How to get URL link on X (Twitter) App

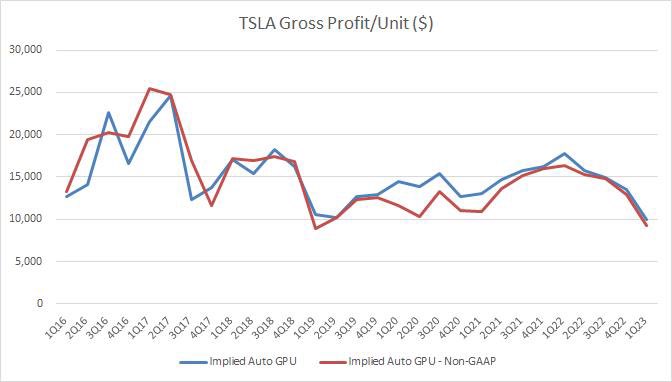

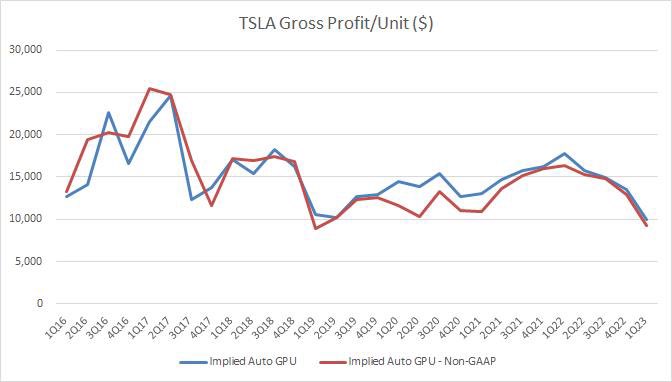

(2)Toyota…? Nope. Their operating margin (9% last FY) is improving. $TSLA

(2)Toyota…? Nope. Their operating margin (9% last FY) is improving. $TSLA

(2) As for yield, $DLR yields 4.6% vs 8.0% for $DCRU.SP. Again these are the same type of global legacy data centers (DCRU is not just Asian DC’s) in both portfolios, so this is a direct comp. REIT investors, can you help me out here?

(2) As for yield, $DLR yields 4.6% vs 8.0% for $DCRU.SP. Again these are the same type of global legacy data centers (DCRU is not just Asian DC’s) in both portfolios, so this is a direct comp. REIT investors, can you help me out here?

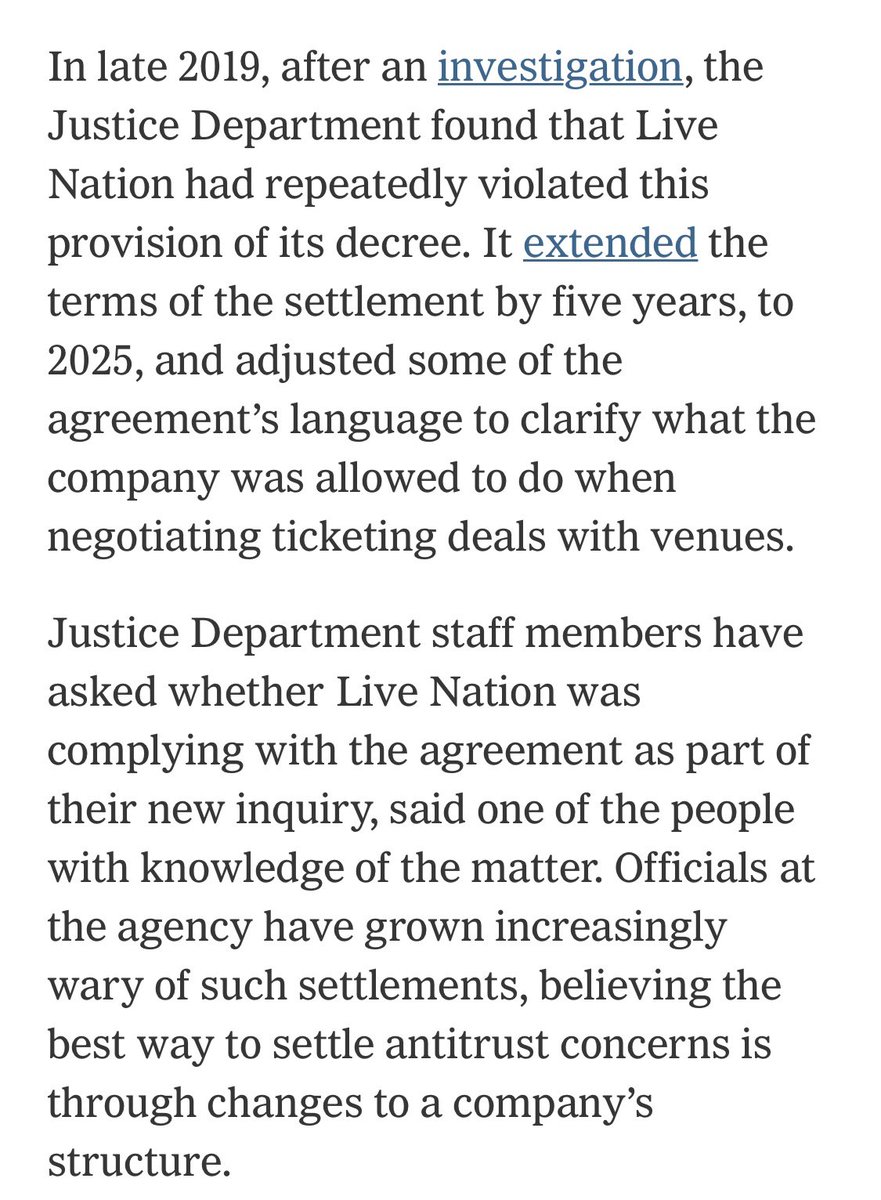

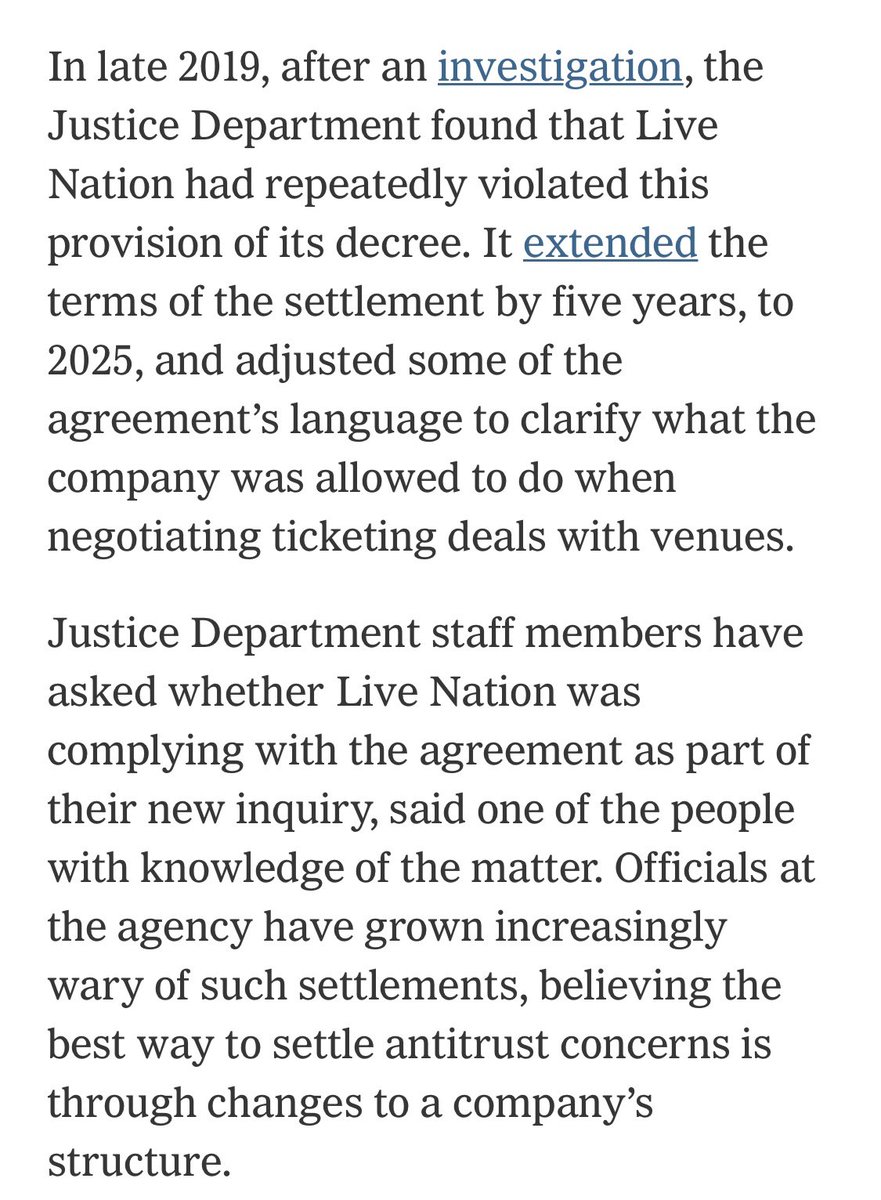

https://twitter.com/Vinny_Daniel0/status/1592888083044761602(2) And now the DoJ is apparently going to revisit the terms of its previous antitrust settlement with $LYV.

(2) And here Morgan Stanley says the quiet part out loud about $RUN’s continued absurd use of a 5% discount rate to calculate its made-up NPV metric. Even the Company admits that their cost of capital (6.5-7.5%) is above 5%, at this point.

(2) And here Morgan Stanley says the quiet part out loud about $RUN’s continued absurd use of a 5% discount rate to calculate its made-up NPV metric. Even the Company admits that their cost of capital (6.5-7.5%) is above 5%, at this point.

(2) $RUN The Company loves to present their own metrics like Customer Additions, Net Subscriber Value and Megawatts Installed. Profits and Cash Flow(for obvious reasons), not so much. Here is their Loss Statement:

(2) $RUN The Company loves to present their own metrics like Customer Additions, Net Subscriber Value and Megawatts Installed. Profits and Cash Flow(for obvious reasons), not so much. Here is their Loss Statement:

(2) Here is $IBM’s actual future “guidance” from its recent Analyst Day. Note that they do not provide earnings guidance, “adjusted” or otherwise.

(2) Here is $IBM’s actual future “guidance” from its recent Analyst Day. Note that they do not provide earnings guidance, “adjusted” or otherwise.

https://twitter.com/Junheng_Li/status/1357458794683330560(2) For those of you wondering about the veracity of the $GSX whistleblower complaint, I would note that the odd dates mentioned for the 2016 RYB audit(June 19-23, 2017) actually checks out with the $RYB F-1 filed in August, 2017(June 22, 2017).