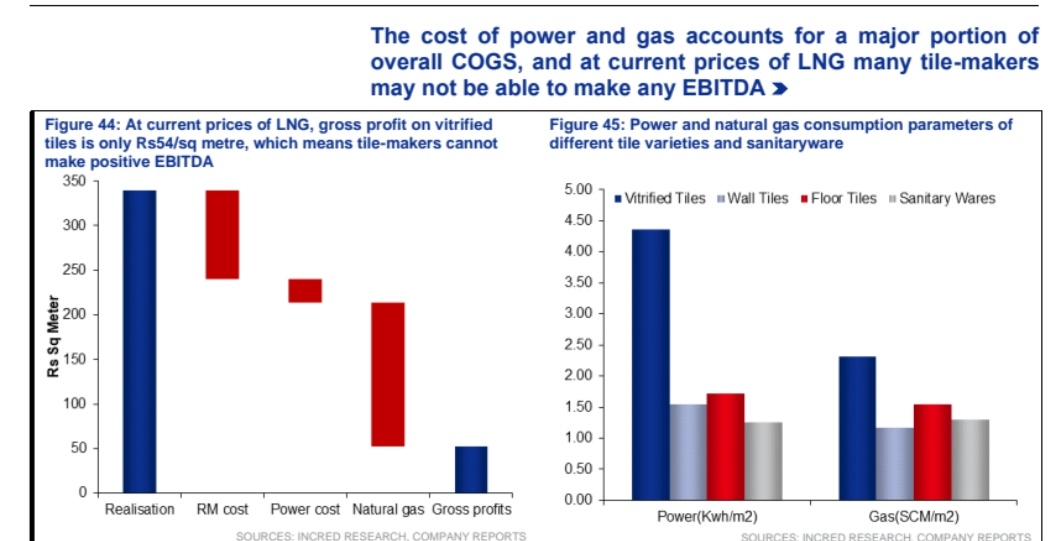

Industrial customers facing heat of higher gas prices already

Ex - Morbi which accounts for 80% of tile production are operating at 70% capacity & may not EBITDA +ve at current gas prices.

This is hurting Gujarat Gas which derives major revenue from Morbi region

Ex - Morbi which accounts for 80% of tile production are operating at 70% capacity & may not EBITDA +ve at current gas prices.

This is hurting Gujarat Gas which derives major revenue from Morbi region

Based on positioning in the value chain, Oil & Gas companies are bifurcated as:

Upstream (Exploration & production) - ONGC, RIL, Essar Oil

Midstream (Transportation & storage) - HP, IOCL

Downstream (Distribution & Marketing) - GAIL, Gujarat Gas, ATGL, IGL, MGL

Src Multipie

Upstream (Exploration & production) - ONGC, RIL, Essar Oil

Midstream (Transportation & storage) - HP, IOCL

Downstream (Distribution & Marketing) - GAIL, Gujarat Gas, ATGL, IGL, MGL

Src Multipie

So from above thread following is conclusion

Upstream will make bumper profits on back rising prices

Downstream will continue to see decline in profitability even though revenue will grow double digit.

Avoid gas distribution companies

Upstream will make bumper profits on back rising prices

Downstream will continue to see decline in profitability even though revenue will grow double digit.

Avoid gas distribution companies

Why City Gas Distribution Shares Fall by 50%?

City Gas Distribution Sector Analysis

Value Chain

Whats wrong with Sector?

Why they are facing structural risk?

Covers : ATGL, IGL, MGL, Gujarat Gas

#CGD #ATGL #GAIL #IGL #MGL

City Gas Distribution Sector Analysis

Value Chain

Whats wrong with Sector?

Why they are facing structural risk?

Covers : ATGL, IGL, MGL, Gujarat Gas

#CGD #ATGL #GAIL #IGL #MGL

Two Important Updates on Gas Distribution Sector

1.Govt asked GAIL to buy imported gas to supply to CGD sector at price of $9/mmbtu

2. Domestic Gas Allocation will be done on Quarterly basis as against 6 months

3. PSU gas co like MGL / Guj Gas post btr results bcoz gas hike

1.Govt asked GAIL to buy imported gas to supply to CGD sector at price of $9/mmbtu

2. Domestic Gas Allocation will be done on Quarterly basis as against 6 months

3. PSU gas co like MGL / Guj Gas post btr results bcoz gas hike

Another risk to City Gas Distribution Sector : New Alternative ways of distribution

Small Liquefaction Plant

m.economictimes.com/industry/energ…

Mobile CNG stations soon to deliver fuel at customers; doorsteps in Mumbai : A startup intiative with MGL

moneycontrol.com/news/business/…

Small Liquefaction Plant

m.economictimes.com/industry/energ…

Mobile CNG stations soon to deliver fuel at customers; doorsteps in Mumbai : A startup intiative with MGL

moneycontrol.com/news/business/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh