The time has finally arrived to simplify how we use the volume indicator on our charts. With a Tradingview script at the end, here is a thread🧵 on what “simple” volumes are, & how to use them: 👇

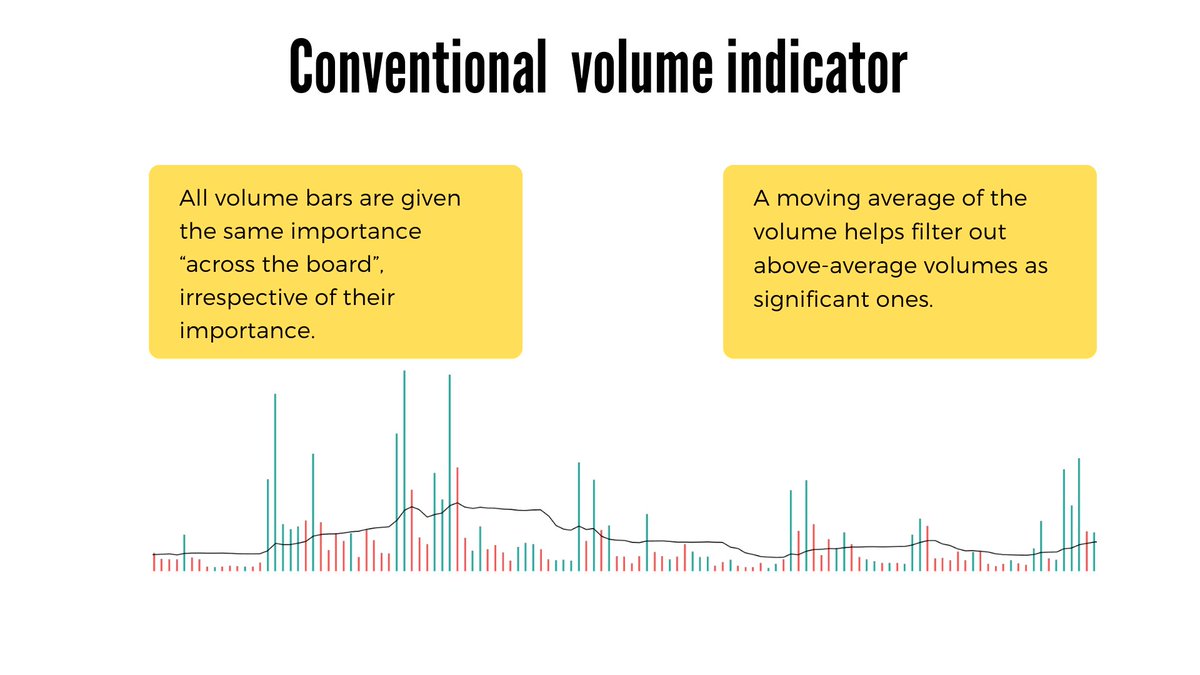

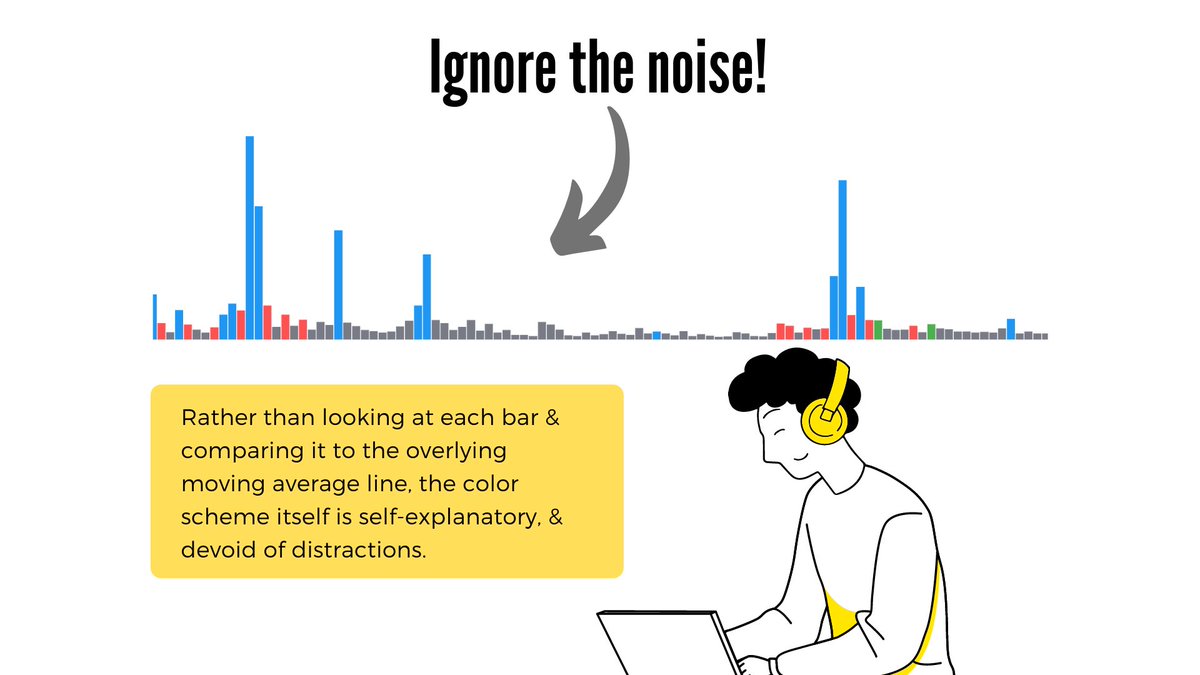

The conventional volume indicator is full of ‘noise’ in that all volume bars are given the same importance. Color & size are the two informations they provide. But this information is “across the board”, irrespective of when it’s important enough or not.

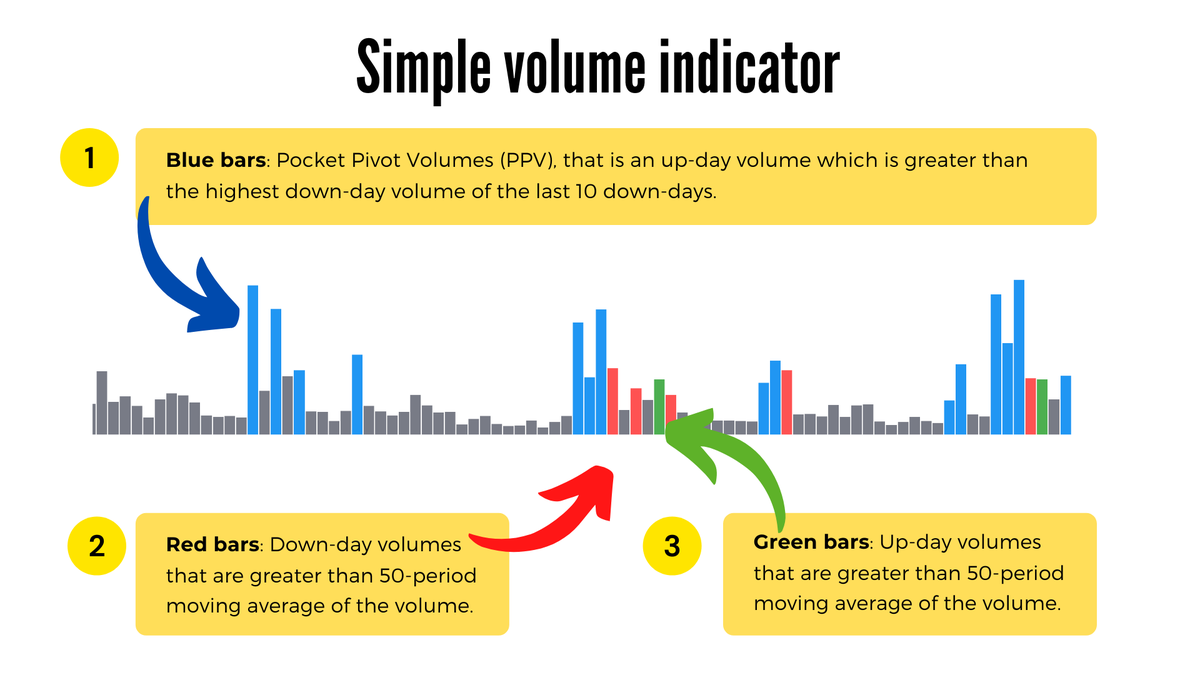

The Simple volume indicator is minimalistic, in that it strips away the conventional volume indicator from a lot of “noise”, & help narrow our focus on actionable volume bars only. It displays only 3 type of volume bars prominently: blue, green & red.

Other than these 3, all other volumes are “noise” & need not be kept into any actionable consideration. All these inconsequential bars are grey. Moving average of the volume is also purposely hidden, as the grey bars themselves are indication of a below-average volume.

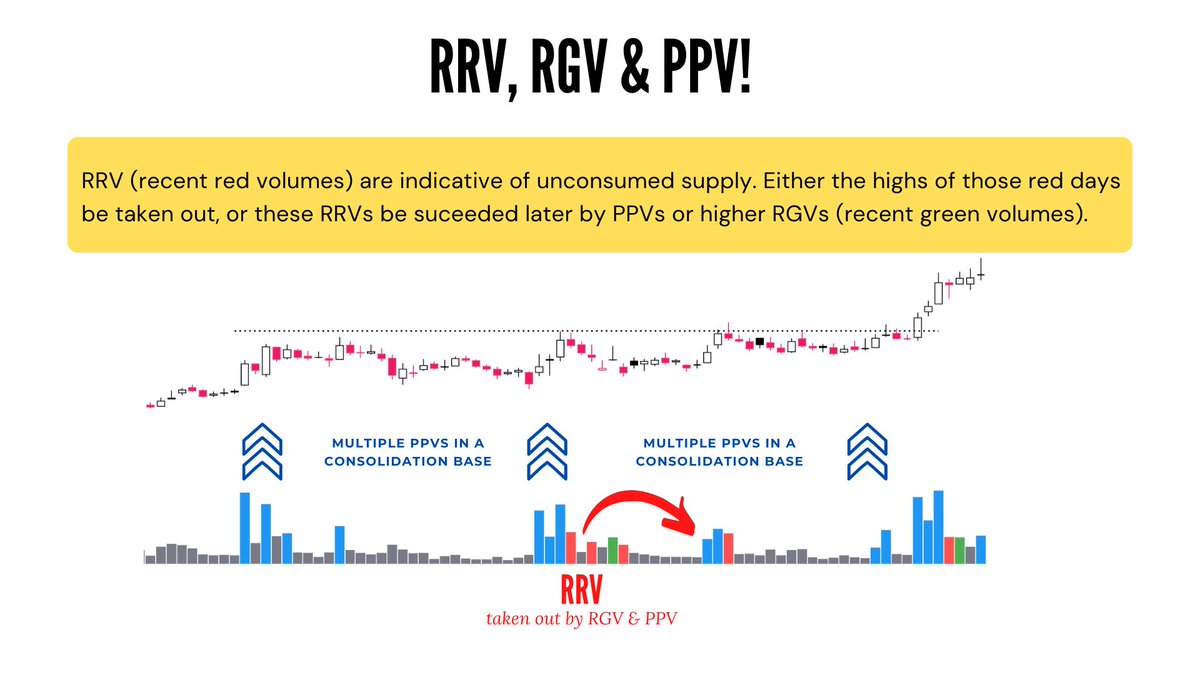

While initiating a long entry, we need to look out for only these 3 volume bars, & arrive at our decision. PPVs are the best indicator of institutional accumulation. Multiple PPVs in a consolidation base, & in a breakout candle are very bullish signals.

Hope you find this useful. If you'd like to read this thread as a newsletter, find it here:

world.hey.com/nitinranjan/si…

world.hey.com/nitinranjan/si…

@jeffsuntrading Hey Jeff, the indicator is live now with an option to display the average dollar volume in millions.

https://twitter.com/finallynitin/status/1659963901520539649

• • •

Missing some Tweet in this thread? You can try to

force a refresh