First legit debate….

https://twitter.com/Stimpyz1/status/1518227141132832769

As far as the part about moving Private Leverage to the Public Balance Sheet.

Public Debt funded Reagan’s SDI, 9-11, 2008 GFC & Covid Near Depression (-5% 1Q20 & -31% 2Q20 GDP w 15% Unemployment)

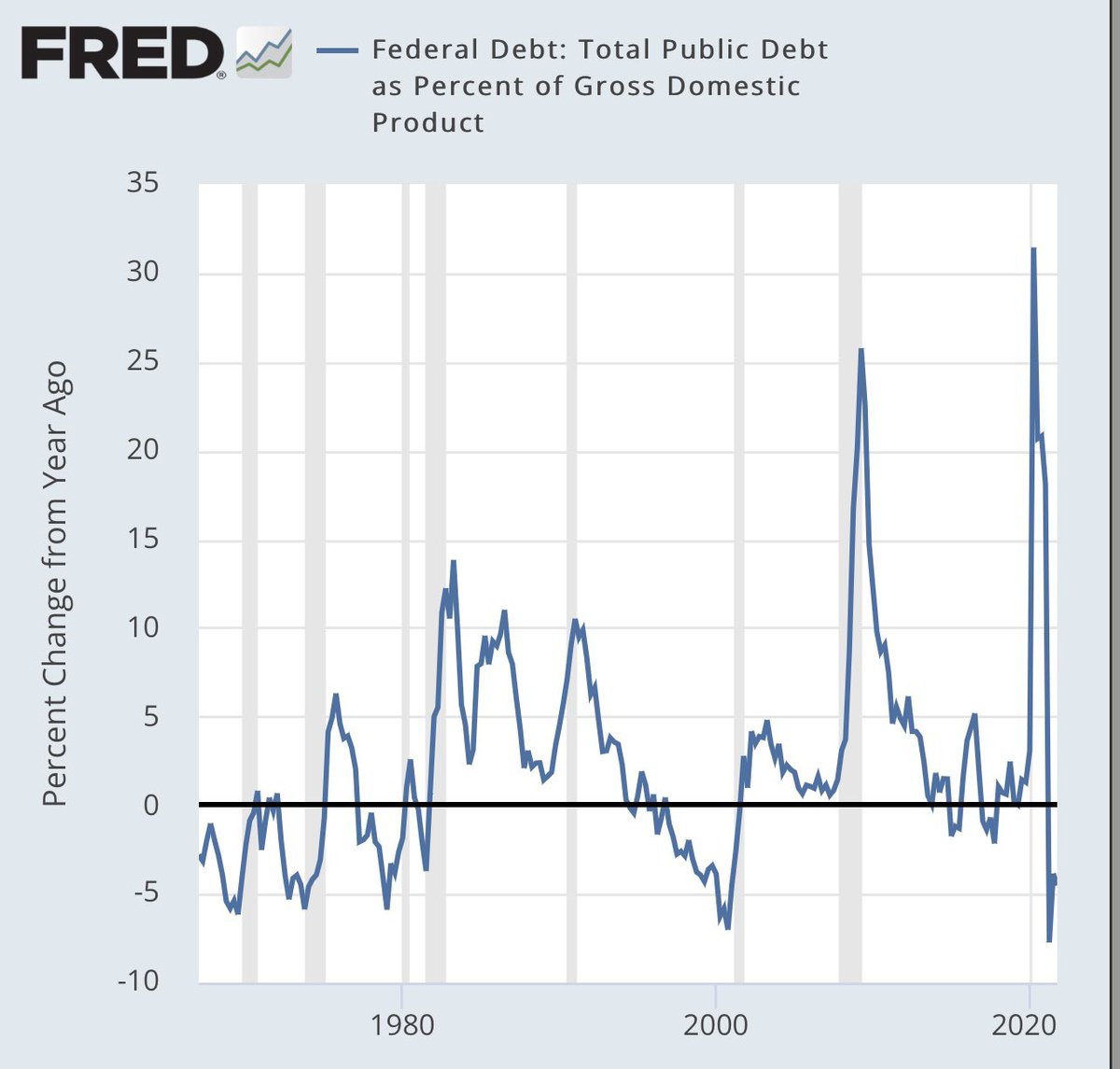

Question is… has Public Debt/GDP Peaked at 135%?

Question is… has Public Debt/GDP Peaked at 135%?

Having said that the rate of change of public debt/gdp has collapsed. As the Fiscal handoff is moving more to Monetary Aggregates like loan growth.

#EarlyCycle

#EarlyCycle

My own view is that Path to Twin Deficit Reduction is gonna be through Nat Gas & Shale Oil… once we get through Nov ‘22 Elections (ESG is just too expensive)..we don’t have the time or Competitive Advantage… eventually we use a cleaner version of Fossil.. w some other stuff.

https://twitter.com/gamesblazer06/status/1484254774601994240

“The U.S. Cements Its Position As World Leader In Oil Reserves”

This is a gift..

Eventually cooler heads prevail over time.. we might get Simpson Bowles type line of sight into twin deficit reduction at appropriate time.

$DXY continues as The World’s Reserve Currency 🇺🇸

This is a gift..

Eventually cooler heads prevail over time.. we might get Simpson Bowles type line of sight into twin deficit reduction at appropriate time.

$DXY continues as The World’s Reserve Currency 🇺🇸

• • •

Missing some Tweet in this thread? You can try to

force a refresh