It's that time of year again, and we once again opened ARK's Tesla Model. No one from ARK responded to our questions about last year's model in the thread quote-tweeted, and there are even more mistakes/ridiculous assumptions this year.

https://twitter.com/TaylorOgan/status/1374474632359600136

2/ Last year, ARK had 17,640 human-driven Teslas coming onto a non-existent Tesla ride-hail network in 2021.

In this year's model, ARK has 29,293 Teslas coming on in 2022, bear case. Again, this network doesn't exist, nor has Tesla hinted it ever will.

In this year's model, ARK has 29,293 Teslas coming on in 2022, bear case. Again, this network doesn't exist, nor has Tesla hinted it ever will.

https://twitter.com/TaylorOgan/status/1374474633492111374?s=20&t=rATRgThTgfrxjYcwWKoGOA

3/ ARK still figures 50% EBITDA margin on Tesla's non-existent human-driven and robotaxi ride-hail network right off the bat, when Uber & Lyft haven't even been profitable.

https://twitter.com/TaylorOgan/status/1374474634582585347?s=20&t=rATRgThTgfrxjYcwWKoGOA

4/ ARK doesn't stagger vehicles coming onto any platform, and has never modeled this correctly. I went into this more last year. It looks like they tried to do a midpoint thing (row 61), but that isn't how it works.

https://twitter.com/TaylorOgan/status/1374474635748634633?s=20&t=rATRgThTgfrxjYcwWKoGOA

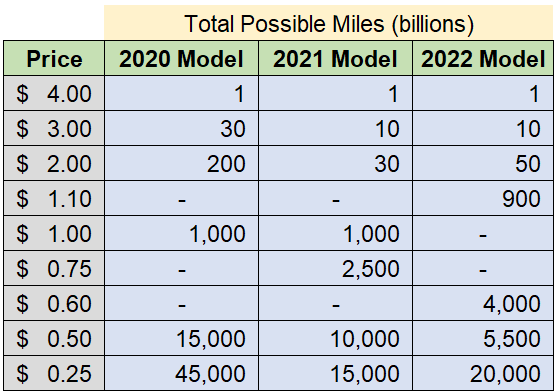

5/ The ASP tables completely changed once again. Why does ARK change the base assumptions for total possible miles every year?

https://twitter.com/TaylorOgan/status/1374474657286352899?s=20&t=rATRgThTgfrxjYcwWKoGOA

6/ Again with the empty cell reference, which is defended by, "Note that we assume that in 2024 Tesla stops using the majority of its excess cash to buy new property plant and equipment."

1) Your years are off.

2) WTF? So it just goes to zero?

1) Your years are off.

2) WTF? So it just goes to zero?

https://twitter.com/TaylorOgan/status/1374474661228998657?s=20&t=rATRgThTgfrxjYcwWKoGOA

7/ Now the new stuff. Remember, ARK locks its spreadsheets so you can't poke around and see how they forecast between now and 2026. We unlocked it.

The most important factors in ARK's entire model are EV/EBITDA for insurance business (which ARK spells "busines"), EV, & robotaxi.

The most important factors in ARK's entire model are EV/EBITDA for insurance business (which ARK spells "busines"), EV, & robotaxi.

8/ ARK figures an enterprise multiple of 13x for Tesla's EV biz, because that's what Daimler is (?), 10x for Tesla's insurance biz, because that's "roughly equivalent to industry average", and 19x for the robotaxi biz, which is "Much less than industry average for software." Huh?

9/ Those assumptions do not change in ARK's bear or bull valuations, and if you tinker with those multiples, you'll get some ridiculous 2026 share prices.

10/ If you hold constant ARK's enterprise multiples, ARK's BULL assumptions suggest a market cap of $327B this year (69% lower than $TSLA's current market cap), and $700B in 2023. Maybe that's why ARK is selling $TSLA?

11/ ARK's model was built entirely on the assumption that Tesla does a ride-hail network. EV/EBITDA is the same whether human-driven or autonomous, purports ARK. #MaaS

That's why 99.7% of ARK's Monte Carlo sims it ran have it higher than current mcap.

That's why 99.7% of ARK's Monte Carlo sims it ran have it higher than current mcap.

https://twitter.com/TaylorOgan/status/1516859824855789571?s=20&t=-0bj-m2Y5tyCoEFdMXuJzQ

12/ What happens if Tesla's robotaxi business has a negative EV/EBITDA, like $LYFT? It destroys ARK's model. In the bull case, Lyft's -13.8x EV/EBITDA would throw ARK's 2026 suggested share price to -$1,147. Yes, negative. Bear case would be $1,210.

13/ ARK added Bitcoin to its TSLA model this year. ARK thinks Tesla will spend 10% of its year-end investable cash on $BTC, and that BTC will have a 33% CAGR.

ARK's Tesla est. for 2022 year-end BTC value: $5.9B (bull) $6.7B (bear)

$TSLA's current BTC value: $1.74B

ARK's Tesla est. for 2022 year-end BTC value: $5.9B (bull) $6.7B (bear)

$TSLA's current BTC value: $1.74B

14/ There's so much more that just doesn't make any sense in this model, & plenty more crazy assumptions, like # of vehicles sold, or that 31% of all new Teslas sold in 2026 will be fed into the non-existent human-driven ride-hail network (bear case), etc.

https://twitter.com/TaylorOgan/status/1516862766761578497?s=20&t=-0bj-m2Y5tyCoEFdMXuJzQ

15/ These are just some initial takeaways from three sets of eyes looking at the model for a few hours. Many thanks to @conor__dalton & @Real_Jack_Shea.

• • •

Missing some Tweet in this thread? You can try to

force a refresh