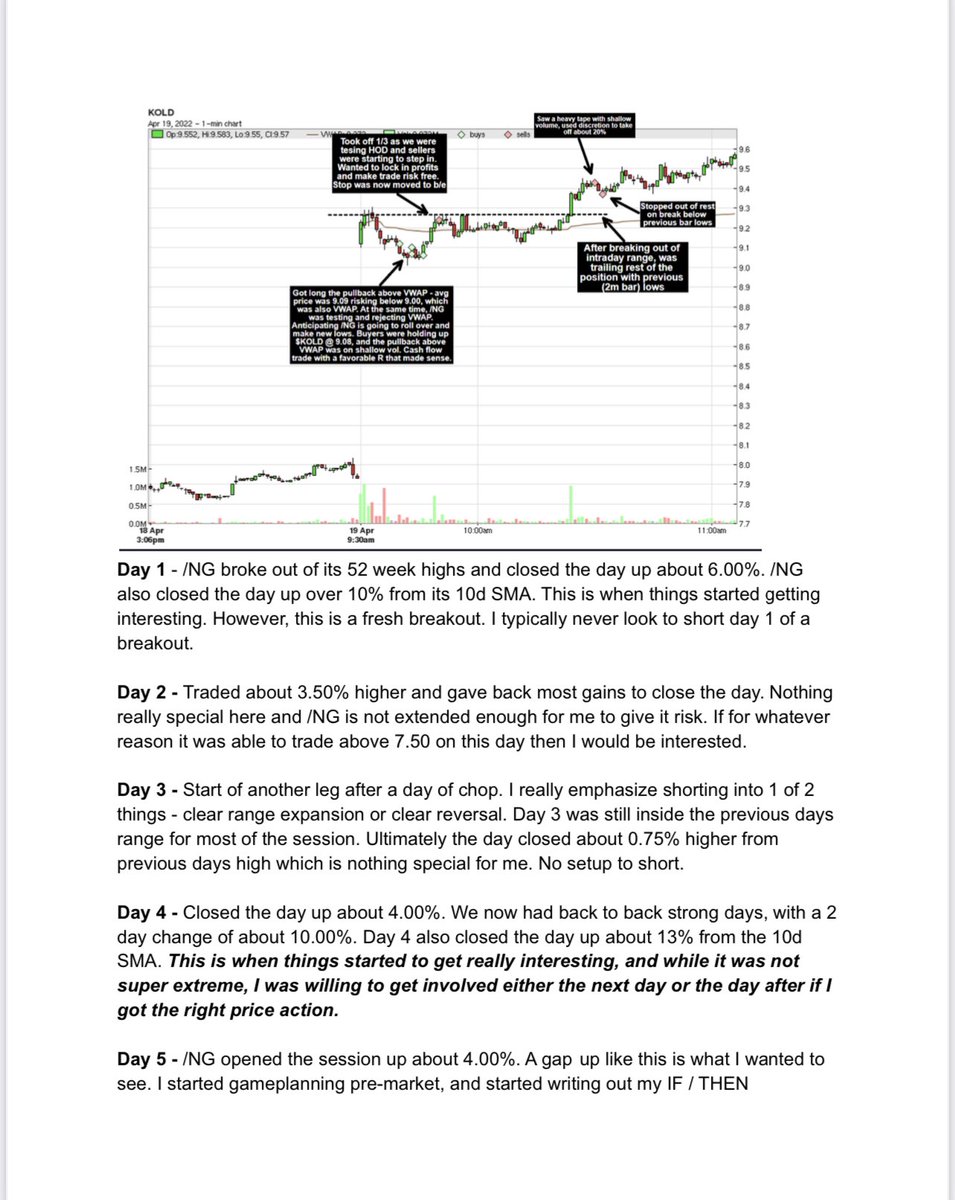

A+ TRADE WRITEUP: Brandon shared this writeup w me having based it on my GME and Yen writeup. Not only did he knock the trade and writeup out of the park, but I traded nat gas similarly myself! Thx to Brandon & @smbcapital for letting me share. Here’s what I loved about it. (1/6)

He proactively gameplanned out the various potential outcomes along with what he was looking for (5/6)

@brandonsochacki for those who wish to follow him on 🐥

• • •

Missing some Tweet in this thread? You can try to

force a refresh