1/ I've followed the IMF for 15 years now, and this is the most impressed I've been by any of their live press events. Some rare truths were shared, on a panel in front of ECB President Christine Lagarde and Fed Chair Jerome Powell.🧵 (video clips below)

2/ The truth teller in question is Kristalina Georgieva, the new Managing Director at the IMF. She grew up in and obtained her phd in communist Bulgaria & did research at London School of Econ and MIT. She co-authored over 100 papers, and previously was World Bank Pres. & CEO.

3/ First, Mrs Georgieva shares some hard facts, which is quite rare in itself for spokespeople from IMFS institutions. She talks about the exploding government debt levels—"largest increase since WWII"—, and how the current spiking rates are putting many countries in a pinch.

4/ She goes on to clarify that we're basically looking at sovereign bond defaults: many governments are staring in the face of bankruptcy and investors will have to accept a haircut on their government bond portfolios (this is what she means with "restructure debt"). Wow.

5/ After talking about some exogenous shocks like Covid and the Ukr-Ru war, Georgieva points out how governments have failed to pay down debt when they could afford to.

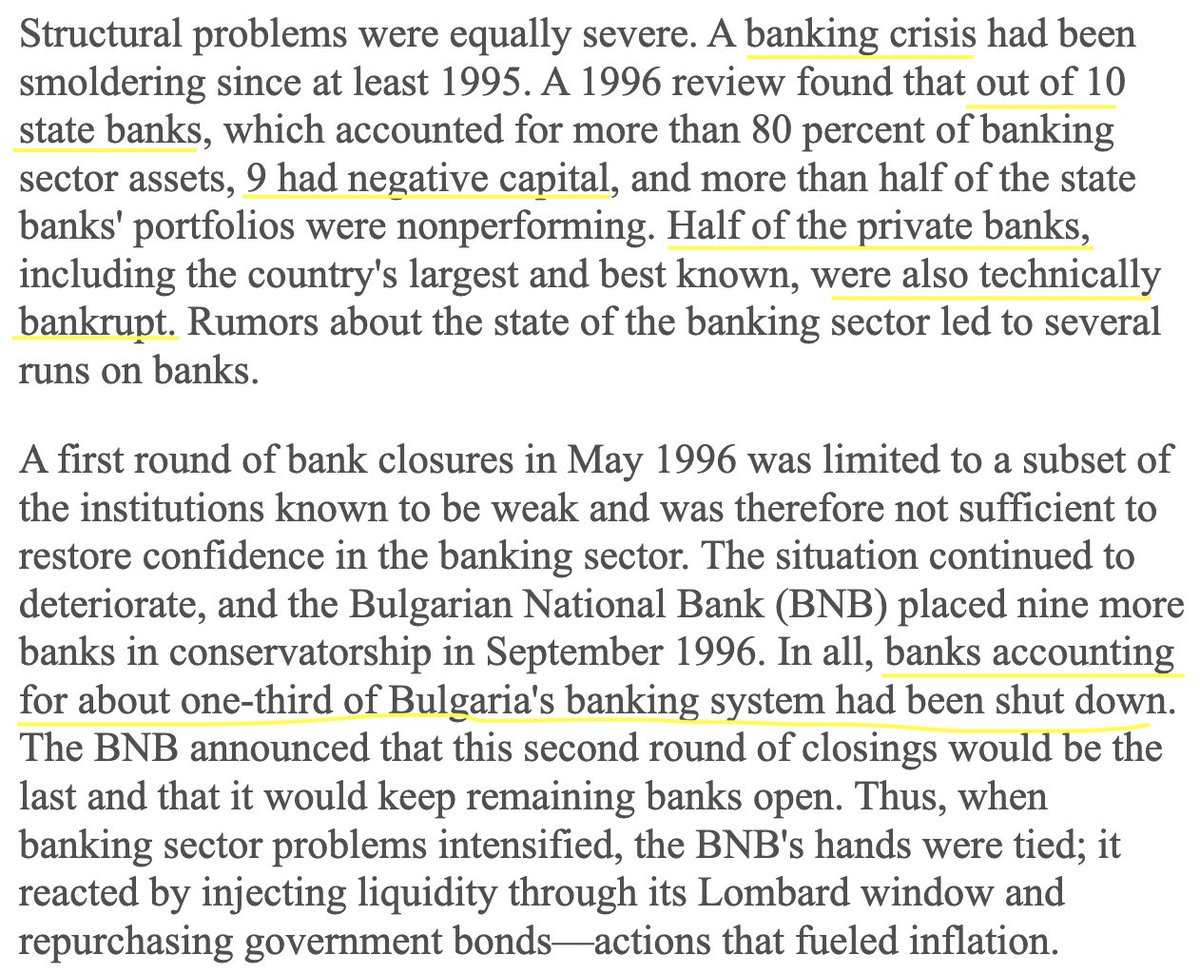

6/ Before I show you the last and most important clip, I think it's relevant to know that Mrs. Georgieva likely had family that lived through Bulgaria's hyperinflation in 1996. I suspect this experience informed what she said on the panel. imf.org/external/pubs/…

7/ During the last moments of the show, Georgieva, as last speaker, spoke a truth rarely spoken in an official live IMF setting; namely that IMFS institutions are often short sighted, and that monetary stimulus programs have the unintended consequence of inflation.

8/ To an audience of hardcore finance tweeps this may not sound impressive, but in a world where nearly all political leaders are pointing solely at exogenous shocks to explain rising inflation, this may be the best we can get in terms of an official acknowledgment of the truth.

9/ Some caveats in closing:

- The clips were short, so some may argue that they're taken out of context. Feel free to check out the full show on the link below.

- I do not know or endorse any of Mrs. Georgieva's positions other than those shown above.

meetings.imf.org/en/2022/spring…

- The clips were short, so some may argue that they're taken out of context. Feel free to check out the full show on the link below.

- I do not know or endorse any of Mrs. Georgieva's positions other than those shown above.

meetings.imf.org/en/2022/spring…

• • •

Missing some Tweet in this thread? You can try to

force a refresh