Understand Options’ VEGA

“VEGA is not exactly the volatility but a tool to measure the effect of it”

A Detailed thread 🧵

#Options #Greeks

“VEGA is not exactly the volatility but a tool to measure the effect of it”

A Detailed thread 🧵

#Options #Greeks

After reading this thread, you will come to know:

Volatility

Implied Volatility

VEGA

Positive & Negative Vega

Vega Neutrality

Volatility

Implied Volatility

VEGA

Positive & Negative Vega

Vega Neutrality

1/ So far, we have learned about three option Greeks namely, Delta, Theta, and Gamma.

If you have not read them, the links are available at the end of this thread.

In this thread, we are going to discuss another notorious Greek used in options analysis, named Vega.

If you have not read them, the links are available at the end of this thread.

In this thread, we are going to discuss another notorious Greek used in options analysis, named Vega.

2/ Before we proceed let’s first understand Volatility

Suppose a stock A is making new highs and lows or fluctuating to create wild swings within a short period of time. Such a stock is said to be highly volatile

Suppose a stock A is making new highs and lows or fluctuating to create wild swings within a short period of time. Such a stock is said to be highly volatile

Another stock B is making new highs in a smooth fashion, reflecting more stability, is said to be less volatile

Therefore, volatility depends upon two factors:

Number of price points that an instrument moves up or down

The speed with which the price movement takes place

Therefore, volatility depends upon two factors:

Number of price points that an instrument moves up or down

The speed with which the price movement takes place

In this sense, volatility is the rate at which the price of an instrument moves up or down over a certain period of time

3/ Implied Volatility (IV)

The measurement of volatility can be done on the basis of three factors:

Historical price movement

Current price movement and

The future price movement of an instrument

The measurement of volatility can be done on the basis of three factors:

Historical price movement

Current price movement and

The future price movement of an instrument

The volatility based upon the last factor is known as IV

IV is the forecast, by the market, of the future price fluctuations of an instrument in a specific period of time

IV is the forecast, by the market, of the future price fluctuations of an instrument in a specific period of time

Example:

Let us say that a stock is trading at Rs500 and its IV is 25%. It means that the stock would fluctuate between 375 and 625 in a year time period, that is 25% in either direction from 500

Let us say that a stock is trading at Rs500 and its IV is 25%. It means that the stock would fluctuate between 375 and 625 in a year time period, that is 25% in either direction from 500

This fluctuation is one standard deviation from the mean price (which is the market price 500 in this case).

However, the price may fluctuate two, three, or more standard deviations away from the price but the probability of the latter cases is far less than the former (1 standard deviation) as shown in the following probability curve

It should be mentioned here that IV is not a constant. It may vary for many reasons such as news, announcements, results, and shocking events like war, etc.

The term IV is vital for options traders and measures the risk involved in an option

The term IV is vital for options traders and measures the risk involved in an option

4/ Vega

By definition, Vega is a tool used to measure the change in an option’s price w.r.t change in IV

In other words, it predicts the sensitivity of an option in relation to a 1% change in expected future volatility.

We can say that it is a derivative of IV

By definition, Vega is a tool used to measure the change in an option’s price w.r.t change in IV

In other words, it predicts the sensitivity of an option in relation to a 1% change in expected future volatility.

We can say that it is a derivative of IV

Let’s understand how, with the help of Ex.

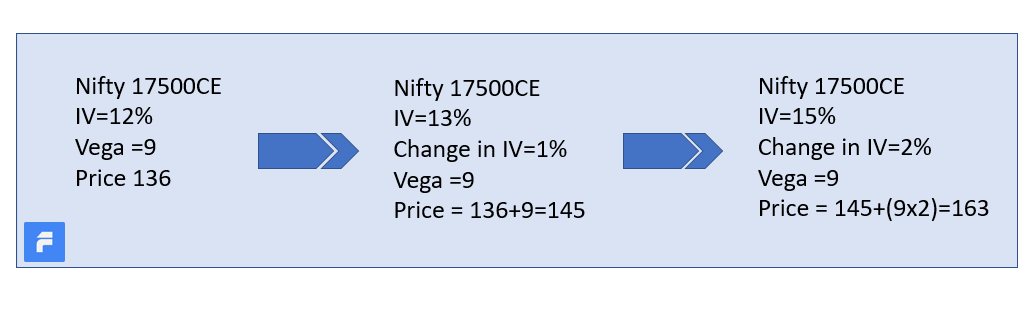

Let us say Nifty 17500CE @ Rs136 has IV 12% and Vega 9

Now if IV increases by 1%, that is from 12% to 13%

then 17500CE would be = Rs136 + 9 = 145

So, with 1% increase in IV option premium increases by Vega = 9

Let us say Nifty 17500CE @ Rs136 has IV 12% and Vega 9

Now if IV increases by 1%, that is from 12% to 13%

then 17500CE would be = Rs136 + 9 = 145

So, with 1% increase in IV option premium increases by Vega = 9

Now if IV increases from 13% to 15% (by 2%), then option would increase by Vega x 2 = 9 x 2 =18

New price 17500CE = 145 + 18 = 163

New price 17500CE = 145 + 18 = 163

5/ Vega over time

We all understand that market fluctuations are not uniform.

Sometimes we observe very calm trending movements while on the other times market ruthlessly swings and hits all stops on both sides

We all understand that market fluctuations are not uniform.

Sometimes we observe very calm trending movements while on the other times market ruthlessly swings and hits all stops on both sides

This clarifies that IV keeps on fluctuating and hence Vega too changes over a period of time. Those who trade on the basis of Vega keep a keen eye on it for any change that can be observed

Following is an illustrative example showing Vega's trend over time:

Vega is highest near ATM options

Vega for a far option (more time to expiry) will be higher than a near option

Therefore, Vega decreases as an option approaches its expiry

Vega is highest near ATM options

Vega for a far option (more time to expiry) will be higher than a near option

Therefore, Vega decreases as an option approaches its expiry

7/ Positive and Negative Vega

Now we know that an option’s premium increases with an increase in IV and it decreases with a decrease in IV

Now we know that an option’s premium increases with an increase in IV and it decreases with a decrease in IV

An option buyer would expect IV to increase which leads an increase in premium whereas, an option seller would expect a decrease in IV so that premium melts

Due to the above reasons, Vega is considered positive for long options and negative for short options.

Due to the above reasons, Vega is considered positive for long options and negative for short options.

8/ Volatility Exposure

Let us say that we create the following position

Short Infy 1800CE with 75 days to expiry and Vega = 3.18

Long Infy 1800CE with 12 days to expiry and Vega = 1.21

Let us say that we create the following position

Short Infy 1800CE with 75 days to expiry and Vega = 3.18

Long Infy 1800CE with 12 days to expiry and Vega = 1.21

In this case, we have

Net Vega = 3.18 – 1.21 = 1.97

This means positive exposure to volatility

Net Vega = 3.18 – 1.21 = 1.97

This means positive exposure to volatility

9/ Vega Neutrality

Positive Vega means higher risk against the increase in volatility

A position having net Vega as zero is called Vega neutral and hence minimal risk against volatility

Positive Vega means higher risk against the increase in volatility

A position having net Vega as zero is called Vega neutral and hence minimal risk against volatility

Let us say we are

Long XYZ 500CE @ Rs24 with Vega = 4

This means that if IV decreases by 1% new premium will be 24 – 4 = Rs20

So, a 1% decline in IV here means a loss of 16.6%

Long XYZ 500CE @ Rs24 with Vega = 4

This means that if IV decreases by 1% new premium will be 24 – 4 = Rs20

So, a 1% decline in IV here means a loss of 16.6%

In order to mitigate this problem, we

Short 2lots of XYZ 550CE @ 12 with Vega = 2

Net Vega for Long and short call = Long (No. of CE x V) – Shorted (No. of CE x V)

Net V = (1 x 4) – (2 x 2) = 0

Short 2lots of XYZ 550CE @ 12 with Vega = 2

Net Vega for Long and short call = Long (No. of CE x V) – Shorted (No. of CE x V)

Net V = (1 x 4) – (2 x 2) = 0

We will discuss a few popular options strategies in our upcoming articles so stay tuned

For more such content, keep liking and sharing our threads on social media, and follow us @FinkarmaIN

Thanks for reading

For more such content, keep liking and sharing our threads on social media, and follow us @FinkarmaIN

Thanks for reading

• • •

Missing some Tweet in this thread? You can try to

force a refresh