How to get URL link on X (Twitter) App

For those who are unaware, Congress and the White House are terrified of a rail union strike because it would cripple the US economy and cause transportation/logistics to break down.

For those who are unaware, Congress and the White House are terrified of a rail union strike because it would cripple the US economy and cause transportation/logistics to break down.

https://twitter.com/TRUExDEMON/status/1545152900078243840$BBIG has more than 250,000 call options hidden in the options chain with the potential to expire ITM and put unimaginable pain on market makers and the shorts who have beaten $BBIG into the dirt.

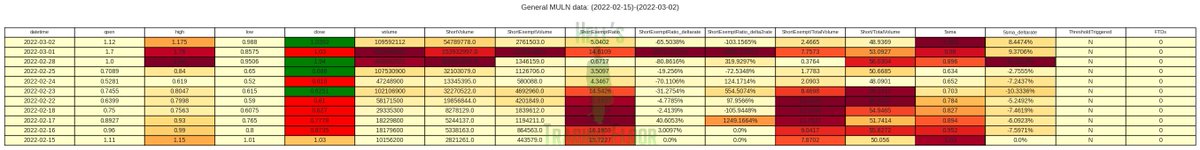

These are just technicals, but the extreme short exempts on $BBIG are in-line with the same behavior that I've observed in dozens of squeezes that were bottoming out within days of squeezing to new heights.

These are just technicals, but the extreme short exempts on $BBIG are in-line with the same behavior that I've observed in dozens of squeezes that were bottoming out within days of squeezing to new heights.

https://twitter.com/TRUExDEMON/status/1542362719055015937Expect further details from us once we have made some progress on the project.

The bad news is that the bid and ask on $BBIG's "adjusted options" is non-existent, indicating that pricing is being dictated by the market makers because retail participants are either unaware or unable to trade these options due to broker restrictions.

The bad news is that the bid and ask on $BBIG's "adjusted options" is non-existent, indicating that pricing is being dictated by the market makers because retail participants are either unaware or unable to trade these options due to broker restrictions.

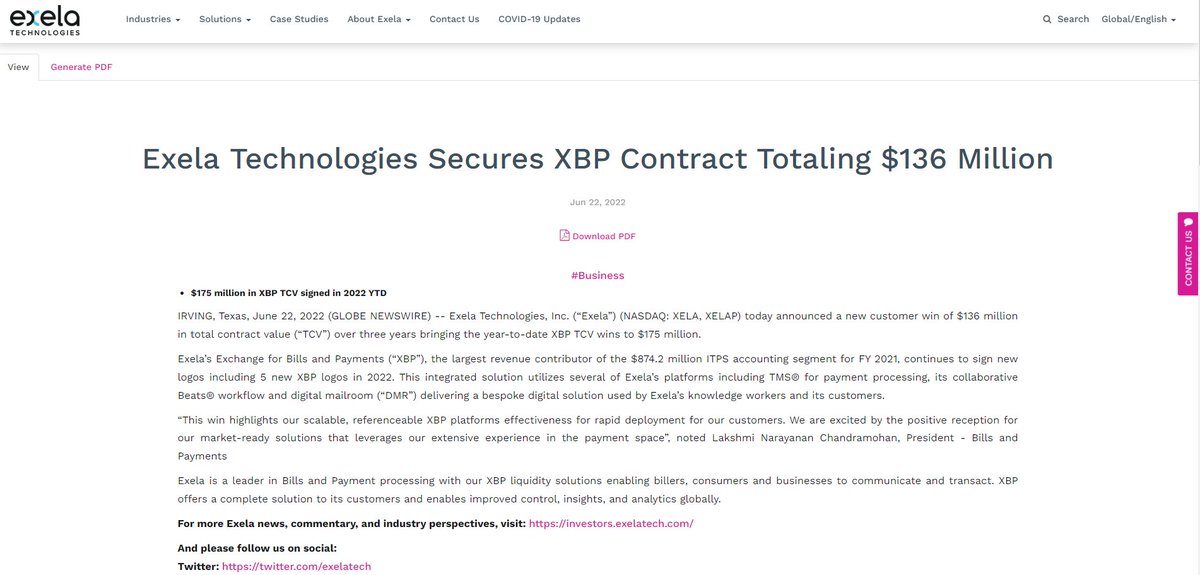

What I find so curious is that $XELA has had a run of good luck in terms of its financial debt restructuring, adding up to a $6M yearly savings on interest, plus multiple new contracts with international and domestic clients adding over $180M to their revenue in just 3 months.

What I find so curious is that $XELA has had a run of good luck in terms of its financial debt restructuring, adding up to a $6M yearly savings on interest, plus multiple new contracts with international and domestic clients adding over $180M to their revenue in just 3 months.

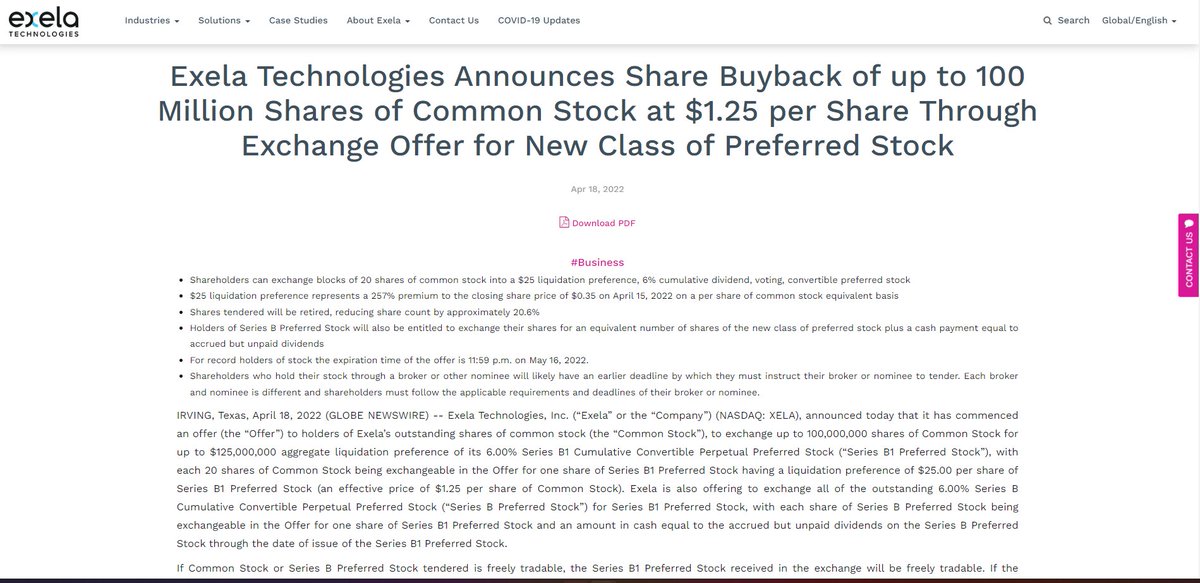

First off, let's review the Ortex Data. Utilization has been maxed out at 100% since the gap-down rug pull in March, and yet shorts and loaned shares have increased since then.

First off, let's review the Ortex Data. Utilization has been maxed out at 100% since the gap-down rug pull in March, and yet shorts and loaned shares have increased since then.

https://twitter.com/unusual_whales/status/1539939072520556545

If this is unclear, there are more than $200 TN in unsecured OTC derivatives held by the largest 25 banks. 90% of this risk is held by the top 6 banks...at a time when bank revenue has posted its first material total losses since this bull market began.

If this is unclear, there are more than $200 TN in unsecured OTC derivatives held by the largest 25 banks. 90% of this risk is held by the top 6 banks...at a time when bank revenue has posted its first material total losses since this bull market began.

This chart demonstrates $MBB versus the $SPX market index.

This chart demonstrates $MBB versus the $SPX market index.

$RDBX (Redbox Entertainment) is currently the largest overleveraged stock on the market according to Ortex data. I've been carefully watching for **any** signs of shorts covering in the last 5 trading days. There have been absolutely none.

$RDBX (Redbox Entertainment) is currently the largest overleveraged stock on the market according to Ortex data. I've been carefully watching for **any** signs of shorts covering in the last 5 trading days. There have been absolutely none.

@ORTEX data shows that 50% of all shorts entered (at best) at $11.00 or lower. The other 50% of all 1.41m shares sold short entered below $3.00 and are deep in the red.

@ORTEX data shows that 50% of all shorts entered (at best) at $11.00 or lower. The other 50% of all 1.41m shares sold short entered below $3.00 and are deep in the red.

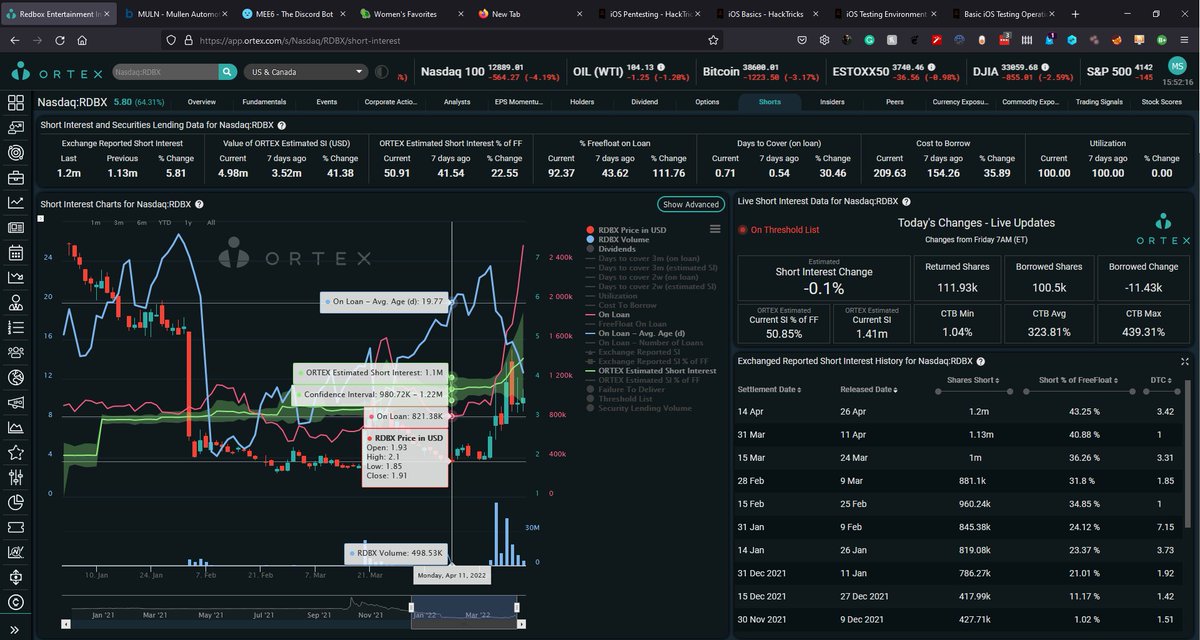

$BRQS or Borqs Technologies is an #IoT (Internet of Things) software company focused on building smart hardware and embedded technology.

$BRQS or Borqs Technologies is an #IoT (Internet of Things) software company focused on building smart hardware and embedded technology.

https://twitter.com/ClimateHuman/status/1513564975524024323These problems are all related to the same evil whose heart beats on Wall Street, New York, NY.

The consistent pattern for $AMC is that the chart always forms a long wedge on the daily chart, and the OBV plateau shows a dip below that wedge before it breaks through both support and resistance, then runs after a brief consolidation period. Note the circled areas on the OBV

The consistent pattern for $AMC is that the chart always forms a long wedge on the daily chart, and the OBV plateau shows a dip below that wedge before it breaks through both support and resistance, then runs after a brief consolidation period. Note the circled areas on the OBV

Short Exempt numbers show that 4.2M short exempts were used on the stock today, which is normal during a highly volatile market where market makers are struggling to fill the buy orders, but these numbers still seem excessive.

Short Exempt numbers show that 4.2M short exempts were used on the stock today, which is normal during a highly volatile market where market makers are struggling to fill the buy orders, but these numbers still seem excessive.

Before you go any further, know that this isn't financial advice, and I'm not an expert in finance or market mechanics.

Before you go any further, know that this isn't financial advice, and I'm not an expert in finance or market mechanics.