Alright, so here's the DD I've been working on lately. This is regarding ticker $BRQS. Before beginning, this is not financial advice, and this trade is very high-risk by all accounts based on both fundamental and technical analysis.

This will be long, but bear with me.

This will be long, but bear with me.

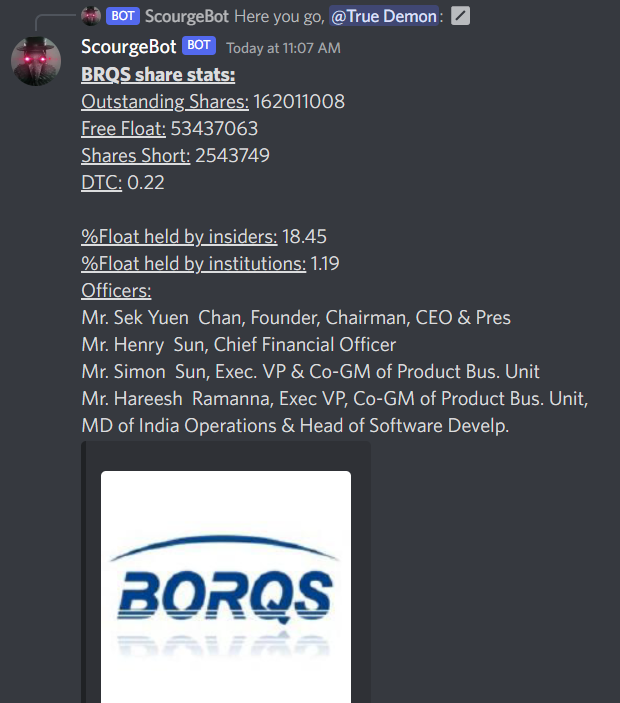

$BRQS or Borqs Technologies is an #IoT (Internet of Things) software company focused on building smart hardware and embedded technology.

They're a micro-cap / small-float which has at least 162M shares outstanding and has been struggling with its financing for years.

They're a micro-cap / small-float which has at least 162M shares outstanding and has been struggling with its financing for years.

They are currently working on entering the EV space by designing and manufacturing hardware for EV chargers and smart home products for average consumers to capture a portion of the growing EV market.

It's a good space to get into, given recent events

borqs.com/NewsEvents/New…

It's a good space to get into, given recent events

borqs.com/NewsEvents/New…

Unfortunately $BRQS has been struggling financially for a long time, and received a financing agreement from a familiar face... Those of you who have been in $MULN likely know this figure.

That's right. Esousa Holdings.

fintel.io/so/us/brqs/eso…

That's right. Esousa Holdings.

fintel.io/so/us/brqs/eso…

Esousa and LMF Acquisitions partnered up to provide a financing agreement in the form of senior convertible notes of $BRQS back in Dec 2020 which is coming due at the end of this year.

This is part of an acquisition agreement in which $BRQS is obligated to issue shares to LMFA

This is part of an acquisition agreement in which $BRQS is obligated to issue shares to LMFA

That filing is here: content.edgar-online.com/ExternalLink/E…

The gist of it is that $BRQS owes a $5M traunch of shares to LMFA and Esousa, and the lower the price goes, the more shares they receive, regardless of dilution.

The company was essentially duped into a malignant financing agreement.

The gist of it is that $BRQS owes a $5M traunch of shares to LMFA and Esousa, and the lower the price goes, the more shares they receive, regardless of dilution.

The company was essentially duped into a malignant financing agreement.

At the time this agreement was filed, $BRQS had only 26.98M shares issued and outstanding.

As of today, $BRQS outstanding shares sits at over 162M, but could be as high as 180M shares. The price has obviously slumped down to $0.20 as of this latest trading week.

As of today, $BRQS outstanding shares sits at over 162M, but could be as high as 180M shares. The price has obviously slumped down to $0.20 as of this latest trading week.

To make matters worse, $BRQS received a delisting notification on August 20, 2021 because it's minimum bid requirements of $1.00 were not met.

Essentially, the price was below $1 for 30 days, so $BRQS needs to salvage the situation quickly.

globenewswire.com/news-release/2…

Essentially, the price was below $1 for 30 days, so $BRQS needs to salvage the situation quickly.

globenewswire.com/news-release/2…

As of Feb 22, 2022, the company has been eligible for delisting by NASDAQ and must submit a plan to rectify the issue of its share price either by reverse split or some other mechanism to restore its share price above $1.00 for 30 consecutive days.

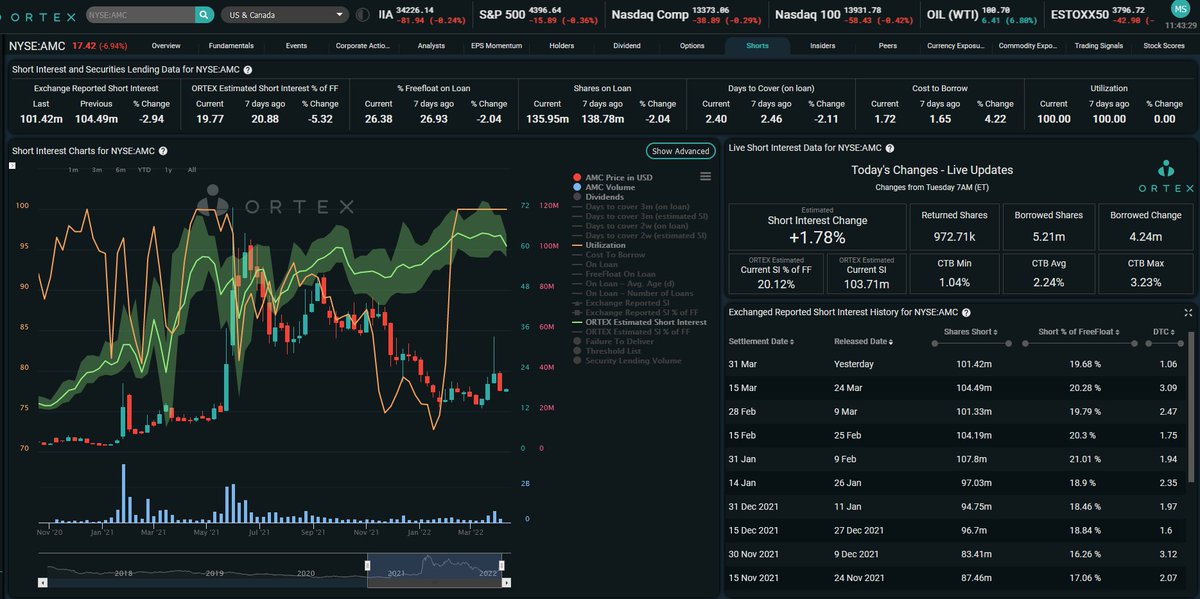

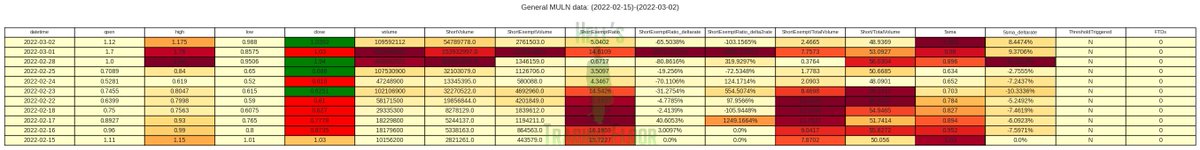

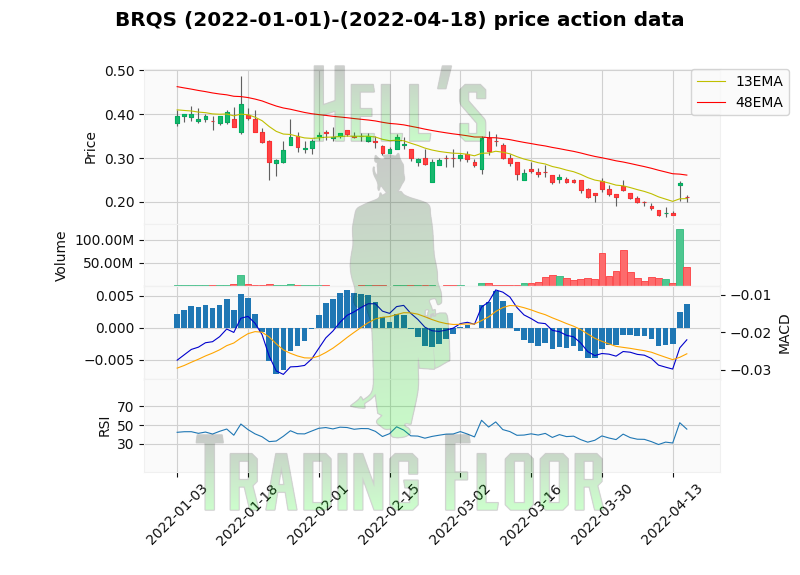

Now... here is where the shit gets interesting. The #HellsTradingFloor bot picked up a massive surge of buying volume, accumulation, and short exempts on $BRQS in the past trading week.

Something is going on with this particular ticker that smells like bullshit.

Something is going on with this particular ticker that smells like bullshit.

Even the MACD long slope to the downside is so severe that this cross could signal a massive reversal by itself, but it came out of nowhere. Some big institutions are leveraging positions here.

What I'm observing in $BRQS is something well-known in the financial industry among malicious shorts is known as cellar boxing, which is a situation in which a stock is pushed down below the $1.00 listing requirements, and it gets pummelled to death by arbitrage via shorting.

The result is that the company is eventually delisted once it cannot survive the onslaught anymore and runs out of financing options, inevitably going bankrupt.

But this is a situation in which retail is capable of taking control back from the institutions.

But this is a situation in which retail is capable of taking control back from the institutions.

While the price is this low, it is possible for retail investors to purchase the entire company for $30M and exhaust the entire supply. This is just a mathematical fact.

For $1M, someone could purchase a 3.5% stake in the company.

$1k buys 5000 shares

For $1M, someone could purchase a 3.5% stake in the company.

$1k buys 5000 shares

The market makers are the ones playing this game and helping malignant financiers hold this company's head underwater and drowning it so they can profit from the arbitrage using short exempts.

But if retail scoops up shares en-masse right now, the company can be swept up.

But if retail scoops up shares en-masse right now, the company can be swept up.

Short exempts in the past week have been growing excessive, and if retail starts buying up the company, it can both rescue the company and simultaneously force market makers to facilitate the volatility by taking more short exempts.

Unlike $MULN, $BRQS can be hit early by retail

Unlike $MULN, $BRQS can be hit early by retail

The way this works is if retail manages to exhaust the outstanding shares of the company and force the market maker to suppress their buying volume with more short-exempts, the market maker will be forced to cover those short-exempts at a later date where the price will be higher

Additionally, if the entire tradable float of the stock is exhausted and held by retail at the time when market makers must cover and deliver those Failures-to-Deliver, they'll be forced to buy at the market price.

They will likely borrow short shares against it first as usual.

They will likely borrow short shares against it first as usual.

This is because they like to kick the can down the road, but if we make them play our game, we can actually hurt them and make them bury themselves.

It's a form of financial protest, if anything, but trust me when I say this is extremely risky. This stock could be delisted tmrw.

It's a form of financial protest, if anything, but trust me when I say this is extremely risky. This stock could be delisted tmrw.

Assuming this stock moves against the market maker in the next few weeks, the volatility could actually smash each market maker, including Citadel and Virtu, who have been juggling positions in and out of $BRQS every quarter.

This is not a recommendation to buy or sell any stock. I've purchased a position in $BRQS because I believe it carries a possibility to squeeze if retail sentiment continues to build for the stock, and because there are no options in the stock, MM option hedging is not possible.

This means the share price controls everything, and if the market maker is put in a position of being forced to cover shares purely with share borrowing and purchasing, then it will cause the price to swing violently in ways we can't even begin to imagine.

Don't follow my trades. Do your own DD. If you want to kick market makers in the nuts, feel free to join me for a little bit of stock market vandalism. I'll have more DD in #HellsTradingFloor.

Make a decision soon though because... whales started buying this morning.

Make a decision soon though because... whales started buying this morning.

@threadreaderapp unroll

Correction to this thread: delisting date is officially set for August 15, 2022. Deadline to raise the price to $1.00 or above for 10 consecutive days

• • •

Missing some Tweet in this thread? You can try to

force a refresh