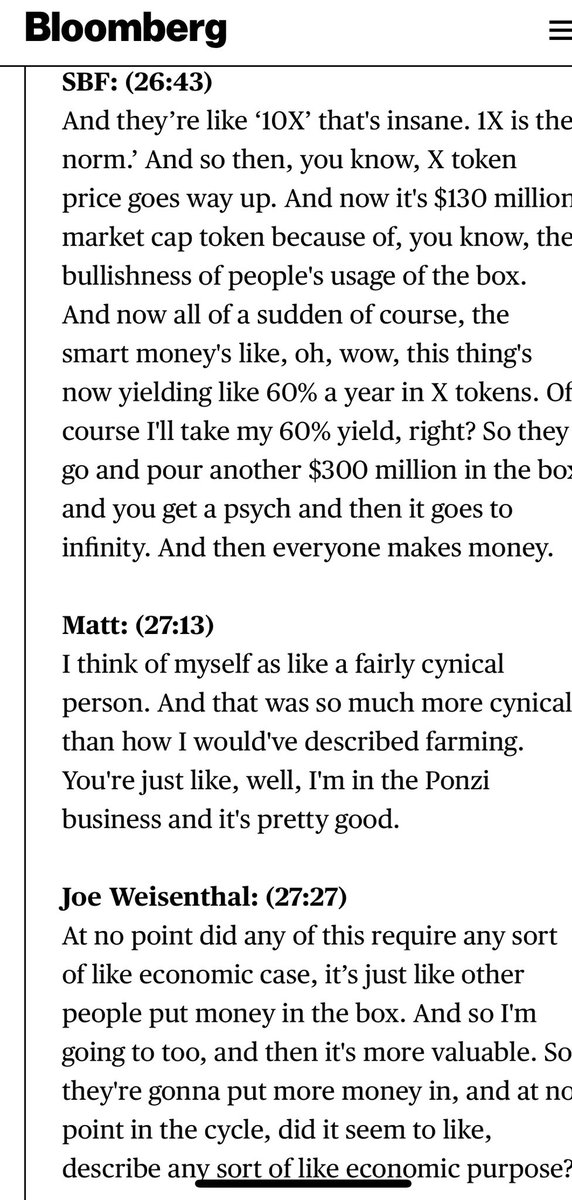

Podcast: Sam Bankman-Fried Described Yield Farming and Left @matt_levine Stunned | Please read this crypto luminary explain “yield farming”. He is literally describing a Ponzi scheme. There is no economic engine. #GoldenAgeOfFraud bloomberg.com/news/articles/…

(3) I’m beginning to think there may be a reason why all these crypto CEO’s reside offshore.

• • •

Missing some Tweet in this thread? You can try to

force a refresh